Norwich City’s 2020/21 accounts covered a “challenging period” for the club due to the financial impact of COVID, but they did win the Championship, securing immediate promotion back to the Premier League. Some thoughts in the following thread #NCFC

Despite the impact of relegation and the pandemic, #NCFC pre-tax profit increased from £2.1m to £21.5m (post-tax £15.7m), even though revenue fell £62m (52%) from club record £119m to £57m, as profit on player sales shot up from £2m to £60m and operating expenses were cut £23m.

As a technical aside, the #NCFC 2020/21 accounts only covered 11 months up to 30 June 2021, while the 2019/20 accounts were extended by a month to match the longer Premier League season, so covered a 13-month period. This presents “the best comparable financial information”.

Main driver of #NCFC revenue decrease was broadcasting, down £41m (46%) from £90m to £49m, as TV deal much more lucrative in Premier League, while gate receipts dropped from £7.6m to just £0.1m as games played behind closed doors and commercial fell £13m (62%) from £21m to £8m.

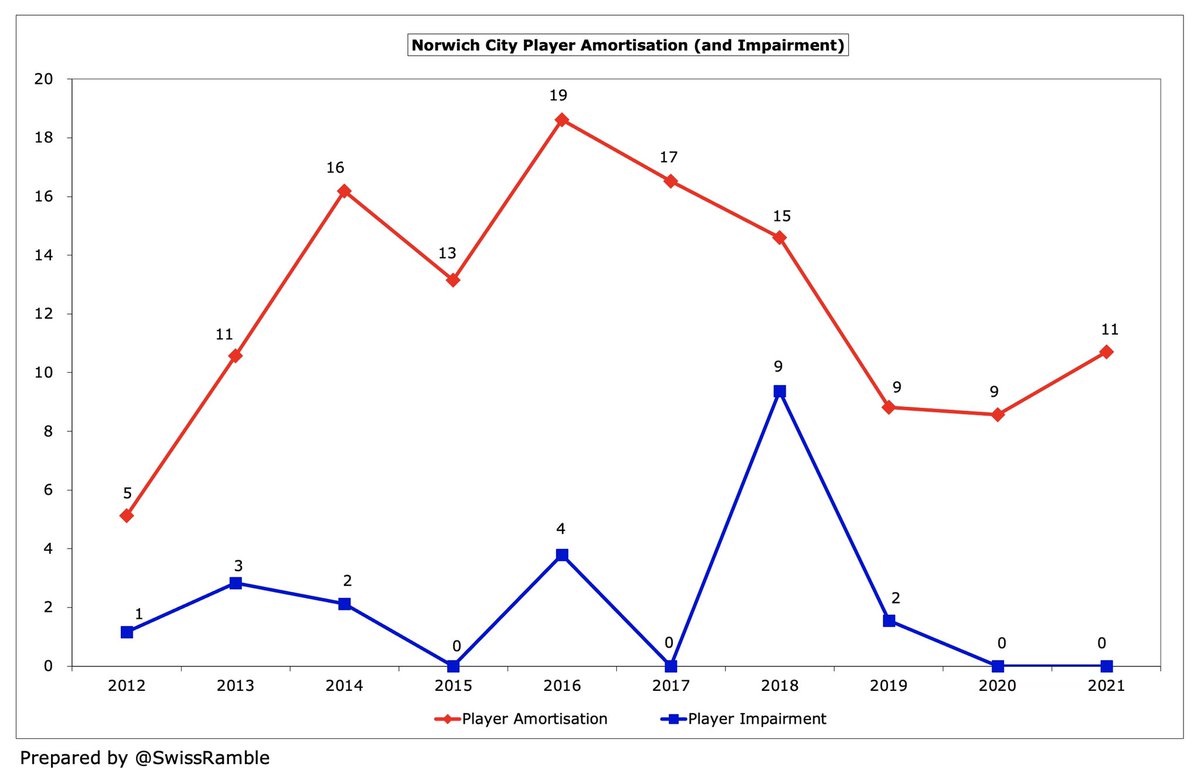

#NCFC wage bill fell £22m (25%) from £89m to £67m, despite including hefty promotion bonuses, other expenses were cut £2m (13%) to £16m and net interest payable was more than halved to £0.8m. In contrast, player amortisation rose £2m (25%) from £9m to £11m.

Given the difficult economic environment, it was a notable achievement for #NCFC to post a £21.5m pre-tax profit. In fact, this was better than any other club in the Championship in 2019/20, when just 3 clubs were profitable (all of which were only around £3m).

#NCFC profit was “significantly impacted” by COVID with total loss to date estimated as £30m, split £10m in 2019/20 and £20m in 2020/21, based on comparisons with revenue in 2018/19, the last time that Norwich were in the Championship: match day £10m, commercial £7m and TV £3m.

#NCFC bottom line was massively boosted by £60m profit from player sales, up from only £2m prior season, including the club record sale of Emi Buendia to #AVFC, Ben Godfrey to #EFC and Jamal Lewis to #NUFC. By far the highest in Championship in the last two years.

