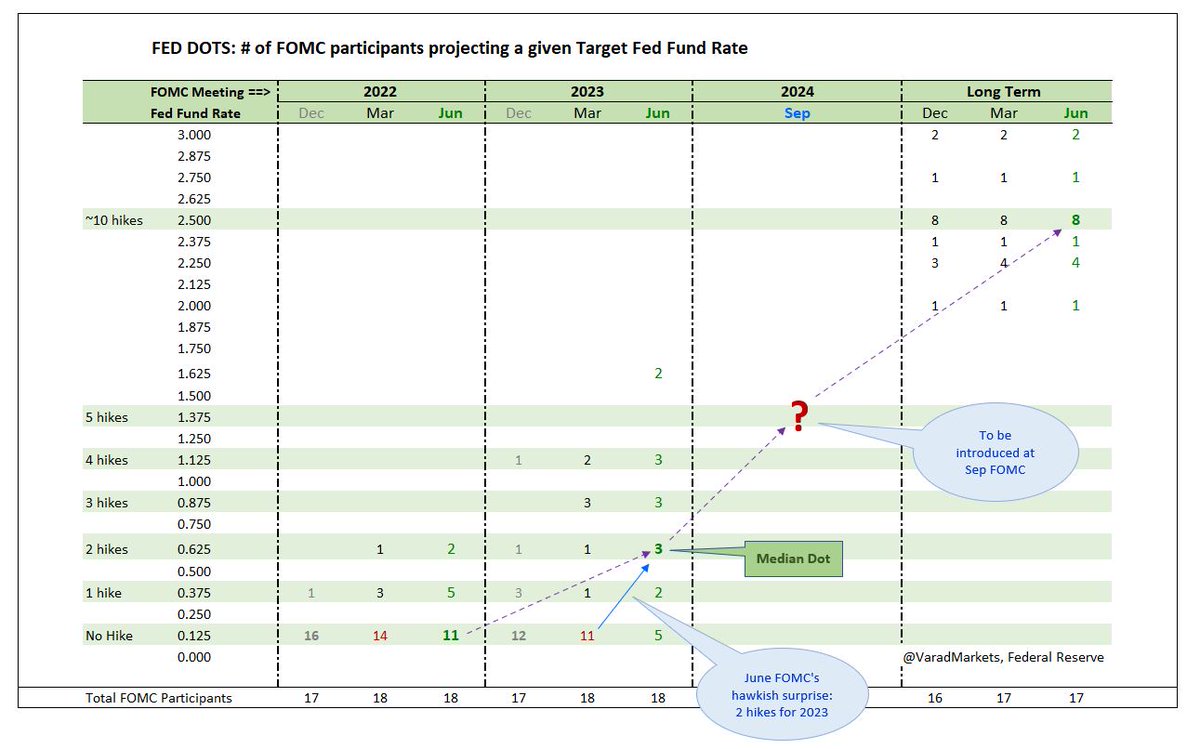

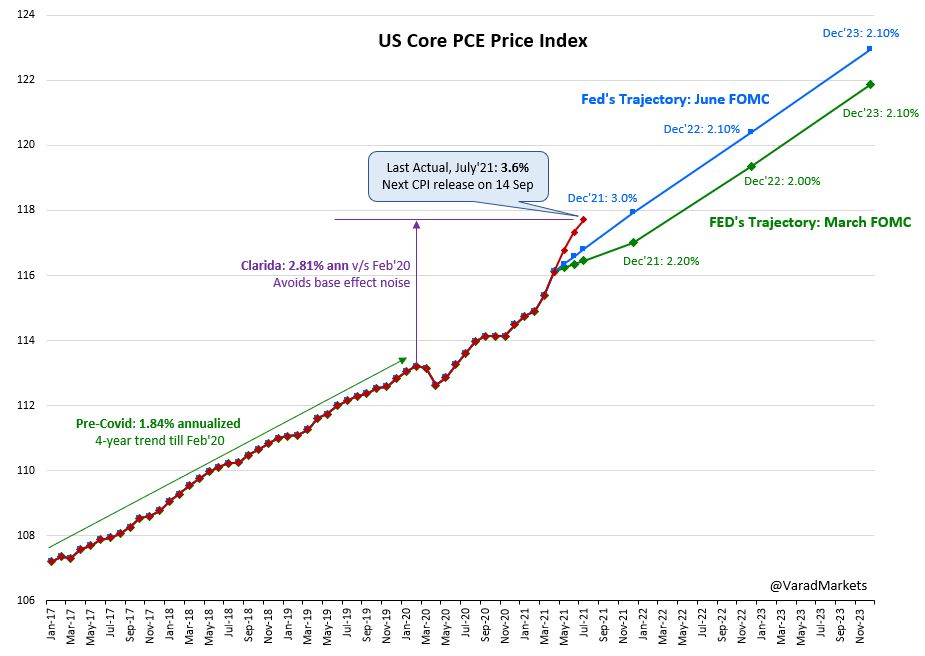

#US Core #PCE #Inflation:

▪️ Annualizing 4.8% in 2021 vs Fed SEP projection 3.0%

▪️ Last Jul 3.6%. Even if annualizes only 2.5% for rest 2021, full year YoY would still be 3.9%

▪️ Sept FOMC will have to revise higher from 3.0% towards 4.0%

▪️ Can 2022 proj be left at 2.1%?

