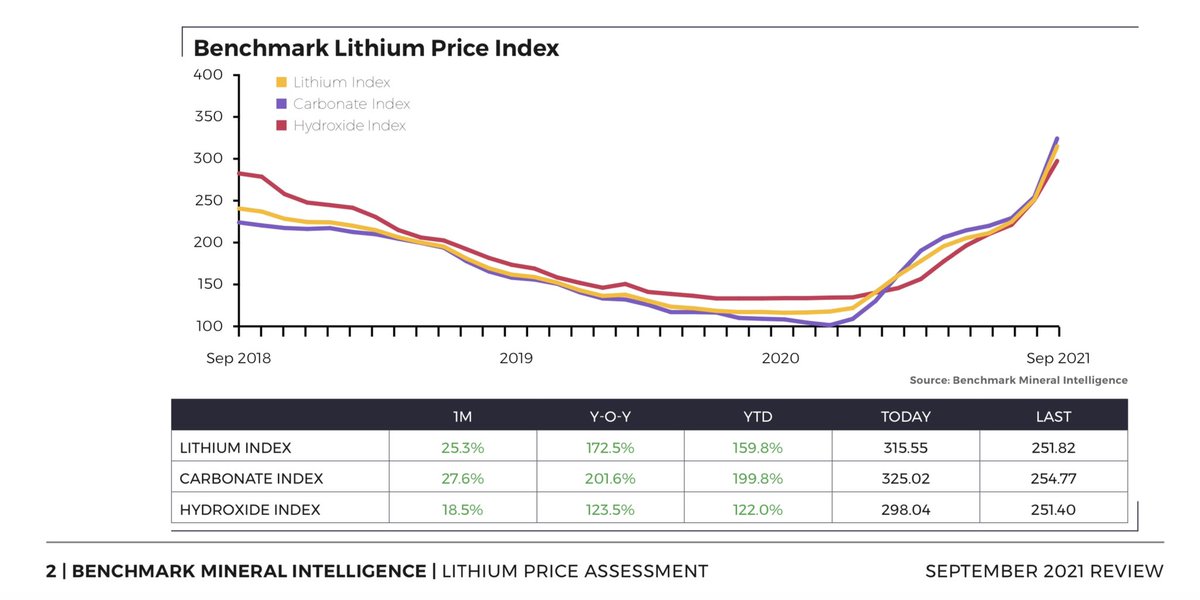

❗️High raw material prices are starting to push some lithium ion battery cell prices up

This is what @benchmarkmin warned of last year below

To understand batteries you need to know your supply chains #lithium #nickel #cobalt #graphite #manganese benchmarkminerals.com/membership/lit…

This is what @benchmarkmin warned of last year below

To understand batteries you need to know your supply chains #lithium #nickel #cobalt #graphite #manganese benchmarkminerals.com/membership/lit…

How Team @benchmarkmin called an end to the major declines in lithium ion battery prices.

A must read here: benchmarkminerals.com/membership/ben…

A must read here: benchmarkminerals.com/membership/ben…

The way to keep battery costs low and falling is the inclusion and expansion of #LFP cathode which has expanded massively in China

benchmarkminerals.com/membership/ben…

benchmarkminerals.com/membership/ben…

And Tesla’s LFP strategy isn’t new. Here’s the @benchmarkmin exclusive from Feb 2020

benchmarkminerals.com/membership/lfp…

benchmarkminerals.com/membership/lfp…

• • •

Missing some Tweet in this thread? You can try to

force a refresh