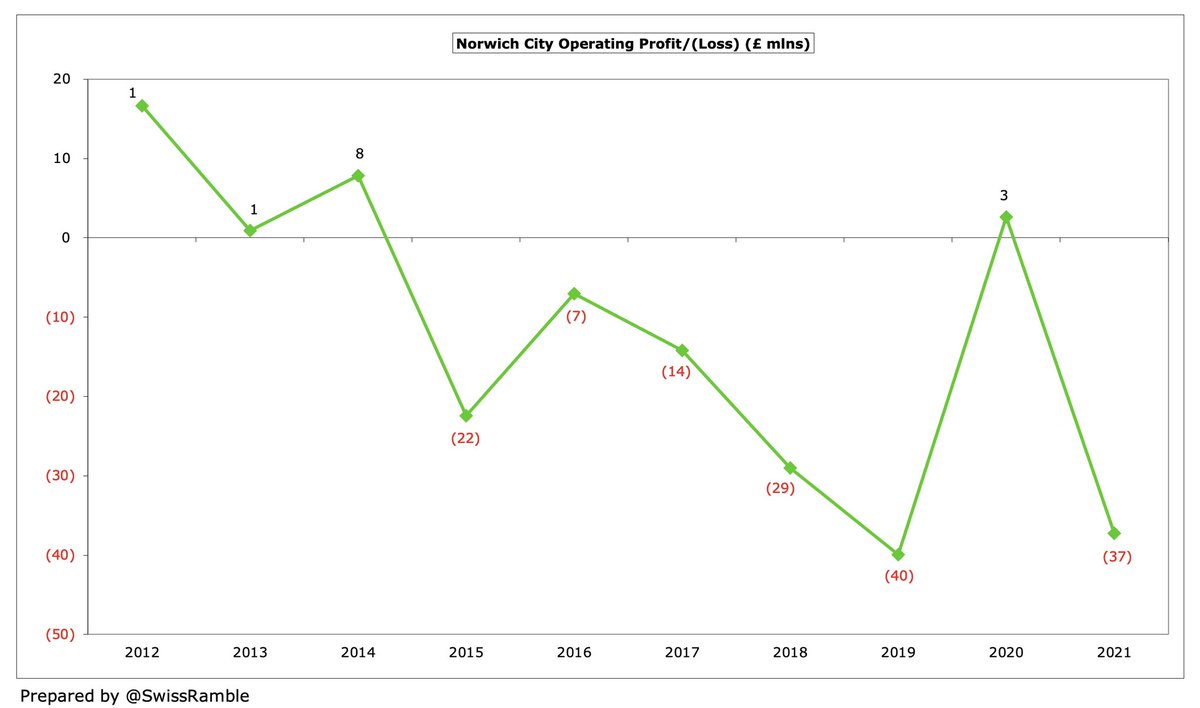

So #NCFC have managed to post profits in each of the last two COVID-impacted seasons. It used to be the case that they were profitable in the Premier League, but lost money following relegation, but they were also profitable twice in last 4 years they were in the Championship.

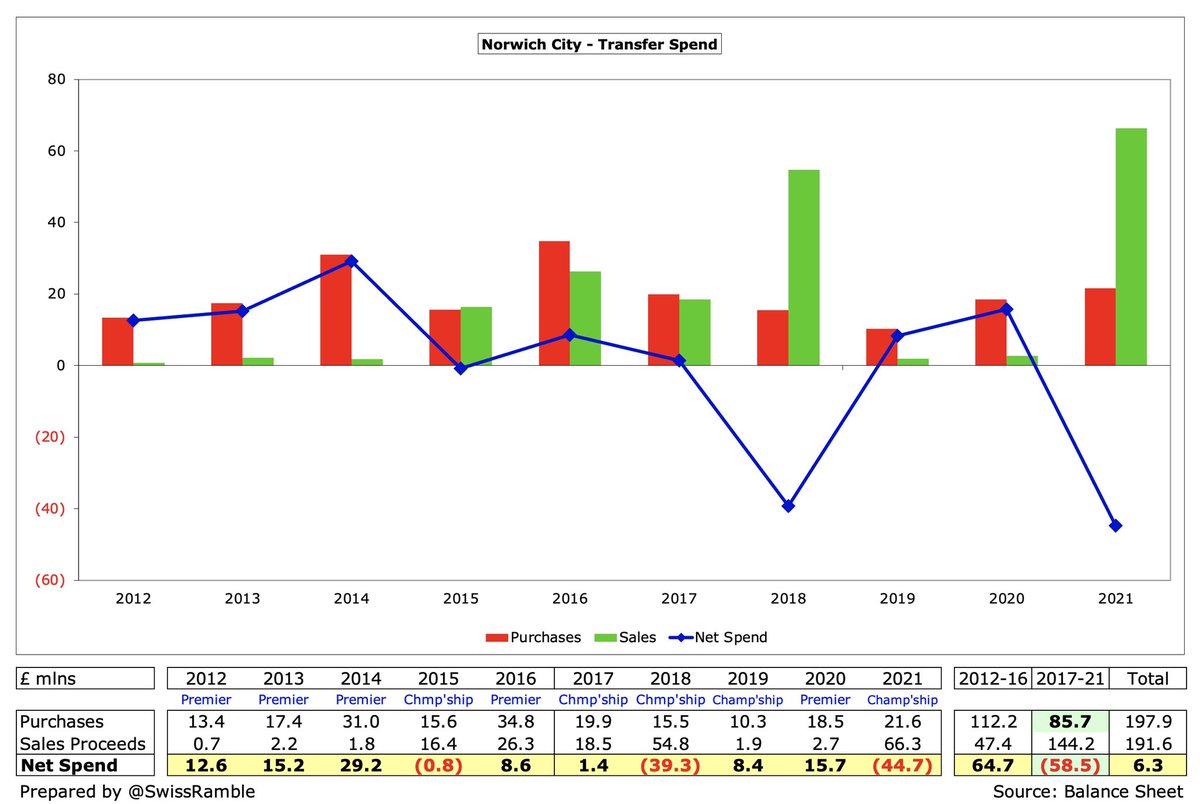

However, the #NCFC business model is very dependent on player sales, where they have made an impressive £158m profit in the last 7 years, including £60m in 2021 and £48m in 2018, mainly due to the big money sales of James Maddison to #LCFC and Josh Murphy to Cardiff City.

In fact, #NCFC have the two highest annual profits from player sales in Championship history. As CFO Anthony Richens said, “It’s key for us to recruit players of resaleable value, so they can impact on the pitch, but the club (also) has assets to be able to call upon.”

At an operating level (i.e. excluding player sales and interest), #NCFC swung from £3m profit to £37m loss, slightly better than the last time in the Championship two years ago. All clubs in this division make operating losses, though Norwich are firmly in bottom half of table.

#NCFC £57m revenue in 2021 was £18m lower than the £75m they generated in 2017, the last time they were relegated from the Premier League. The reduction is very largely driven by the impact of the pandemic: gate receipts down £9m, commercial £7m and broadcasting £2m.

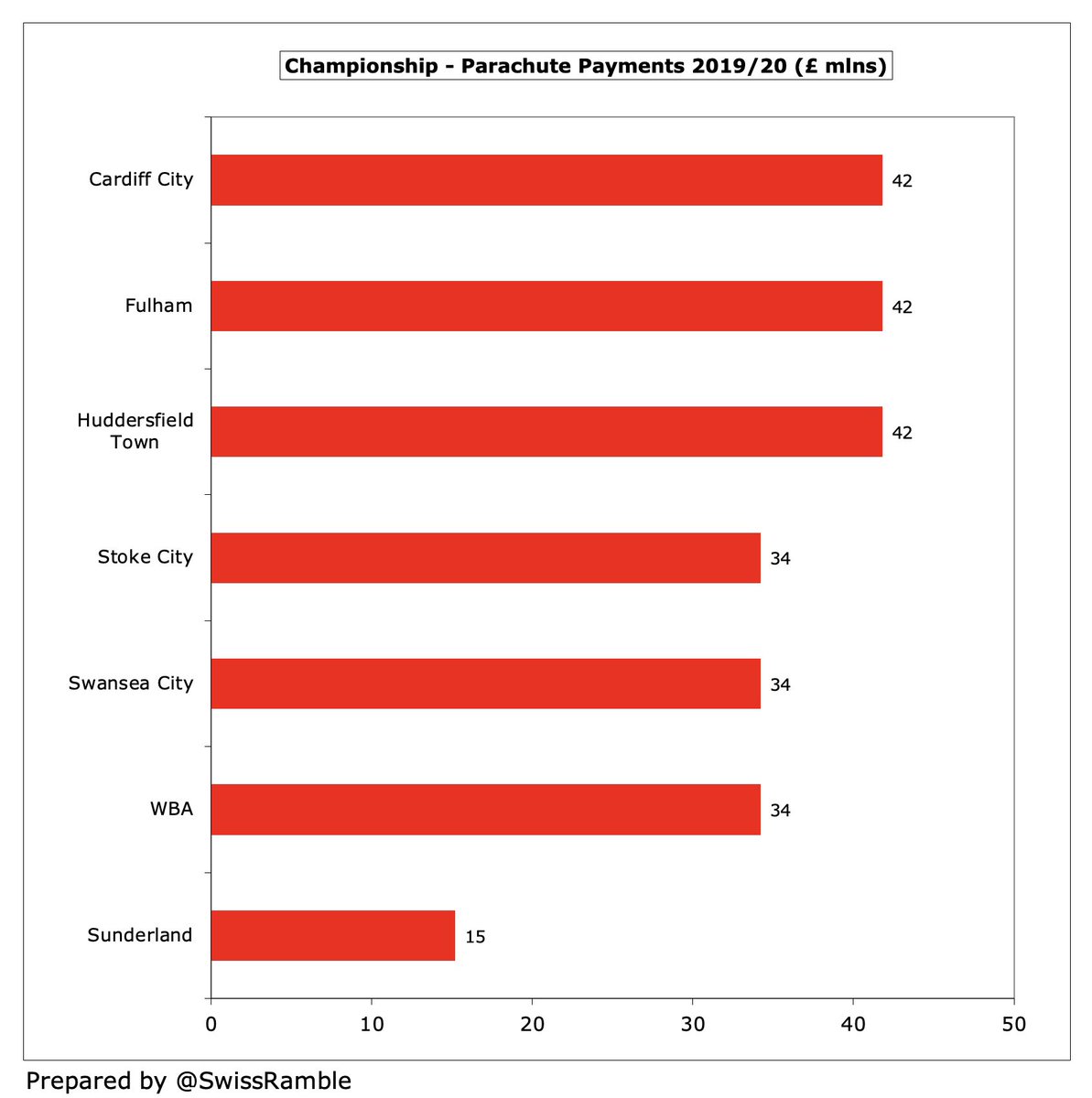

Despite the significant decrease, #NCFC £57m revenue was still one of the highest in the Championship, around the same level as three other relegated clubs in 2019/20, namely #FFC £58m, #WBA £54m and #HTAFC £53m, thanks to parachute payments from the Premier League.

Championship revenue ranking is hugely influenced by parachute payments. Details for 2020/21 have not yet been published, but relegated clubs received £42m in the first year in 2019/20. If Norwich are again immediately relegated this season, will only get 2 years of parachutes.

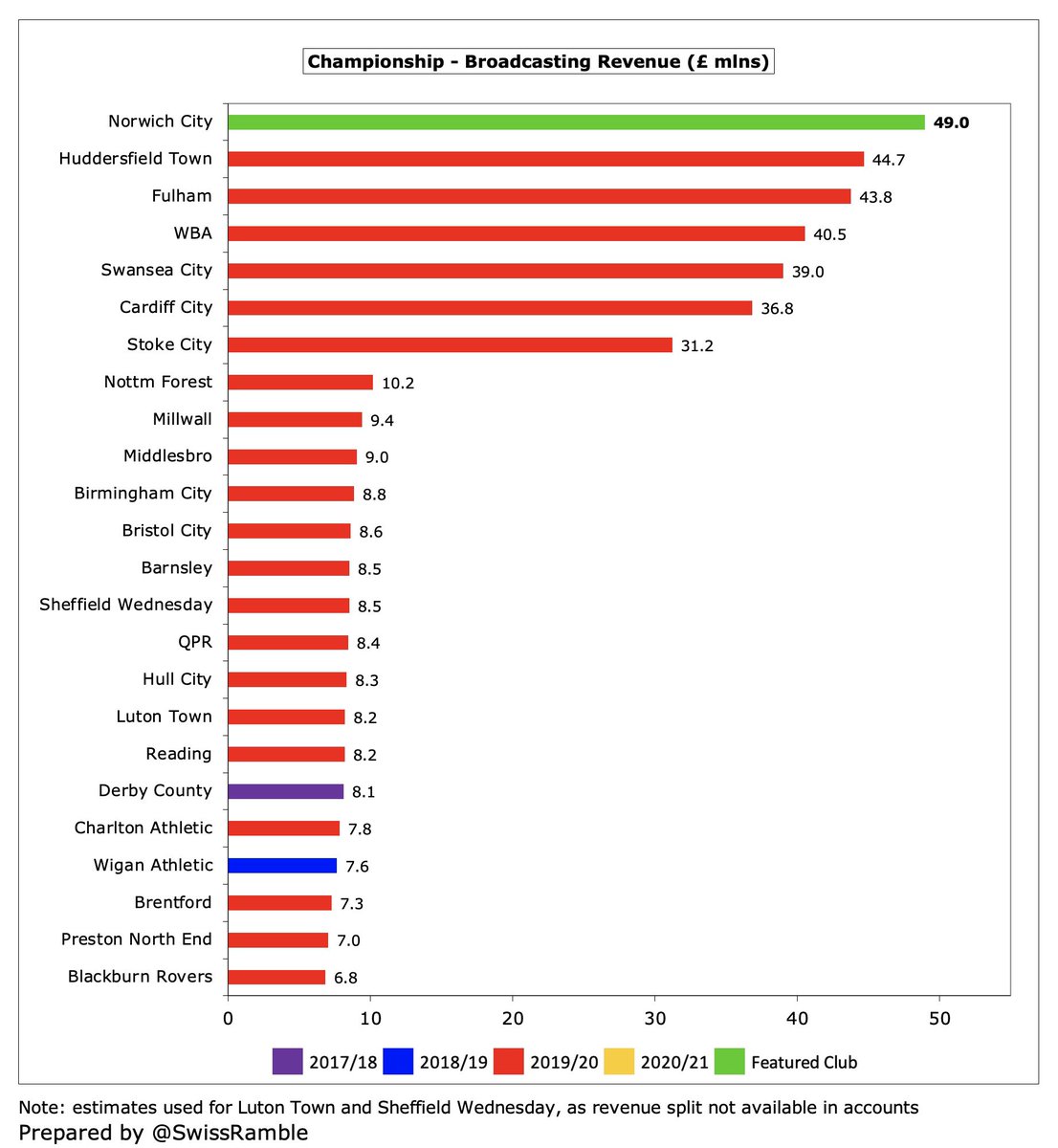

Despite the parachute payment, #NCFC broadcasting income still nearly halved after relegation from £90m to £49m, though this is still the highest in the Championship. Clubs that don’t benefit from parachutes earn between £7m and £10m, a significant gap.

#NCFC gate receipts dropped £7.5m (98%) to just £0.1m, as nearly all home games were played behind closed doors (only first match allowed 1,000 fans). Their 2018/19 income of £9.7m from this stream would have been one of the highest in the division.

Like other clubs, #NCFC will be delighted that grounds returned to full capacity at the start of 2021/22 season. Their 27,005 average attendance in 2019/20 (for games played with fans) was one of the lowest in the top tier, but would have placed them 3rd highest in Championship.

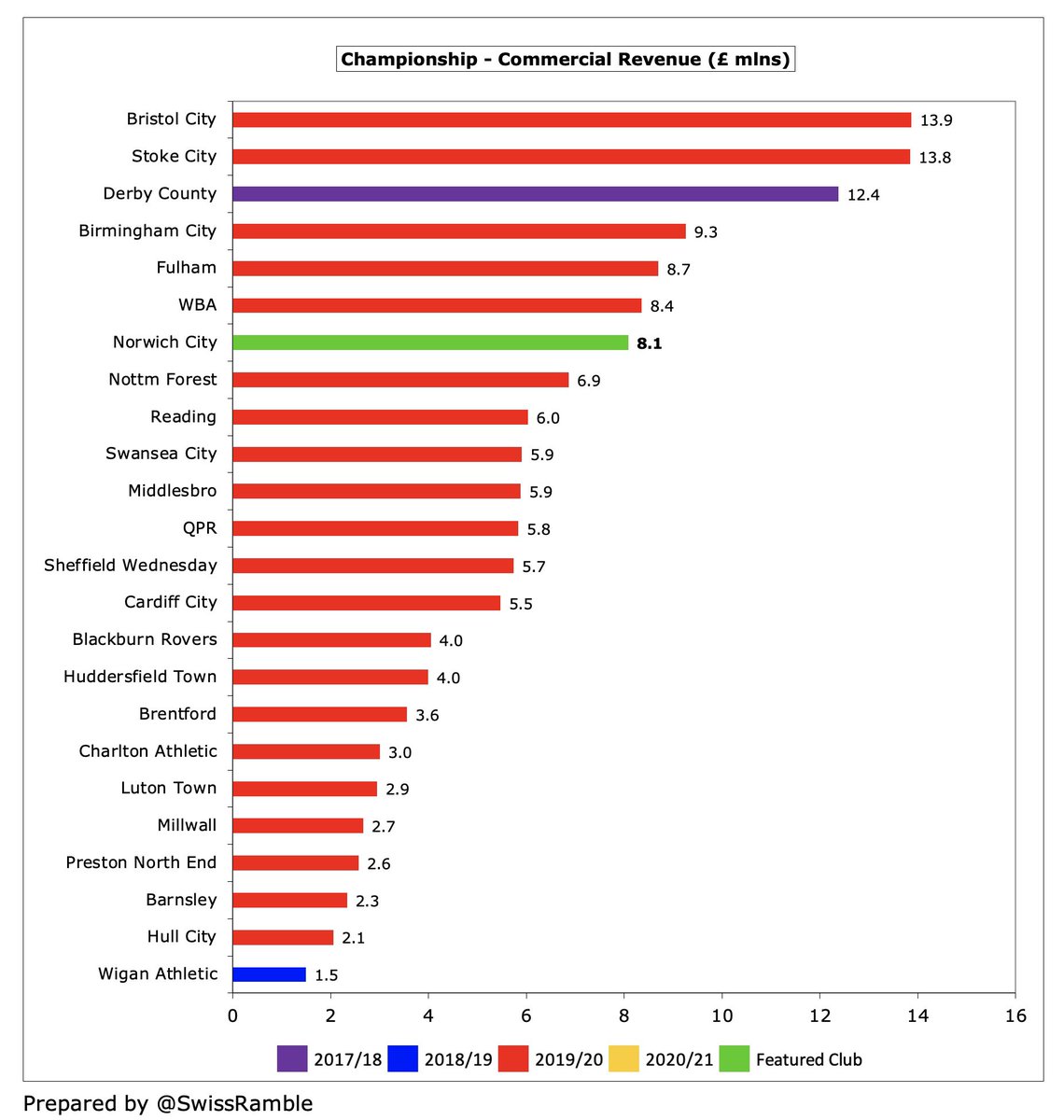

After surging to £21m in the Premier League, commercial revenue dropped £13m (62%) to £8m after relegation, with big falls in sponsorship & advertising from £10.3m to £2.7m and catering from £4.6m to £0.4m, as COVID took a toll. Still pretty good for the Championship.

#NCFC had Dafabet and Errea as principal sponsors in 2020/21, but these have since been replaced. Joma confirmed as new kit supplier, but agreement with shirt sponsor BK8 was terminated due to the gambling company’s tasteless marketing, replaced by Lotus Cars.

#NCFC other operating income fell £0.4m to £1.4m, including £741k grant income for furlough payments under the Coronavirus Job Retention Scheme and £639k loan player income. #HTAFC sizeable £6.3m in 2019/20 included £5.7m from player loans.

#NCFC wage bill fell £22m (25%) from £89m to £67m following relegation, though this was still the club’s third highest ever. Wages would have been much lower without a good-sized bonus payment for the Championship-winning promotion exploits.

Despite the decrease, #NCFC £67m wage bill was still one of the highest in the Championship, though the three largest were all inflated by promotion payments. On the other hand, Norwich’s figure only covered 11 months, due to the change in accounting date.

Following the big decrease in revenue due to relegation and COVID, #NCFC wages to turnover ratio increased from 75% to 117%, though not as high as 2019 (when they had no parachute payments). The vast majority of clubs in the Championship have (unsustainable) ratios over 100%.

None of the #NCFC directors received any remuneration in 2020/21, which has been the case for the last two years, presumably due to the impact of COVID. In 2018/19 the highest paid director received £480k.

