Following Newcastle United’s takeover by a consortium led by Saudi Arabia's Public Investment Fund (80% stake), #NUFC fans are eagerly anticipating a spending spree, due to the enormous wealth of the new owners, but how much can the club really spend, especially with FFP rules?

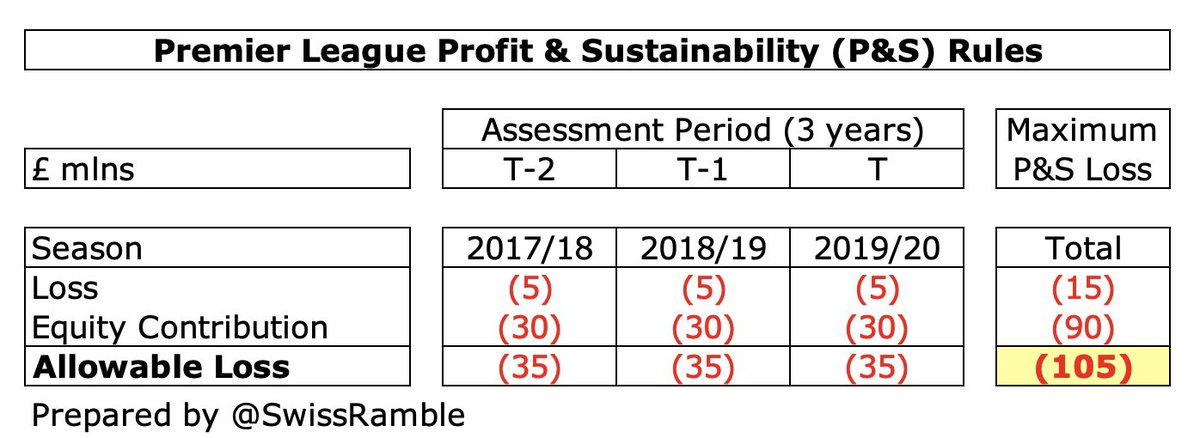

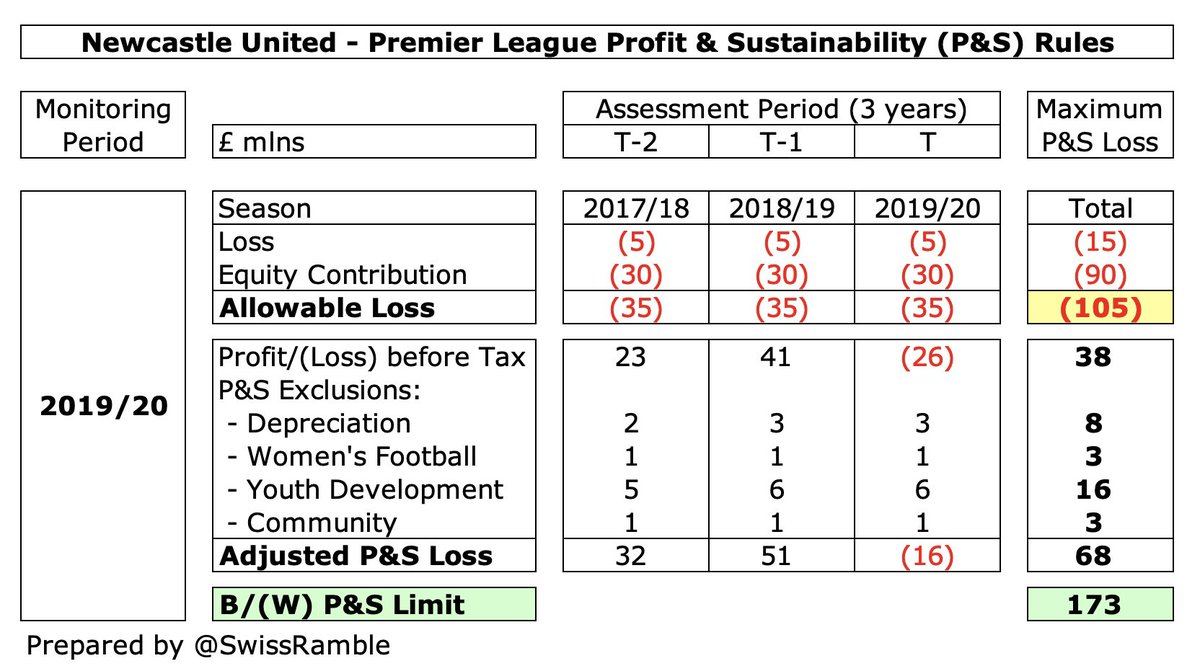

#NUFC spending ability will be limited by the Premier League Profitability and Sustainability rules. These allow a £5m loss a year, which can be boosted by £30m equity injection, giving allowable losses of £35m a year. This works out to £105m over the 3-year monitoring period.

#NUFC made £38m pre-tax profit over 3 years up to 2020 (latest published accounts), but they can make a £30m adjustment for “good” expenditure (depreciation, women’s football, youth development & community). Adding this £68m to £105m allowable loss gives £173m possible spend.

However, clubs can also adjust for COVID impact, which was £27m for #NUFC in 2019/20, so their total spending potential rises to £200m. Clearly, the 2020/21 accounts are likely to show a loss, due to playing almost all games without fans, but impact will again be offset.

To understand what that £200m spend actually means, we need to understand player trading accounting. Transfer fees are not fully expensed in the year a player is purchased, but instead written-off evenly over the length of the player’s contract via player amortisation.

So if a player is purchased for £30m on a 5-year contract, the annual amortisation in the accounts would be £6m, i.e. £30m divided by 5 years. This is important, as it means #NUFC could actually spend much more than £200m, as only the impact on profits is considered for FFP.

In theory, #NUFC could splash out around £600m on transfers (say, 4 top class players at £150m each), increasing player amortisation by £120m a year (assuming 5-year contract), while increasing the wage bill by £62m (with players paid £300k a week) and still be below £200m.

However, that would use up #NUFC entire FFP limit in one year, which would cause a problem the following year – unless they grow revenue. So it might be more sensible to buy, say, 4 players for £50m each on £100k wages, which would give a £61m impact a year.

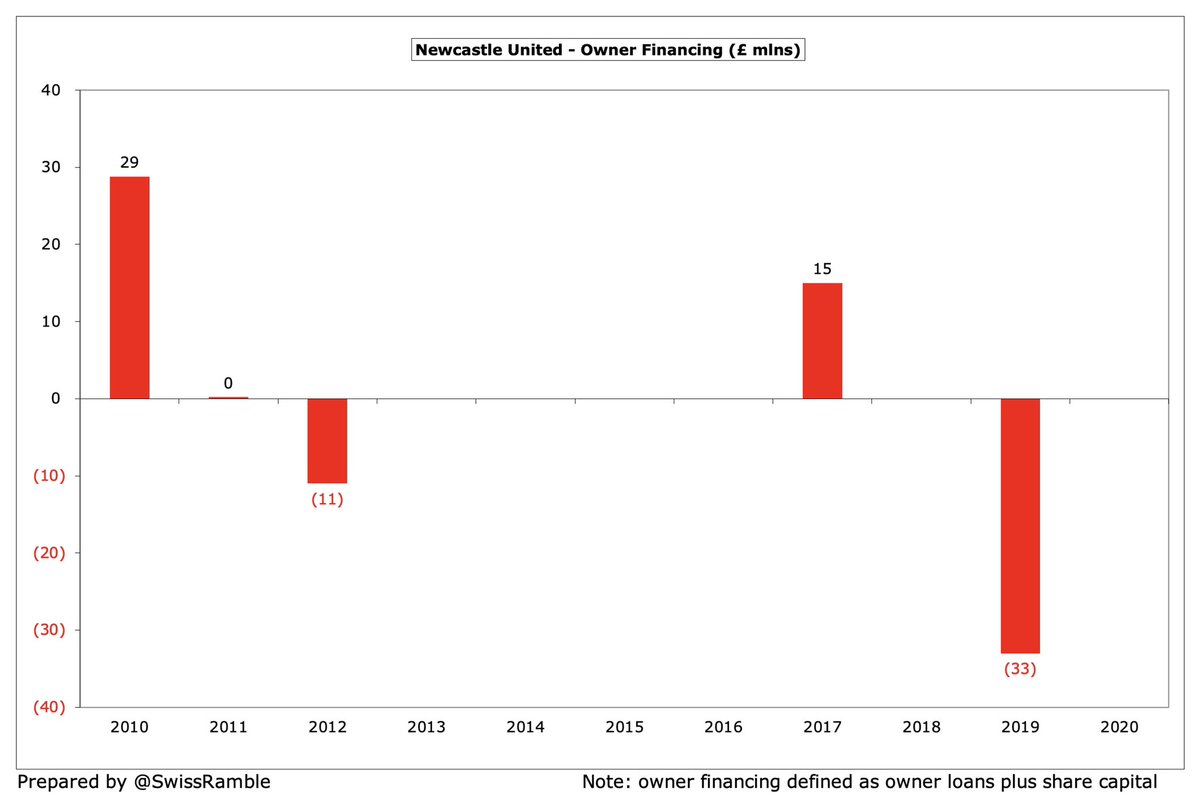

The fact that #NUFC can spend so much despite P&S regulations is thanks to Mike Ashley’s parsimonious approach to spending in the last few years. While this conservative strategy was not appreciated by supporters, it has ironically now left the club with plenty of wriggle room.

