📢 Aurora is Integrating @chainlink Price Feeds to Enable Rapid, #EVM-Compatible #DeFi Development.

aurora.dev/blog/aurora-is…

aurora.dev/blog/aurora-is…

Aurora is excited to announce that we are integrating the industry-standard #Chainlink #PriceFeeds into our turn-key, #Layer2 EVM solution for scaling the #Ethereum ecosystem.

data.chain.link

data.chain.link

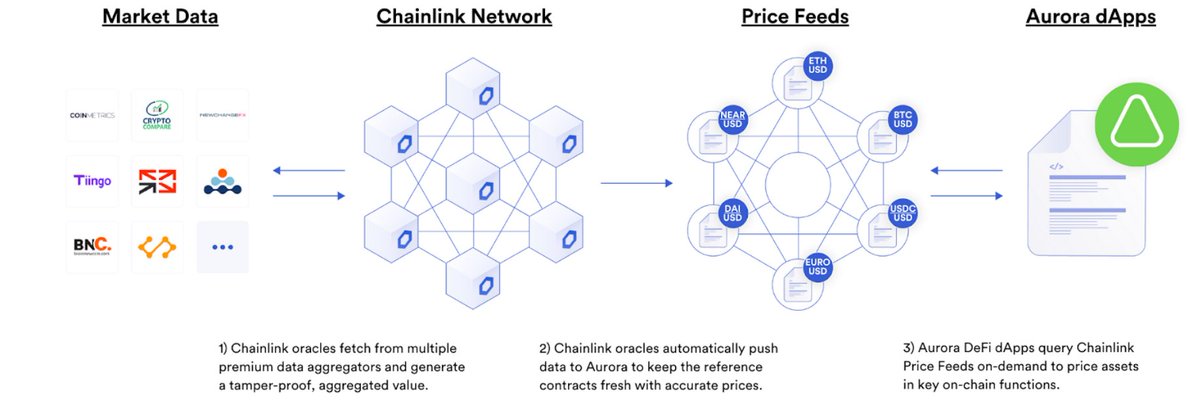

🧲 The integration of Chainlink Price Feeds will allow developers to connect their smart contracts to high-quality, tamper-proof price data across a wide range of assets.

This will ultimately establish support for DeFi use cases such as money markets, algorithmic stablecoins, synthetic assets, options and futures contracts, asset management services, and much more.

blog.chain.link/44-ways-to-enh…

blog.chain.link/44-ways-to-enh…

The result is Ethereum-based DeFi projects being able to seamlessly extend their projects onto the @NEARProtocol using #oracle infrastructure that they already trust and know, along with enhanced scalability and lower costs enabled by Aurora #L2.

We opted for #Chainlink as the recommended oracle solution for Aurora developers needing external data because it is thoroughly time-tested and relied on by top #DeFi and various other smart contract protocols.

Chainlink Price Feeds already help secure billions of dollars in value for leading #dApps thanks to its accuracy and resilience during even the most intense market conditions, including extreme market volatility, network congestion, and centralized infrastructure outages.

Aurora is an EVM-based solution that serves as a fully compatible L2 for Ethereum-based dApps wanting to deploy on the @NEAR_Blockchain.

The Aurora environment is made up of the Aurora Bridge—a cross-chain bridge that allows users to transfer ETH and ERC-20 assets between Ethereum and Aurora—and the Aurora Engine, a high performance EVM.

Through the combination of these two, smart contract developers can attract Ethereum users by making it easy to enter the Near ecosystem and enjoy a similar EVM experience, such as paying fees in ETH.

One of the most crucial pieces of infrastructure needed by smart contract developers building on Aurora is a secure and reliable connection to off-chain data and resources, particularly price data for DeFi.

Lending markets need price data to issue loans and execute liquidations; algorithmic #stablecoins need price data to trigger rebases and rebalances to maintain their peg; and synthetic asset protocols need price data to mint, swap, redeem, and liquidate synthetic asset positions.

Price data that reflects a weighted average of all exchanges is not inherently available on blockchains. Instead, developers require additional oracle infrastructure so they can fetch and deliver external data into the blockchain that is then consumed by their smart contracts.

Chainlink has established itself as the industry leader in secure oracle solutions, with Chainlink Price Feeds serving as pre-built and thoroughly tested decentralized oracle networks that supply premium price data on-chain in a secure and reliable manner.

Some of the key optimizations of Chainlink Price Feeds that made them the preferred solution for Aurora developers include: 👇

💽 High-Quality Data — Chainlink Price Feeds source data from numerous premium data aggregators, leading to price data that’s aggregated from hundreds of exchanges, weighted by volume, and cleaned from outliers and suspicious volumes.

Chainlink’s data aggregation model generates more precise global market prices that are resistant to #API downtime, flash crash outliers, and data manipulation attacks like #flashloans.

🔏 Secure #Node Operators — Chainlink Price Feeds are secured by independent, security-reviewed, and Sybil-resistant oracle nodes.

The nodes are run by leading blockchain DevOps teams, data providers, and traditional enterprises with a strong track record for reliability, even during high gas prices and heavy network congestion.

🕸️ Decentralized Network — Chainlink Price Feeds are decentralized at the data source, oracle node, and oracle network levels, generating strong protections against downtime and tampering by either the data provider or the oracle network.

🔎 Transparency — Chainlink provides a robust reputation framework and set of on-chain monitoring tools that allow users to independently verify the historical performance of node operators and oracle networks, as well as check the real-time prices being offered.

By natively integrating Chainlink Price Feeds into Aurora, Ethereum-based dApps currently using Chainlink Price Feeds can deploy on Aurora without the need for custom tooling or modifications.

❕ Importantly, Chainlink Price Feeds will be able to update at a higher frequency due to Aurora’s high-throughput and low fees. Chainlink can also enable connection to other types of external resources in the future to support the expansion of the Aurora development community.

💬 “As the most widely adopted #oracle solution on #Ethereum, Chainlink Price Feeds are key to growing the Aurora ecosystem and creating a fluid transition for Ethereum #dApps tapping into the #NEAR ecosystem.” — said Dr. Alex Shevchenko, Founder of Aurora.

💬 “With a proven track record of successfully securing high-value #smartcontracts, Chainlink Price Feeds will give Aurora developers plug-n-play #decentralized price oracles to be used to quickly build and deploy DeFi applications across a variety of use cases and asset types.”

ℹ️ About Chainlink

Chainlink is the industry standard for building, accessing, and selling oracle services needed to power hybrid smart contracts on any blockchain.

Chainlink is the industry standard for building, accessing, and selling oracle services needed to power hybrid smart contracts on any blockchain.

Chainlink oracle networks provide smart contracts with a way to reliably connect to any external API and leverage secure off-chain computations for enabling feature-rich applications.

Chainlink currently secures tens of billions of dollars across DeFi, insurance, gaming, and other major industries, and offers global enterprises and leading data providers a universal gateway to all blockchains.

Learn more about Chainlink by visiting chain.link or read the documentation at docs.chain.link. To discuss an integration, reach out to an expert.

ℹ️ About Aurora

Aurora is an EVM built on the NEAR Protocol, providing a solution for developers to deploy their apps on an Ethereum-compatible, high-throughput, scalable and future-safe platform, with low transaction costs for their users.

Aurora is an EVM built on the NEAR Protocol, providing a solution for developers to deploy their apps on an Ethereum-compatible, high-throughput, scalable and future-safe platform, with low transaction costs for their users.

Developers may enjoy familiar #Ethereum tooling when working with their #Solidity smart contracts on Aurora. The base fee of Aurora is $ETH, which provides a smooth experience for dapps’ users.

The features of @NEARProtocol, such as delegated #PoS consensus mechanism and dynamic #resharding, allow to achieve unprecedented transaction speed and opportunities for #scalability.

• • •

Missing some Tweet in this thread? You can try to

force a refresh