-- When Macro Top? When Exit/Sell? --

This thread will cover a few indicators and metrics i will be looking at to help me identify when i should start to sell my #Bitcoin with the potential of a bear market to come.

TLDR: When i am going to sell my #Crypto

🔹Q2/3 2022 @ ~$200k

This thread will cover a few indicators and metrics i will be looking at to help me identify when i should start to sell my #Bitcoin with the potential of a bear market to come.

TLDR: When i am going to sell my #Crypto

🔹Q2/3 2022 @ ~$200k

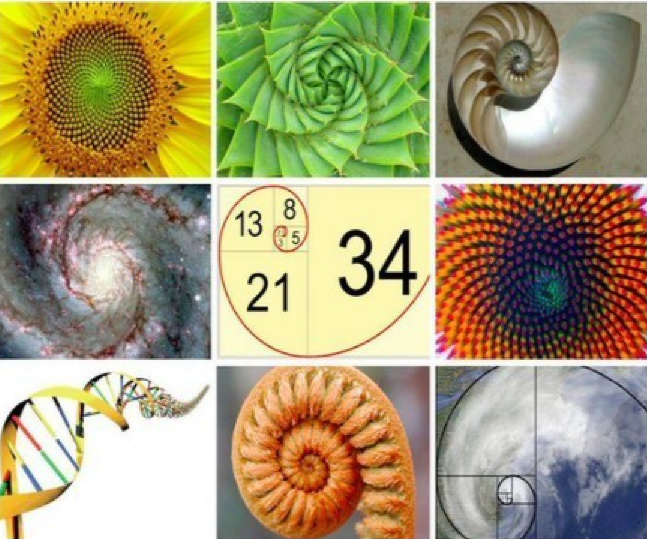

-- 1/ The #Bitcoin / #Crypto Bubble --

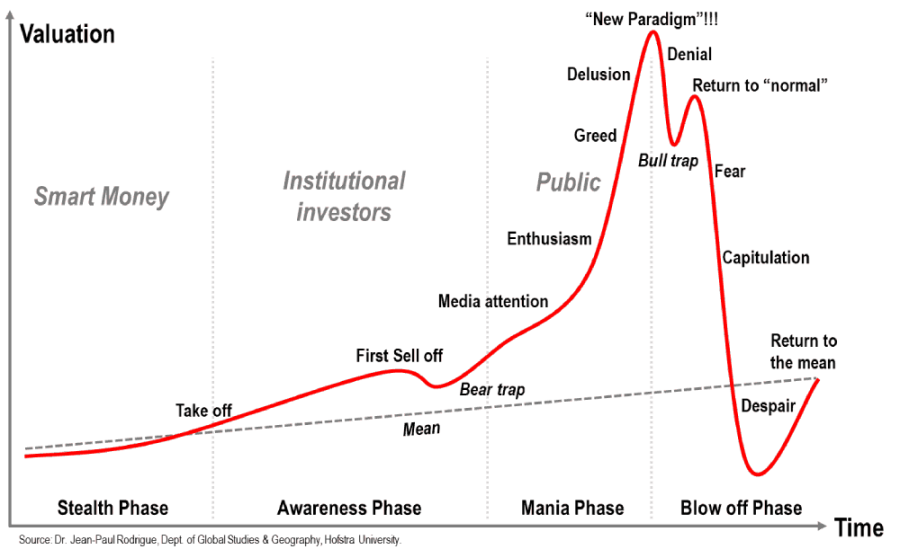

First thing is understand how bubble markets move, & especially how the #cryptocurrency market moved in the past, & where we are now.

Below shows the stages of a bubble market, which #BTC has been through 3 full cycles & now is in its 4th.

First thing is understand how bubble markets move, & especially how the #cryptocurrency market moved in the past, & where we are now.

Below shows the stages of a bubble market, which #BTC has been through 3 full cycles & now is in its 4th.

-- 2/ Retail FOMO --

There are 2 key metrics that I use to help understand the stage of the bubble which we are in & when a top is close.

1⃣ Google Trends

2⃣ Fear & Greed Index

There are 2 key metrics that I use to help understand the stage of the bubble which we are in & when a top is close.