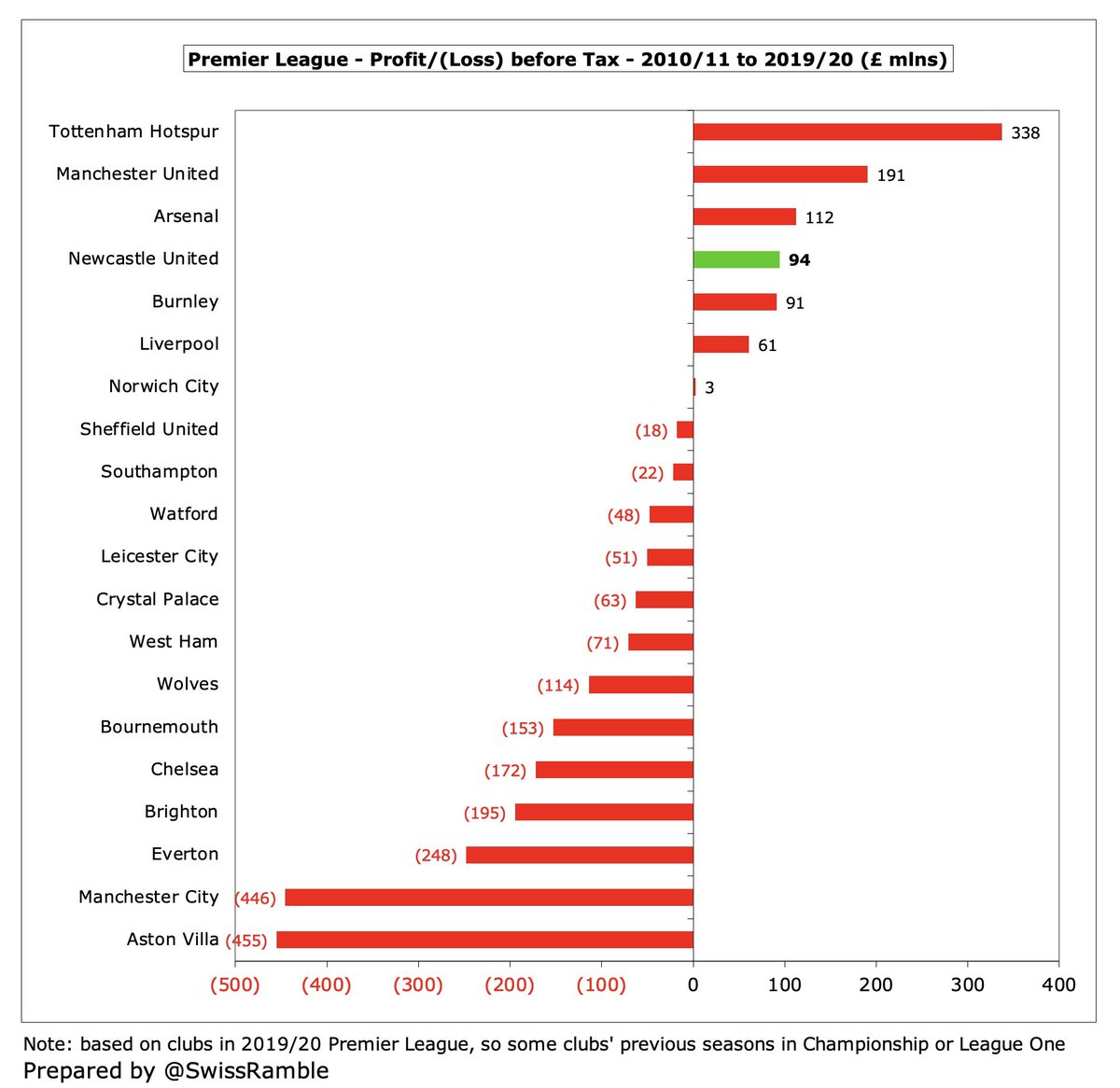

#NUFC have only lost money twice in the last 10 years, the largest being in the Championship in 2017. The £26m loss in 2020 would have actually been a £1m profit without COVID. In fact, Newcastle have the 4th highest profits in the Premier League over the last decade.

#NUFC enjoyed the 5th highest wage bill in England before Ashley bought the club in 2007, but this slipped to 11th in 2020, as their growth was significantly outpaced by others. In fact, the £121m wages in 2020 were inflated by the accounting period being extended to 13 months.

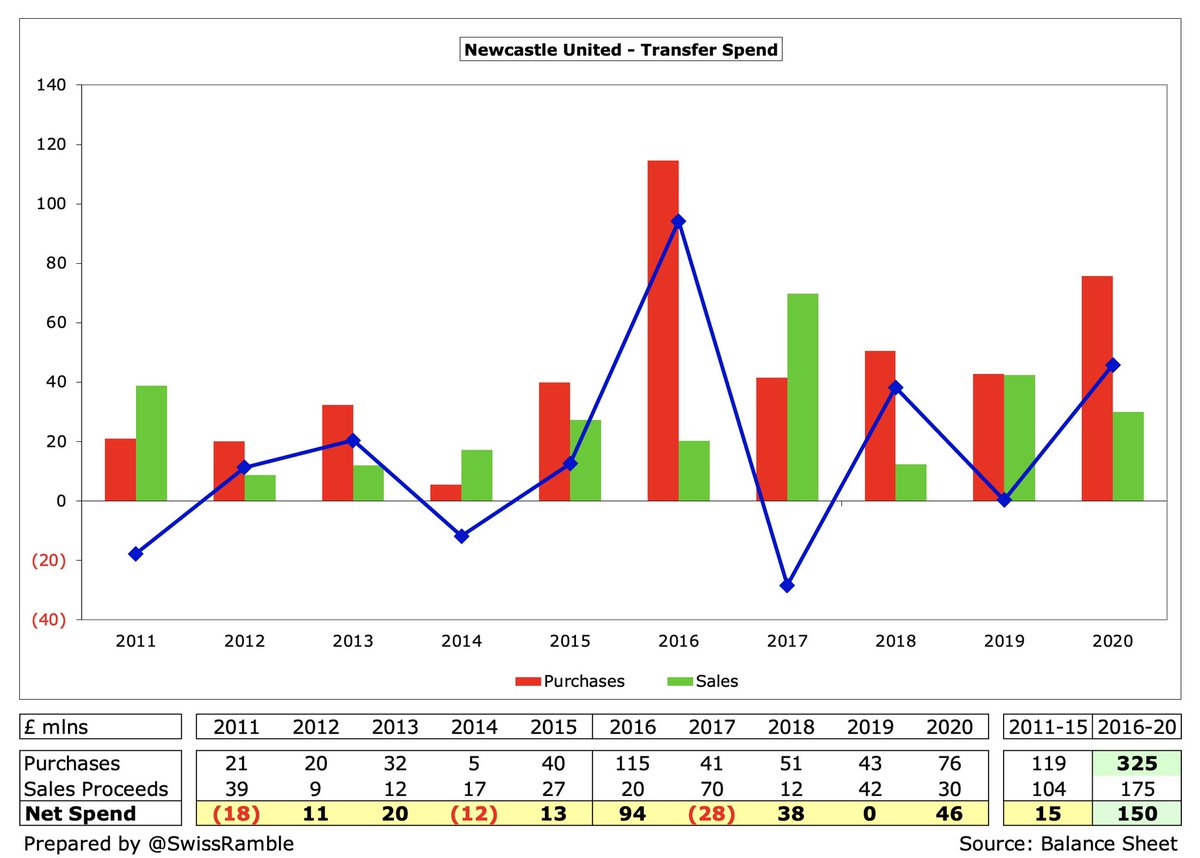

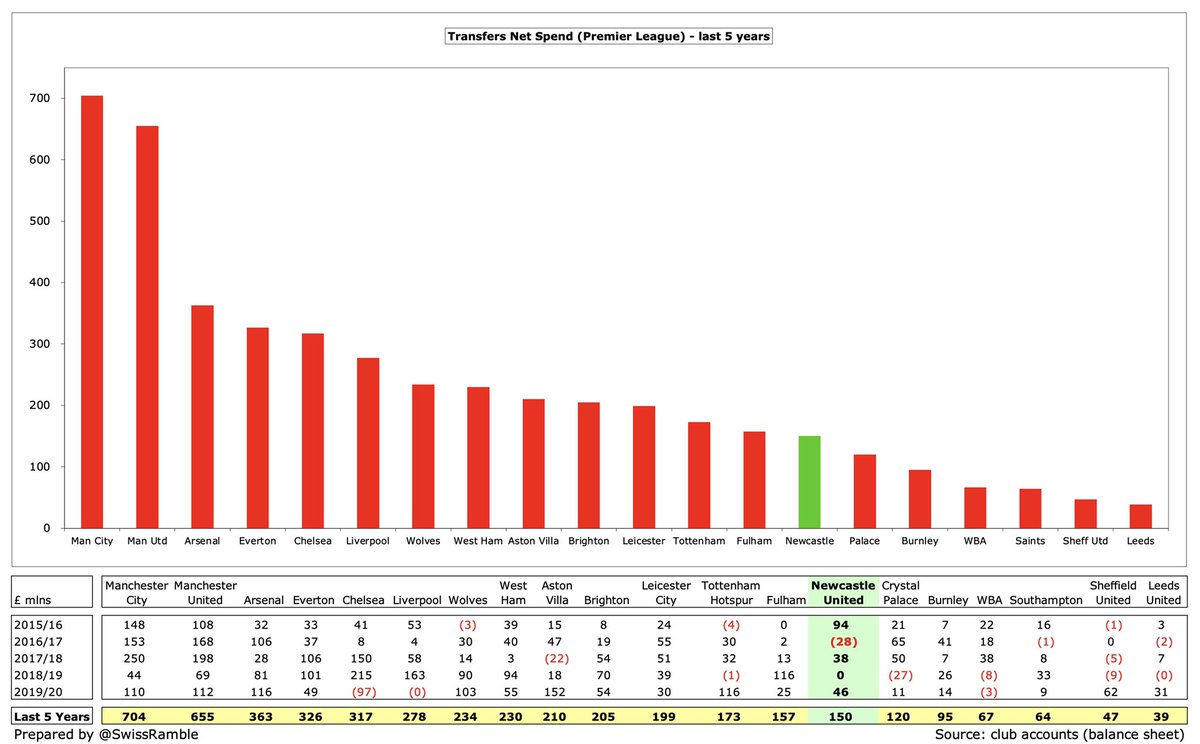

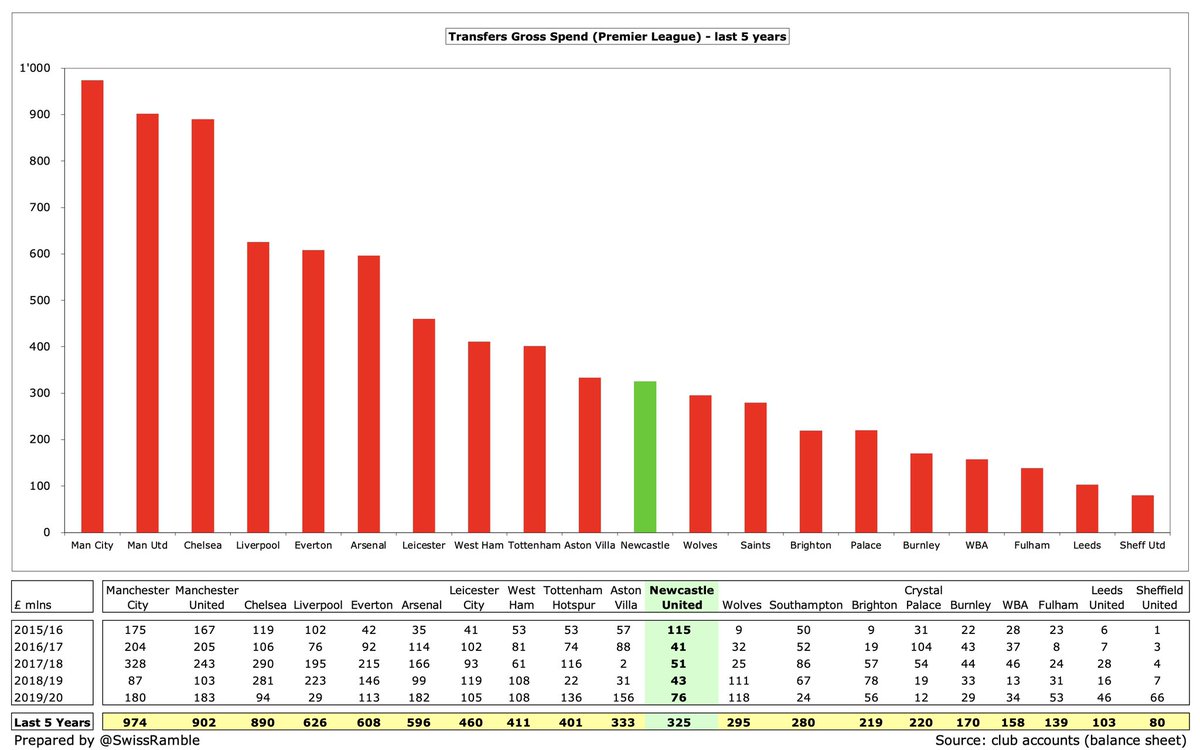

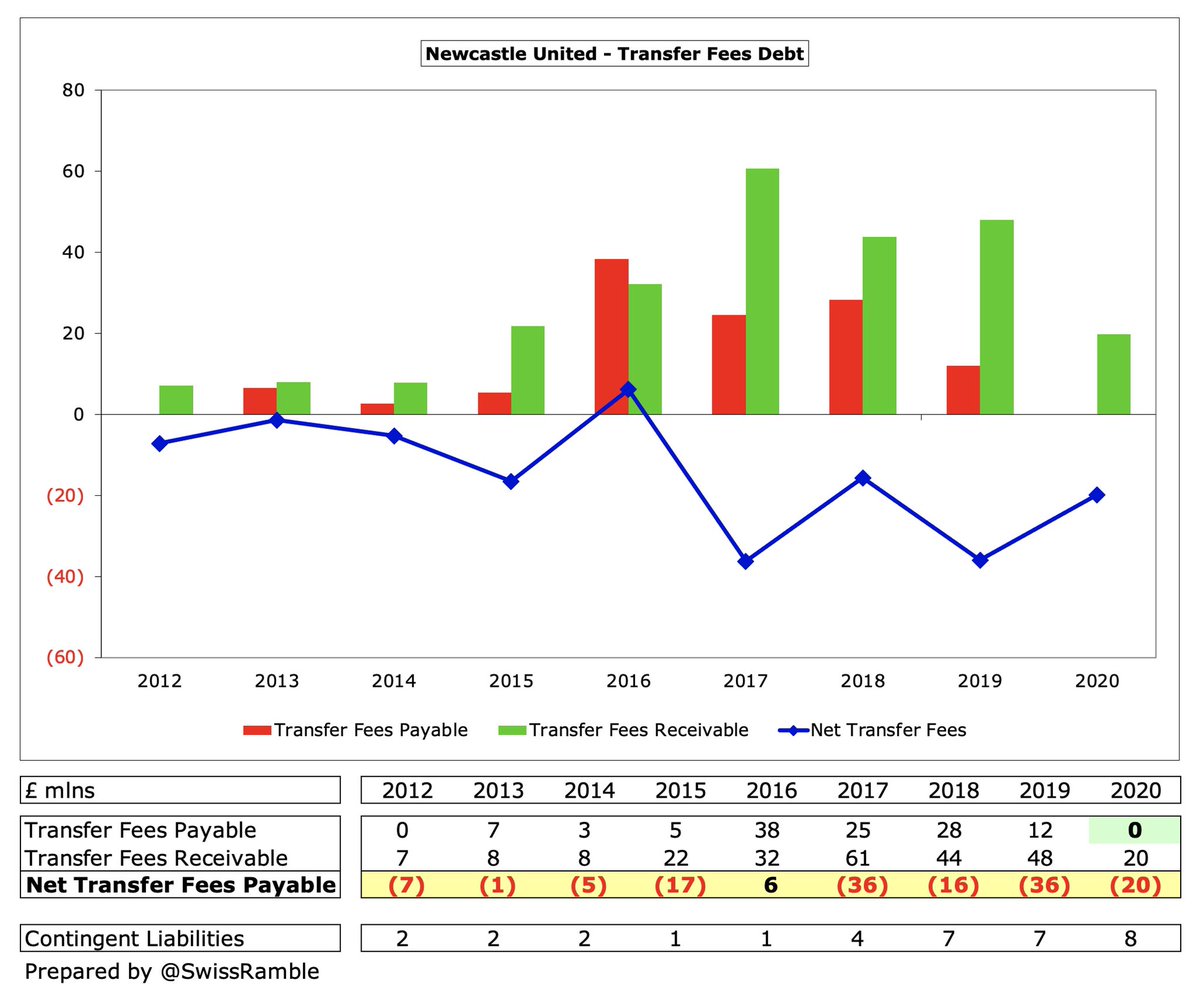

#NUFC have also lagged behind in the transfer market, e.g. their £150m net spend in the l5 years up to 2020 is only 14th highest in the Premier League, behind the likes of #FFC, #AVFC and #WWFC. The ranking is higher for gross spend, but still only 11th.

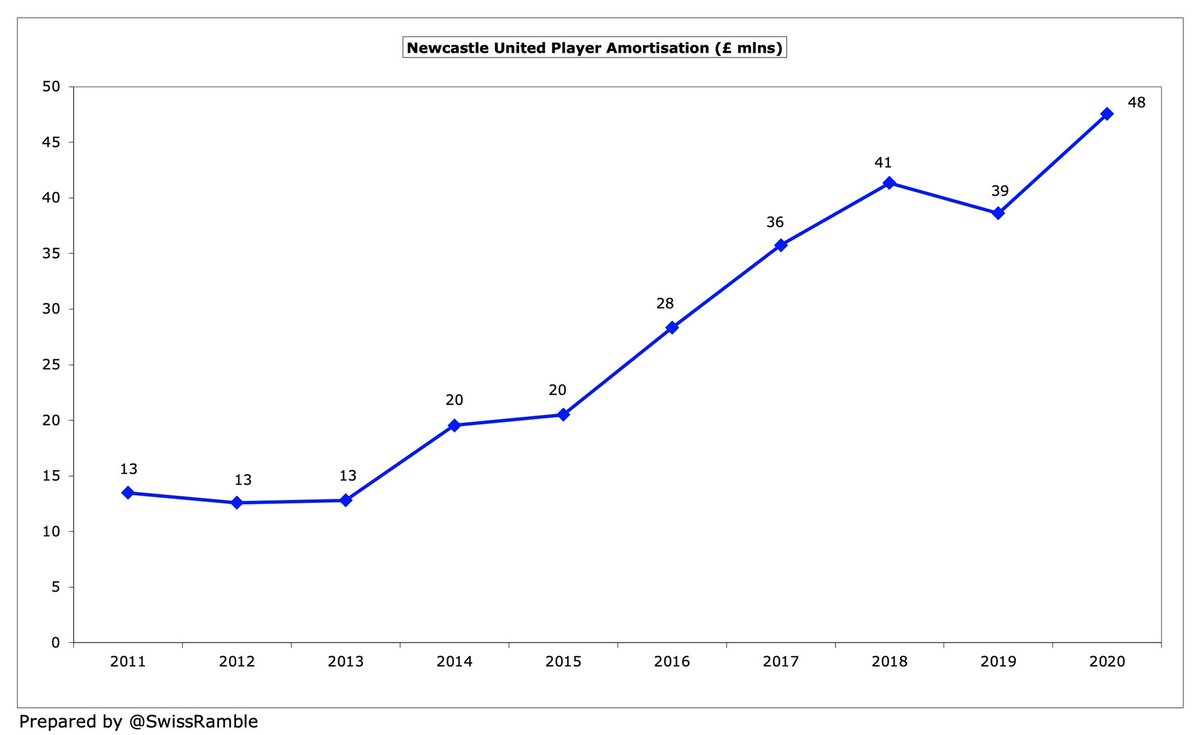

As a result, #NUFC £48m player amortisation is firmly in the bottom half of the Premier League. It would have been even lower if the 2020 accounts had not covered 13 months. Also booked £11m impairment charge to reduce player values, which is helpful for future accounts.

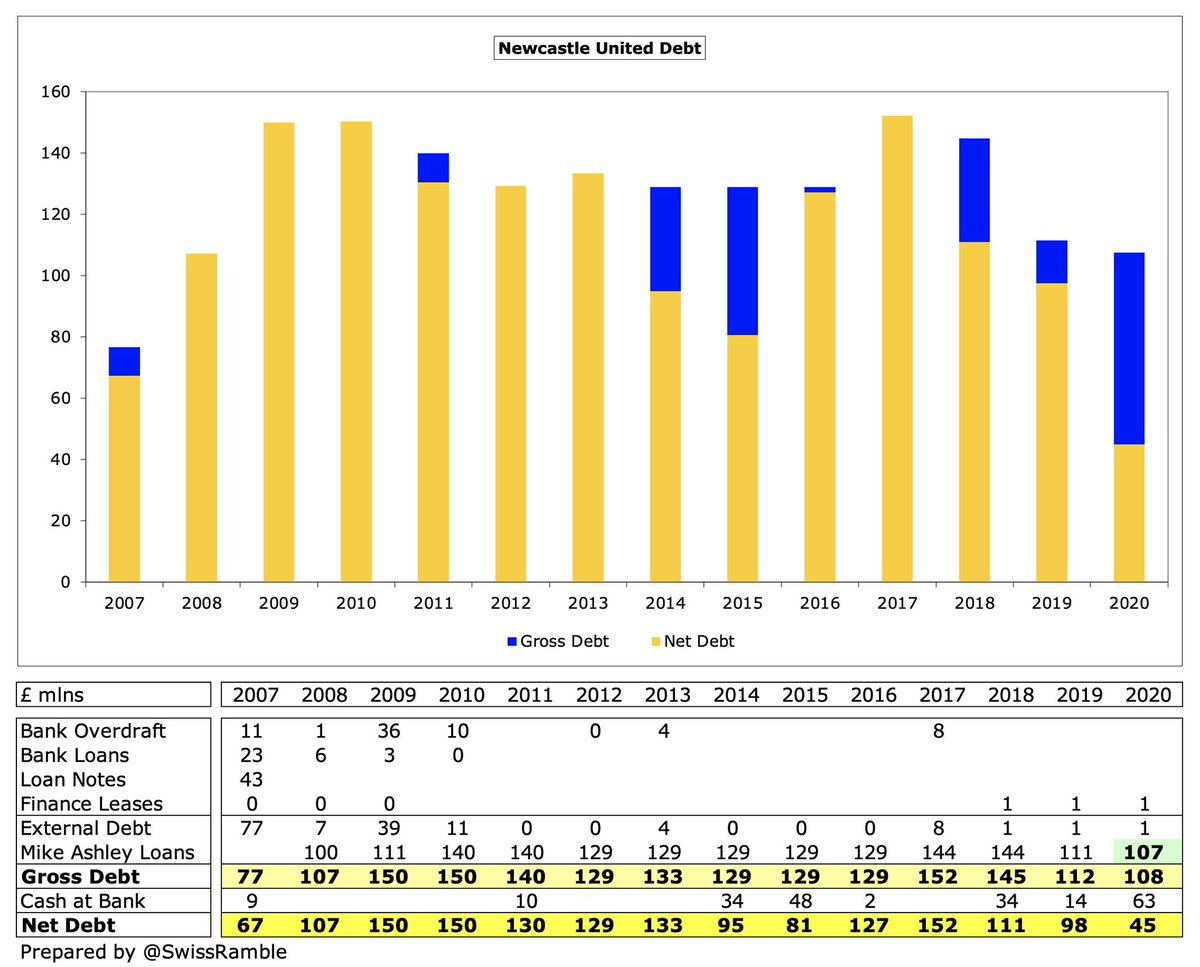

#NUFC £108m debt is also on the low side, only the 11th highest in the top tier. The club has virtually no external debt, while Ashley’s £107m loan has presumably been repaid as part of the acquisition, which would then leave the club pretty much debt-free.

As Ashley’s loans were interest-free, #NUFC only paid £160k interest in 2020, which was one of the lowest in the top flight, miles below the likes of #MUFC £20m (Glazers’ leveraged buy-out), #THFC £14m (new stadium) and #AFC £11m (Emirates stadium).

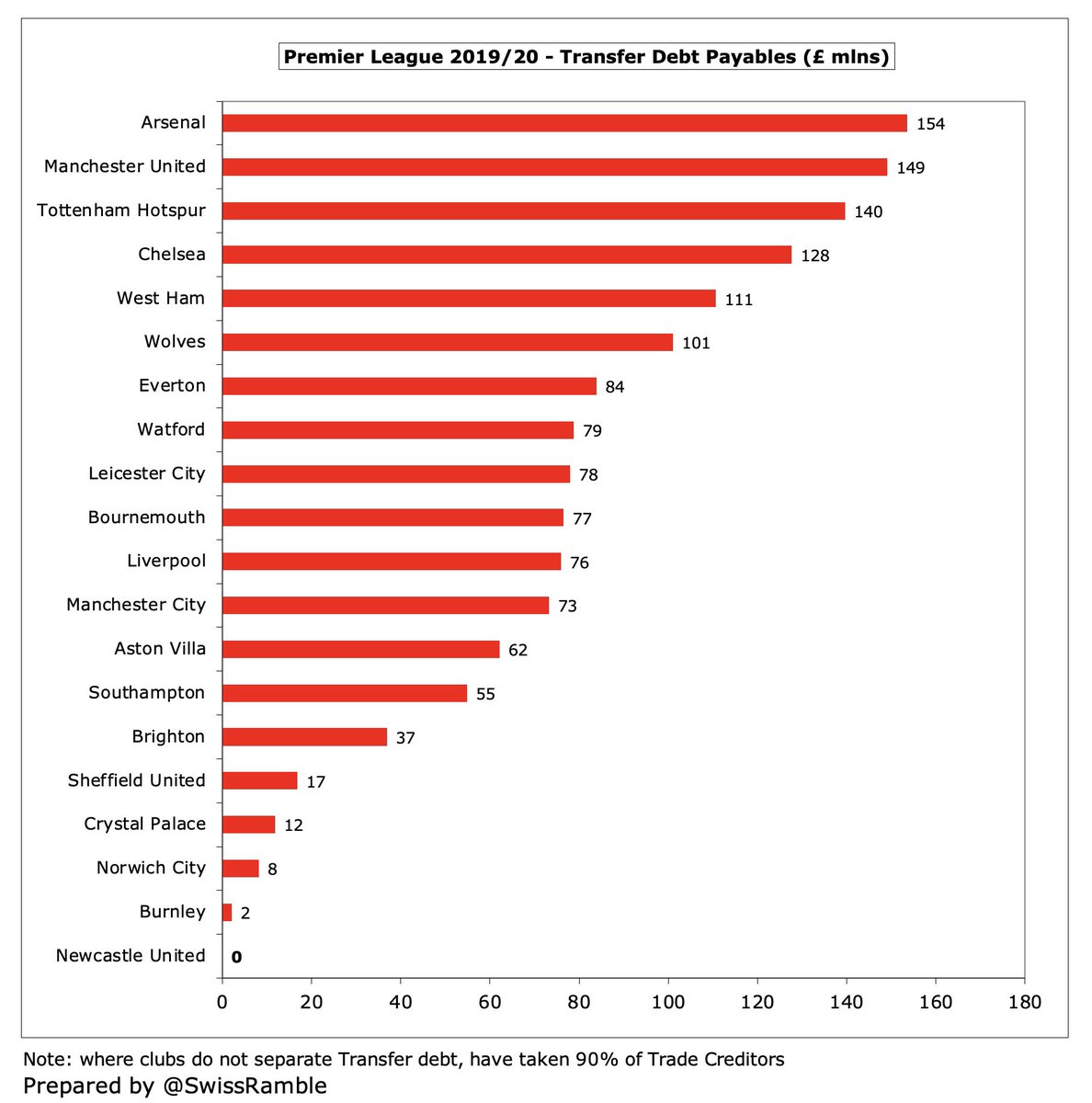

In addition, #NUFC cleared their transfer debt in 2020, reducing the amount owed to zero, which unsurprisingly is the lowest (best) in the Premier League, in stark contrast to others, e.g. six clubs had more than £100m outstanding, led by #AFC £154m, #MUFC £149m and #THFC £140m.

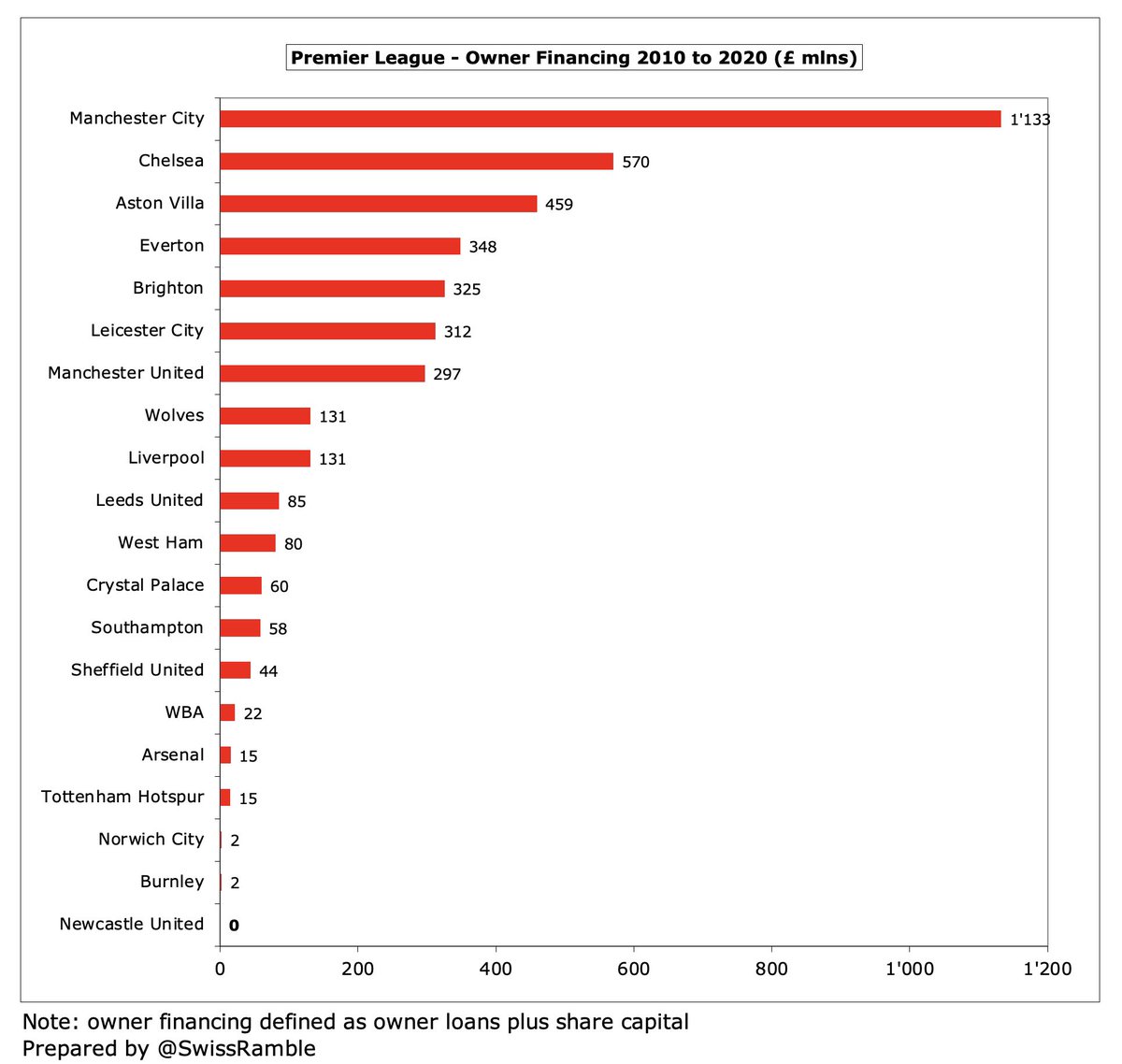

#NUFC fans will appreciate some owner financing, as theirs is the only club in the Premier League to have had nothing since 2010 (owner loans plus capital). Other owners have been far more generous than Ashley: #MCFC £1.1 bln, #CFC £570k, #AVFC £459k, #EFC £348k & #BHAFC £325k.

One more indication of Ashley’s unwillingness to invest is capital expenditure, i.e. stadium and training ground, which was a feeble £7m at #NUFC in the last 10 years, the lowest in the top tier. For some context, this was £148m at #BHAFC and £105m at #LCFC.

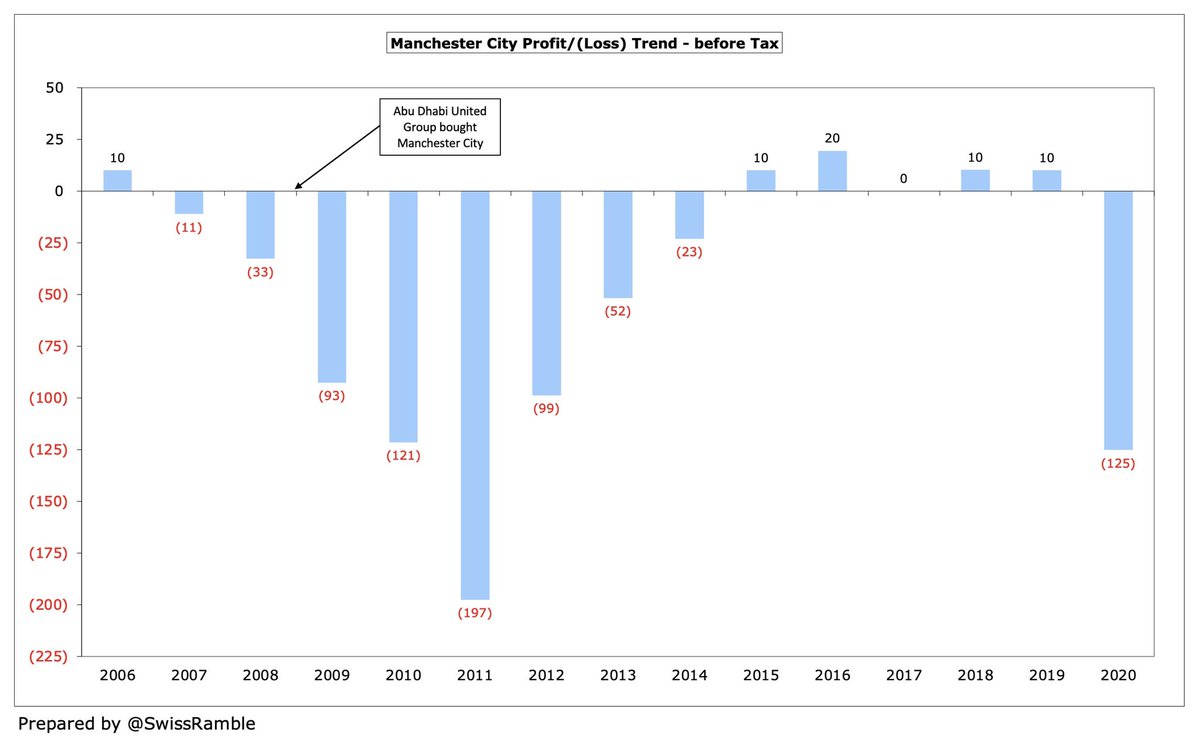

Interestingly, FFP rules allow investment into infrastructure, so theoretically there is no limit on what could be invested into the stadium or training ground. This has been a key element in #MCFC strategy with their academy producing some top talent, exemplified by Phil Foden.

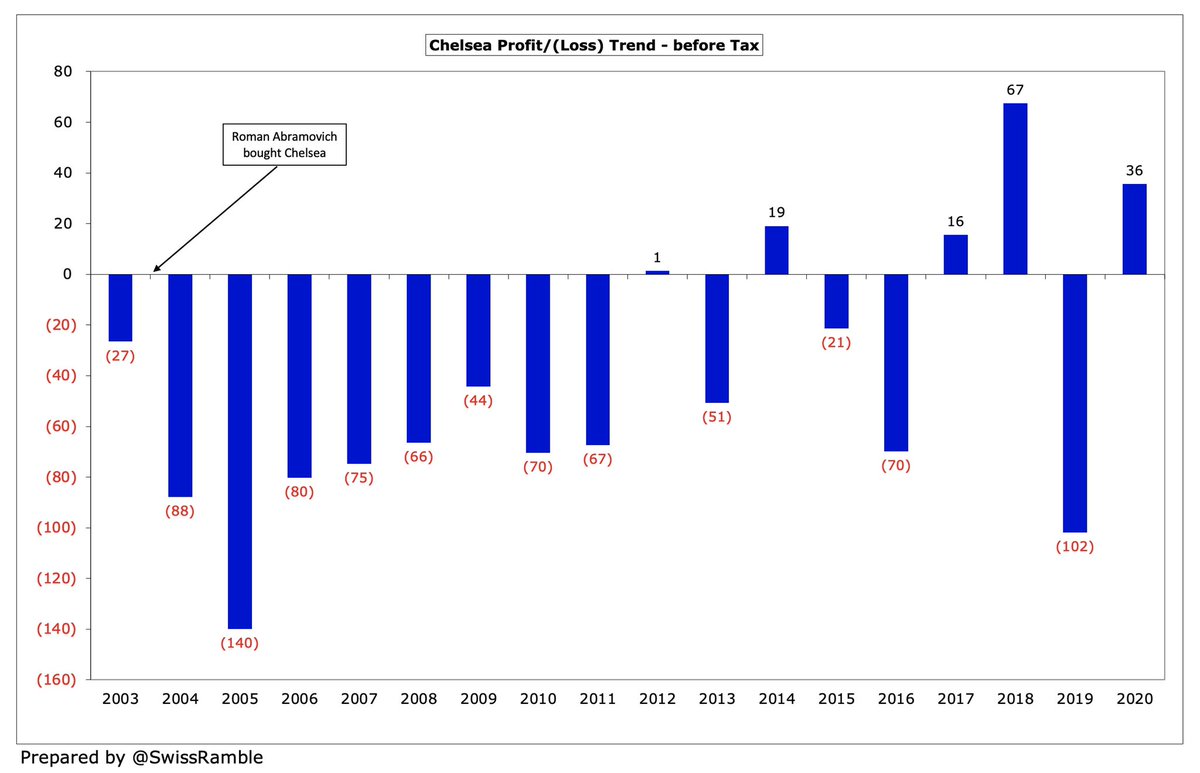

Looking at other clubs that have benefited from significant owner investment, we can get an idea of the likely financial impact. In the 5 years after acquisition by Roman Abramovich and Abu Dhabi UG, #CFC and #MCFC lost £449m and £562m respectively, before moving to profitability

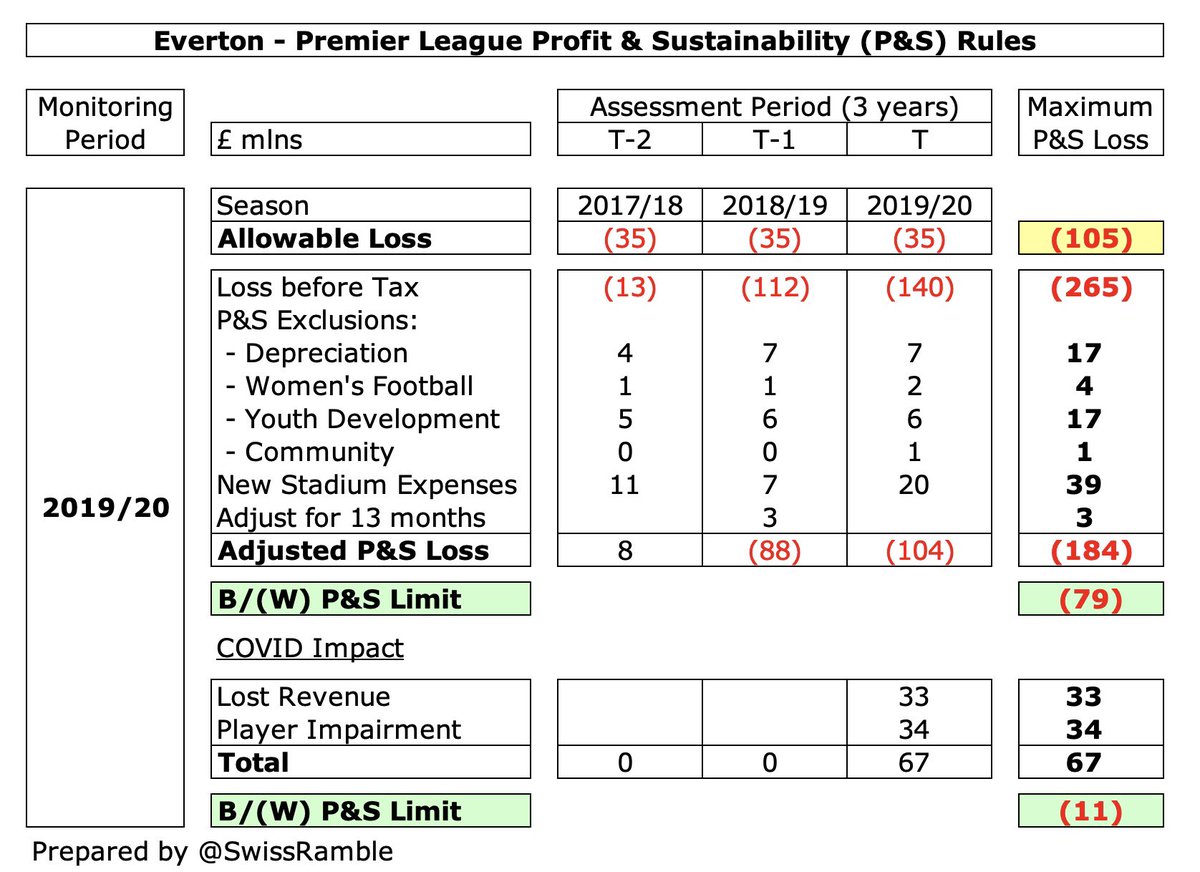

More recently, Farhad Moshiri increased his stake in #EFC to 69% in September 2018 (now up to 92%), leading to £252m losses in the next 2 years, albeit 2020 was severely impacted by COVID. The expectation would be for another substantial loss in 2021.

After the initial periods of significant investment to catch-up with the leading clubs at the time, both #CFC and #MCFC are now in good shape in terms of FFP, even before adjusting for the COVID impact in 2020.

However, #EFC are struggling with FFP, even after adjusting for allowable expenses on new stadium and a hefty COVID impact, including £34m for player impairment. This helps explain why they spent so little on transfers this summer after splashing the cash in recent years.

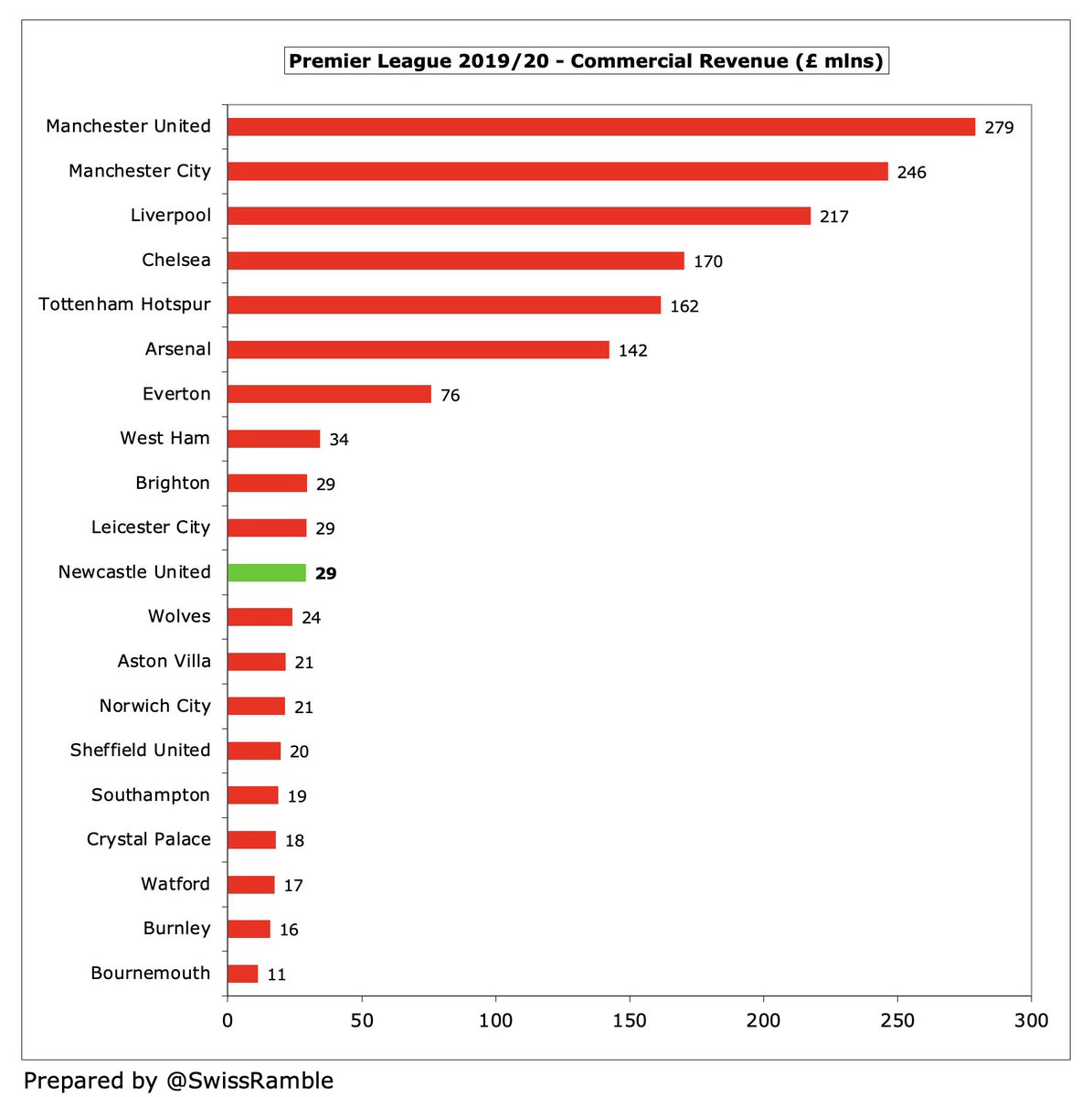

Although Ashley’s frugal approach helped #NUFC bottom line, he was not so good on revenue, so there are plenty of growth opportunities for the new owners, especially on the commercial side, though match day actually fell during his tenure from £34m in 2007 to £25m in 2019.

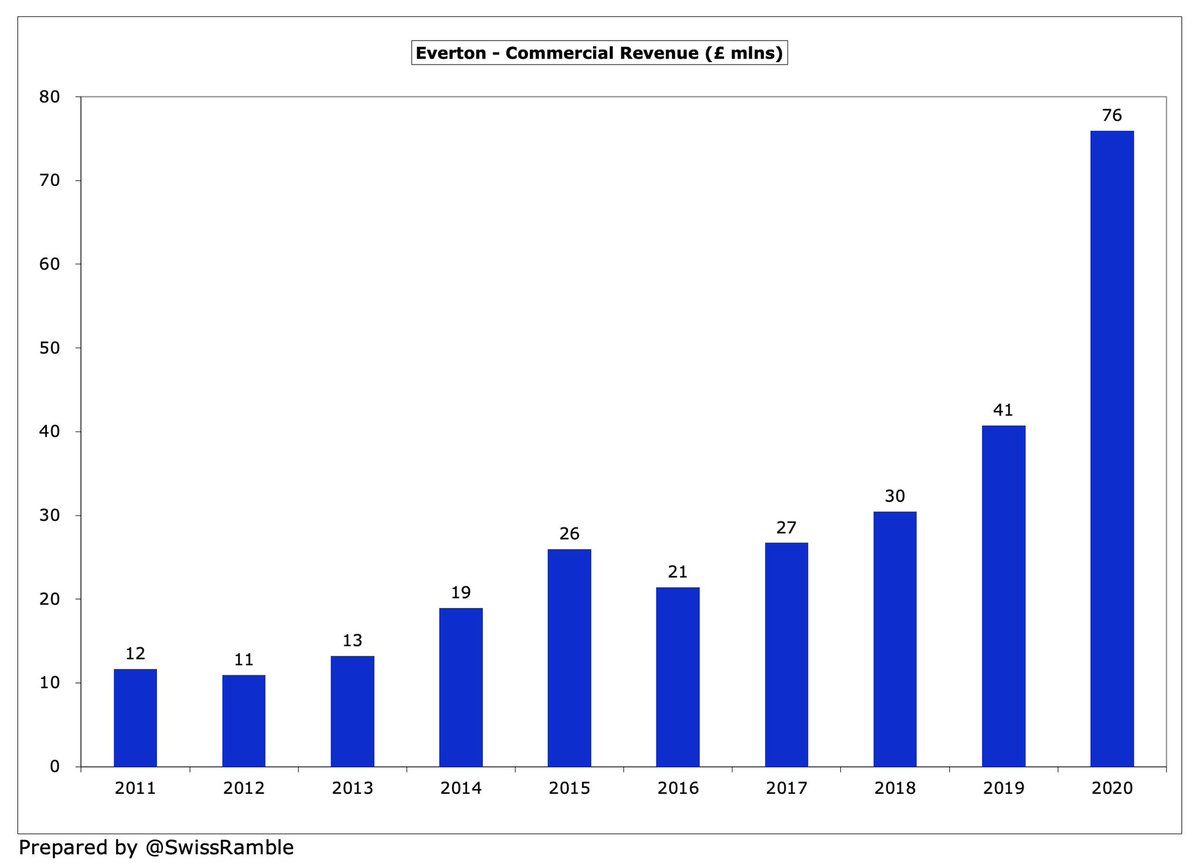

Ashley barely managed to grow #NUFC commercial income at all in 13 years, so the club fell way behind rivals, e.g. the Big Six have grown by £100-200m in this period. Newcastle outsourced catering in 2009, but that was only worth £6m. Now also behind #EFC, #WHUFC, #BHAFC & #LCFC.

#NUFC current shirt sponsorship is £6.5m with Fun88, which pales into insignificance compared to others in the Premier League, e.g. the Big Six are all at least £35m. Newcastle will be looking at agreements for shirt, stadium naming rights, training kit/ground, etc.

Following similar club purchases by wealthy owners, there has been significant growth in commercial revenue, e.g. in the last 10 years #MCFC have increased from £58m to £246m and #CFC from £57m to £170m, while #EFC have grown from £30m to £76m in last 2 years.

One challenge for #NUFC is to ensure new sponsorships are deemed to be fair value, which is difficult to assess, as we have seen with extensive review of #MCFC Etihad deal (ultimately considered “not too excessive” by UEFA). Will argue that future developments should be priced in

The Premier League has also implemented a temporary ban on clubs agreeing sponsorship deals with companies linked to their owners. #NUFC believe this is unlawful, so might seek an injunction to block this measure. If this is made permanent, would be a blow to their plans.

#NUFC will point to existing Premier League deals: USM, owned by Moshiri associate Alisher Usmanov, sponsors #EFC training ground for £12m and paid £30m for option to buy naming rights for new stadium; #LCFC owners King Power pay £16m sponsorship (shirt & stadium naming rights).

There are also a few sponsorship deals at major European clubs that #NUFC will no doubt reference in any discussions, as there is a strong degree of owner involvement in the sponsoring companies, not to mention high values.

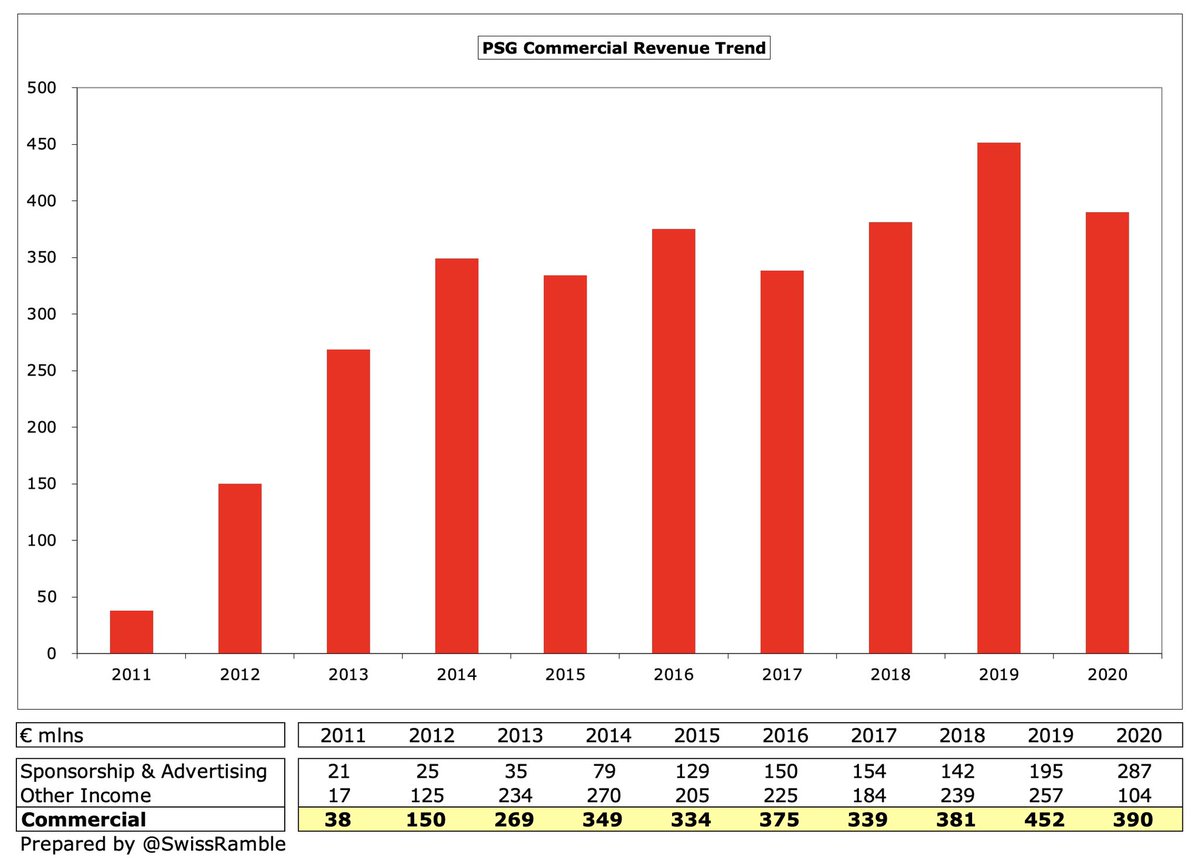

Perhaps the most egregious was PSG’s deal with the Qatar Tourist Authority for a “publicity campaign”. This has now expired after FFP pressure from UEFA, though was reportedly as high as €200m a year at one stage, despite a much lower independent valuation.

Moral arbiters Bayern Munich have the second highest commercial income in Europe, though this is boosted by strategic partnerships with three German companies who each have an 8.33% stake in the club (the other 75% is owned by the fans): Adidas €60m, Audi €60m and Allianz €6m.

Similarly, some of Borussia Dortmund’s largest sponsorship deals are from companies that are also shareholders: Evonik (9.8% stake) €20m shirt sponsor (combined deal with 1&1); Puma (5% stake) €31m kit deal; and Signal Iduna (5.4% stake) €5.8m stadium naming rights.

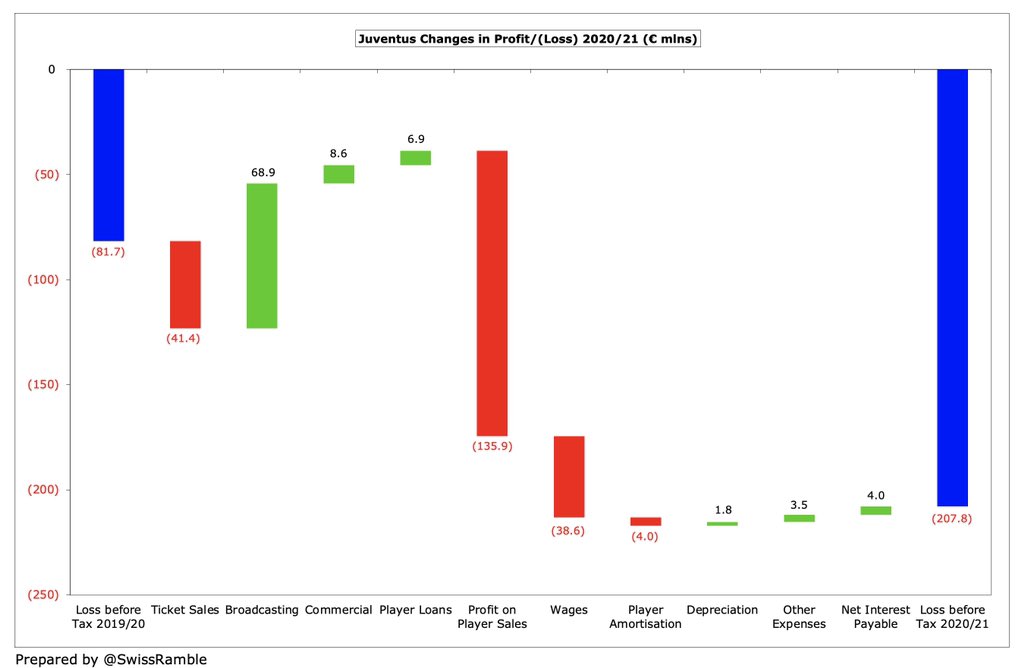

The Juventus shirt sponsorship with Jeep increased from €17m to €42m in 2019/20– even though the original deal still had two years to run (now up to €45m). Jeep is part of Fiat, which is owned by the Agnelli family. As much as Roma, Inter, Milan and Napoli combined.

Even one of the lesser lights in Italy has benefited from a sweet sponsorship deal, as Sassuolo’s owners Mapei pay the club a hefty €18m a season for shirt sponsorship, which is the third highest in Serie A, plus another €5m for stadium naming rights.

