Q&A 162

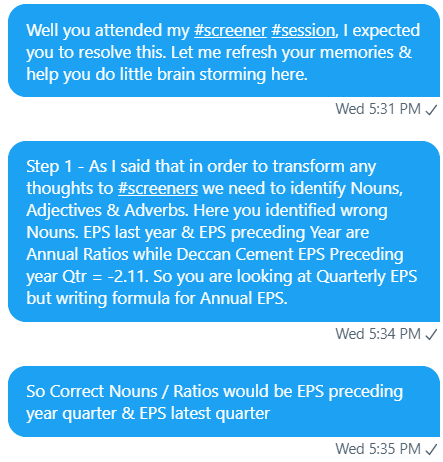

#personalized #screener discussion !

⚡️Take away

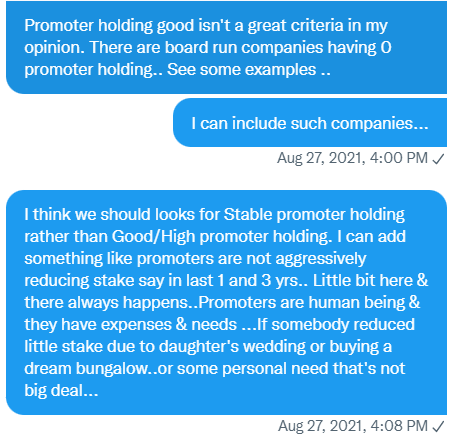

- What should be Promoter Holding ?

- How much Debt ? Should we only invest in low debt companies ?

- Should we only invest in less Debtor days ? When can be High Debtor days companies be good investment ?

1

#personalized #screener discussion !

⚡️Take away

- What should be Promoter Holding ?

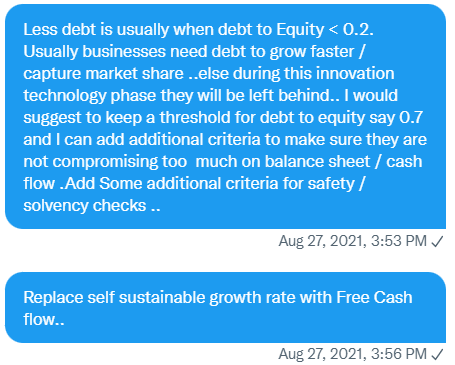

- How much Debt ? Should we only invest in low debt companies ?

- Should we only invest in less Debtor days ? When can be High Debtor days companies be good investment ?

1

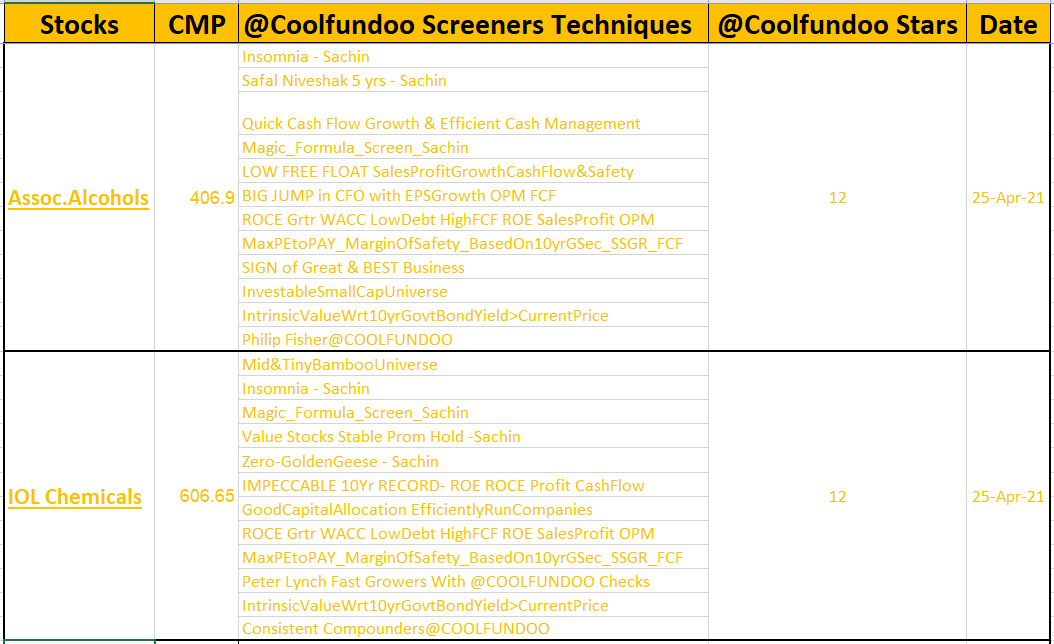

Promoter Holding = 0

There are around 90 companies which are run by Board & hence Zero Promoter Holding !

Don't forget them, some are really great compounders !

3

There are around 90 companies which are run by Board & hence Zero Promoter Holding !

Don't forget them, some are really great compounders !

3

Instead of Looking for High Promoter Holding, look for Stable Promoter Holding (that's more practical).

Promoter holding above 60 or 50 doesn't make sense to me !

4

Promoter holding above 60 or 50 doesn't make sense to me !

4

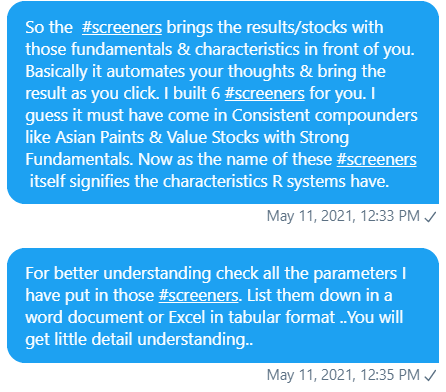

You may miss out on several great companies if you say Promoter holding >= 60

See screenshot from one of my #screeners arranged for ascending Promoter Holding !

5

See screenshot from one of my #screeners arranged for ascending Promoter Holding !

5

🌟Debtor Days

It varies from industry to industry.. e.g. following companies have less debtor days..

But there are equally good if not better companies where Debtor days is more than 2 months (2nd screenshot).

Both pics are from one of my #screeners !

6

It varies from industry to industry.. e.g. following companies have less debtor days..

But there are equally good if not better companies where Debtor days is more than 2 months (2nd screenshot).

Both pics are from one of my #screeners !

6

• • •

Missing some Tweet in this thread? You can try to

force a refresh