#NCFC player amortisation, the annual charge to expense transfer fees over a player’s contract, rose £2.1m (25%) from £8.6m to £10.7m, way down from the £18.6m peak in 2016. Just about in the top ten in the Championship, which highlights the club’s limited investment in players.

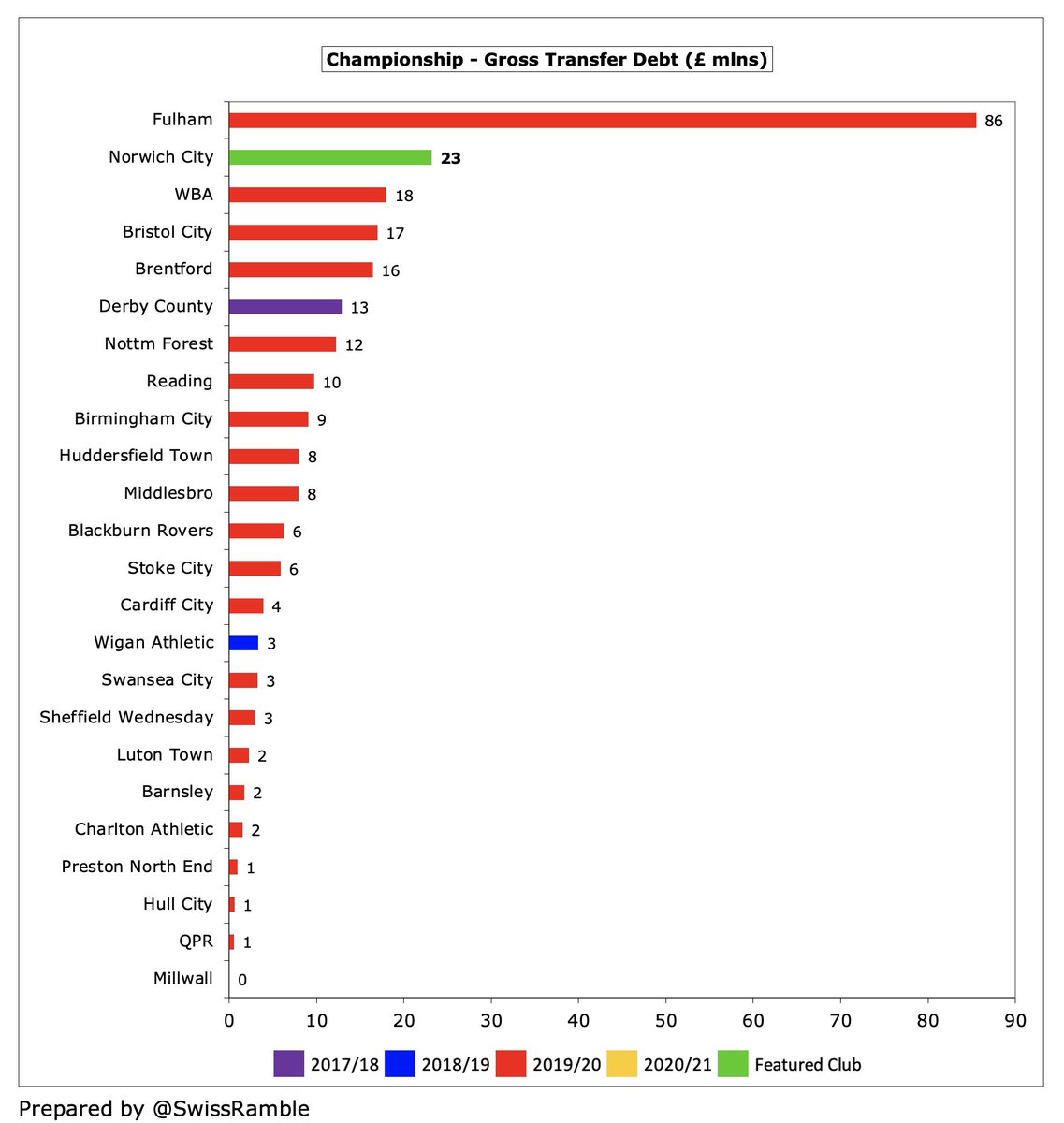

That said, #NCFC player purchases of £22m were among the highest in the Championship, including Milot Rashica from Werder Bremen, though not as much as #FFC and #WBA spent following relegation from the top flight with £53m and £34m respectively.

#NCFC had £45m net sales in 2020/21, contributing to £59m net sales in the last 5 years. Gross spend has also fallen to £86m in this time from £112m in the preceding 5-year period. In fact, they only have total £6m net spend in the last decade, though spent £53m after accounts.

