Barcelona 2020/21 accounts cover a season when they finished third in La Liga, won the Copa del Rey and reached the last 16 of the Champions League. Their finances were significantly impacted by COVID-19. Some thoughts in the following thread #FCBarcelona

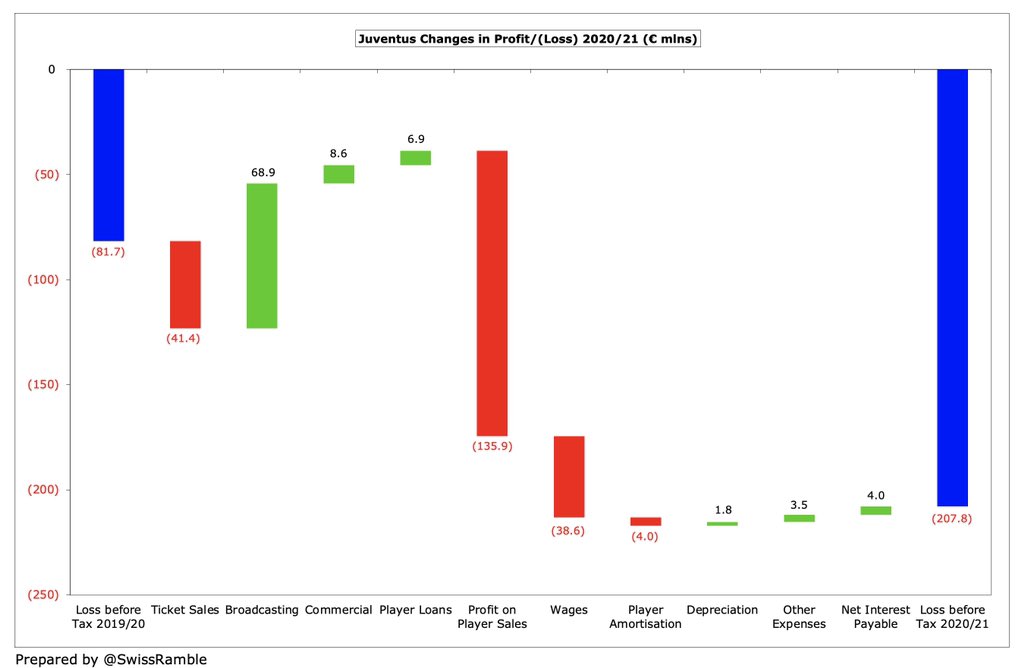

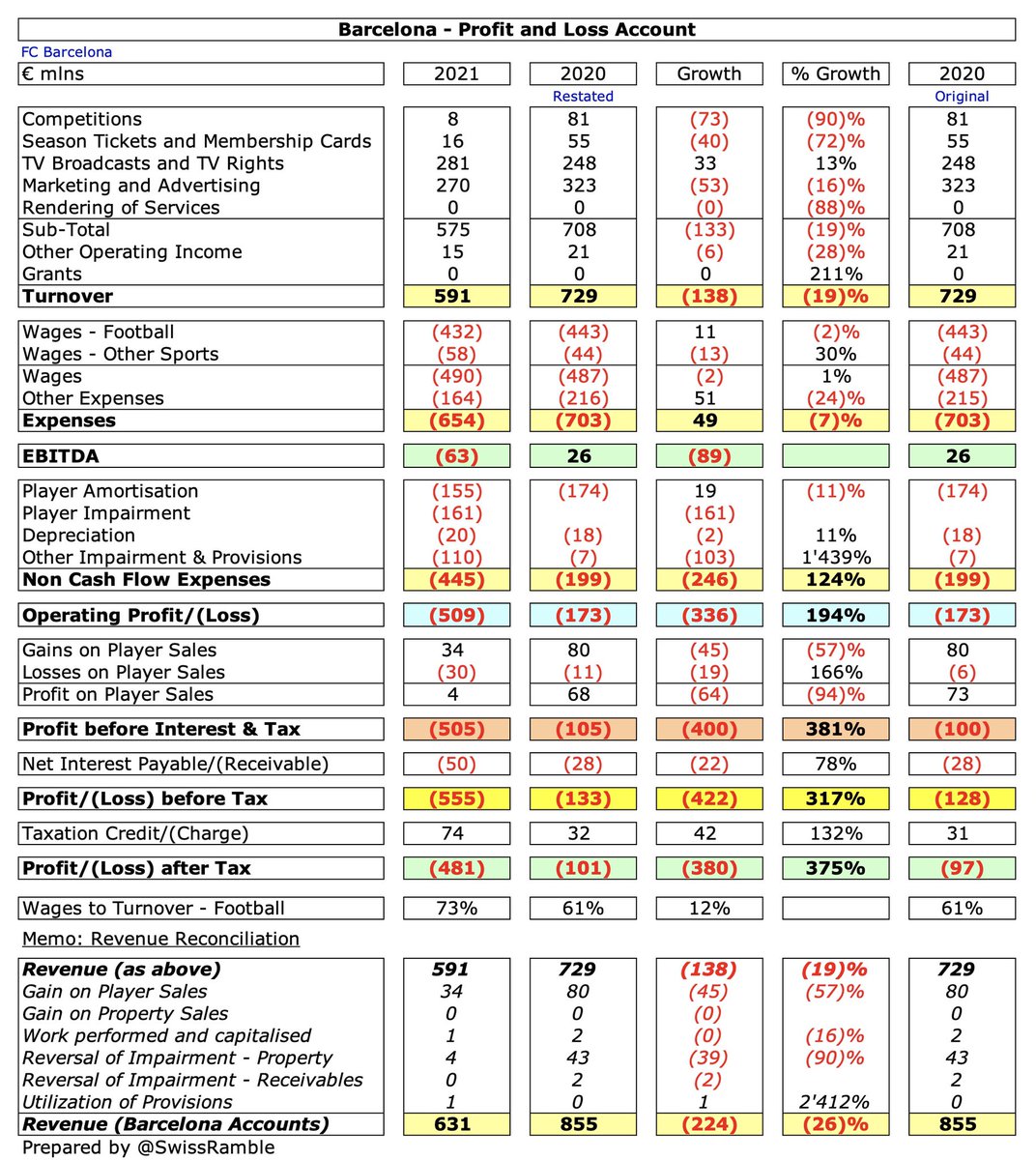

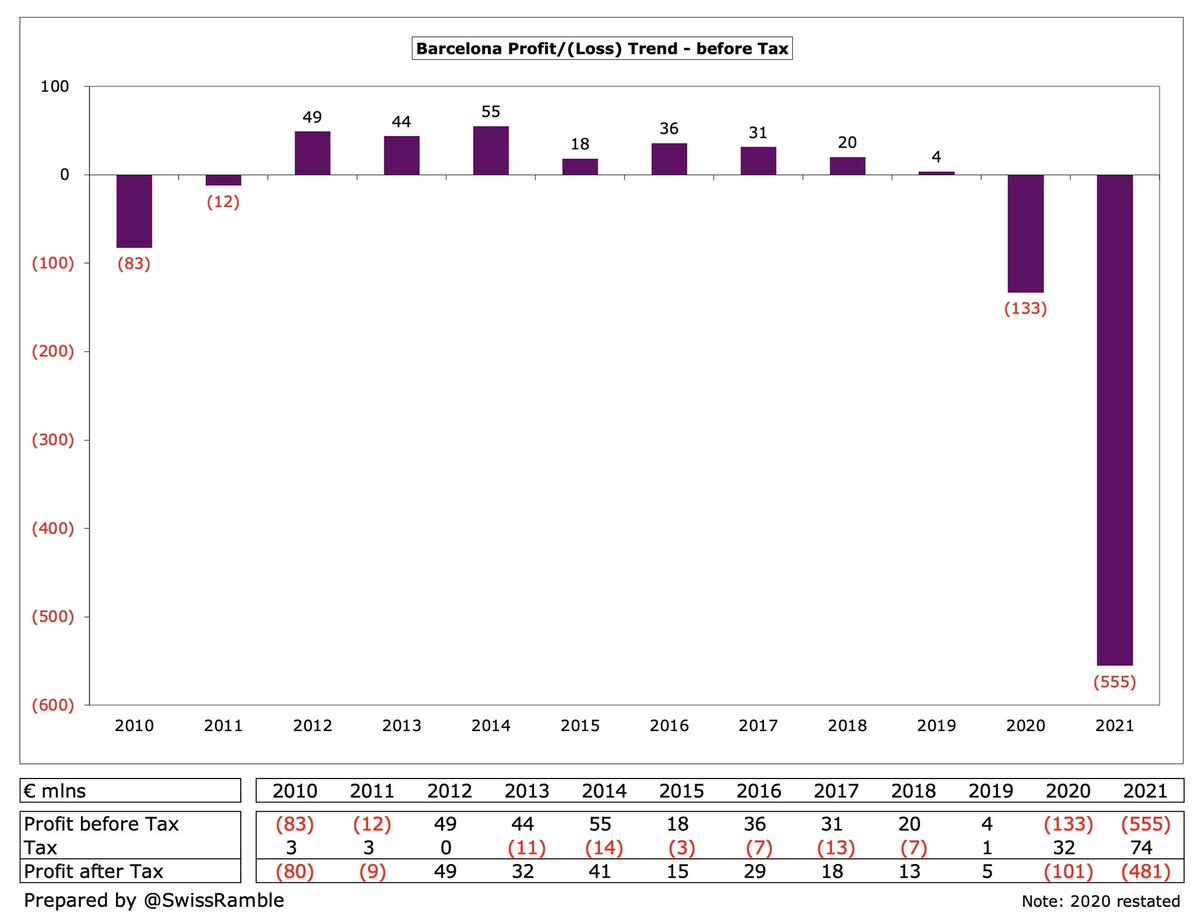

#FCBarcelona pre-tax loss widened from €133m to a shocking €555m (€481m after tax). Revenue dropped €138m (19%) from €729m to €591m and profit on player sales fell €64m to just €4m, partly offset by operating expenses down €66m, though net interest payable rose €22m.

#FCBarcelona president Joan Laporta blamed this on the previous management, who “delivered the worst accounts in Barca history”. This resulted in €161m player impairment and €110m other impairment and provisions (law suits, tax cases) following the Due Diligence report.

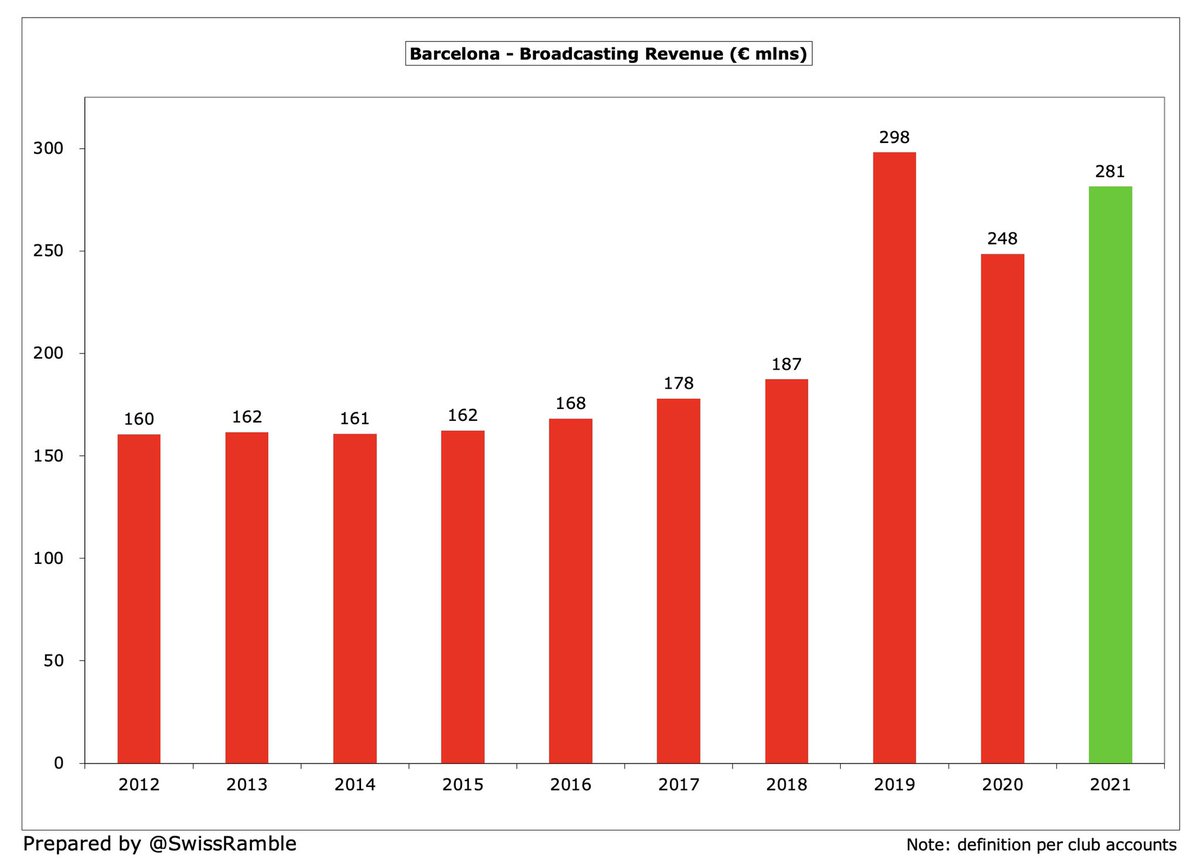

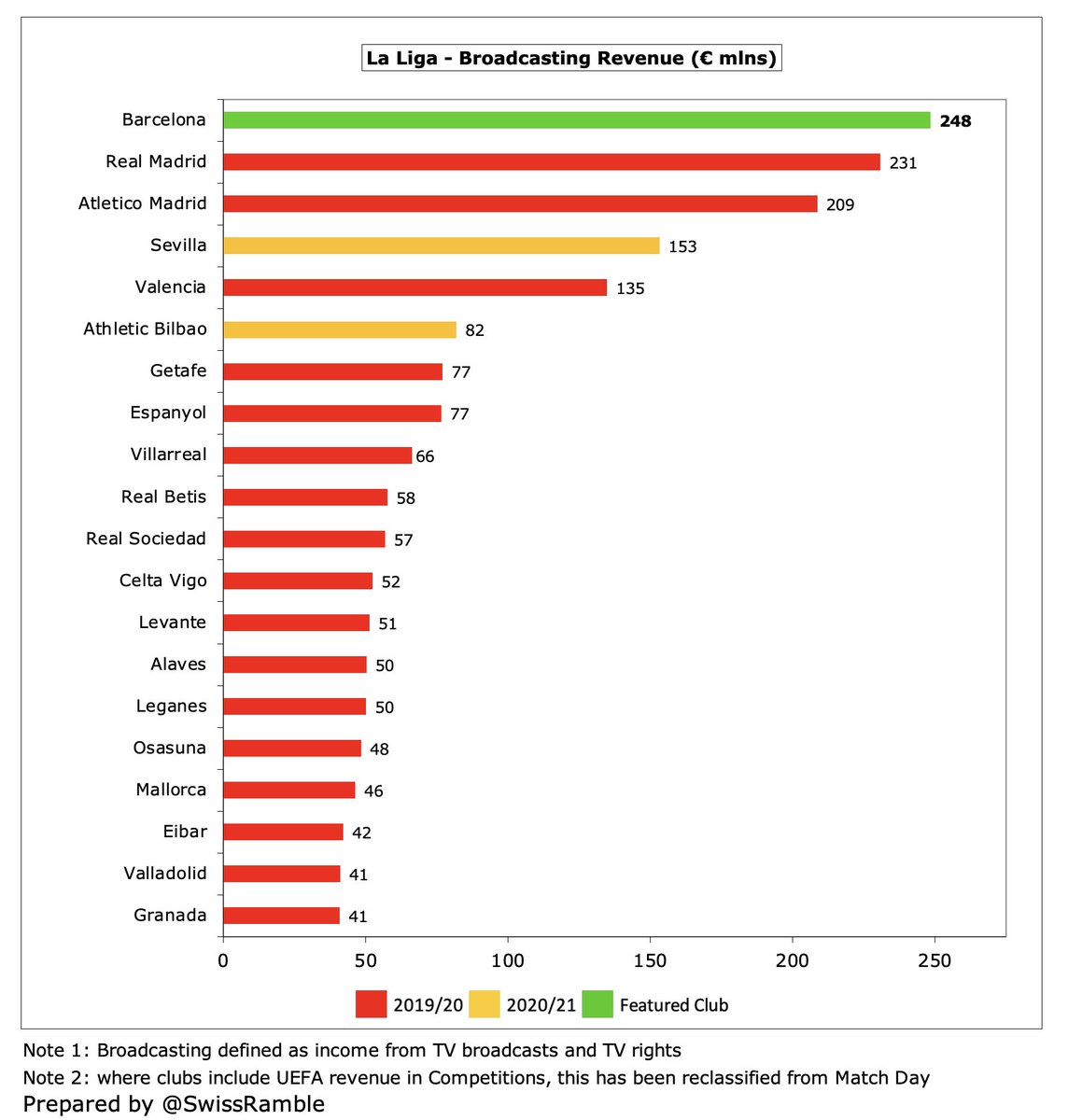

#FCBarcelona €138m revenue fall due to COVID driven reductions in competitions €73m (90%) to €8m, season tickets €40m (72%) to €16m and marketing & advertising €53m (16%) to €270m, though broadcasting rose €33m (13%) to €281m, mainly due to revenue deferrals from 2019/20

As a technical note, the #FCBarcelona definition of €631m revenue is different from the standard Deloitte Money League figure of €591m operating income, as it includes €34m gain on player sales, €5m impairment reversal and €1m for work performed and capitalised.

