Q&A 148

📢Study this short 🧵

🌟If you wish to know how to build your #thoughts in to a meaningful #screener Step-by-step ⁉️

🌟How to deal with a tricky scenario in @screener_in ⁉️

#screener #transformation #tips #tricks #workaround

Retweet to help others !

1

📢Study this short 🧵

🌟If you wish to know how to build your #thoughts in to a meaningful #screener Step-by-step ⁉️

🌟How to deal with a tricky scenario in @screener_in ⁉️

#screener #transformation #tips #tricks #workaround

Retweet to help others !

1

Situation / Problem / Bottleneck !

Try to brain-storm yourself before you proceed to next steps in the 🧵

2

Try to brain-storm yourself before you proceed to next steps in the 🧵

2

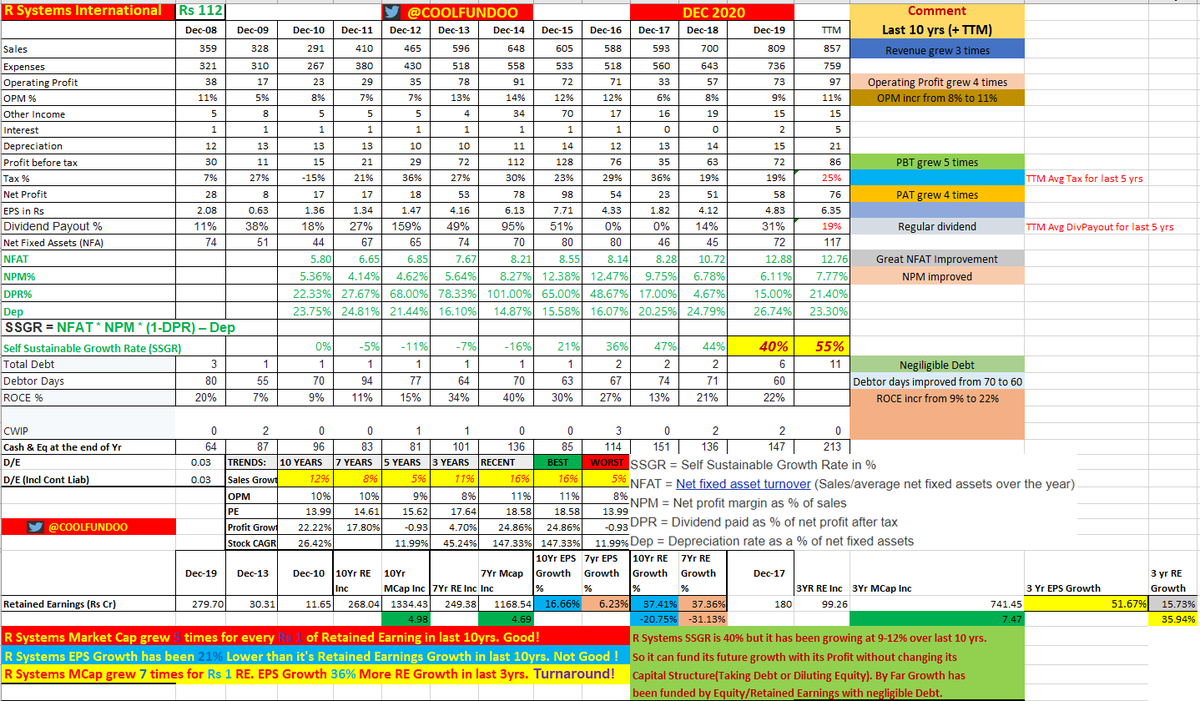

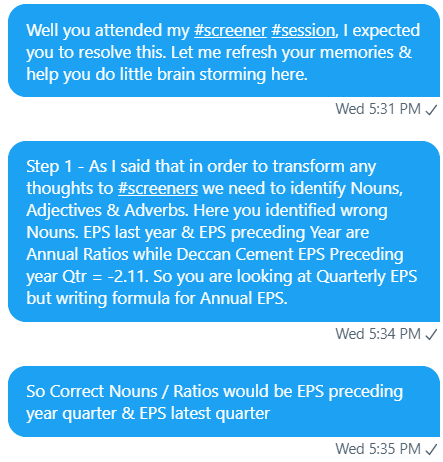

Step 1 - Identifying the problem correctly. Don't assume everything presented to you is correct.

Most people fail at this step. Sometimes there are data errors in examination paper as well. It's rare but it does happen !

3

Most people fail at this step. Sometimes there are data errors in examination paper as well. It's rare but it does happen !

3

Step 2 - Real issue is how to handle -ive (NEGATIVE) EPS in the formula. Next thing I taught was to break task in to sub-tasks, simplify all jargons and think about all possible business scenarios.

Highlighted Red where you have trouble..

Deccan Cement falls under Scenario F.

4

Highlighted Red where you have trouble..

Deccan Cement falls under Scenario F.

4

Step 3. Once you broke down to possible business scenario brain-strom to tackle them. For that apart from business knowledge, query skills you also need Data understanding.

This is how Step 3 will look when you transformed your thoughts & understanding into possible solution.

5

This is how Step 3 will look when you transformed your thoughts & understanding into possible solution.

5

Step 5. Next step is Validation of your formula & eliminating any issues & improving it further if needed. Here is validation, you can see how Deccan Cement is appearing.

7

7

• • •

Missing some Tweet in this thread? You can try to

force a refresh