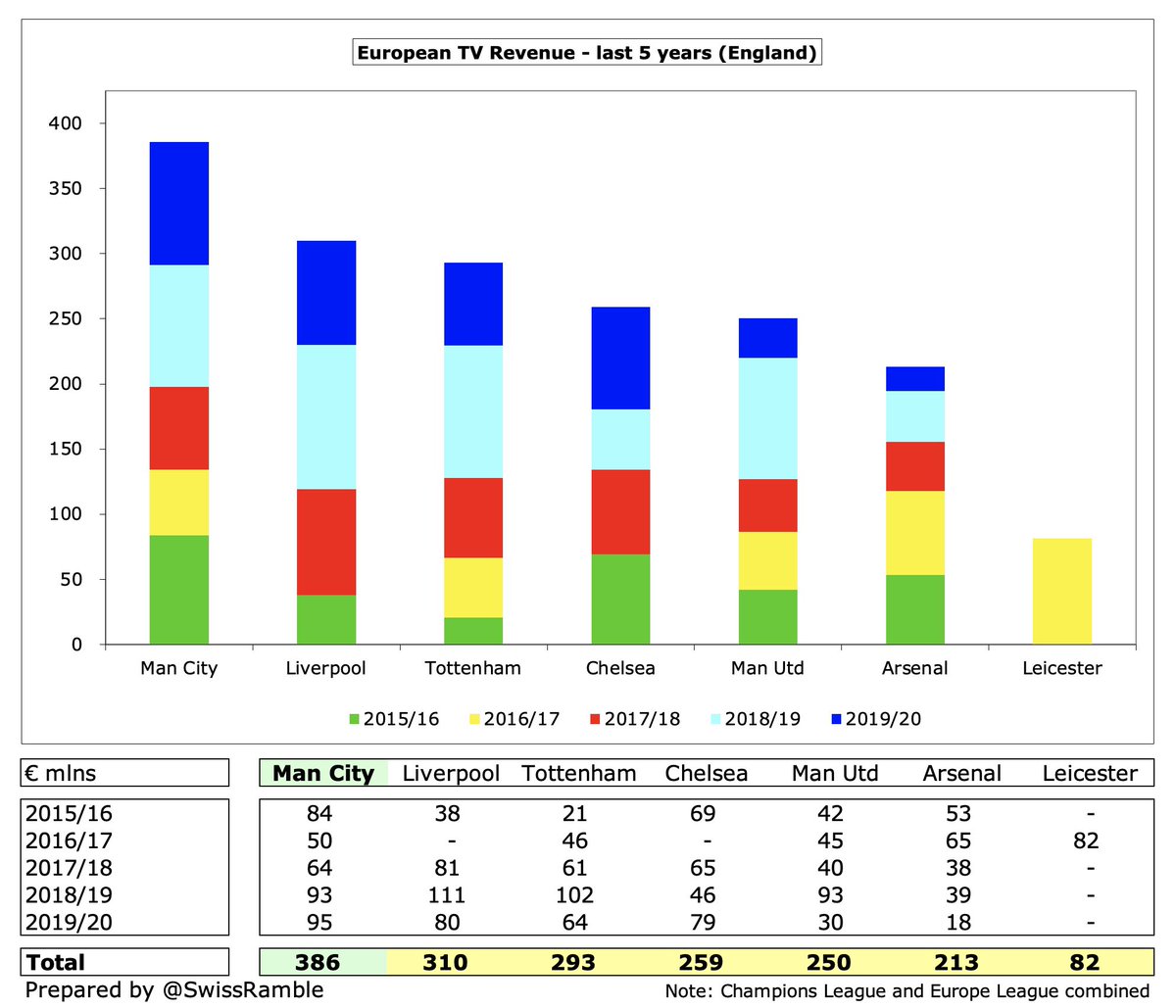

In the medium term #NUFC will look to qualify for Europe, where the financial rewards would have a huge impact on finances. As an example, #MCFC have received €386m TV money in last 5 years from the Champions League with annual income rising from €28m in 2012 to €95m in 2020.

That said, the UEFA FFP rules are stricter than the Premier League with the allowable losses (acceptable deviation) over 3 years being only €30m (including €25m equity contribution), though the rules have been relaxed “to neutralise the adverse impact of the COVID-19 pandemic”.

One strategy to ensure compliance with FFP rules is profitable player trading, as is the case with #CFC, who have offset large operating losses with £434m profit from player sales in the last 5 years. #NUFC £100m profit in this period is not bad, but room for improvement.

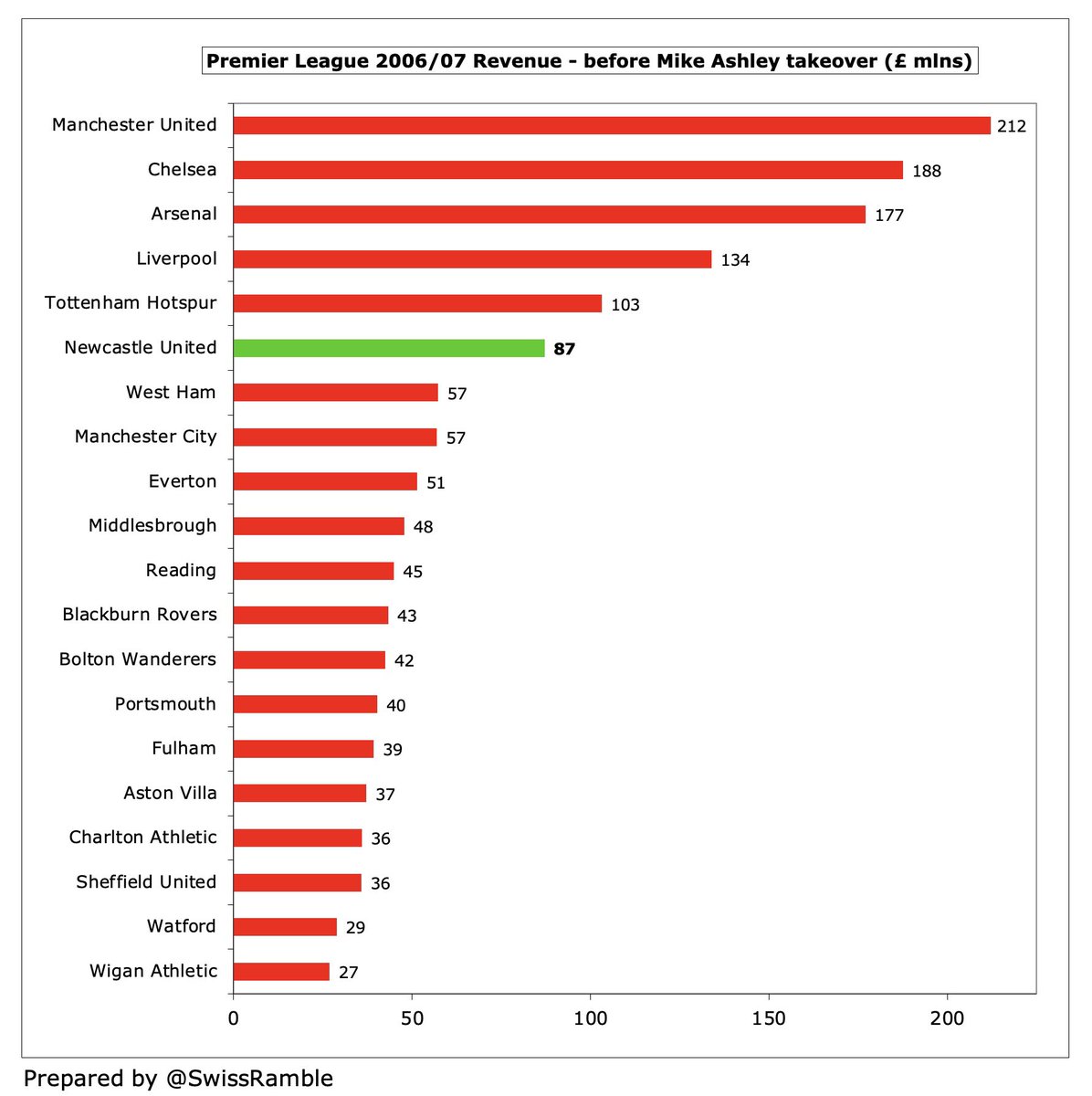

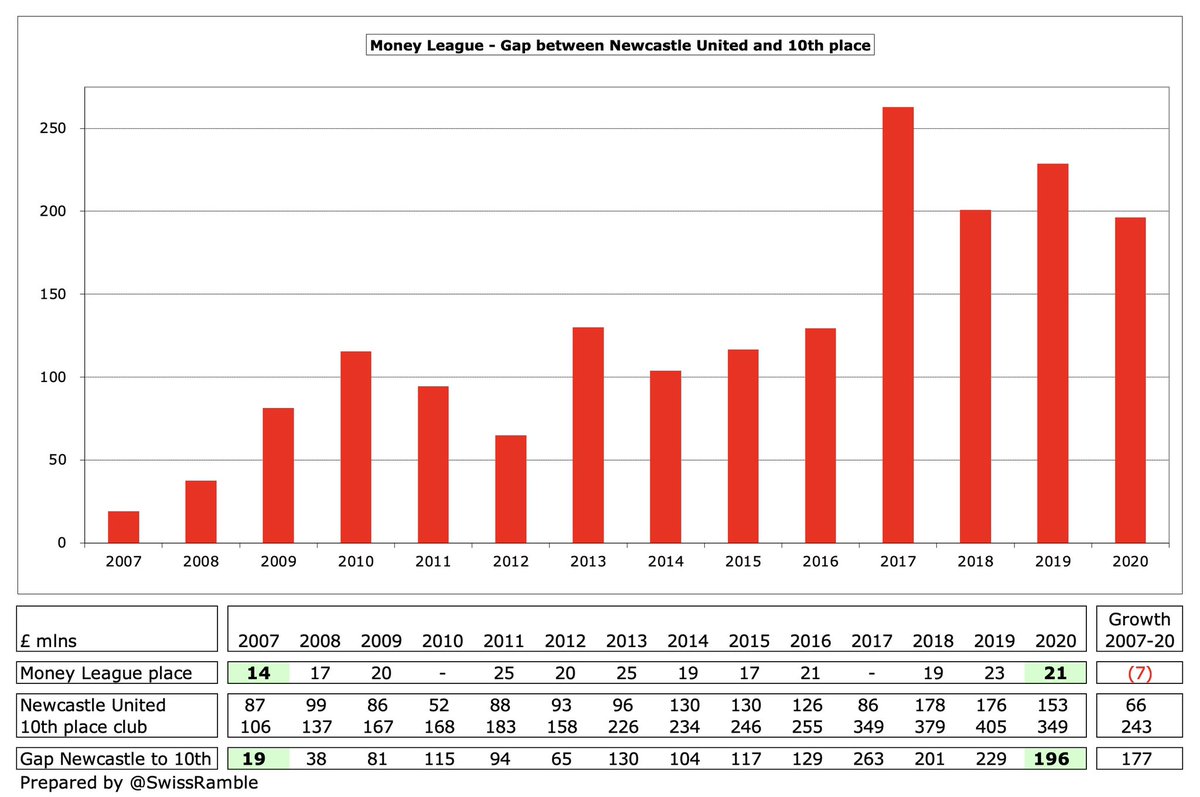

It might seem like pie in the sky for #NUFC to reach these heady heights, especially as their £153m revenue in 2020 was less than half of sixth-placed #AFC £343m and miles below #MUFC £509m. However, before Ashley arrived, Newcastle had 6th highest revenue in England.

Furthermore, #NUFC already have the 21st highest revenue in the world, though Ashley did not submit revenue details to Deloitte for their annual Money League. Indeed, before his takeover in 2007, Newcastle had the 14th highest revenue, just £19m lower than the 10th placed club.

#NUFC might benefit from a transfer market that has been in the doldrums since the pandemic struck, but it would not be surprising if clubs applied a “Newcastle premium” to a player’s selling price. After #MCFC received new money, they had to pay more to attract players.

Despite the many “sportswashing” issues associated with the new #NUFC owners, fans will undoubtedly appreciate their ambition after years of Ashley crushing their hopes. However, they will still have to show some fancy footwork to stay within Premier League regulations.

• • •

Missing some Tweet in this thread? You can try to

force a refresh