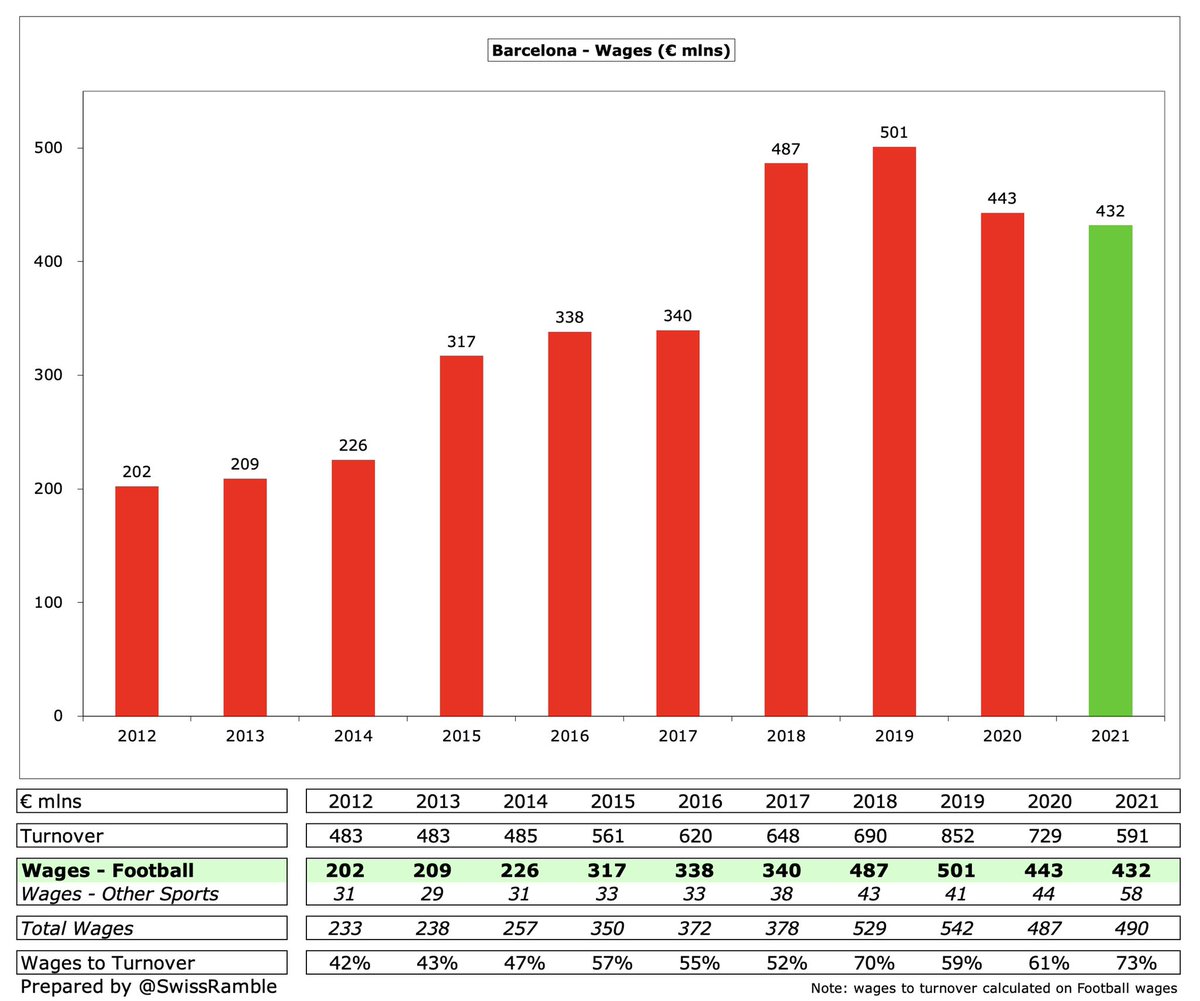

Laporta criticised #FCBarcelona’s recent “inability to contain spending”. Indeed, wages remained high at €490m (football €432m, other sports €58m). However, excluding impairment, player amortisation fell €19m (11%) to €155m, while other expenses cut €51m (24%) to €164m.

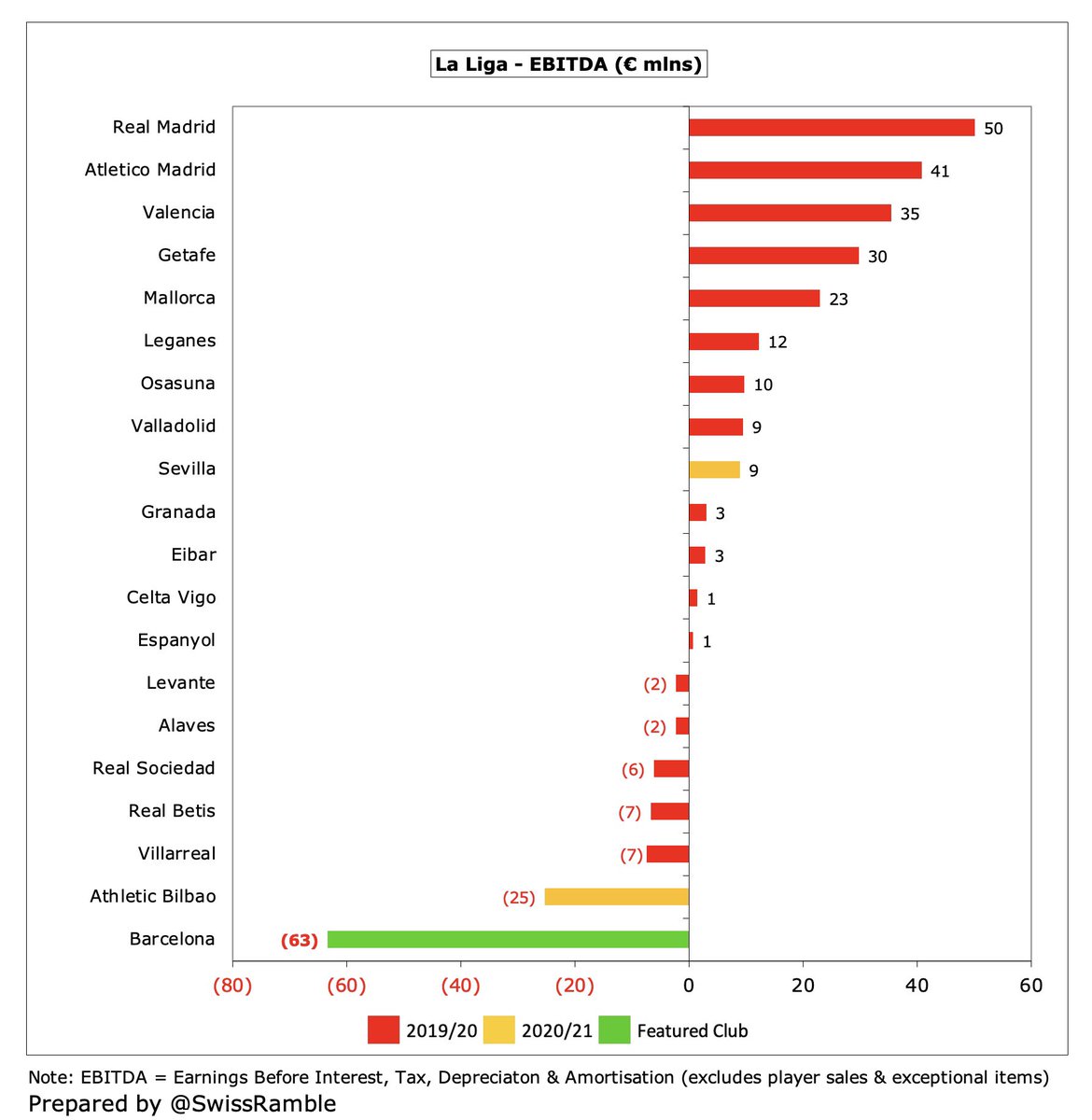

#FCBarcelona €555m pre-tax loss is by far the highest in Spain, though worth noting that next largest losses were made by clubs that have also published 2020/21 accounts, Sevilla €39m and Athletic Bilbao €25m. In stark contrast, Real Madrid have announced a small profit.

Clearly, COVID has had a huge impact on finances in 2020/21 with many leading clubs across Europe reporting horrific losses, e.g. Inter €246m, Juventus €210m & #MUFC €105m. That said, #FCBarcelona’s €481m post-tax loss is the worst ever, almost twice as much as next highest.

