Lithium ion battery prices are going up for the first time. Some said it would never happen. #EV

But rising lithium prices are the cause.

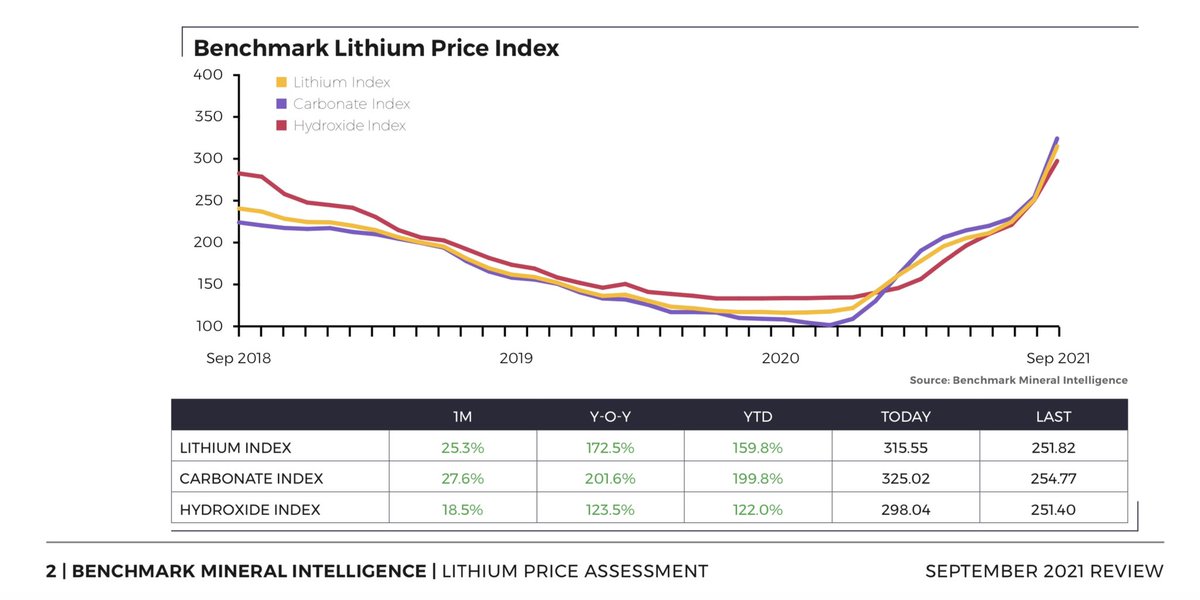

172% increase in Benchmark Lithium Price Index since this time in 2021 says it all

Automakers to take the hit

More TBA @benchmarkmin

But rising lithium prices are the cause.

172% increase in Benchmark Lithium Price Index since this time in 2021 says it all

Automakers to take the hit

More TBA @benchmarkmin

Lithium carbonate price increases have hurt the most.

These have risen 200% y-o-y on the Benchmark Lithium Price Index

These have risen 200% y-o-y on the Benchmark Lithium Price Index

Crazy thing is we are not even hitting a major shortage of lithium until next year.

This lithium price squeeze could turn into a lithium price crisis for those not locked into long term contracts.

benchmarkminerals.com/lithium-prices/

This lithium price squeeze could turn into a lithium price crisis for those not locked into long term contracts.

benchmarkminerals.com/lithium-prices/

Automakers have done the right thing in building JV battery cell plants aka Megafactory / Gigafactory

But the lack of strategy or focus on the up streaming in doing the same for key raw materials - lithium and nickel esp - will come back to haunt the automotive industry

But the lack of strategy or focus on the up streaming in doing the same for key raw materials - lithium and nickel esp - will come back to haunt the automotive industry

It’s of course just the start and not the end. But 2022 to 2026 won’t be pretty as electric vehicle models attempt to come to market at an ever decreasing cost

You can’t make an EV without a lithium ion battery. And you can’t make lithium ion battery without lithium

And all at the right quantities and qualities.

Some of the most obvious statements are usually the ones ignored.

Contact @benchmarkmin here

benchmarkminerals.com/contact/

And all at the right quantities and qualities.

Some of the most obvious statements are usually the ones ignored.

Contact @benchmarkmin here

benchmarkminerals.com/contact/

Lithium ion battery price rises update:

> Naturally OEMs are baulking at the idea of rising cell prices

> Where lithium prices are at and heading there will be some pain for EV makers and no real short term fix unless supply is already locked into a contract a a fixed price

> Naturally OEMs are baulking at the idea of rising cell prices

> Where lithium prices are at and heading there will be some pain for EV makers and no real short term fix unless supply is already locked into a contract a a fixed price

> Negotiations are well underway between Chinese cell makers and autos

> All battery price rises coming from Chinese 🇨🇳 makers at present; interesting to see how the South Korea 🇰🇷 majors react

> All battery price rises coming from Chinese 🇨🇳 makers at present; interesting to see how the South Korea 🇰🇷 majors react

• • •

Missing some Tweet in this thread? You can try to

force a refresh