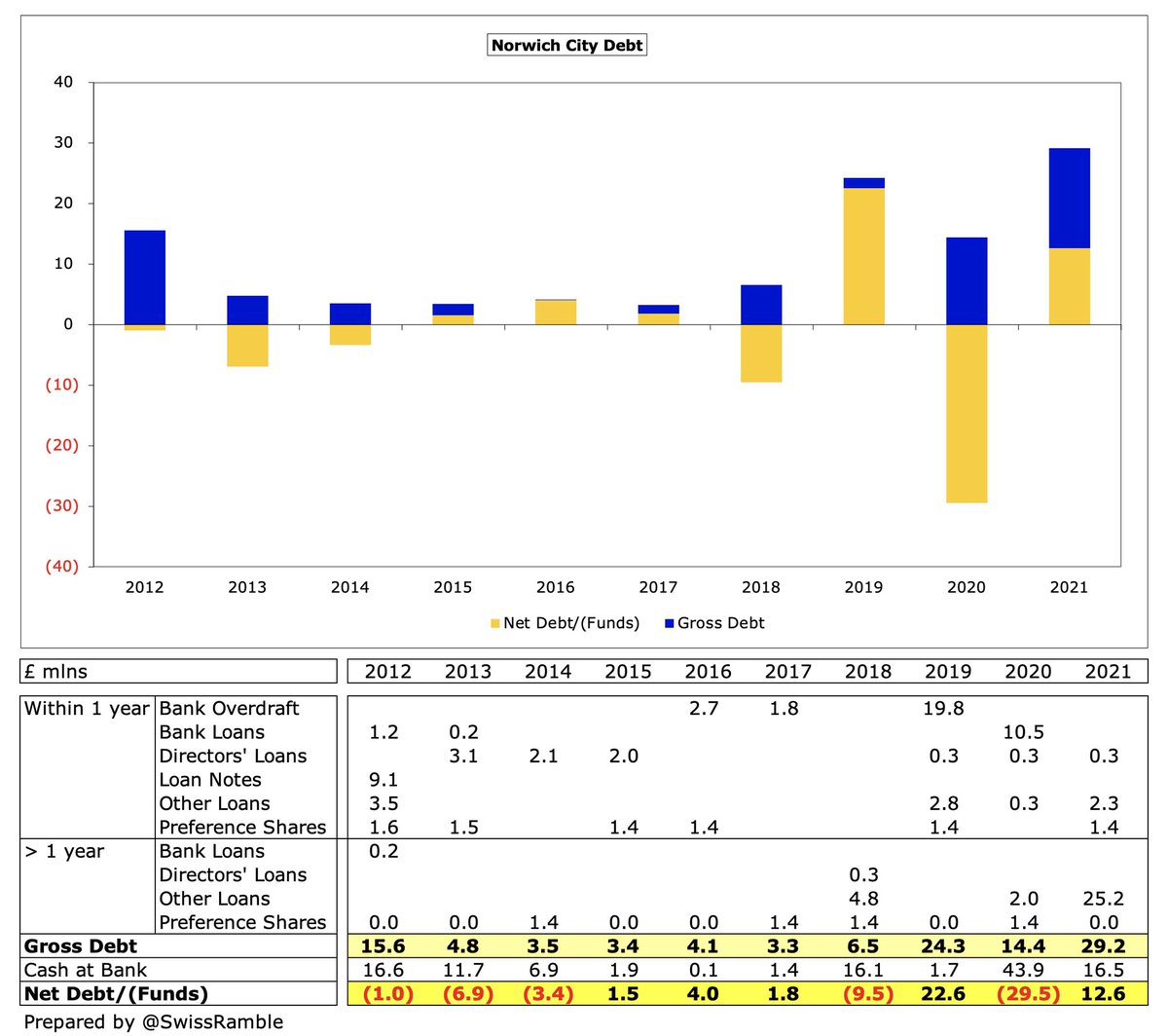

#NCFC gross debt more than doubled from £14m to £29m, mainly £25m bank loan secured on TV money, repayable by September 2022, plus £2.3m Canary Bond and £250k from directors to help fund the new training ground. Also includes £1.4m preference shares classified as debt.

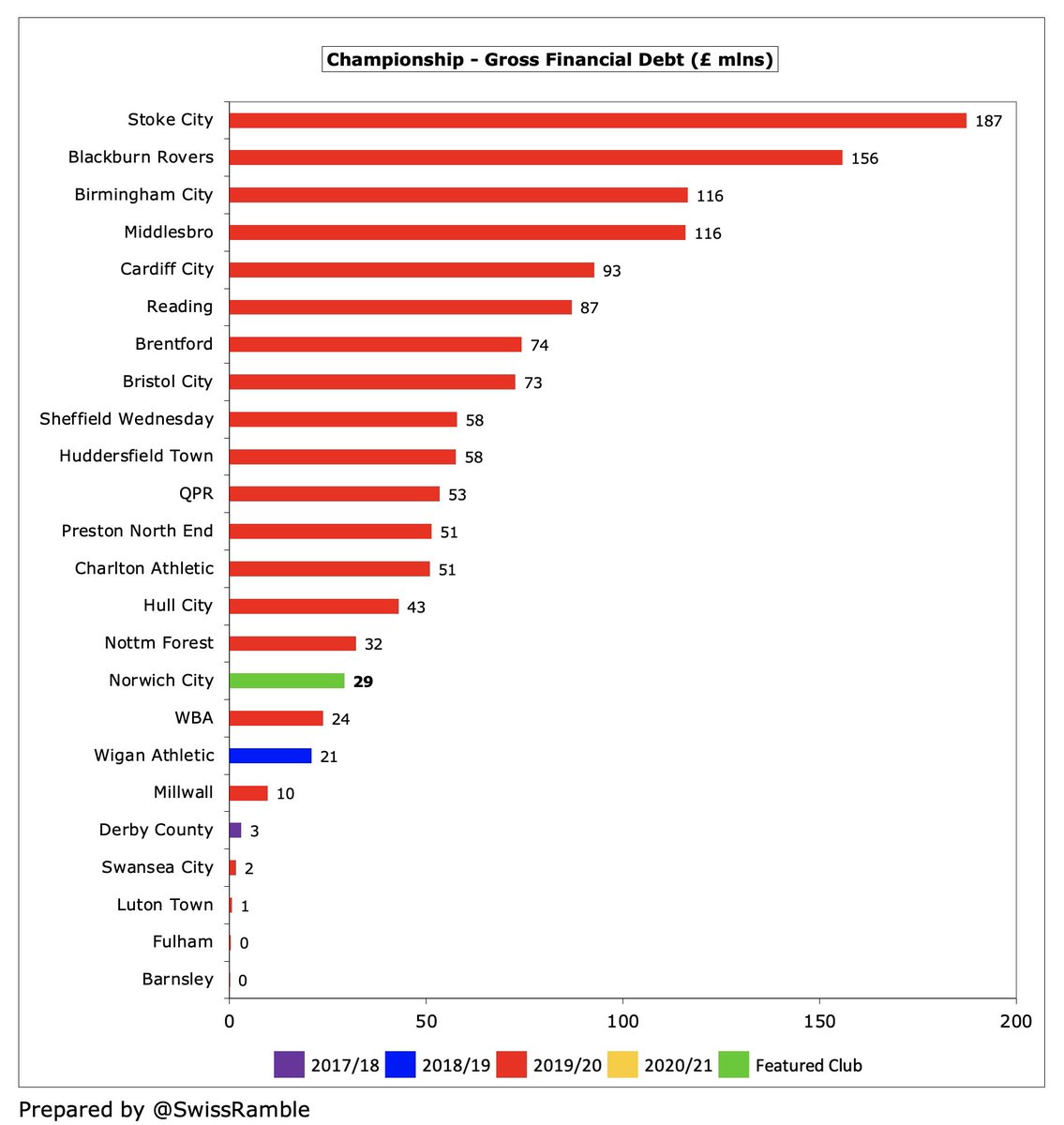

Even after the increase, #NCFC £29m debt was still one of the smallest in the Championship, miles below the likes of Stoke City £187m, Blackburn Rovers £156m, Birmingham City £116m and Middlesbrough £116m.

#NCFC paid £978k interest in 2020/21, down from prior year £2.5m, though their bank loan charges a chunky 5%. Most debt in the Championship is provided interest-free by club owners, so only 5 clubs pay more than £1m annual interest.

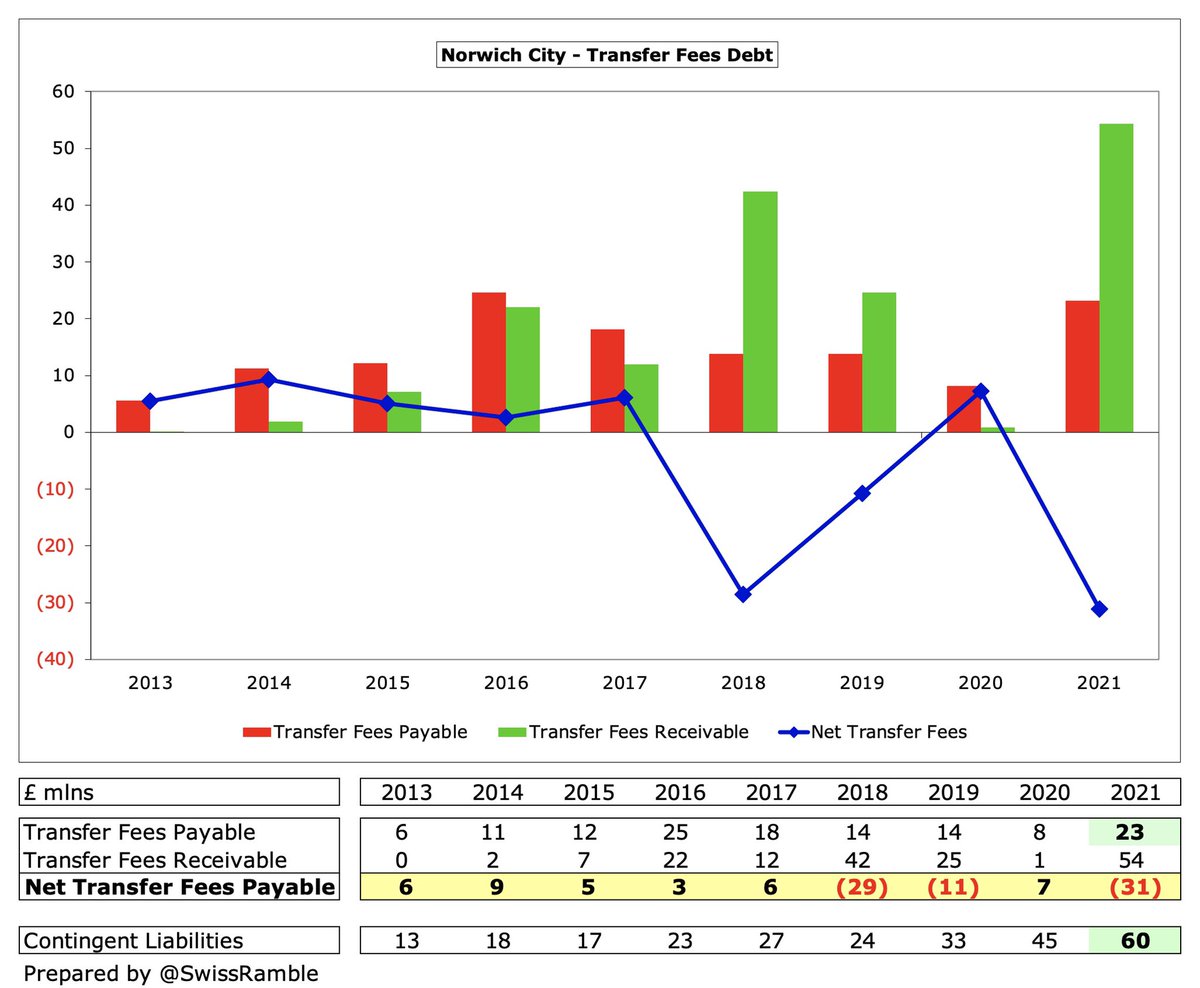

#NCFC transfer debt increased from £8m to £23m, but also worth noting that contingent liabilities (e.g. payments for surviving in Premier League) are up to £60m. Norwich player sales were largely on credit, so other clubs owe them £54m, half of which is due in the next 12 months.

#NCFC had £43m negative operating cash flow, only slightly offset by £6m net player sales (sales £22m, purchases £16m), but still invested £4m in infrastructure at Carrow Road and the Lotus Training Centre and paid £1m interest. Only partly offset by £15m net new loans.

As a result, #NCFC cash decreased by £27m from £44m to £17m. Sporting director Stuart Webber emphasised, “We are not sitting here on a load of money”, though Norwich’s cash balance was still one of the highest in the Championship.

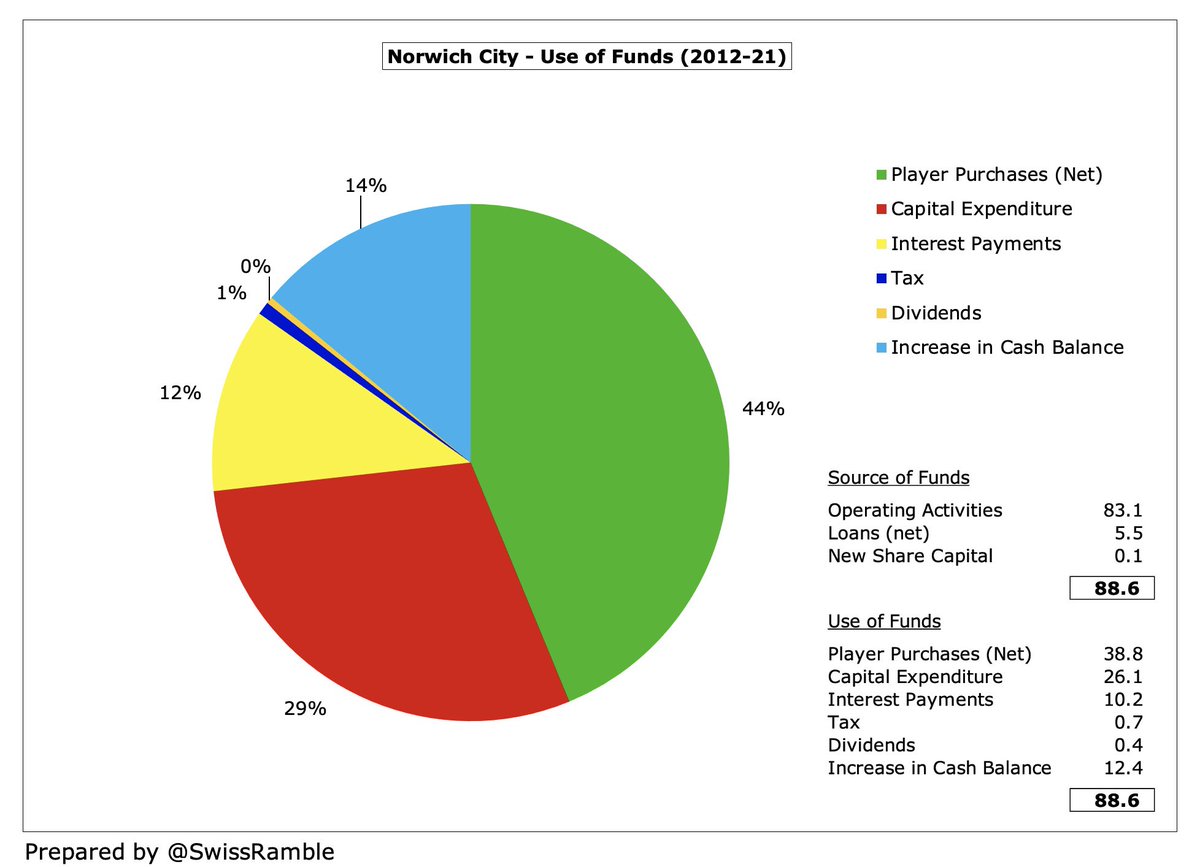

In the last 10 years #NCFC have generated £89m cash, mainly from operating activities. Much of this has either gone on players £39m, while the club has also spent £26m on infrastructure and made £10m interest payments. In addition, cash balance rose £12m.

#NCFC owners have not put much cash into the club in contrast to those at some other clubs. For example, in 2019/20 there was significant owner funding at #FFC £78m, Bristol City £59m, Stoke City £46m and Reading £38m.

As Webber said, “We can’t go all in now just to try to stay up for a season, because if we get relegated, we’re in deep, deep trouble. You can do that if you have a rich benefactor, who says: spend £100m – if it goes wrong, then I can write that off. We don’t have that.”

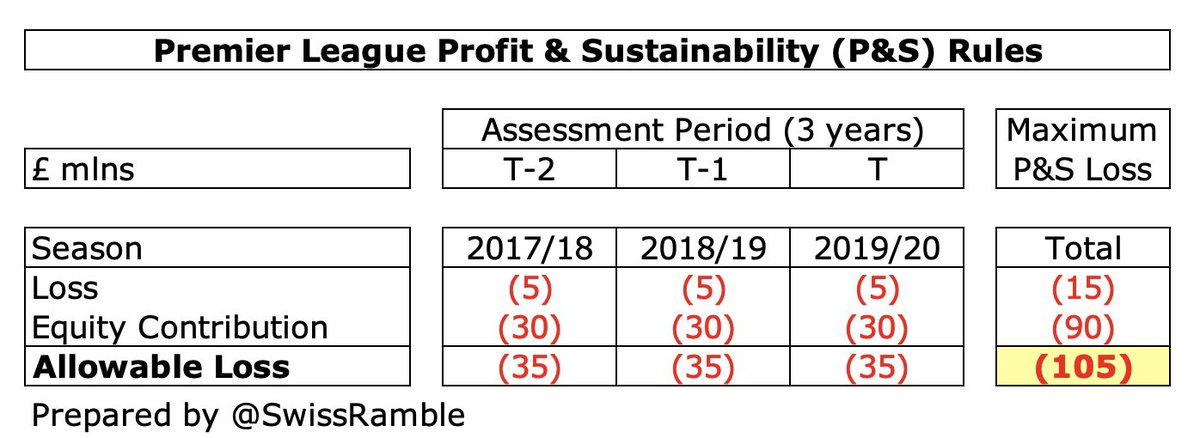

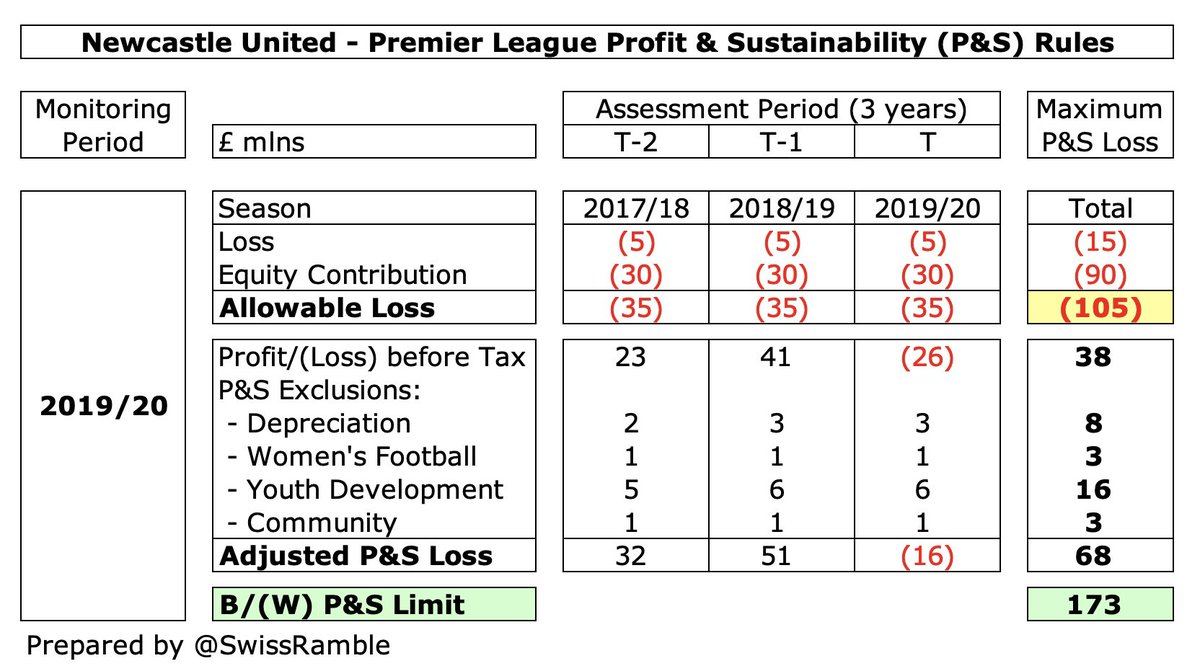

Unlike many Championship clubs, #NCFC have no FFP concerns, as their £16m loss over the 3-year monitoring period is lower than £61m limit (two Championship years of £13m, one Premier League year of £35m), even before allowable deductions £18m and estimated promotion bonuses £23m.

There is no doubt that #NCFC are run sustainably, which is no bad thing looking at other clubs in dire financial straits. Their £21m profit in 2021 despite relegation and COVID is a minor miracle, though their fans might be a little fed up with them being a classic “yo-yo” club.

• • •

Missing some Tweet in this thread? You can try to

force a refresh