1/12 A thread on #ANT and how to read #China #PBOC Governor speech on Fintech(#ANT) yesterday. The headline says only FinTech, but Wink Wink, ANT is all over. Get strapped because I will sprinkle some wide guesses and rumors in the end. pbc.gov.cn/goutongjiaoliu…

2/12 My quick take on Fintech (Ant) SINS: 1. Monopoly power 2. Winner takes all 3. Payment system seeping into finance, insurance, small loan and asset mgt. 4. FIN must be separated from Tech, Payment from FIN. 5. Data Security 6. Global Coop on Fintech regulation

3/12 Points 3, 4, 5 has been addressed! I'v written on ANT credit scoring JV+ SASAC take stakes in the three private credit scoring companies. And Alipay has been ordered to be separated from financial services, because FinTech is more Finny than Techy!

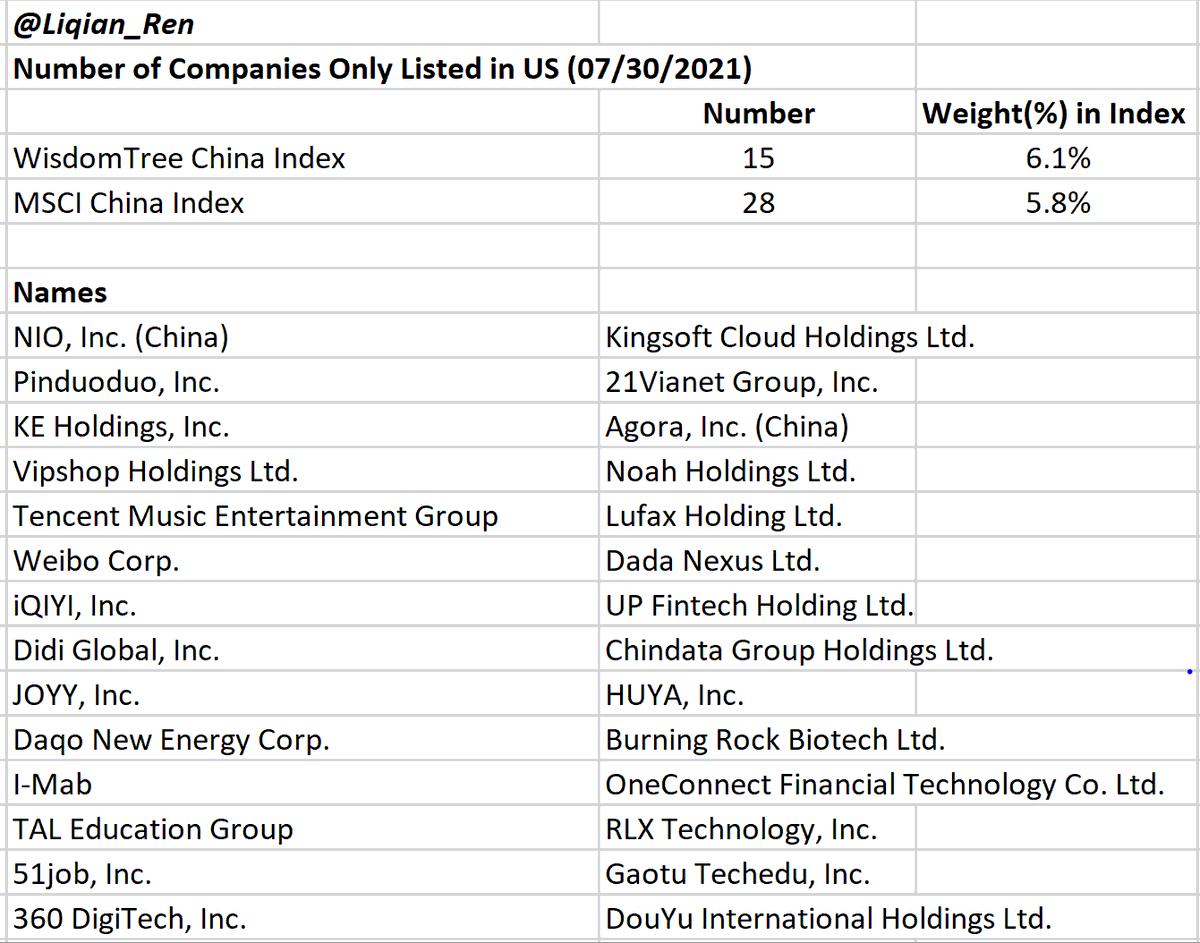

https://twitter.com/liqian_ren/status/1434955732579913729

4/12 Point 6 means expect FINTECH to be regulated as FIN, not just China, but globally. And China could use some European partners.

5/12 Points 1/2 are related about Monopoly power of Fintech(ANT) platform and its stifling on innovation/small fin. firms. I've studied short history of Chinese antitrust regulation and generally they don’t break up companies. So what regulation could make ANT less of a monopoly?

6/12 Here is one wild pure guess: might one day interoperability be extended not just between wechat and Taobao, but also ANT and WECHAT payment systems as this is one way to foster competition and reduce monopoly power.

7/12 But is all above 6 SINs addressed enough for ANT IPO? Not necessary. Here is some rumor on the vine.

8/12 Under English media’s radar 3 days ago China Securities Regulator CSRC, with Propaganda Dept, Supreme court, Supreme procurator, Ministry of Public Security, Dept. of Justice and Treasury set up a new working group to combat illegal activities in securities dealings.

9/12 This news should seem odd. Isn’t what CSRC supposed to do, like SEC, cracking down on illegal securities dealings? Why need for another high level working group? Is it a tacit rebuke of some in CSRC who were perceived to have not done due diligence when approving ANT IPO?

10/12 I cant help but thinking back on the recent high level corruption case 周江勇 in ZheJiang Prov. where I grew up that rocked #BABA. It was forced with press release disputing ANT has anything to do with this case. But social media rumor mill was in full swing.

11/12 In summary, one big under reported #PBOC governor speech and one big CSRC initiatives to investigate securities dealings suggest ANT still have two big mountains (monopoly and clean holdings) to climb before IPO.

12/12 Looking back, so thankful for my first ever job in the US is at @ChicagoFed that helps me write on PBOC. I started being active on twitter last month. If you find these long threads useful, where I bring under reported China news and my own analysis, please like or retweet.

@threadreaderapp unroll #ANT #IPO #China #Fintech #Payment #Monopoly #Regulation #YIGANG #PBOC #CSRC #蚂蚁金服 #央行 #易纲 #证监会 #金融科技 #支付 #反垄断

China FinTech is many times more Finny than Techy. And any FIN will be regulated, #China or #global, as #PBOC speech and #Coinbase example illustrates. Now help me start a global collection. ( *COINBASE DROPS PLAN TO LAUNCH CRYPTO LENDING PROGRAM)

• • •

Missing some Tweet in this thread? You can try to

force a refresh