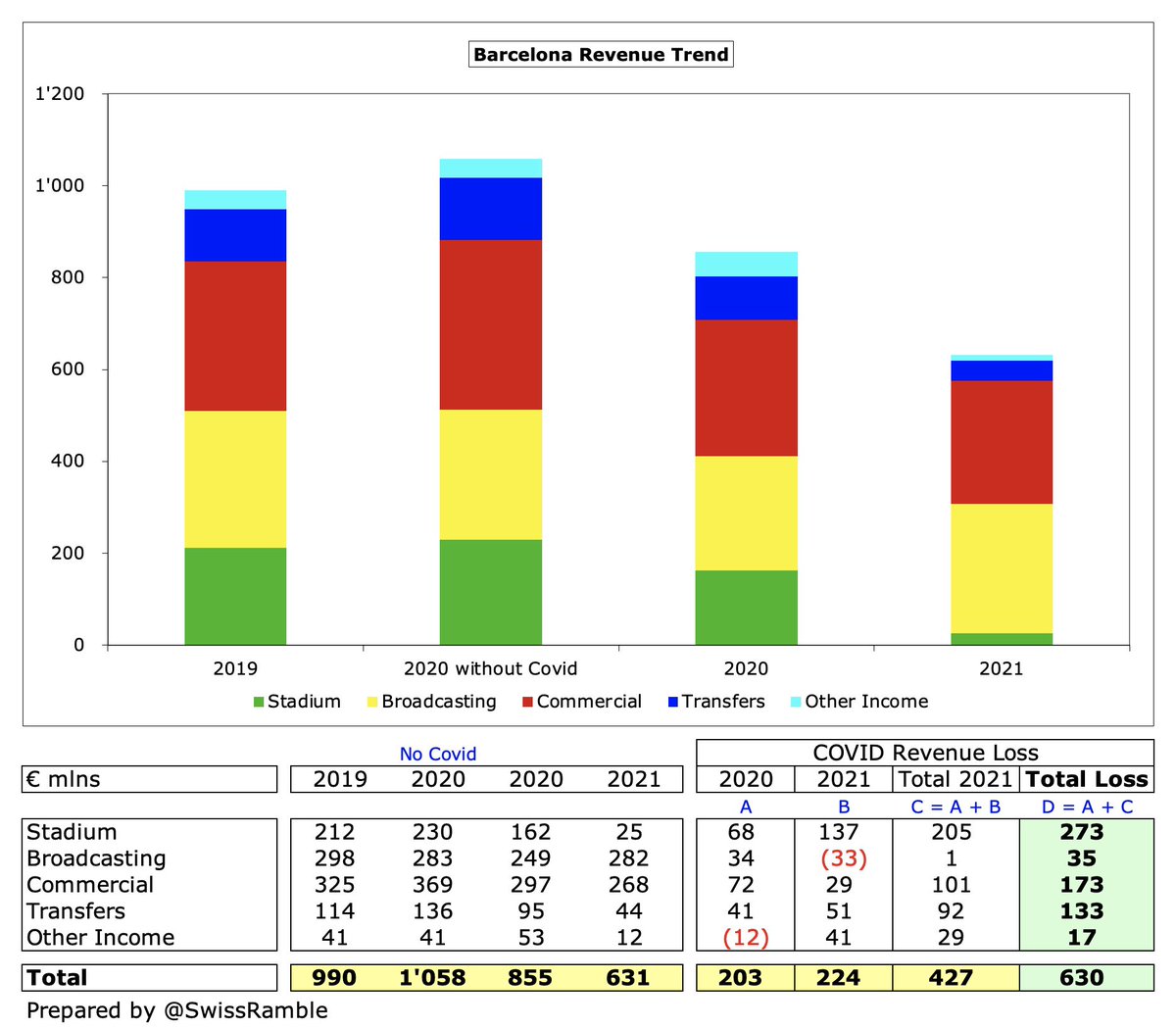

#FCBarcelona net COVID impact was €92m, so post-tax loss would still have been €390m without pandemic. Revenue fall was €219m, mainly stadium €181m and commercial €56m, while expenses were cut €127m (deferred wages €60m, savings from not opening stadium and stores €64m).

However, #FCBarcelona COVID revenue loss over last two seasons is much higher. Without the pandemic, club said they would have achieved €1 bln revenue (including player sales), so 2020 loss was €203m. Adding 2021 €427m shortfall against that budget gives total loss of €630m.

In contrast to previous years, #FCBarcelona did not benefit from player trading, as profit from player sales slumped from €68m to just €4m, as €34m gains were largely offset by €30m losses. Last year included profits from the swap deal with Juventus for Arthur and Pjanic.

Before the 2020 loss, #FCBarcelona had reported profits 8 years in a row, amounting to around a quarter of a billion pre-tax over this period. However, they have now posted massive €689m losses in last 2 years. Club has budgeted a return to profitability (€4m) in 2021/22.

Like many other clubs, #FCBarcelona have become increasingly reliant on player sales, though profits have fallen 3 years in a row from €208m peak in 2018 (mainly Neymar to PSG). Third highest profits from this activity in Europe in 5 years to 2020, only behind Juventus & #CFC.

#FCBarcelona EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), a measure of underlying profitability, fell from €104m to €60m (including player sales), down from €179m two years ago. Excluding provisions, in 2020 €26m on low side for a leading European club

#FCBarcelona operating loss, excluding player sales and interest, has been on a steady downward trend, but significantly increased from €173m to €509m in 2021. In fairness, most football clubs post operating losses, but Barca’s was one of the highest of ESL clubs in 2019/20.

#FCBarcelona ongoing revenue is down by a third (€262m) from 2019 pre-COVID €852m peak to €591m in 2021. Decrease even higher (€359m) using club’s definition (incl player sales & impairment reversals), falling from €990m to €631m. Budgeted to bounce back to €765m in 2022.

Real Madrid revenue also fell in 2021, but not as much as #FCBarcelona, so they have overtaken the Catalans (€653m vs. €591m), which represents €146m swing in last 2 years. Barca still much higher than other Spanish clubs, e.g. Atleti €345m, Valencia €172m & Sevilla €171m.

#FCBarcelona had the highest revenue in the world in 2019/20 with their €715m topping the Deloitte Money League, but this only highlights the fact that revenue is not the whole story. As the old saying has it, “Revenue is vanity, profit is sanity and cash is king.”

#FCBarcelona marketing & advertising revenue fell €53m (16%) to €270m, nearly £100m less than 2019 €363m peak, as stores were closed and no summer tour due to COVID. In 2020 commercial income of €340m was 3rd highest in Europe, only surpassed by Real Madrid and Bayern Munich.

#FCBarcelona have extended Rakuten shirt sponsorship by 1 year to June 2022, though media reports suggest that value has reduced from €55m to €30m. Beko sleeve/training deal worth €19m also extended 1 year for 50% less. Nike €105m kit deal runs to June 2028.

#FCBarcelona broadcasting income rose €33m (13%) from €248m to €281m, the club’s second highest ever, mainly due to revenue deferred from 2019/20 for games played after accounting close. Had highest TV revenue in the world in prior year, ahead of #LFC €233m and Madrid €224m.

After years of individual deals in Spain, La Liga have introduced a collective deal, based on 50% equal share, 25% performance over last 5 years and 25% popularity (1/3 for average match day income, 2/3 for number of TV viewers). Gross income reduced by liabilities (7%).

Even after the changes, the big two still receive by far the highest TV income from La Liga’s TV deal. No figures yet for 2021, but in 2020 #FCBarcelona and Real Madrid got €153m and €145m, followed by Atletico Madrid €116m, then a big gap to Valencia €76m and Sevilla €73m.

#FCBarcelona benefited from La Liga international TV deal rising 30% in 2019/20, giving €2.0 bln total TV rights. Although still a long way behind the Premier League €3.6 bln, it is comfortably ahead of the others: Bundesliga €1.4 bln, Serie A €1.3 bln and Ligue 1 €0.8 bln.

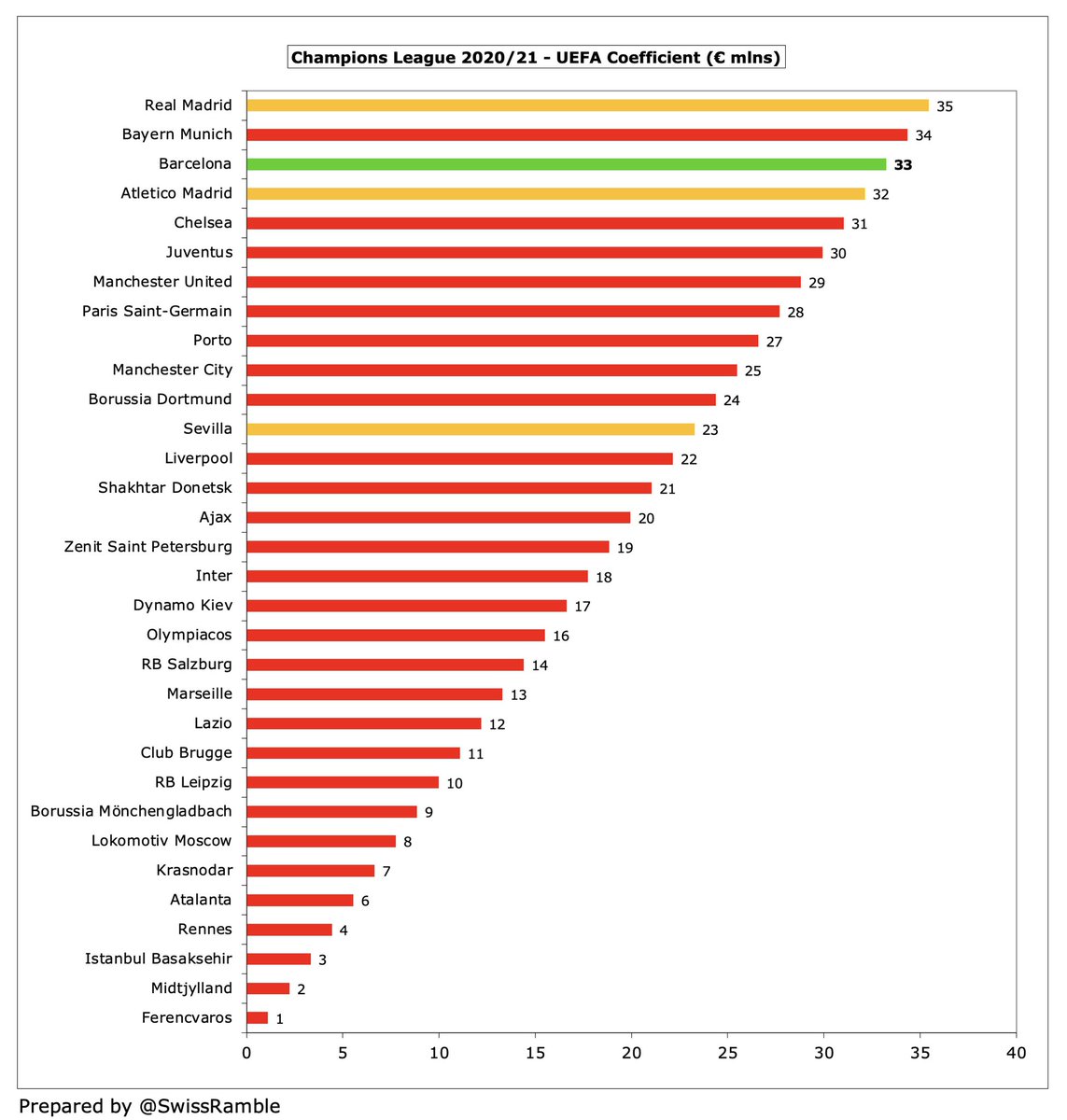

Based on my estimate, #FCBarcelona earned €85m from the Champions League after reaching the last 16, €15m less than prior season €100m (quarter-final). Less than Real Madrid’s €111m, but ahead of Atletico Madrid €76m and Sevilla €68m. Figures are net of 3.4% COVID rebate.

Worth noting the influence on Champions League money of the UEFA coefficient payment (based on performances in Europe over 10 years), where #FCBarcelona had the 3rd highest ranking in 2020/21, giving them €33m. This change in distribution rewards good record of Spanish clubs.

#FCBarcelona have earned a hefty €421m from European competition in the last 5 years, only surpassed in Spain by Real Madrid €446m. Atletico Madrid’s success has brought them €361m, then a big gap to Sevilla €201m, Valencia €118m and Villarreal €80m.

#FCBarcelona competitions revenue fell €73m (90%) to €8m, while season tickets & memberships cards were down €40m (72%) to €16m, as all home games were played behind closed doors. In 2020 they had highest revenue in the world from this stream with €126m, above Madrid €108m.

#FCBarcelona had highest crowds in Spain in 2019/20 with over 72,000, so they will be delighted that stadiums have re-opened to fans this season. Recently Spanish authorities have allowed the capacity to be increased to 100%

#FCBarcelona football wages fell €11m (2%) to €432m, down from €501m two years ago, partly due to players agreeing payment deferrals. That said, still nearly €100m more than €340m wage bill in 2017. Total wages including other sports €490m – €512m including image rights.

#FCBarcelona €432m wage bill is still €54m higher than Real Madrid €378m, though gap has narrowed in last 2 years, and over €200m more than Atleti €227m. Will further reduce in 2022 following departure of players on high wages and agreed pay cuts (Pique, Busquets and Alba).

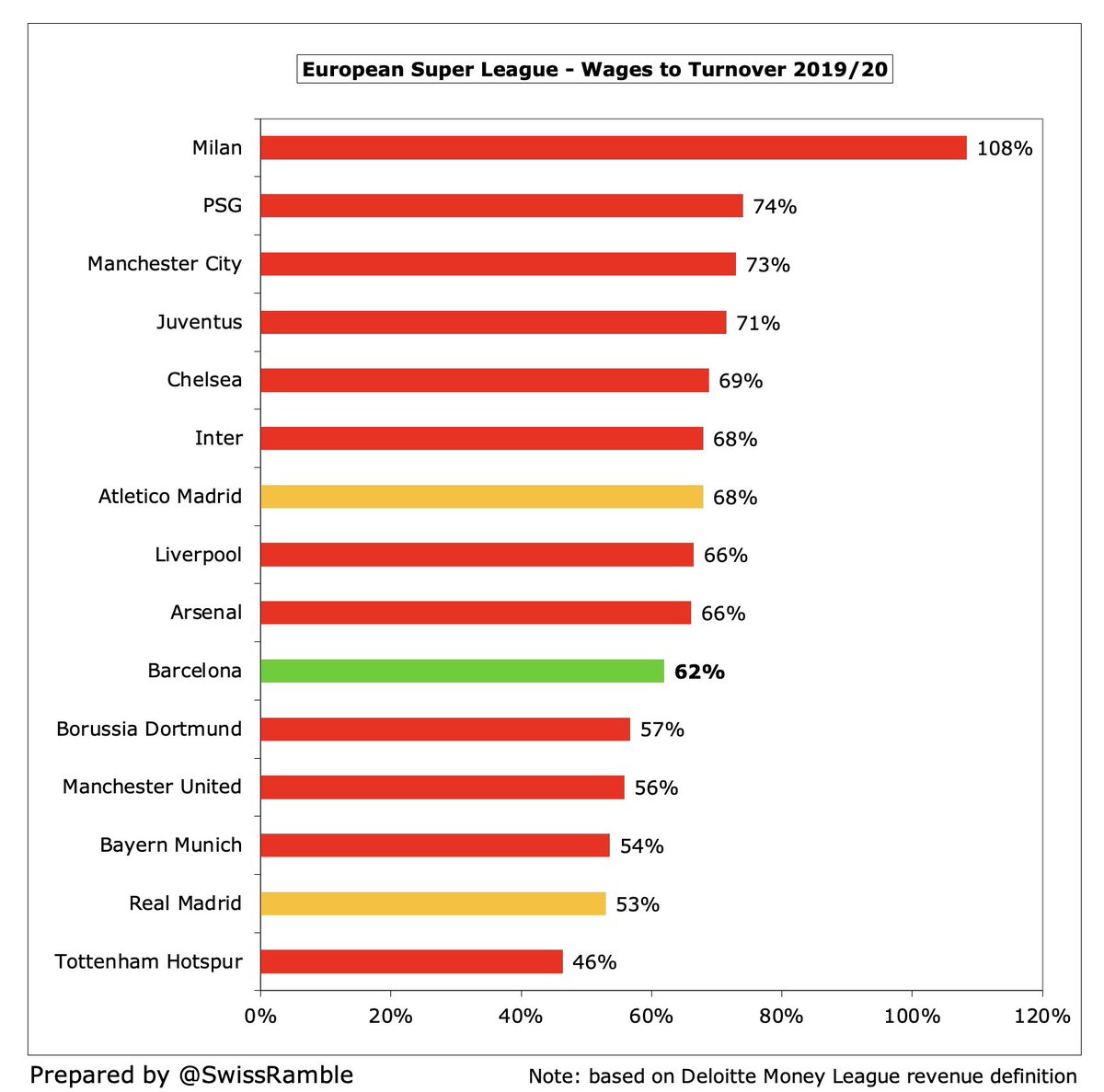

Not only is #FCBarcelona’s wage bill the highest in Spain, but their €443m in 2019/20 was easily the highest in Europe, ahead of PSG €414m and #MCFC €401m. Club said that payroll would have been a barely credible €835m in 2021/22 if they had kept the same squad.

#FCBarcelona’s challenge is illustrated by their salary cap being severely reduced from €383m to €98m in 2021/22, down from €671m 2 years ago. This is only 7th highest in La Liga, miles below Real Madrid’s €739m, and explains the departures of Messi and Griezmann this summer.