1⃣ Google Trends

2⃣ Fear & Greed Index

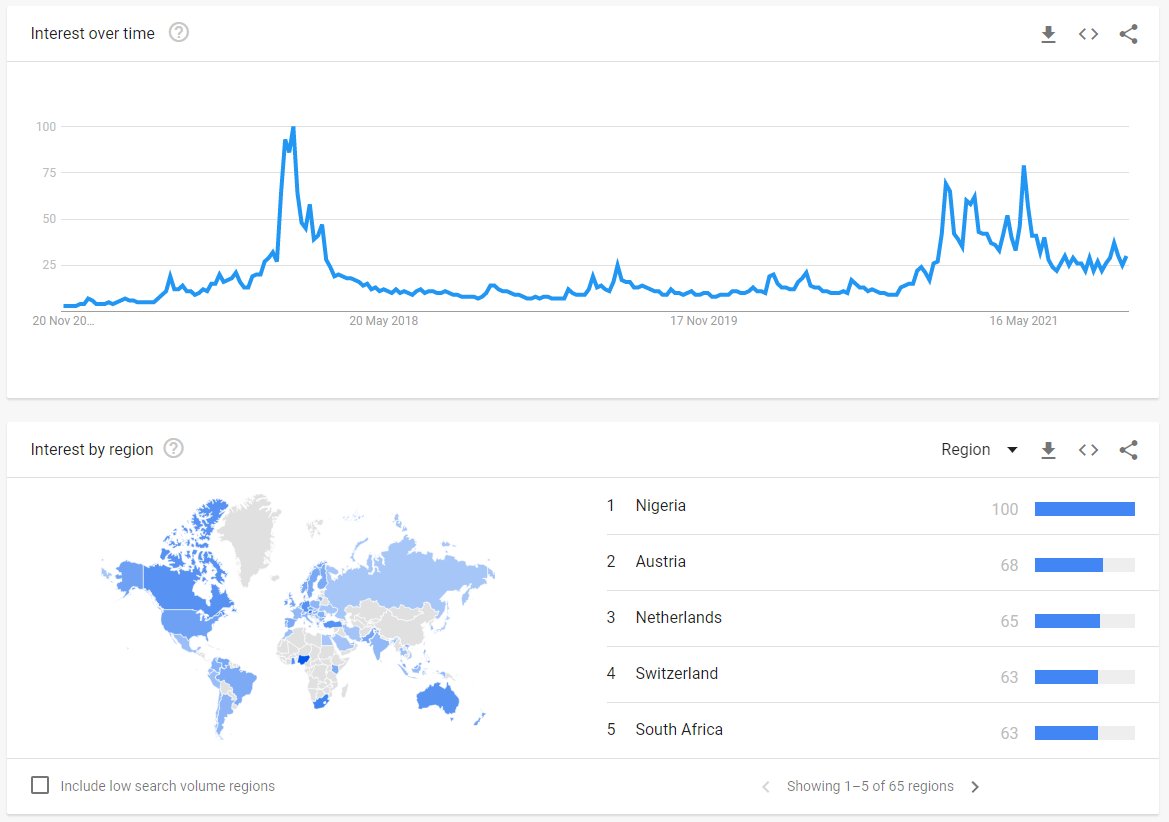

-- 2a/ Google Trends --

🔹Shows the trends on search keywords i.e. #bitcoin & #ethereum etc...

🔹The level to I want to see is between 80-90 on the yearly chart for a top to be close

🌐: trends.google.com/trends/explore…

🔹Shows the trends on search keywords i.e. #bitcoin & #ethereum etc...

🔹The level to I want to see is between 80-90 on the yearly chart for a top to be close

🌐: trends.google.com/trends/explore…

-- 2b/ Fear & Greed --

Made up of emotions & sentiments from different sources, which ave been crunched / combined into one simple number.

Be “fearful when others are greedy, and greedy when others are fearful.”

⚠️ When F&G > 90 look for tops

🌐: alternative.me/crypto/fear-an…

Made up of emotions & sentiments from different sources, which ave been crunched / combined into one simple number.

Be “fearful when others are greedy, and greedy when others are fearful.”

⚠️ When F&G > 90 look for tops

🌐: alternative.me/crypto/fear-an…

-- 3/ Weekly RSI --

When a Macro top is put in, we tend to see a clear Weekly Bearish divergence formed inside the 🐂 control zone.

