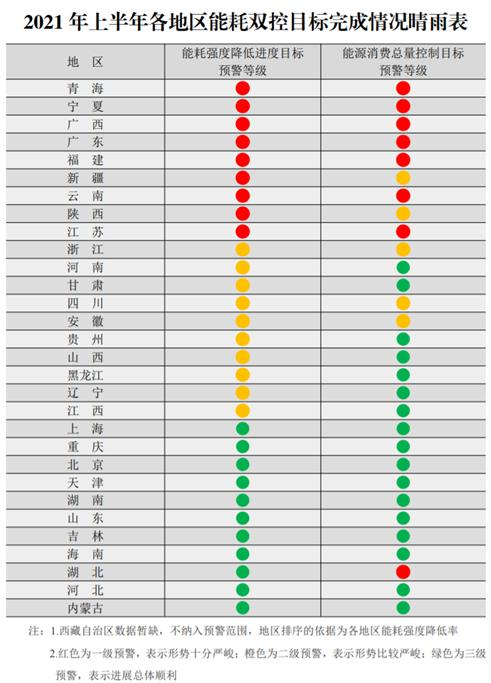

1/9 A thread of one potential negative wind for #China #growth next few months: manufacturing firms forced to halt production under energy/environmental constraints 能耗双控. Firms in #Jiangsu asked to stop production. Malls asked to delay opening for 1/2 hour to conserve energy.

2/9 Background: 2060 carbon neutrality goal, National Development and Reform Comm.(#NDRC) sets a staged road map2025/30/35. Each province, two annual hard targets need to meet: total energy usage growth and GDP per unit energy used. (in Chinese) in-en.com/article/html/e…

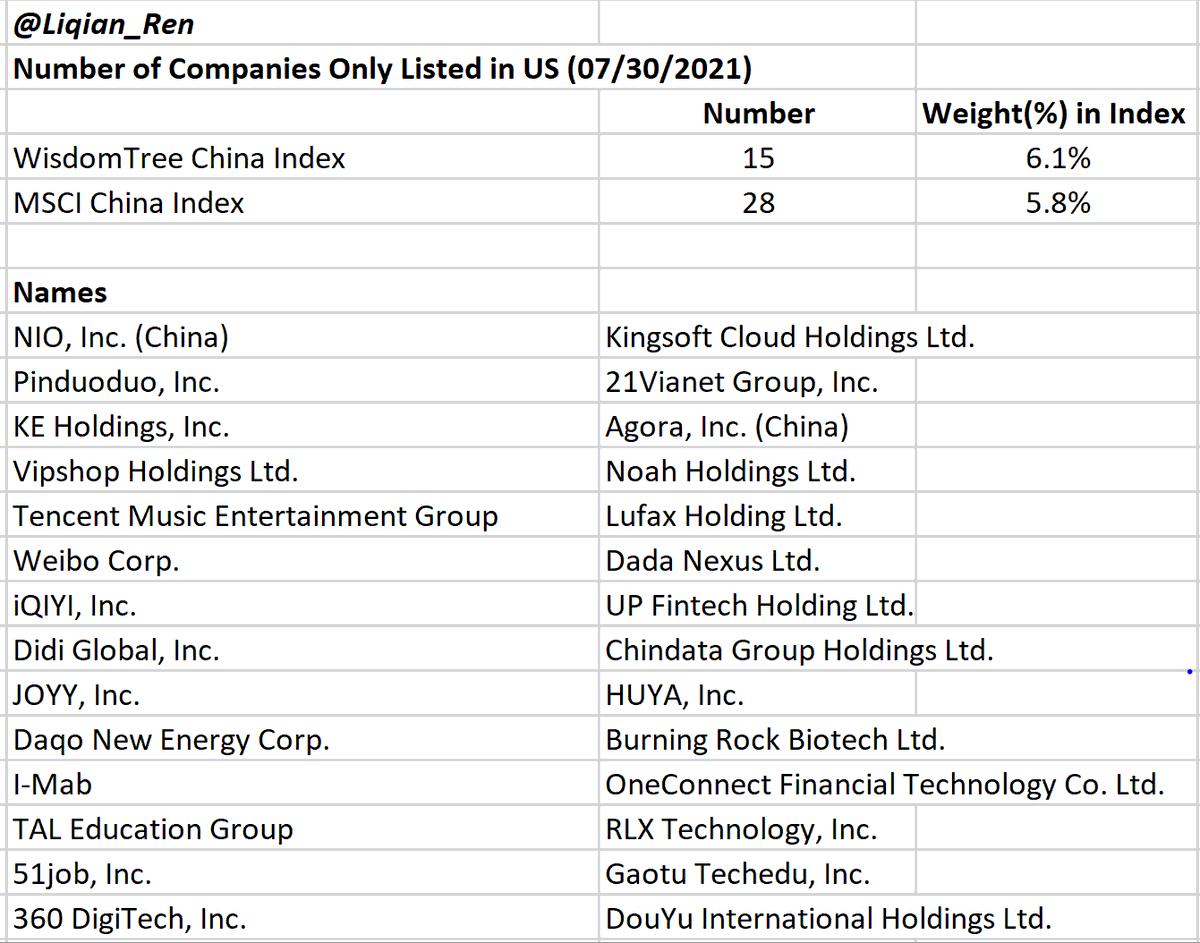

3/9 AUG 7th, #NDRC graded each province in YTD red/yellow/green. Economically important provinces like #Guangdong, #Jiangsu #Fujian red for both targets. #ZheJiang yellow for both.

gov.cn/zhengce/zhengc…

gov.cn/zhengce/zhengc…

4/9 This supply side brute force implementation has exacerbated for materials and #commodity price #inflation. Futures for Aluminum has hit 15-yr high while production companies suffered stock price. It's been heated headlines on social and official media.

5/9 Indeed China's economy is not very energy efficient. World Bank data showed that China GDP per unit energy use is close to Russia and lower than most other nations.

6/9 How this played out: The top has expressed that hard targets need to be given elasticity, but bureaucracy travels on its own speed. It is hard KPI of every government heads and draconian policies are not uncommon when they are motivated to hit those specific energy targets.

7/9 The last few years, taxes and environmental regulation forced production shutdown have been the most common complaints of business owners within my own extended family. Some Wechat group only discuss carbon neutrality. Actions implemented could be highly state directed.

8/9 This is one of many growth risk factors(some positive like virus and upcoming National Day shopping) and its negative effect depend on how swift news reach the top and get some quiet correction, like the Education Ministry who was fired after the education regulation debacle.

9/9 US Sec. Kerry visit not warm. Likely US wants to only discuss climate, while China wants to discuss bundle of issues. That's my 2cents on a political topic I had little research. Sectors helping com. achieve energy efficiency will continue benefit from these top down policies

Energy efficiency often requires energy intensive chemicals (The paint reflects 98.1% of solar radiation while also emitting infrared heat, Uses: a high concentration of a chemical compound barium sulfate and different particle sizes of barium sulfate. )

news.yahoo.com/scientists-cre…

news.yahoo.com/scientists-cre…

• • •

Missing some Tweet in this thread? You can try to

force a refresh