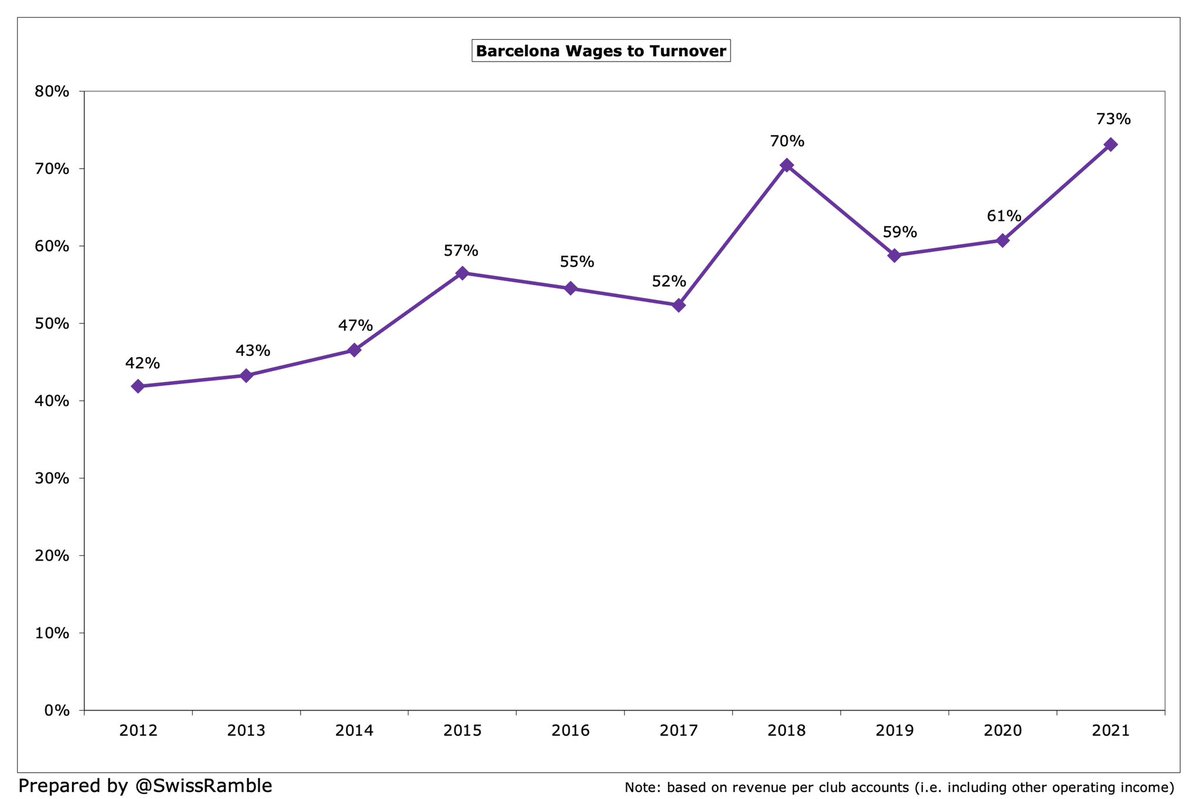

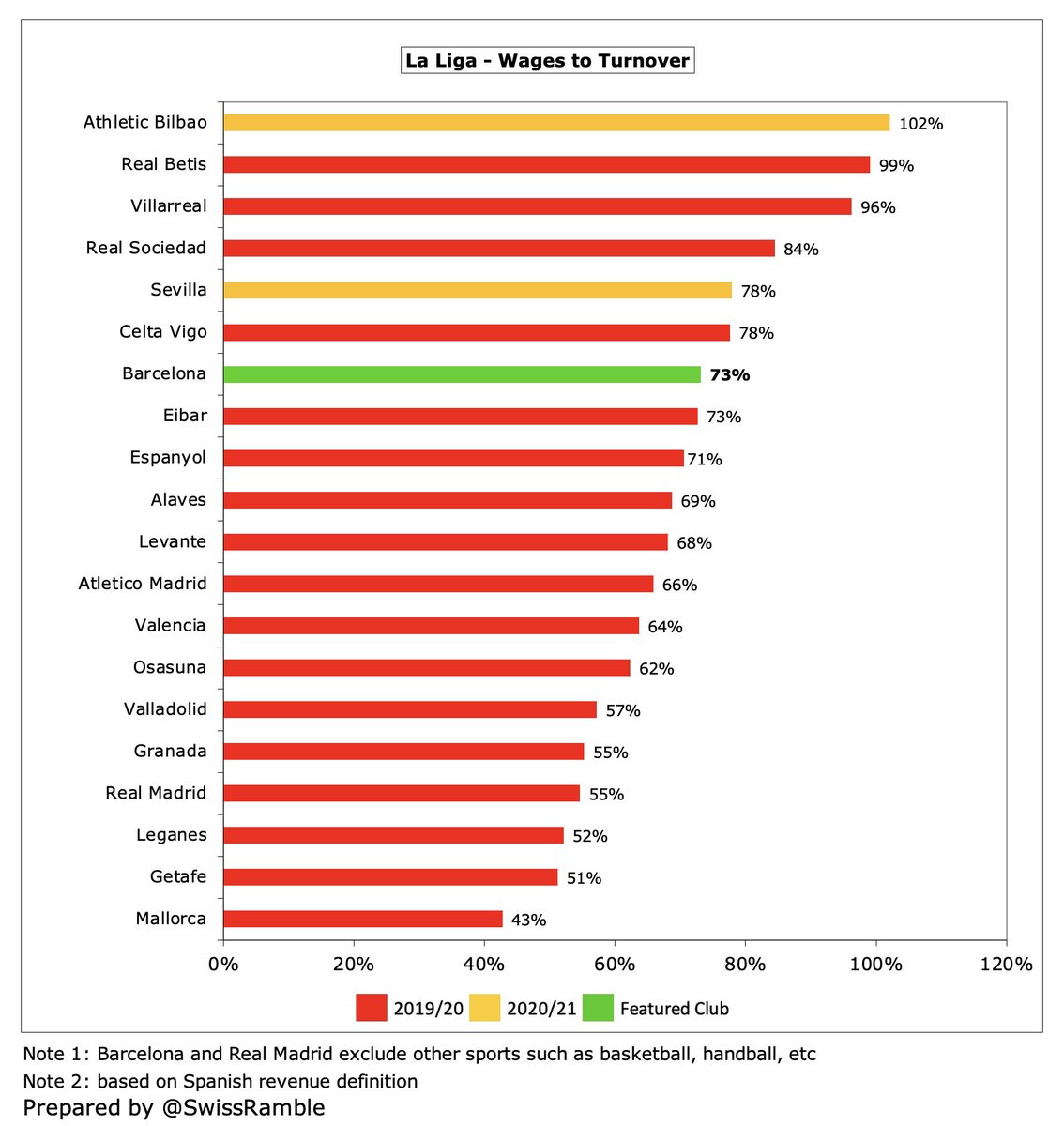

#FCBarcelona wages to turnover ratio worsened from 61% to 73% (it was only 52% just four years ago). That said, the only other clubs to publish 2021 accounts were higher: Athletic Bilbao 102% and Sevilla 78%. In 2020 Barca actually had one of the better ratios in Europe.

#FCBarcelona other expenses have been cut 20% (€49m) in the last two years, as COVID meant closed-door matches and reduced travel, though the Due Diligence audit noted a significant increase in administrative costs since 2017, due to “a lack of governance and management”.

#FCBarcelona player amortisation, the annual cost of writing-off transfer fees, fell €19m (11%) from €174m to €155m, though this has still more than doubled from €67m in 2017. In fact, this was the highest in Europe in 2020, just ahead of Juventus and #MCFC.

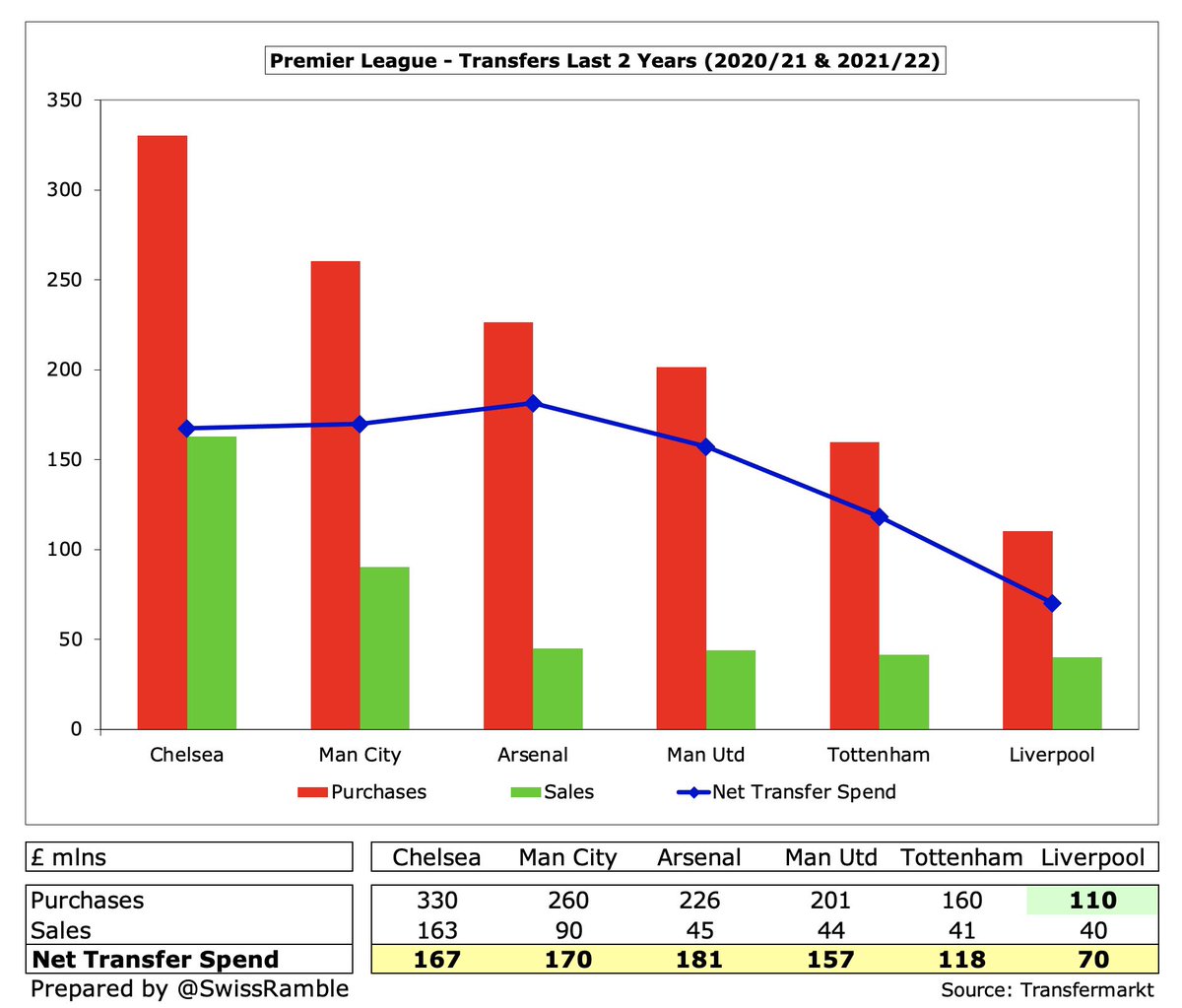

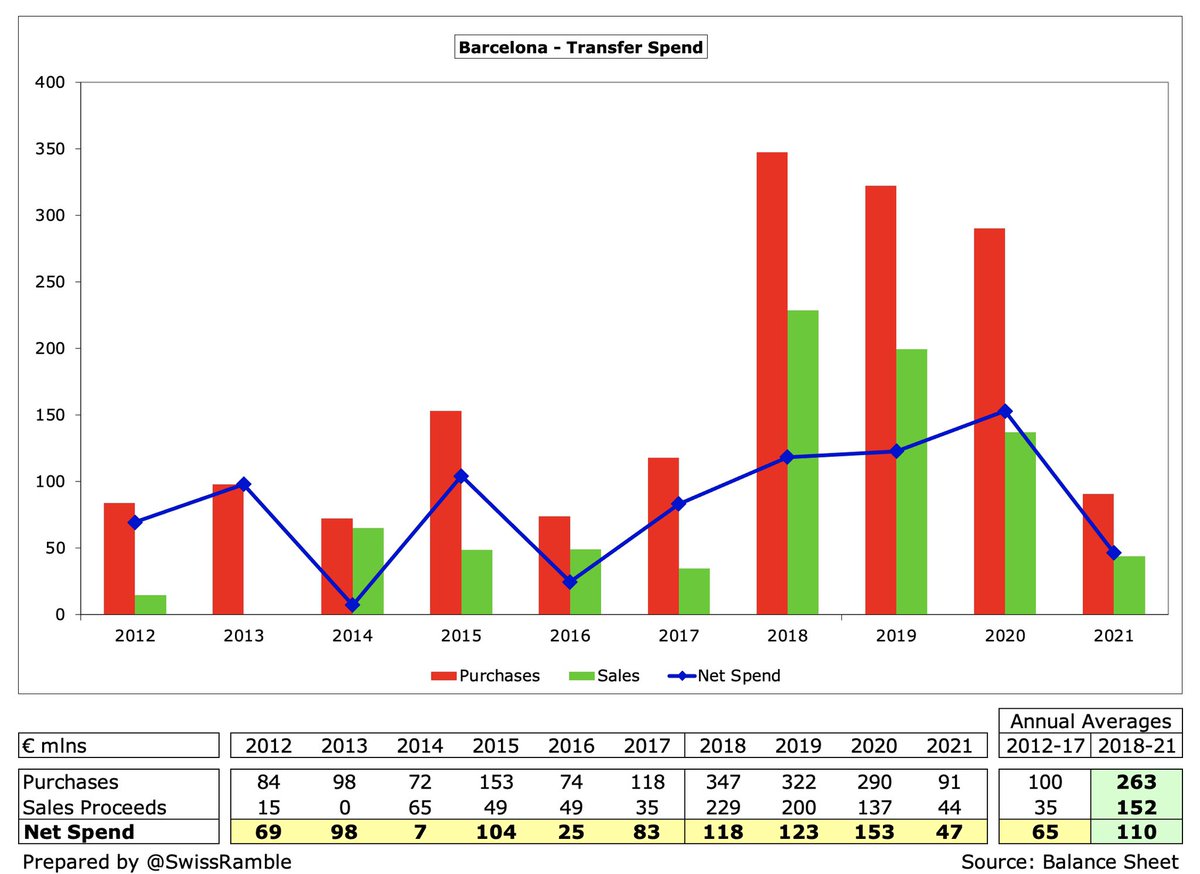

#FCBarcelona have spent big in the transfer market, averaging €263m in last 4 years, though gross spend dipped to “only” €91m in 2020/21. Player sales have also increased in this period, but net spend has still nearly doubled from €65m in preceding 6-year period to €110m.

In fact, #FCBarcelona spent nearly a billion on bringing players to the club in the 3 years up to 2020 with their €960m by far the highest in Europe, well ahead of Juventus €801m, #CFC €758m & #MCFC €678m. In terms of net spend, Barca were outpaced by the two Manchester clubs

However, it was a very different story this summer, as #FCBarcelona only spent €15m to bring in Emerson Royal plus Depay, Garcia and Aguero on free transfers. In fact, they had the lowest “net spend” in La Liga with €49m net sales, though to be fair Real Madrid were similar.

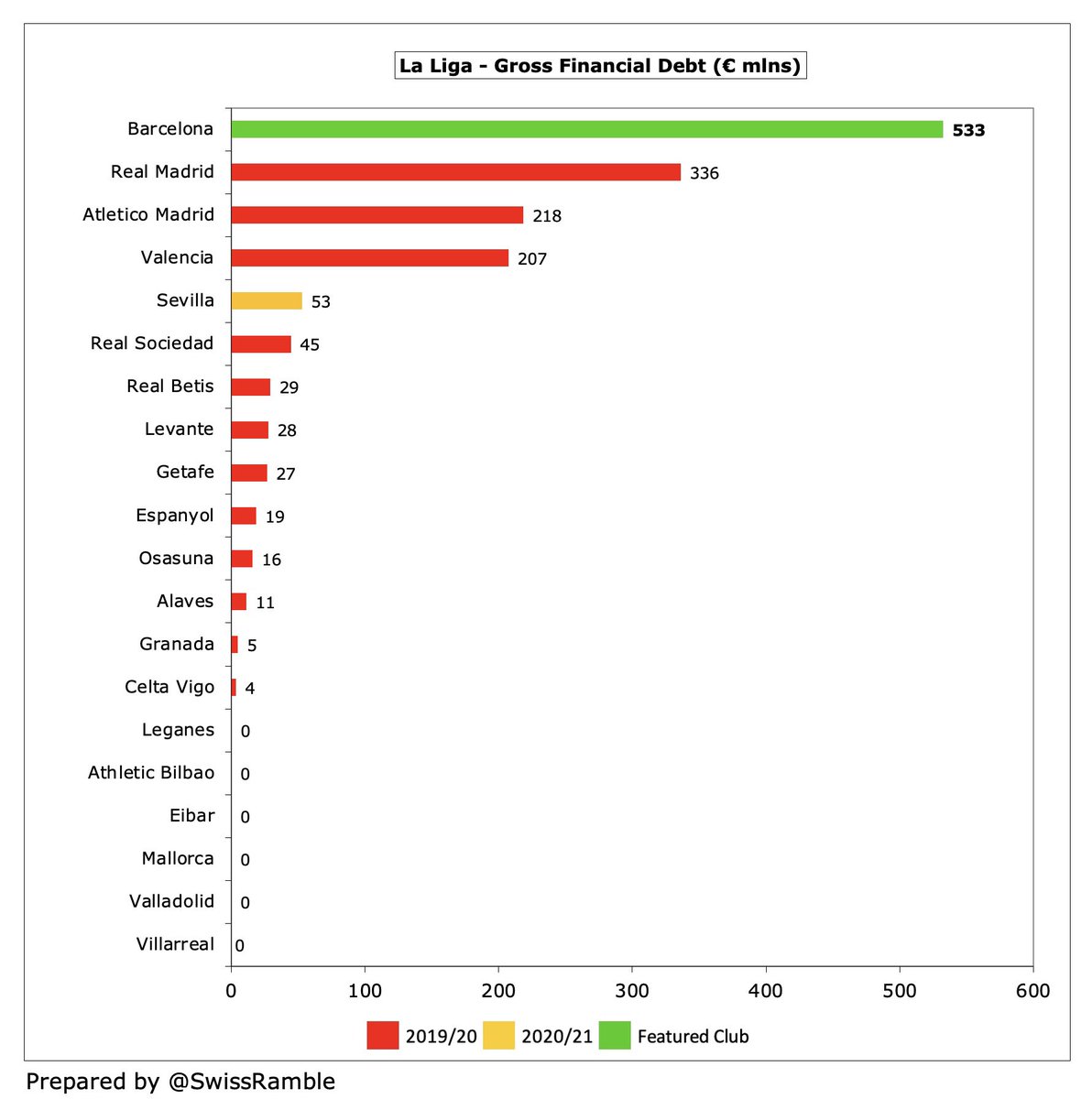

#FCBarcelona gross financial debt rose by €53m from €480m to €533m, comprising €330m bank loans and €203m bonds, which means a hefty €464m increase in only three years. Cash fell from €162m to €60m, so net debt grew from €318m to €472m.

Unsurprisingly, #FCBarcelona €533m gross financial debt is the highest in Spain, significantly more than Real Madrid £336m, Atletico Madrid €218m and Valencia €207m. Third highest in Europe in prior year, only behind #THFC €947m (new stadium) and #MUFC €599m (Glazers’ LBO).

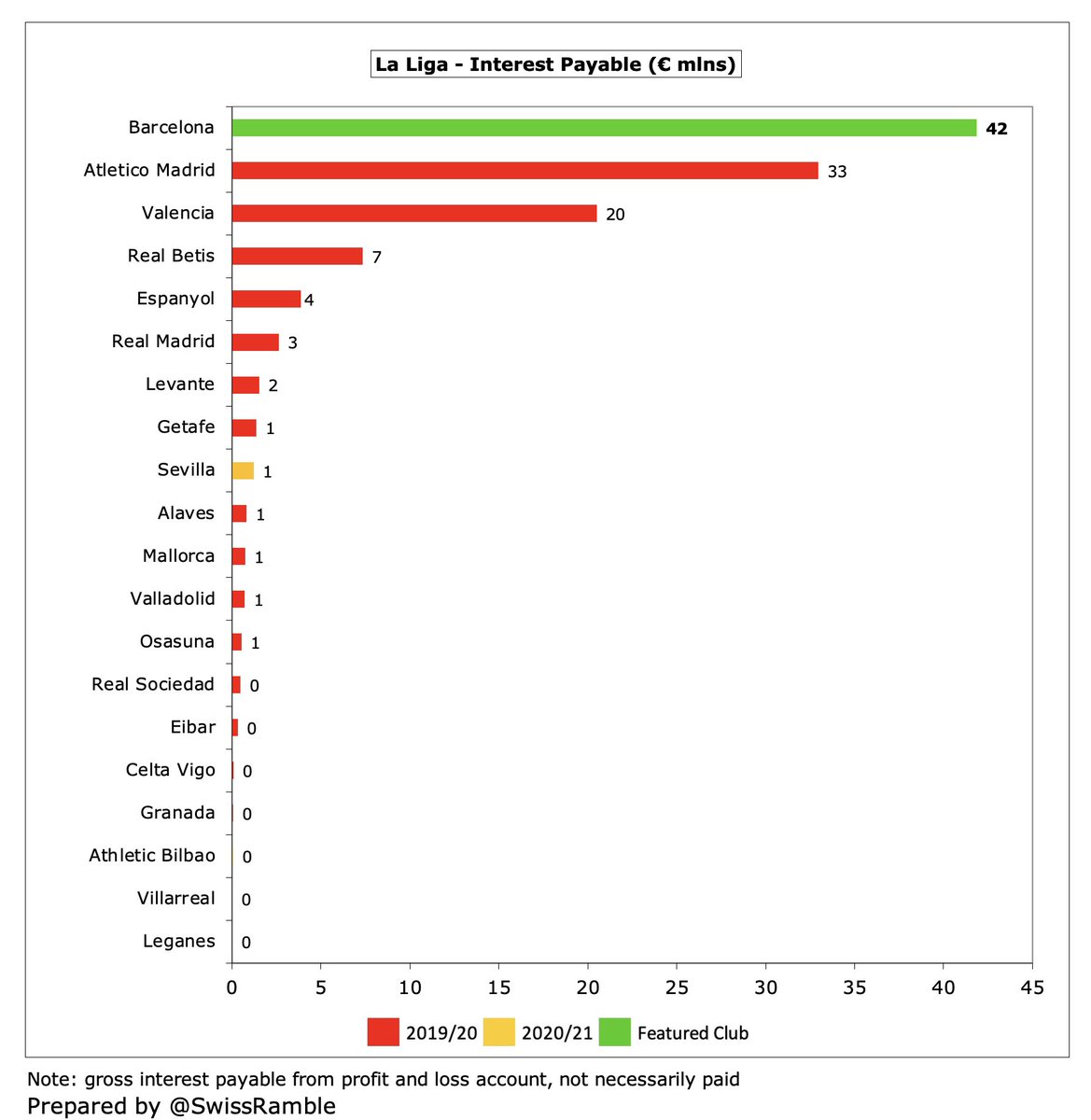

#FCBarcelona debt growth has come at a price, as the amount of interest paid has shot up from just €1m in 2018 to €41m in 2021, the highest in La Liga. The €26m they paid in the prior season was also the highest in Europe, ahead of #MUFC €23m, Inter €17m and #THFC €16m.

#FCBarcelona managed to reduce transfer debt by €92m to €231m, though this had shot up from €64m in 2017. Now lower than Atletico Madrid €316m, though the €323m payables were highest in Europe in 2020. Mainly owed to Ajax, Juventus and #LFC, but debt sold on to institutions.

#FCBarcelona total debt (including wages, tax authorities debt, trade creditors and other creditors) was virtually unchanged at €1.2 bln. Worth noting that staff debt, i.e. outstanding wages, rose €36m to €240m. Only surpassed by #THFC last year.

One reason #FCBarcelona have had more problems with debt than others is that so much was short-term, i.e. needs to be repaid within the next 12 months (€731m in 2020). The good news is that debt was restructured in August with a 10-year €595m loan at 1.98% replacing old ST debt

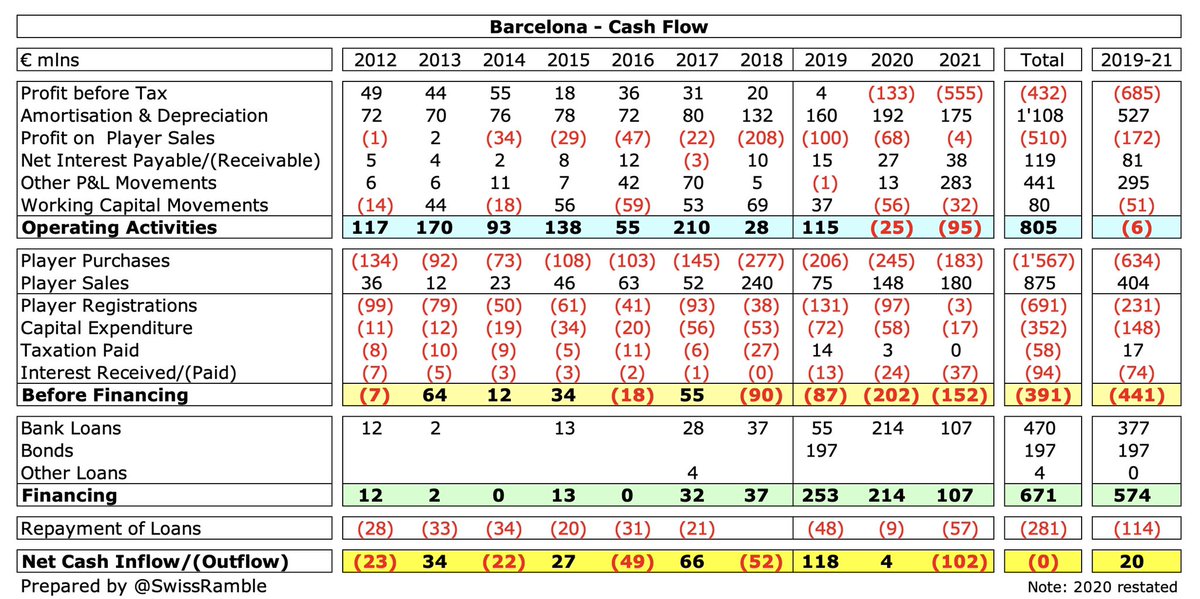

In the last 3 years, #FCBarcelona huge €765m operating loss was offset by non-cash adjustments, but the club then spent net €231m on players (purchases €635m, sales €204m), €148m infrastructure and €74m interest. This had to be funded by taking on €461m additional debt.

#FCBarcelona Espai project, including Camp Nou redevelopment, increasing capacity from 99,000 to 110,000, will cost €1.5 bln if approved by members. Club looking for €200m additional revenue per annum: naming rights, sponsorships, VIP boxes, tickets, catering & events.

Laporta said #FCBarcelona was “technically bankrupt”, due to “serious deficiencies in the way the previous management ran the club”, i.e. a huge wage bill and astronomical transfer spend funded by more debt. Drastic steps have been taken, but it’s unlikely to be a quick fix.

The #FCBarcelona business model clearly faces major financial challenges, made worse by the pandemic, which is why they did not make a major signing to replace Messi. It also helps explain why the club remains interested in the European Super League project.

• • •

Missing some Tweet in this thread? You can try to

force a refresh