Currently we have only had the first stab into the 🐂 control zone, now waiting for the 2nd and the divergence to form to mark a macro cycle top.

When a Macro top is put in, we tend to see a clear Weekly Bearish divergence formed inside the 🐂 control zone.

Currently we have only had the first stab into the 🐂 control zone, now waiting for the 2nd and the divergence to form to mark a macro cycle top.

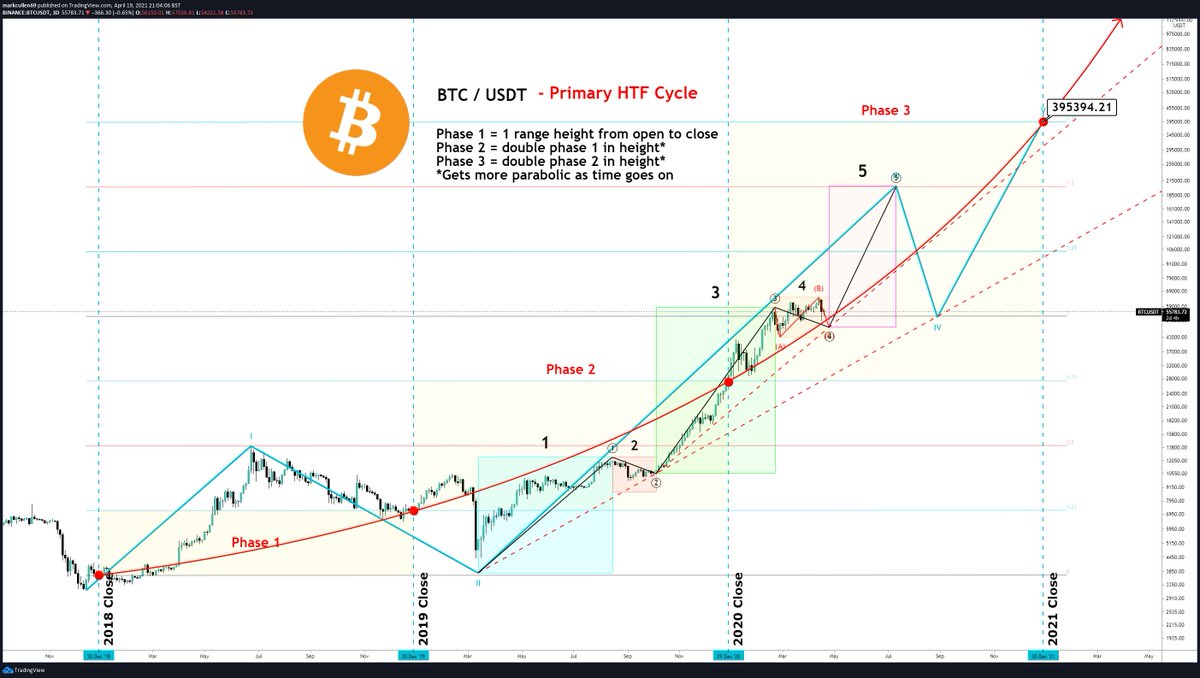

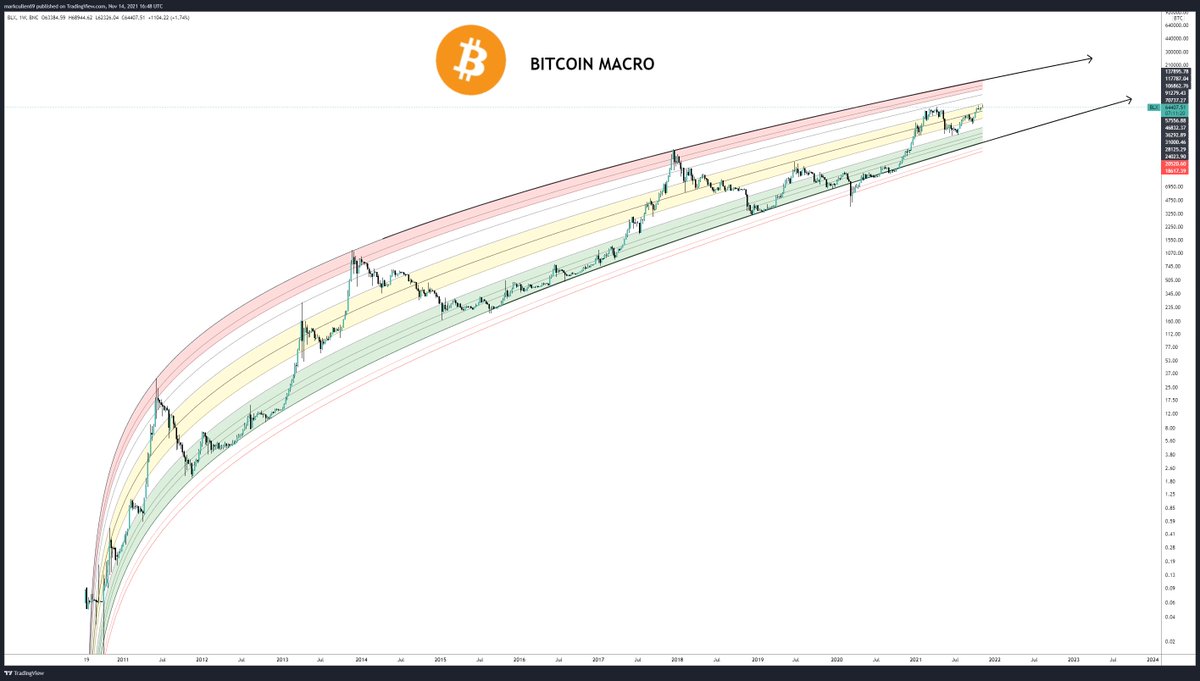

-- 4/ Log Curve --

The #Bitcoin log curve indicator, plots logarithmic curves fitted to major Bitcoin bear market tops & bottoms.

Tops are made in the 🟥 zone, bottoms in the 🟩

Currently #BTC isn't anywhere near the 🟥 zone, where a top is likely.

The #Bitcoin log curve indicator, plots logarithmic curves fitted to major Bitcoin bear market tops & bottoms.

Tops are made in the 🟥 zone, bottoms in the 🟩