▪️ Annualizing 4.8% in 2021 vs Fed SEP projection 3.0%

▪️ Last Jul 3.6%. Even if annualizes only 2.5% for rest 2021, full year YoY would still be 3.9%

▪️ Sept FOMC will have to revise higher from 3.0% towards 4.0%

▪️ Can 2022 proj be left at 2.1%?

Core PCE MoM past its peak?

- 5y avrg 0.17%

- Post Covid avrg 0.30%

- Post Vaccine avrg 0.39% (since Nov'20)

- Post Covid peak 0.63% (Apr'21)

- Last July print 0.34%

Transitory assumption: will ease towards 0.17-20% MoM into H1'22 (equivalent to 2.0-2.4% YoY)

- 5y avrg 0.17%

- Post Covid avrg 0.30%

- Post Vaccine avrg 0.39% (since Nov'20)

- Post Covid peak 0.63% (Apr'21)

- Last July print 0.34%

Transitory assumption: will ease towards 0.17-20% MoM into H1'22 (equivalent to 2.0-2.4% YoY)

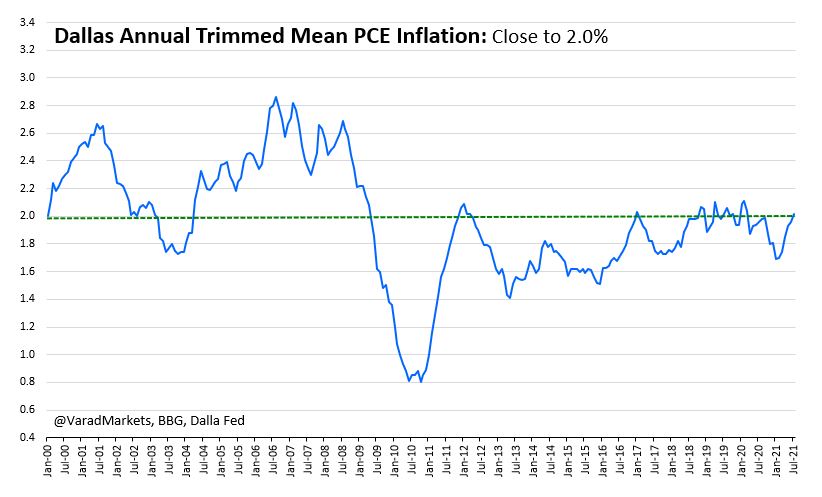

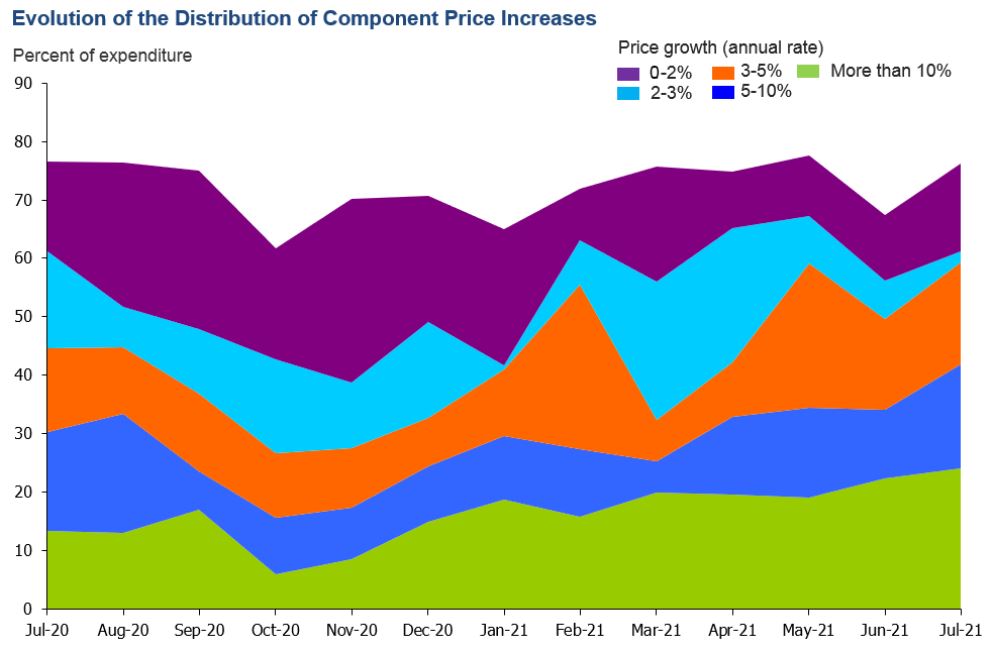

Trimmed Mean Inflation?

▪️ Powell at JH "..to capture whether price increases for particular items are spilling over into broad-based inflation. These include trimmed mean.."

▪️ Excluded: 50 components from lower tail of distribution of monthly price changes & 71 from upper tail

▪️ Powell at JH "..to capture whether price increases for particular items are spilling over into broad-based inflation. These include trimmed mean.."

▪️ Excluded: 50 components from lower tail of distribution of monthly price changes & 71 from upper tail

▪️ Out of total 178 components, 121 components with weight of 54% excluded from Trimmed Mean

- Most price spike (July MoM): Hotels & Air transportation

- Most MoM price collapse: Motor vehicle rental & leasing

- Most price spike (July MoM): Hotels & Air transportation

- Most MoM price collapse: Motor vehicle rental & leasing

https://twitter.com/VaradMarkets/status/1399347401530306560?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh