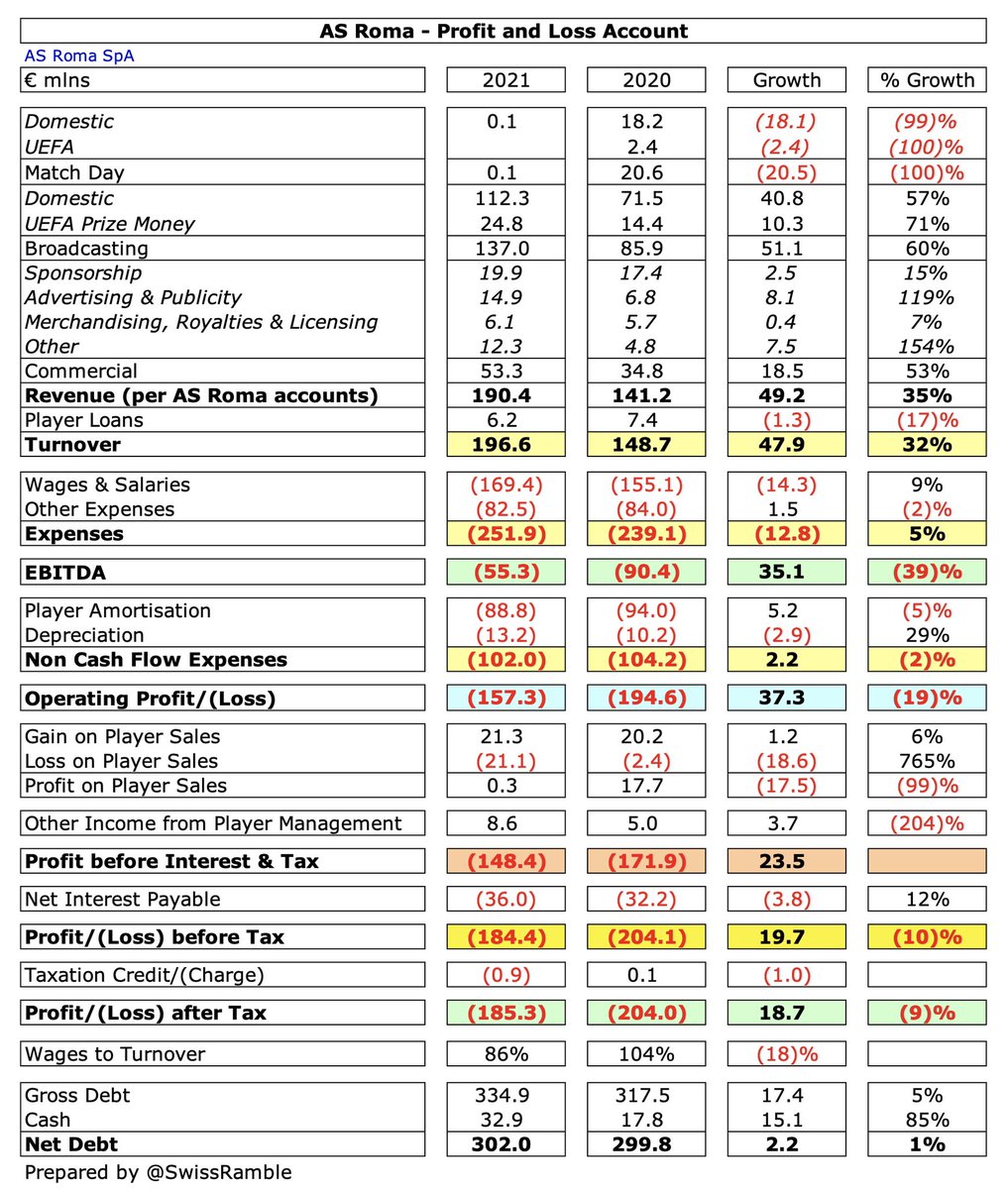

#ASRoma 2020/21 accounts cover a COVID-impacted season when they finished 7th in Serie A and reached the semi-finals of the Europa League. First season under the ownership of The Friedkin Group, who purchased the club from fellow American James Pallotta. Some thoughts follow.

#ASRoma pre-tax loss reduced by €20m from €204m to €184m, but still club’s second highest ever. Revenue rose €48m (32%) from €149m to €197m, but profit on player sales fell €18m to just €256k and operating expenses increased by €11m (3%). Loss after tax was €185m.

#ASRoma broadcasting income rose €51m (60%) from €86m to €137m, including revenue deferred from 2019/20 accounts, and commercial increased €18m (53%) from €35m to €53m. This compensated for COVID driven reductions in match day, down €21m to less than €100k.

As a technical aside, this definition of #ASRoma €197m revenue is different to the one used in the club accounts €190m, as it includes player loans, which were down €1m (17%) from €7m to €6m. Participation and performance fees reclassified from match day to broadcasting.

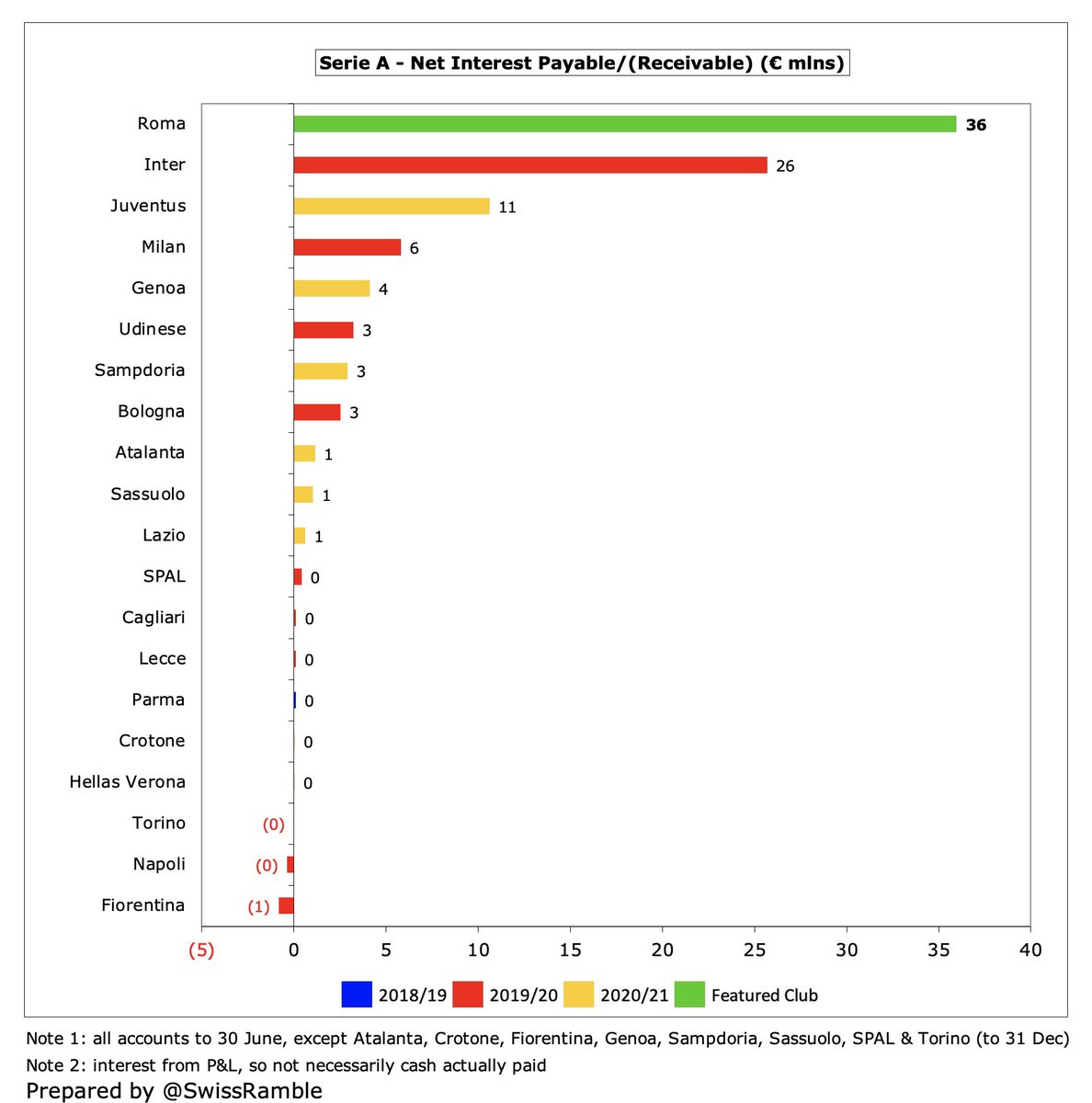

#ASRoma wage bill rose €14m (9%) from €155m to €169m, though player amortisation fell €5m (5%) from €94m to €89m and other expenses were cut €2m (2%) to €82m. On the other hand, depreciation/other provisions rose €3m to €13m and net interest was up €4m to €36m.

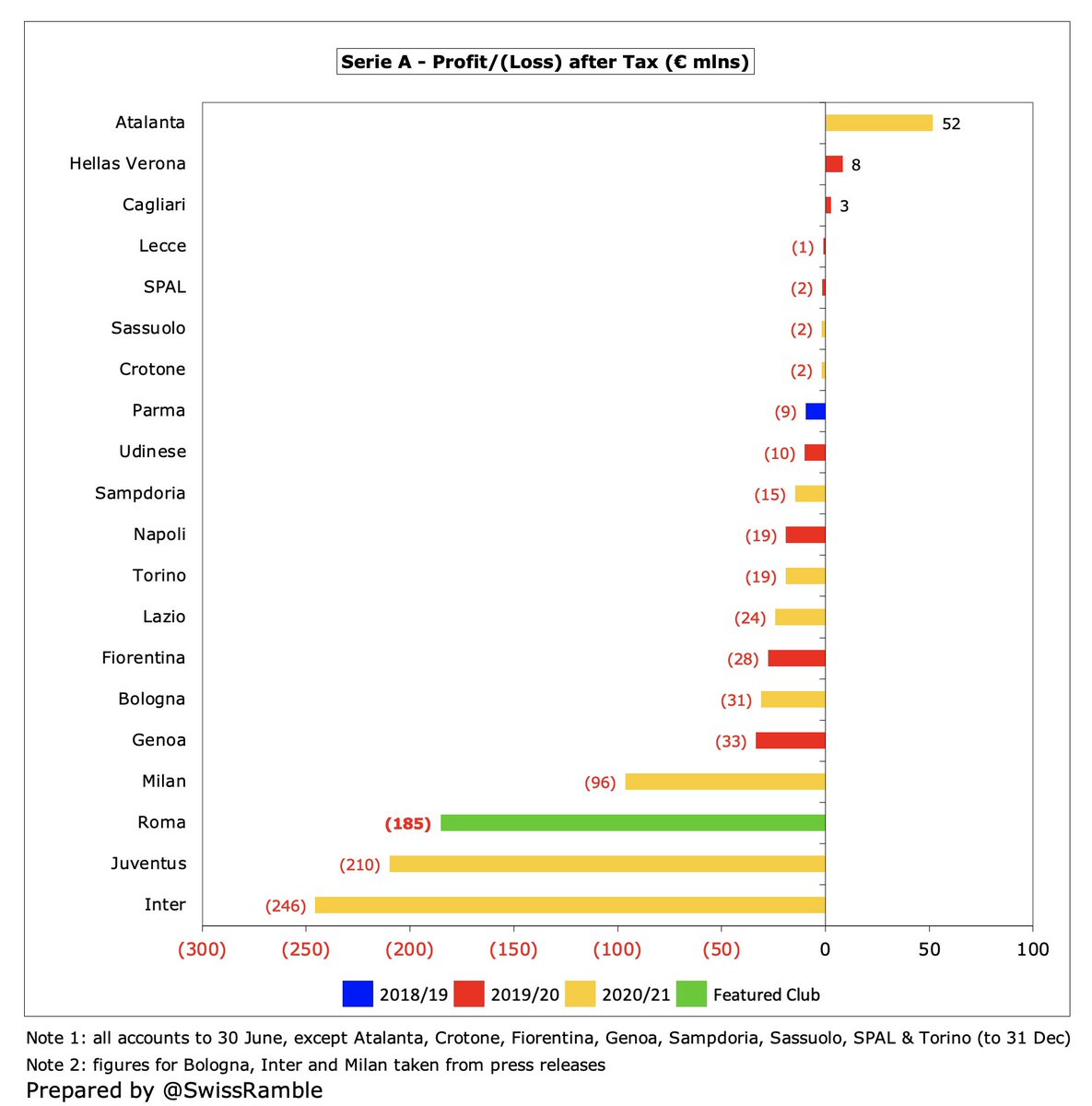

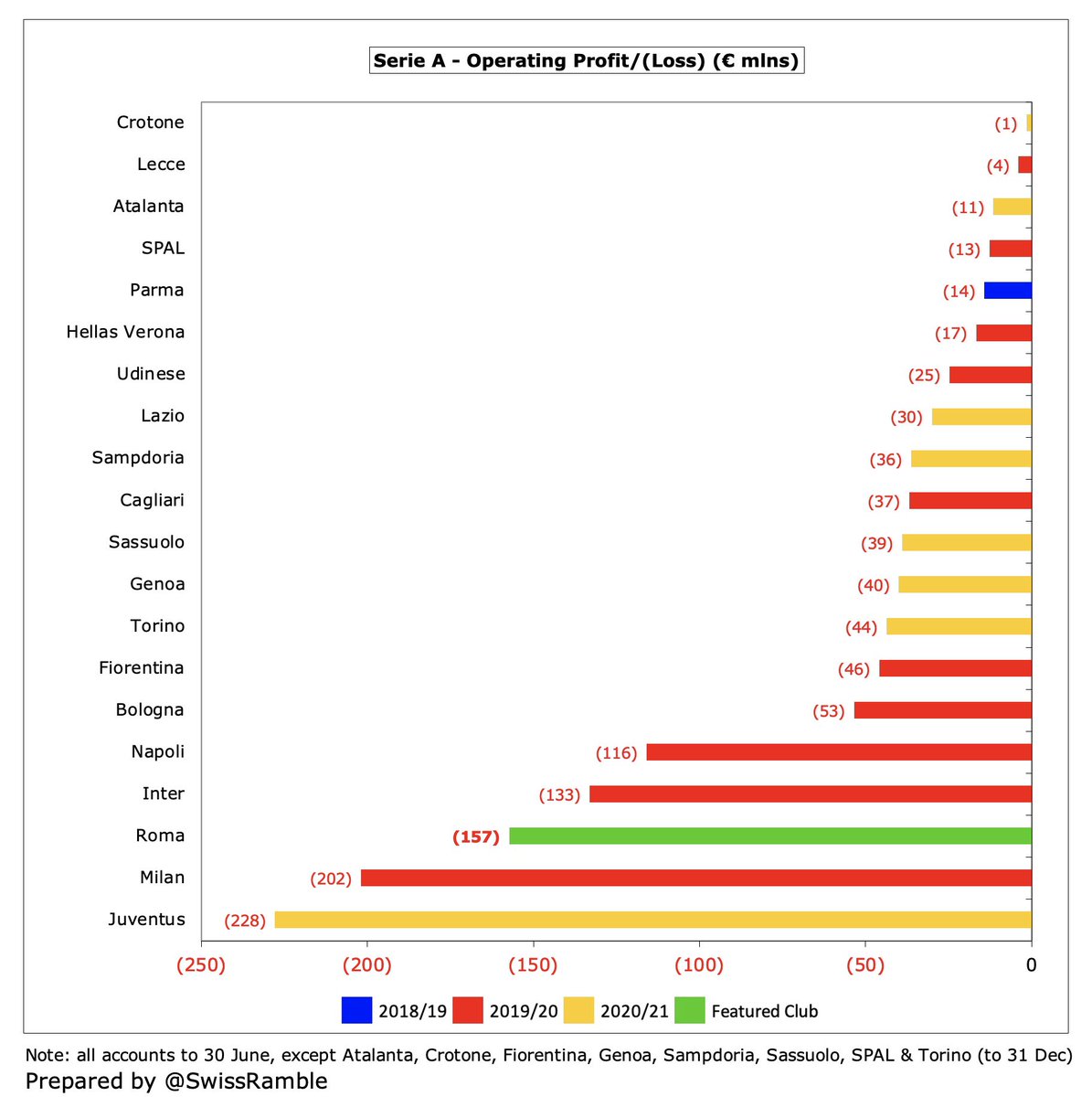

Incredibly, #ASRoma hefty €185m post-tax loss is not the highest in Italy in 2020/21, as it is surpassed by Inter €246m and Juventus €210m, though it is almost twice as much as Milan €96m. Atalanta have a December year-end, but their €52m profit is still pretty impressive.

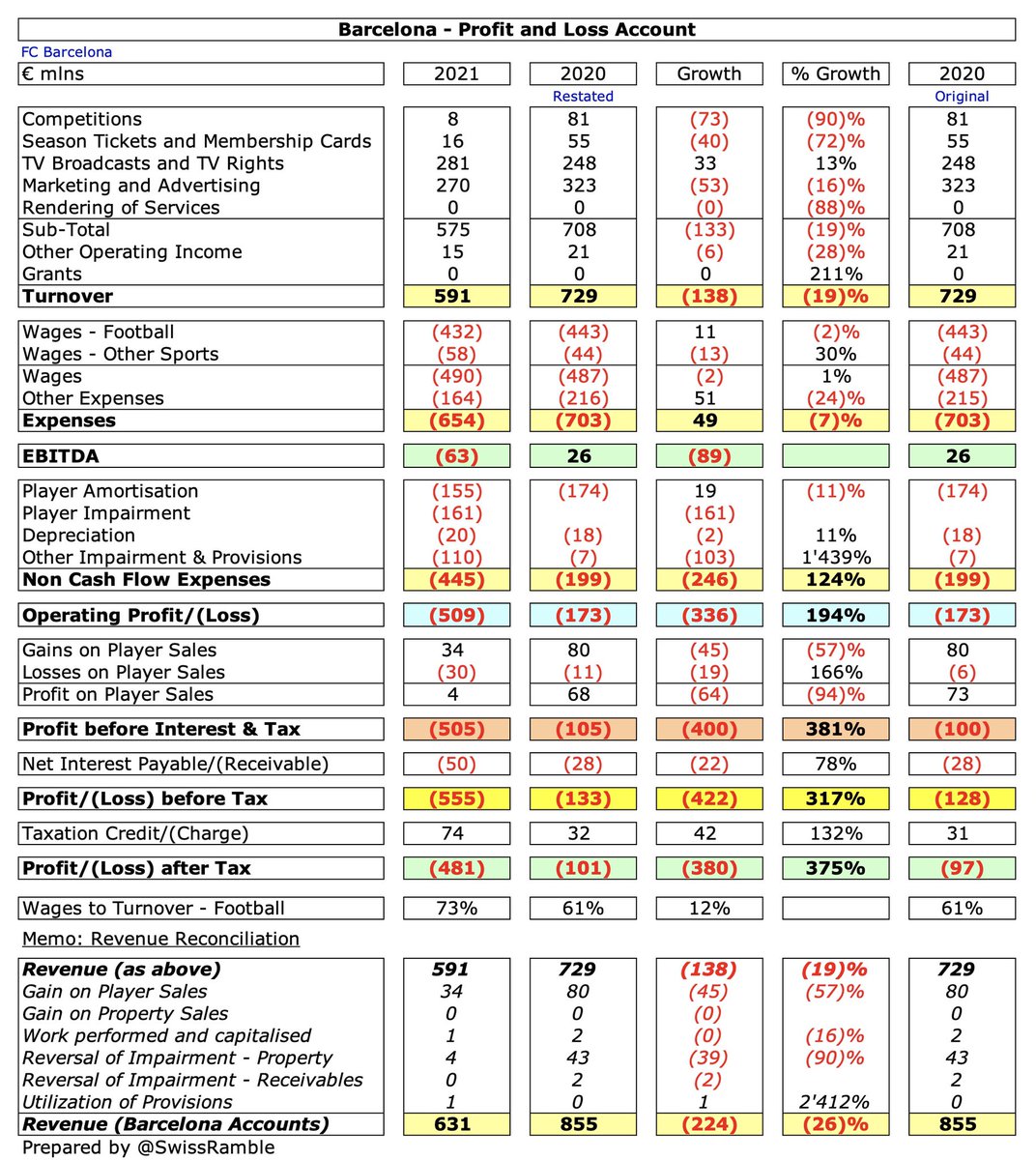

COVID has exacerbated underlying financial issues in Italy, so the two highest losses ever were registered in 2020/21. However, it is worth noting that #ASRoma are now responsible for two of the six worst losses (4th & 6th). In fairness, Barcelona made a €481m loss last season.

In fact, the big four Italian clubs have lost a staggering €1.3 bln in the last two seasons (€591m in 2019/20 and €737m in 2020/21). #ASRoma “lead the way” with their €389m deficit, followed by Inter €348m, Juventus €300m and Milan €291m.

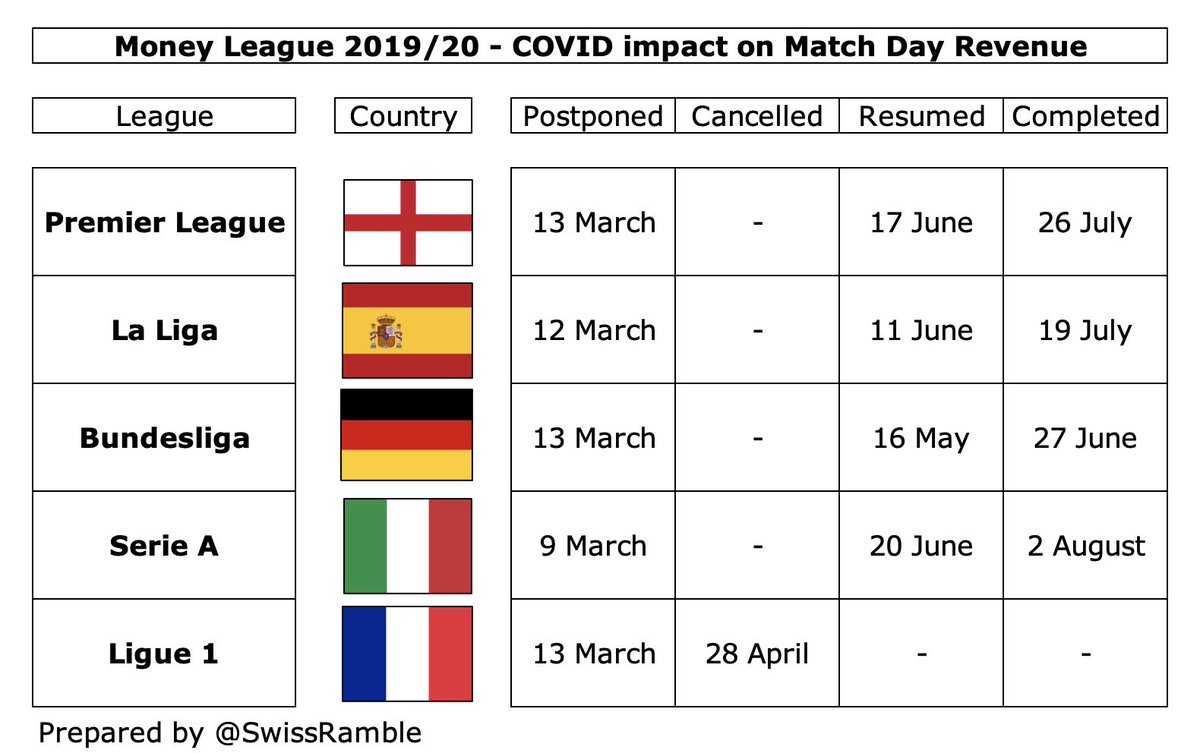

I estimate total #ASRoma COVID revenue loss as €53m (€21m in 2020 and €32m in 2021), split between match day €39m and broadcasting €15m. However, the 2021 figures benefit from €29m revenue deferred from 2020 for games played after 30 June accounting close (mainly TV).

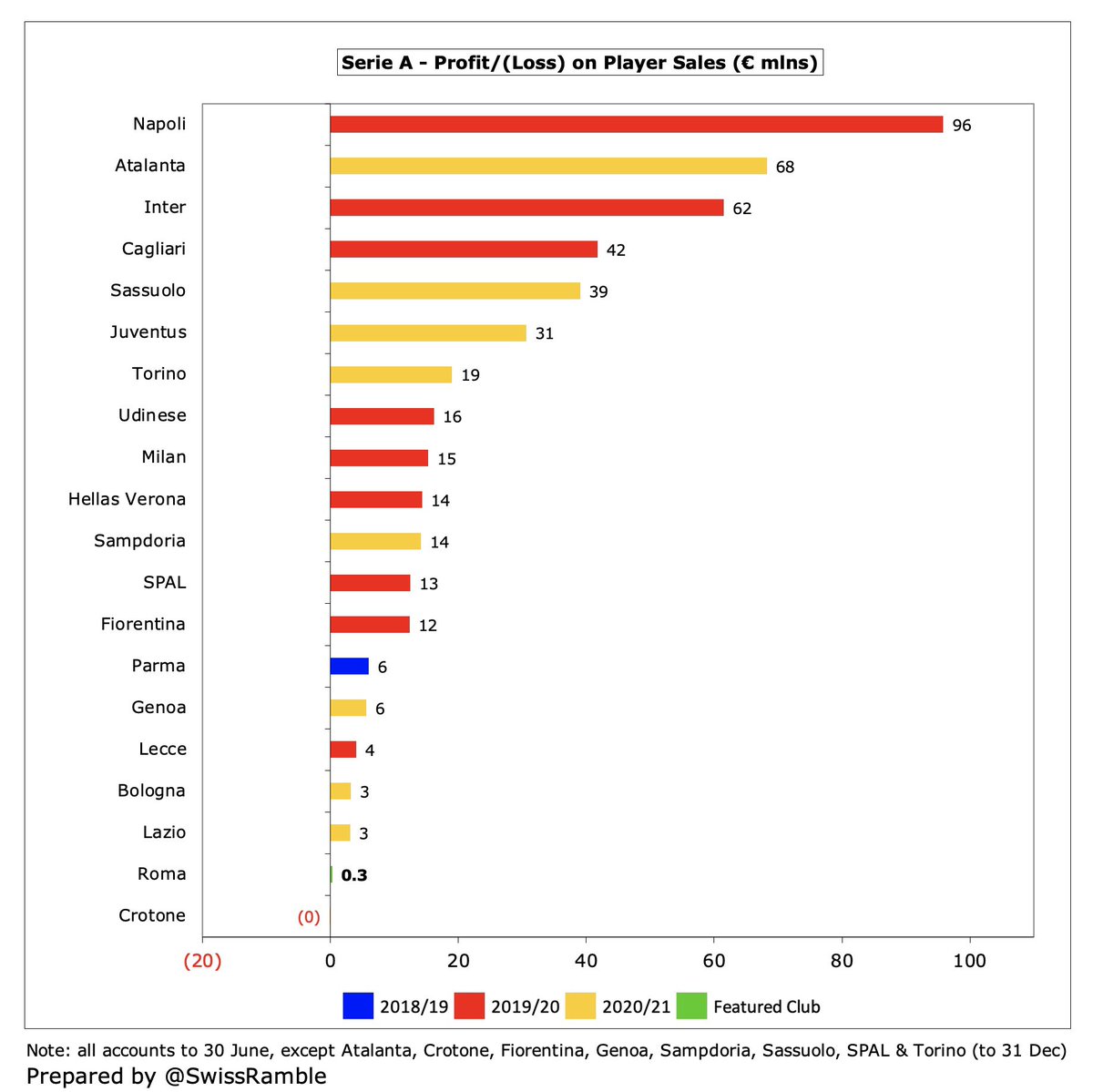

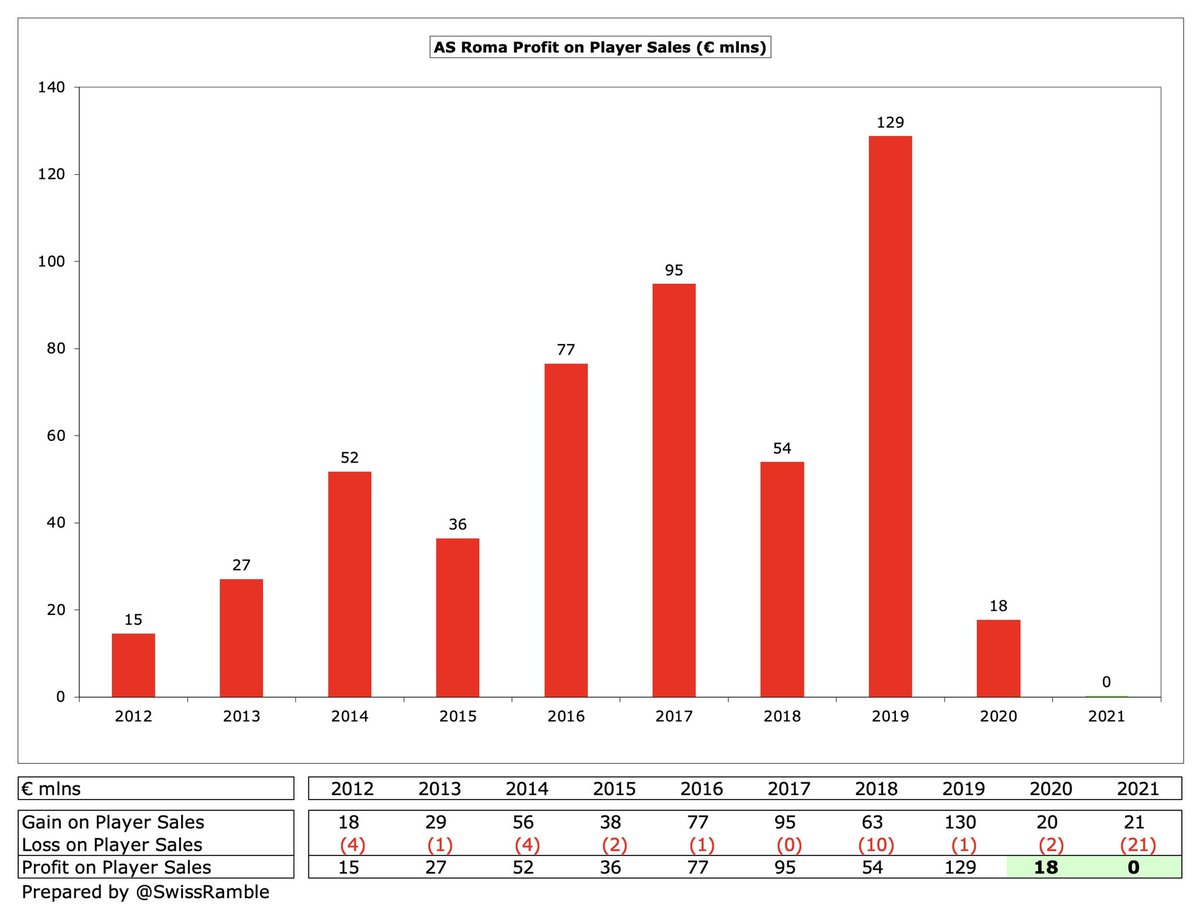

#ASRoma loss was not helped by profit on player sales falling from €18m to just €256k, as €21m gains were offset by similar losses. Highest gains came from Schick €8m, Cetin €4m, Cancelleri €2.5m & Diaby €2.5m, but large losses were booked on Pastore €10m & Nzonzi €8m.

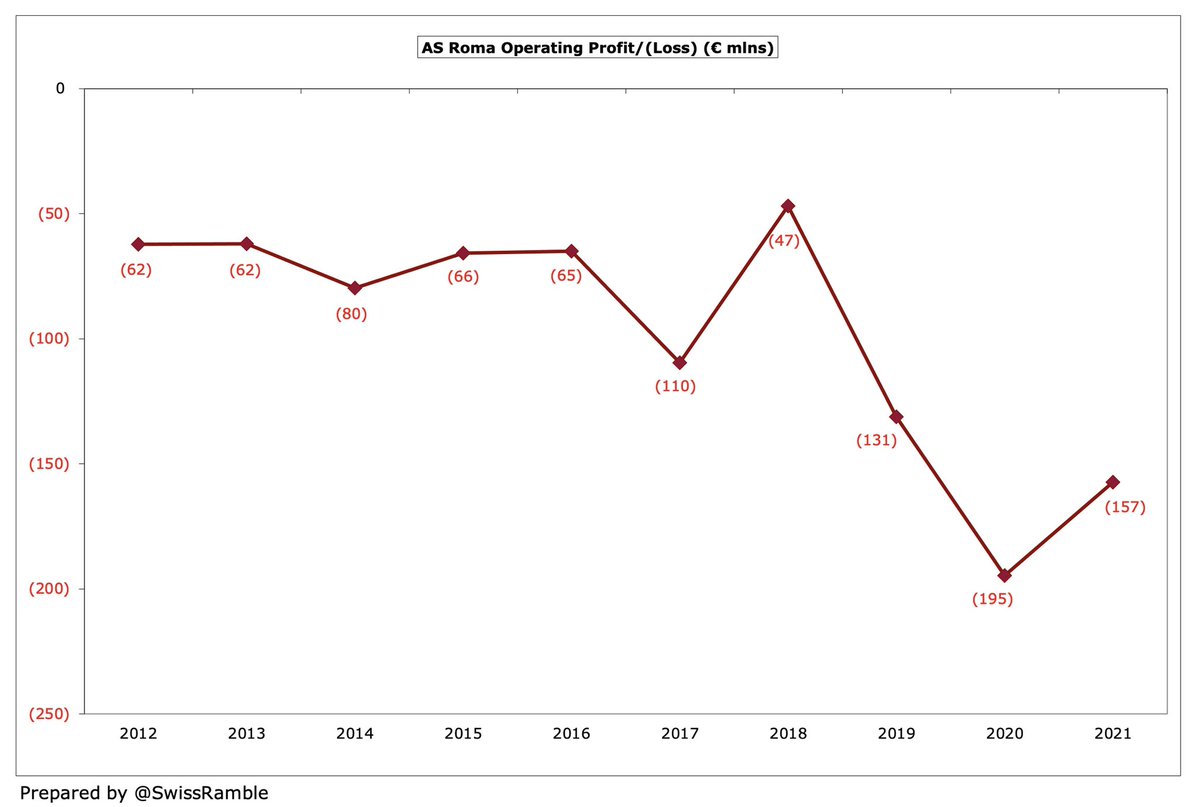

#ASRoma are no strangers to losing money, having suffered losses 12 years in a row, adding up to a horrific €674m. The last time they posted a profit was back in 2009 – and that was only €3m. That said, before COVID their only previous loss above €100m was €113m in 2003.

Profit from player sales has been very important for #ASRoma, generating €372m from this activity in 5 years up to 2020, second only to Juventus. However, player trading has dried up in the last two years with just €18m made in this period. Surely a focus area for new owners.

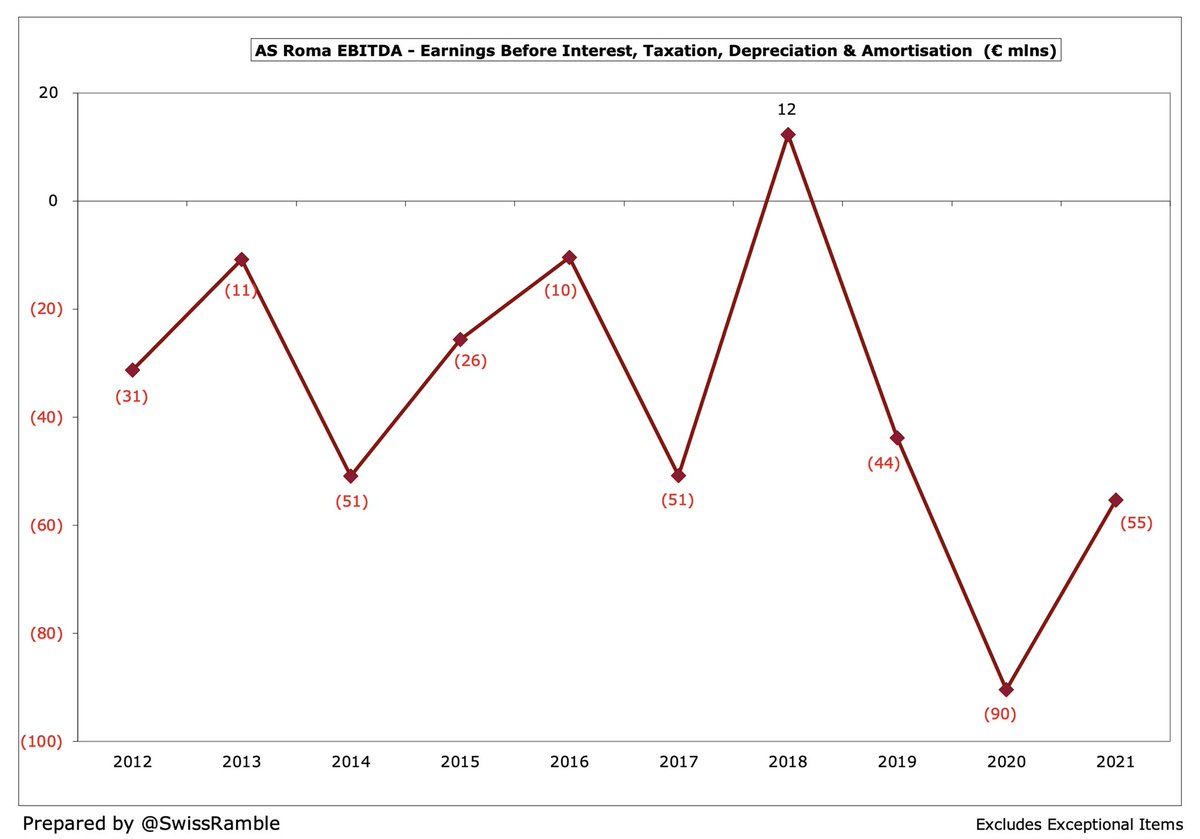

#ASRoma EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), a proxy for underlying profitability, as it excludes once-off items like player sales, improved from €(90)m to €(55)m, though still likely to be worst in Italy (once Milan publish 2020/21 accounts).

Similarly, #ASRoma operating loss (excluding profit from player sales and interest payable) narrowed from €195m to €157m, though this has declined from €47m only 3 years ago. This is likely to be the second worst in Serie A in 2020/21, only “beaten” by Juventus €228m.

#ASRoma €56m (22%) revenue fall in the last 3 years from €253m to €197m is obviously partly due to the impact of the pandemic, but also highlights the importance of qualifying for the Champions League, which was worth €98m in 2018 (TV €84m plus match day €15m).

Following the increase, #ASRoma €197m revenue is 3rd highest in Italy, though it will surely be overtaken by Milan and Napoli when those clubs publish their detailed 2020/21 accounts. Still less than half of Juventus €450m.

#ASRoma dropped out of the Deloitte Money League in 2019/20, having been 16th the previous season, partly due to German clubs benefiting from the Bundesliga completing its season before end-June. It is worth noting that Roma were as high as 9th in 2007/08.

#ASRoma broadcasting revenue shot up €51m (60%) from €86m to €137m, , benefiting from €21m deferred from 2019/20 for games played after end-June accounting close plus progress to Europa League semi-finals. Still behind Lazio, as rivals played in the Champions League.

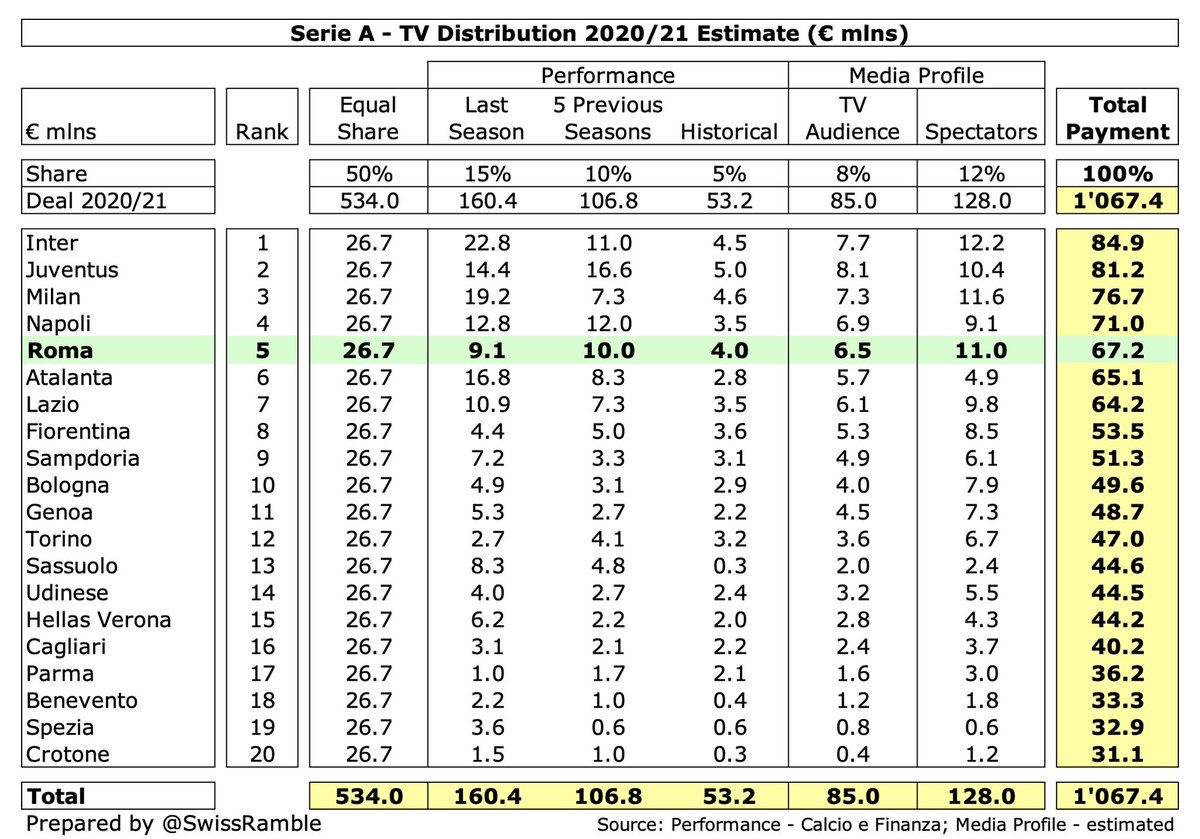

Per my model #ASRoma received €67m TV money from Serie A in 2020/21: 50% equal share; 30% performance (15% last season, 10% last 5 years, 5% historical); 20% media profile (8% TV audience, 12% fans). Also some income deferred from 2019/20 for games played in July and August.

It is imperative that #ASRoma do well in Europe to boost broadcasting income, as TV rights in Serie A are relatively low. England €3.6 bln and Spain €2.0 bln saw big increases in 2019, while Italy was unchanged at €1.3 bln. In fact, the new 2021-24 deal will be lower.

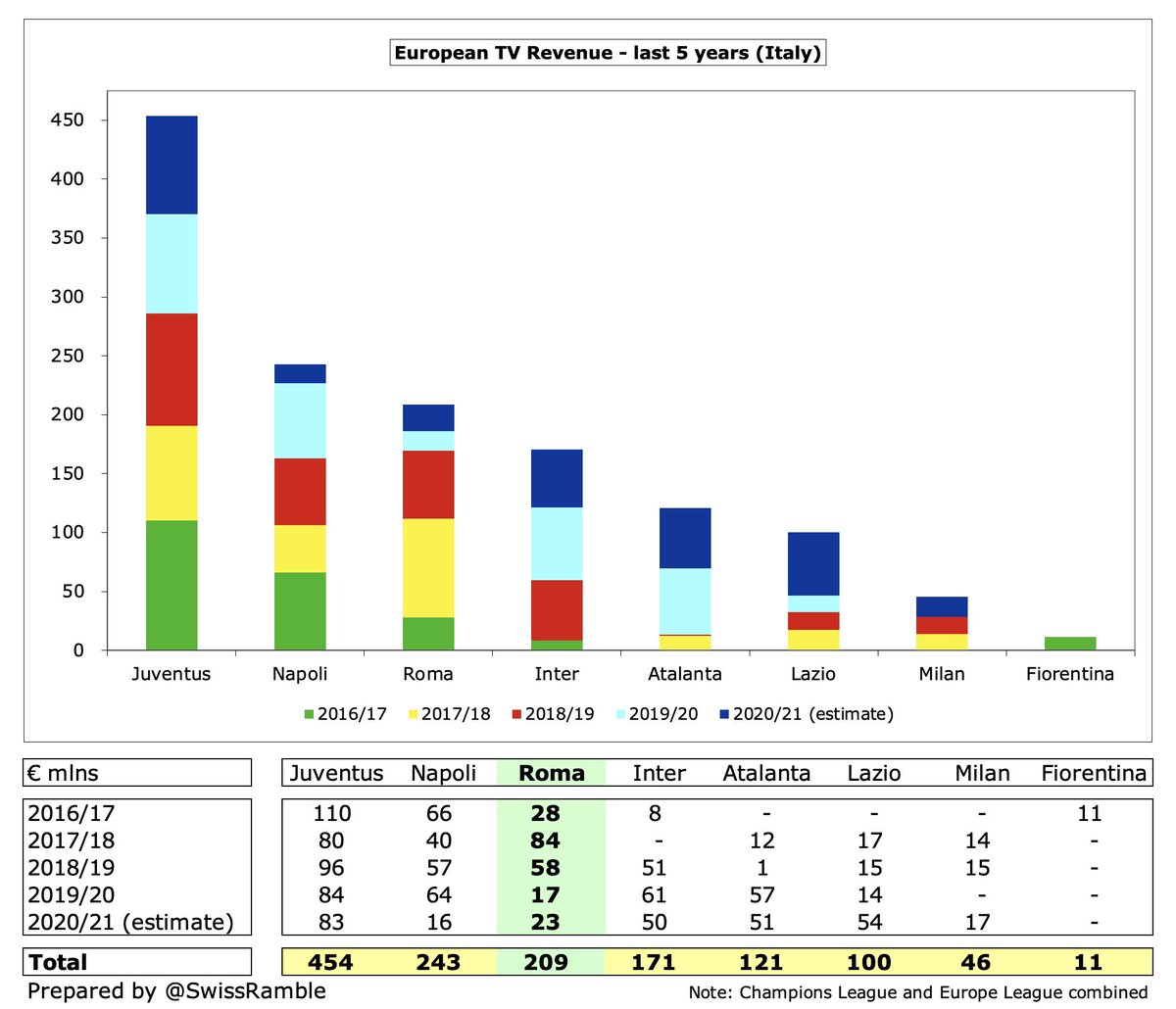

Based on my estimate, #ASRoma earned €23m for reaching Europa League semi-final after receiving €17m for prior season’s last 16 (both net of COVID rebate). Much lower than Champions League representatives: Juventus €83m, Lazio €54m, Atalanta €51m and Inter €50m.

European participation is extremely important for #ASRoma, who have earned €209m from Europe in last 5 seasons, only surpassed in Italy by Juventus €454m and Napoli €243m. However, they have only qualified for the inaugural (less lucrative) UEFA Conference League this season.

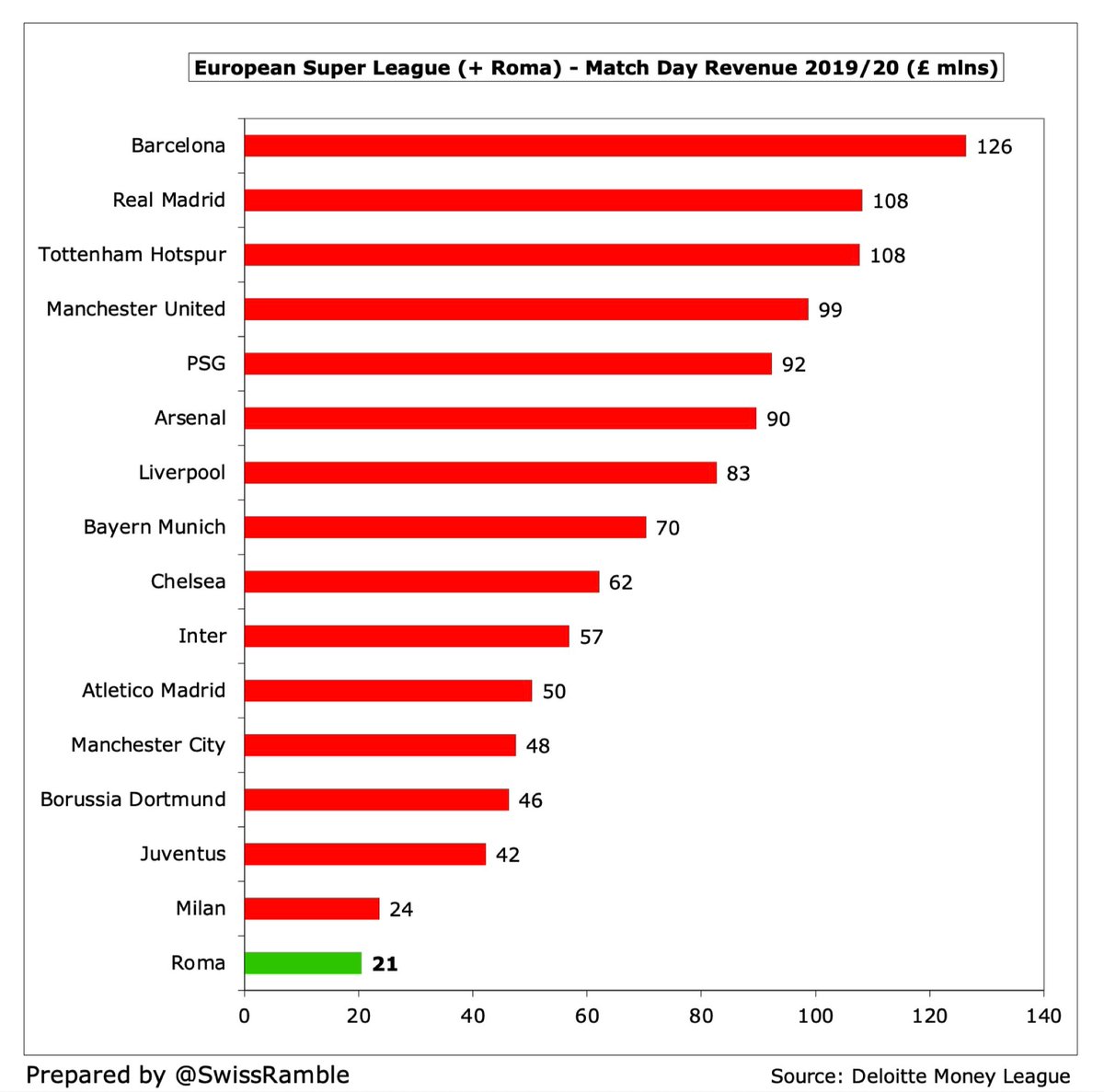

#ASRoma match day income fell €21m to less than €100k, as all home games were played behind closed doors (except one with 1,000 fans). This revenue stream was as high as €39m pre-COVID, though this is only around half of Juventus.

#ASRoma had the third highest attendance in Italy of 39,000 pre-COVID, so they will be happy that Italian stadiums have returned to 75% capacity this season with media reports of a full return of fans in November.

#ASRoma have long sought a new stadium, but this has suffered many delays, which may well be one reason that Pallotta sold the club. Indeed, the Friedkins have abandoned the Tor di Valle project, so match day revenue will continue to suffer compared to elite clubs.

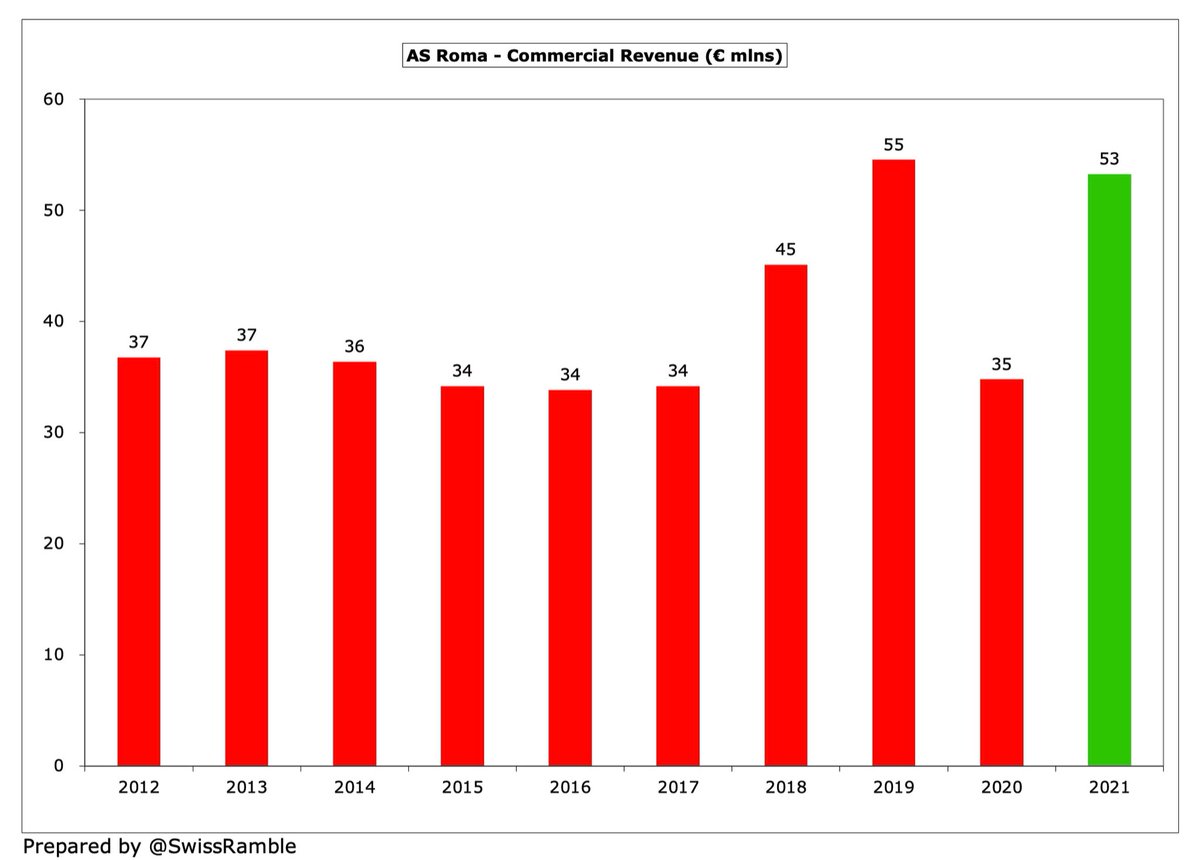

#ASRoma commercial income rose €18m (53%) from €35m to €53m, partly because of deferred revenue from extended 2019/20 season, but also due to new partnerships and higher insurance payments for injured players.

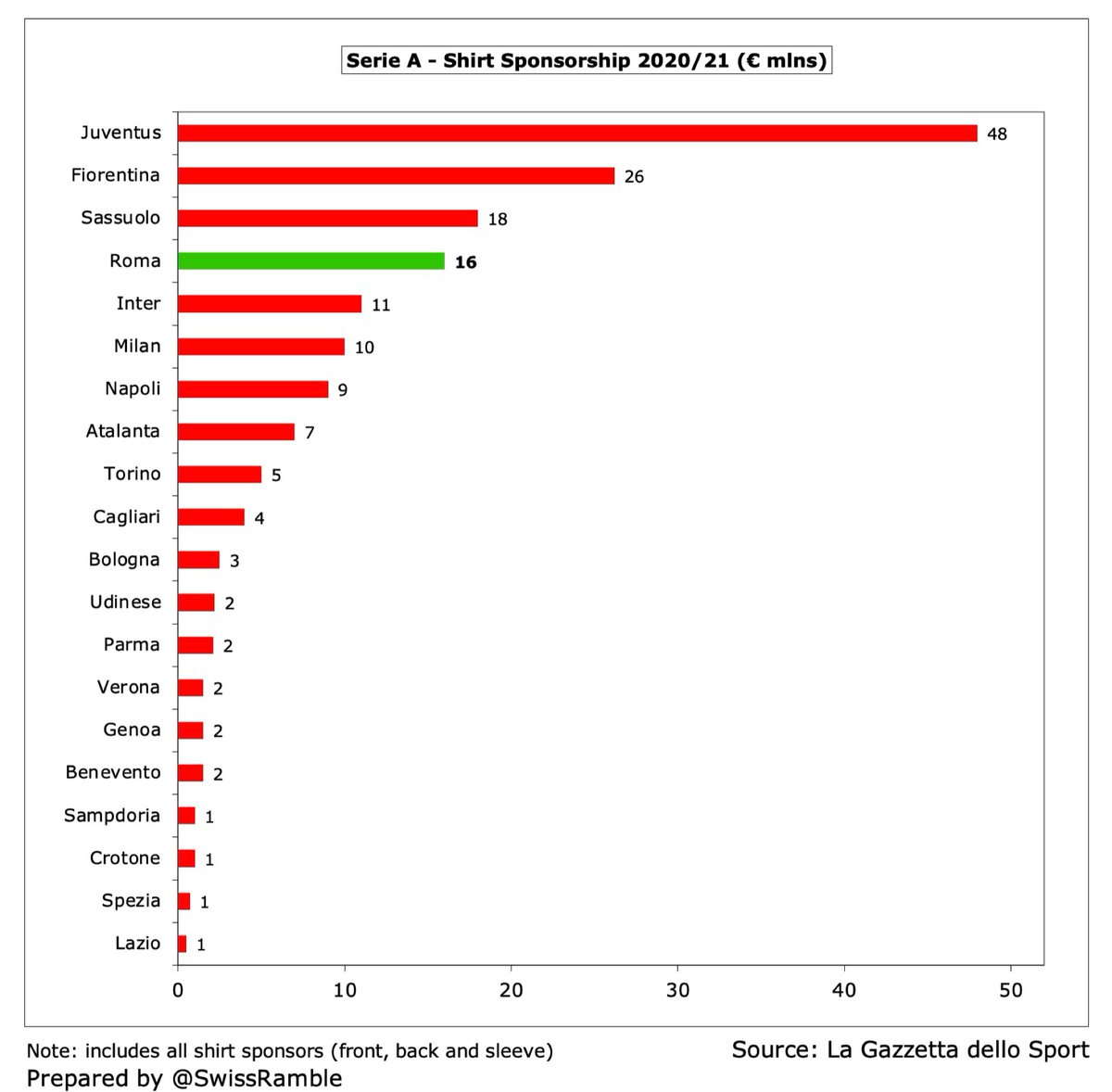

Following the increase, #ASRoma €53m commercial income is 4th highest in Italy, but only around a quarter of Juventus €194m. Also a fair way below Inter and Milan, so the new owners will be aiming to boost growth here.

#ASRoma main sponsorship agreements with Qatar Airways and Nike both ended in 2021, replaced by 3-year deals with DigitalBits blockchain company (worth around €12m a year) and New Balance (€3m). Hyundai back-of-shirt deal extended for 2021/22. Far below Juventus (Jeep €45m).

#ASRoma player loans income decreased from €7m to €6m, largely Under to #LCFC and Kluivert to RB Leipzig, though other income from player management (mainly performance bonuses from previous player sales) rose from €5m to €9m. One of the highest in Italy in total.

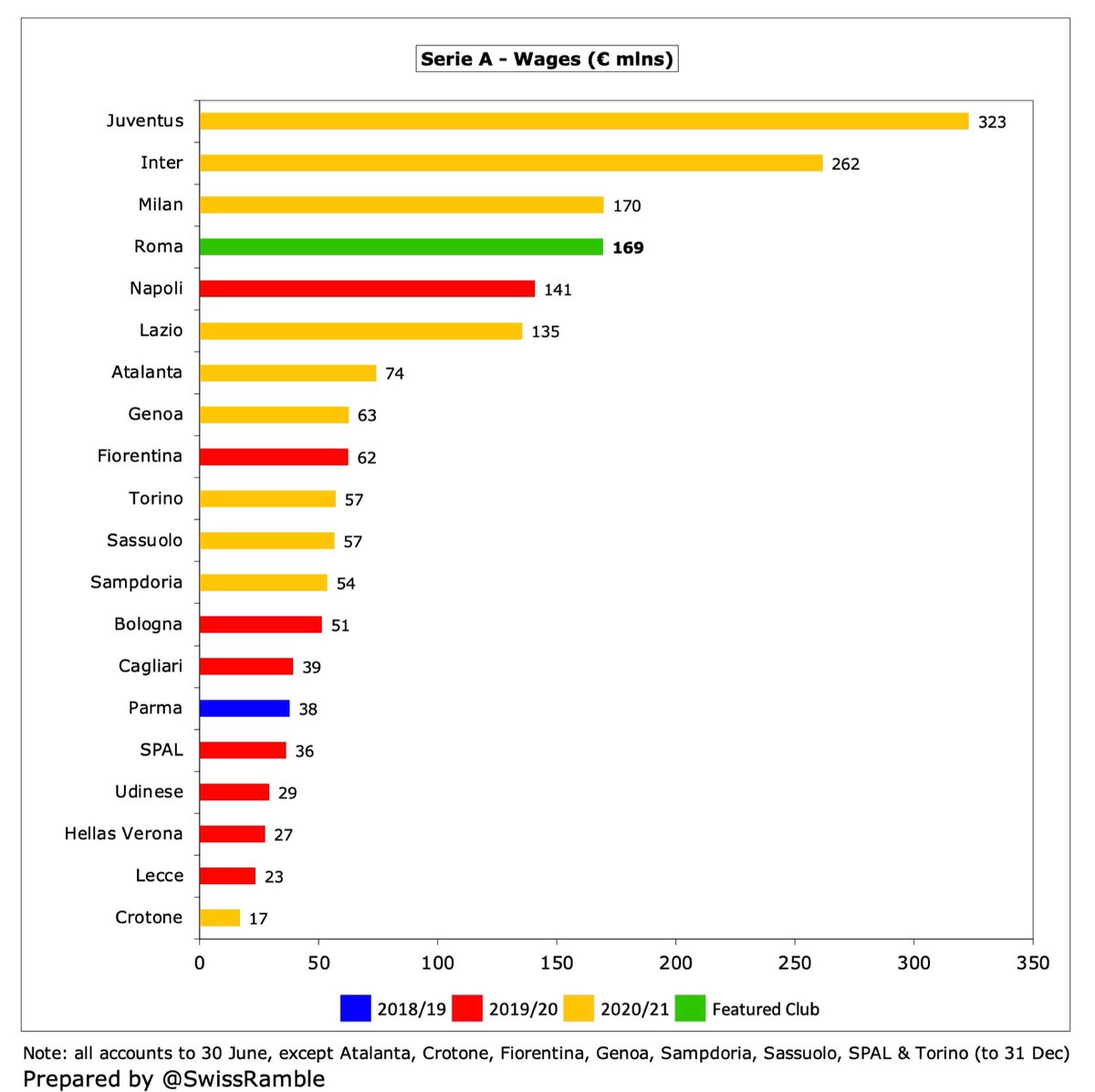

#ASRoma wage bill rose €14m (9%) from €155m to €169m, partly because of €10m postponed from 2019/20 due to COVID-extended season. Wages only up €14m (9%) in last 5 years, while others’ growth has significantly outpaced them (Inter €137m, Juventus €101m & even Lazio €76m).

#ASRoma €169m is 4th highest wage bill in Serie A, around the same level as Milan €170m, but miles below Juventus €323m & Inter €262m. The only other clubs above €100m are Napoli €141m (2019/20) & Lazio €135m, followed by Atalanta €74m (punching well above their weight).

#ASRoma wages to turnover ratio improved from 104% to 86%, though this is still one of the highest (worst) in Italy, much more than Juventus 72% and especially Atalanta 48%. Wages should fall after the departure of a number of high earners like Dzeko, Pastore and Nzonzi.

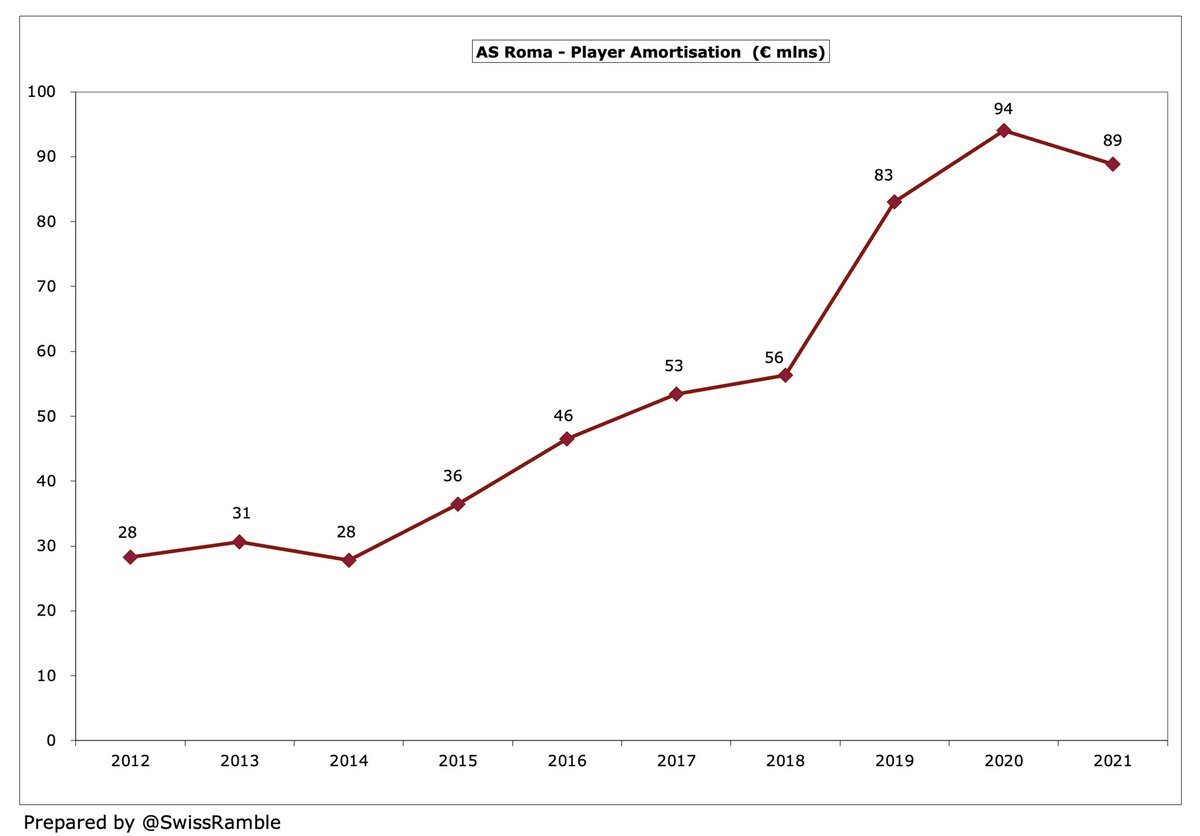

#ASRoma player amortisation, the annual cost of writing-off transfer fees, decreased by €5m (5%) from €94m to €89m, but this expense has still more than tripled from €28m in 2014. Nevertheless, only around half of Juventus €177m.

#ASRoma have increased gross transfer spend with €542m in the last 5 years, compared to €462m in the preceding 5-year period, but sales have also increased from €344m to €442m, so net spend actually fell from €118m to €101m.

Based on Transfermarkt, #ASRoma have the 2nd highest gross transfer spend in Italy in last 4 years, only behind Juventus (3rd for net spend, below Milan & Juve). They actually had the highest outlay this summer with €124m, including most expensive signing (Tammy Abraham €40m).

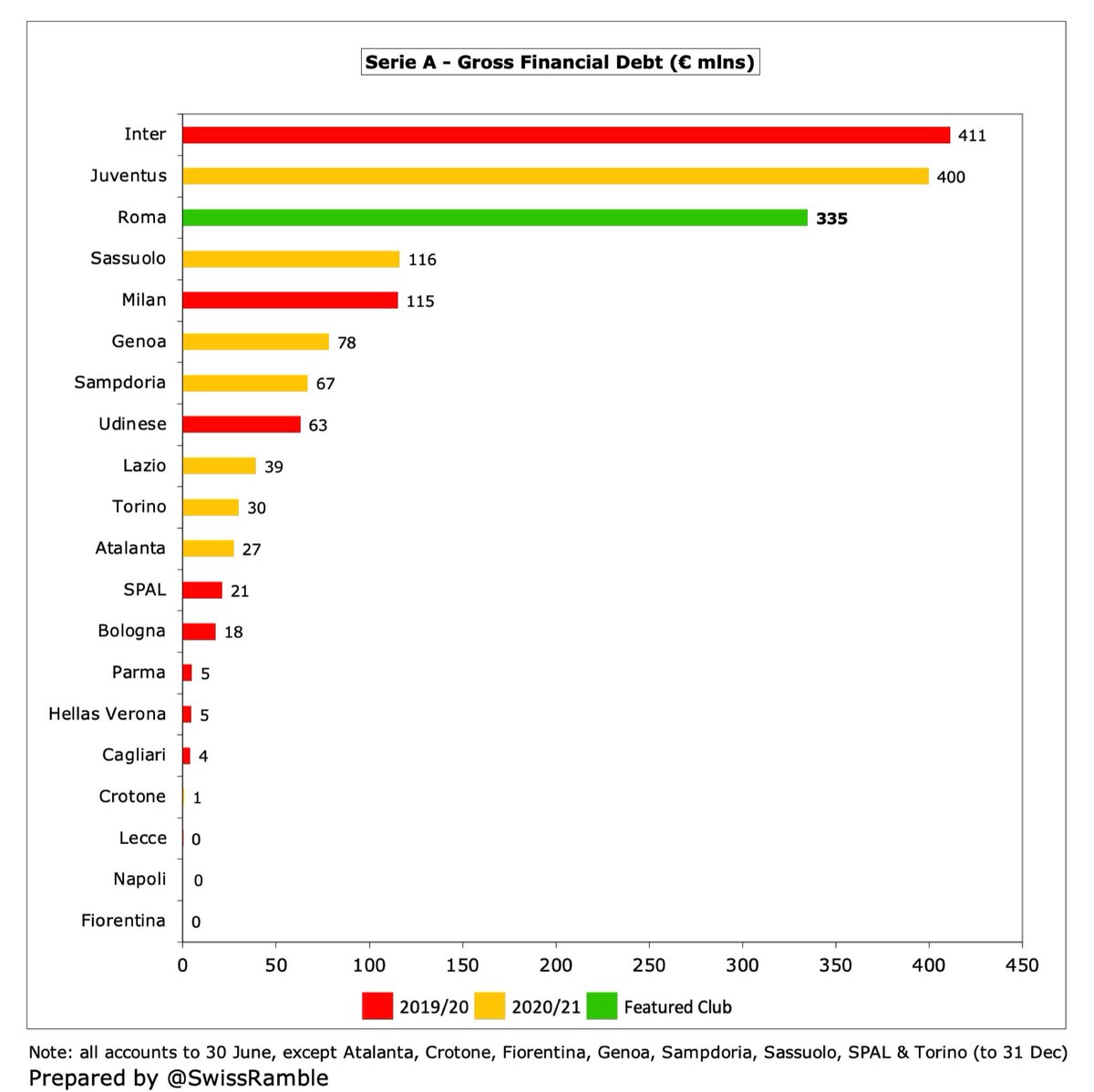

#ASRoma gross financial debt increased by €17m from €318m to €335m, comprising €261m bonds, €31m shareholder loans, €26m finance leases (due to IFRS 16) and €16m bank loans. Net debt virtually unchanged at €302m, as cash & cash equivalents rose €15m from €18m to €33m.

#ASRoma gross debt of €335m is 3rd highest in Italy, only behind Inter €411m (2019/20) & Juventus €400m. These three have much more debt than all other Italian clubs. Since these accounts closed, owners provided working capital loans up to €121m, but now converted to capital.

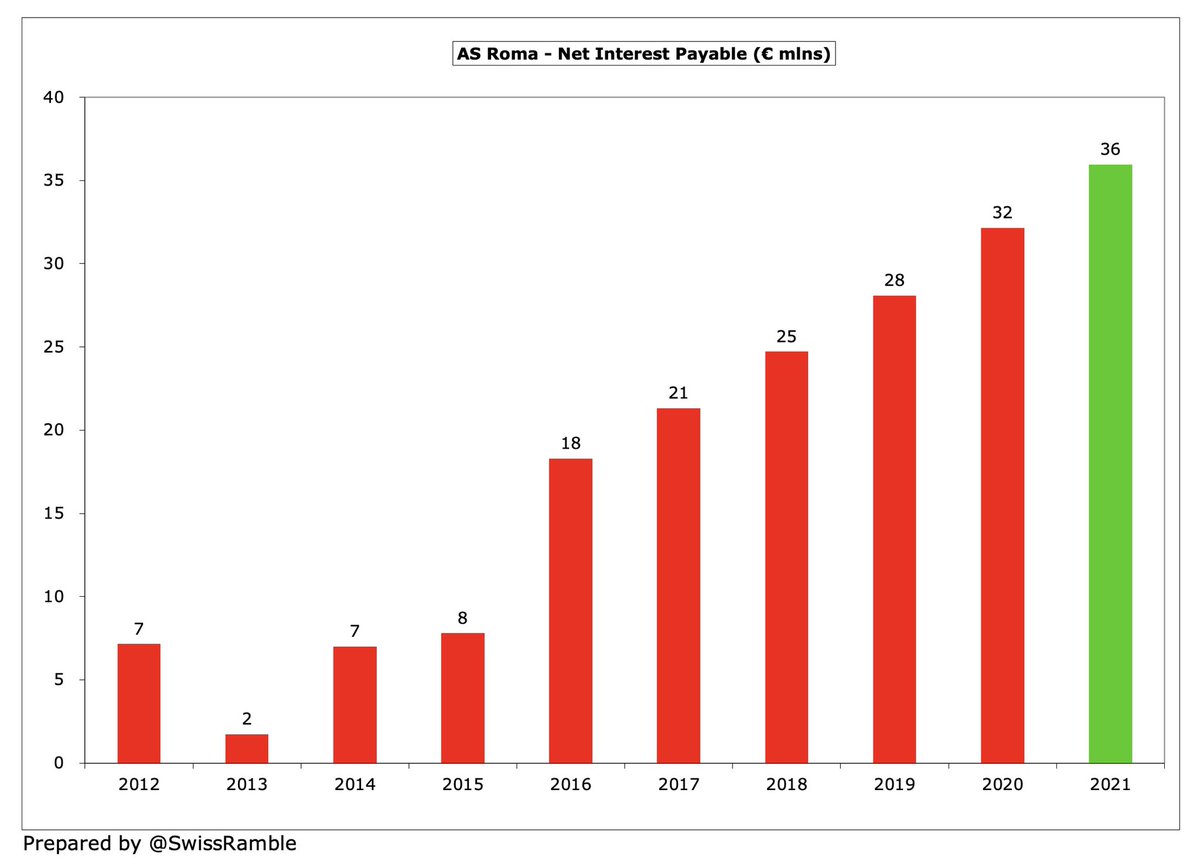

#ASRoma net interest payable rose €4m (12%) from €32m to €36m, mainly due to interest on the bonds (fixed rate 5.125%). This expense has increased from only €8m in 2015 and is now easily the highest in Italy, far ahead of Inter €26m and Juventus €11m.

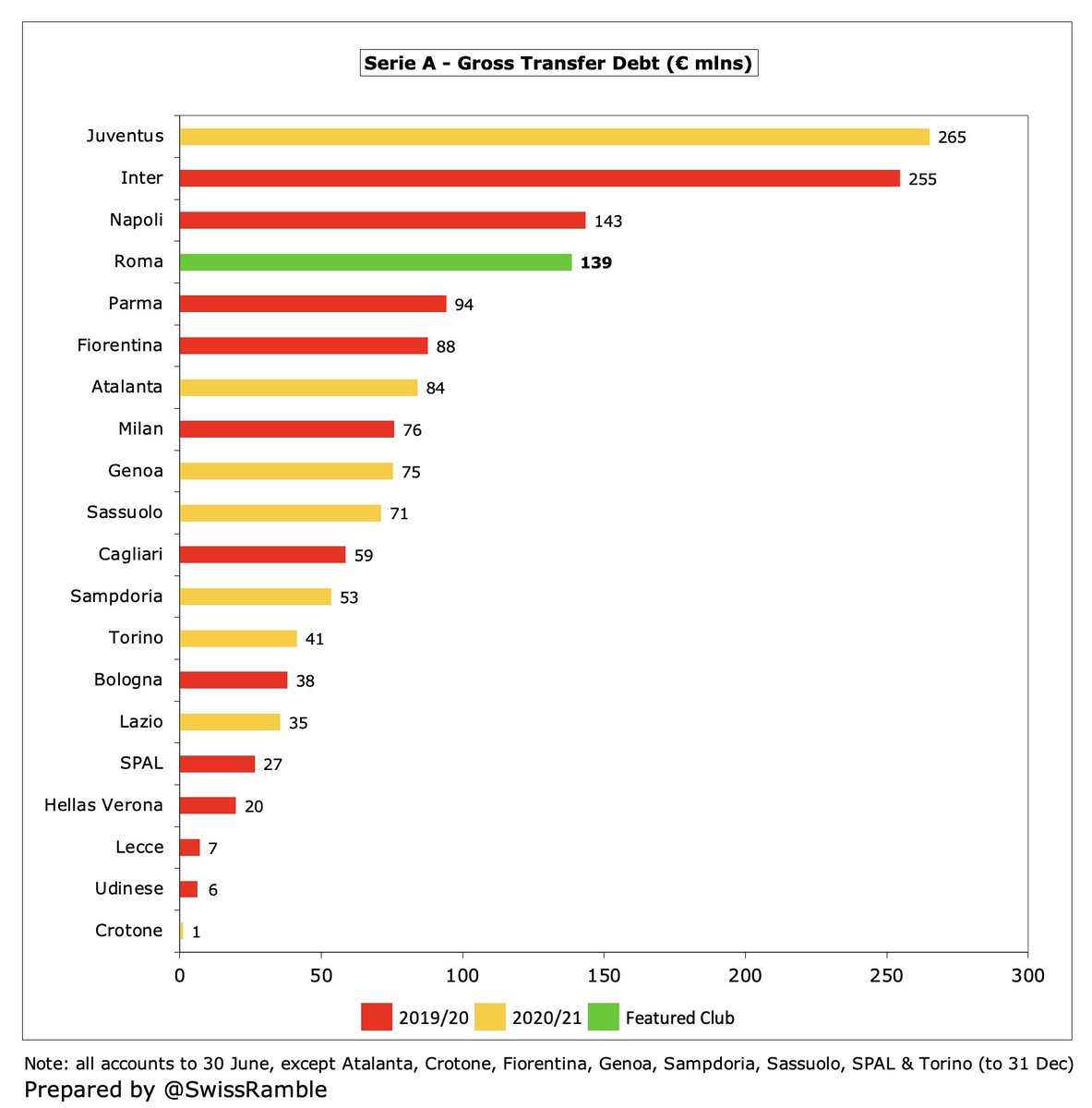

In addition, #ASRoma owe €139m in transfer fees, though they did manage to cut this by €52m from €192m in 2020. Still one of the highest in Italy, but only around half of Juventus’ €265m.

#ASRoma have been very reliant on capital injections by their owners. Initially, €150m was approved in 2020, but this was then raised to €210m and recently was further increased to €450m by 31 December 2022. That would take capital funding since 2012 to a massive €654m.

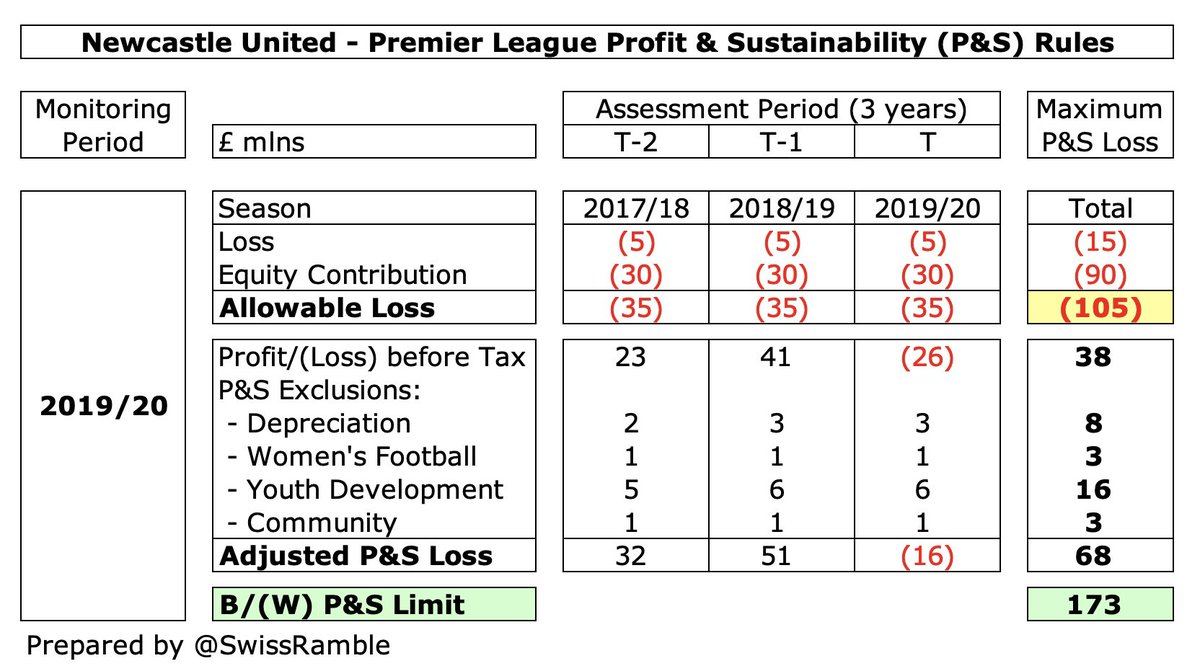

#ASRoma noted that they have failed to meet UEFA’s Financial Fair Play targets for the 4-year monitoring period, even though these were relaxed for COVID. However, they also say that “the automatic application of a sanction as a consequence of violation is not predetermined”.

#ASRoma are caught between a rock and a hard place, as they require significant investment to compete (and to meet Jose Mourinho’s expectations), but they cannot afford to spend big if they want to improve finances, especially if they fail to qualify for the Champions League.

• • •

Missing some Tweet in this thread? You can try to

force a refresh