Currently #BTC isn't anywhere near the 🟥 zone, where a top is likely.

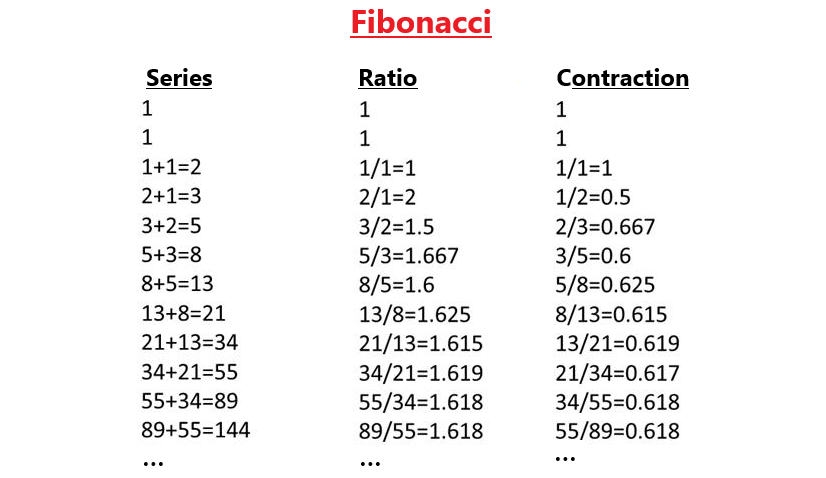

-- 5/ Major Fib levels --

#Bitcoin tops have in the past 2 cycles been at or very close to the 2.272 extension of the previous 🐻market dip, see 🟥 boxes

The subsequent 🐻 market bottom has been at the 1.618 of that same fib extension, see 🟦 boxes

🔥#BTC still has a way 2 go!

#Bitcoin tops have in the past 2 cycles been at or very close to the 2.272 extension of the previous 🐻market dip, see 🟥 boxes

The subsequent 🐻 market bottom has been at the 1.618 of that same fib extension, see 🟦 boxes

🔥#BTC still has a way 2 go!

-- 6/ When to Sell?

Using time of the cycles & the fact that we expect the cycles to get longer. We can extrapolate with the 2.272 fib target, the log curve 🟥 zone, pitchfork channeling and simple time expansion, that the top will be:

🔥Q2/3 2022 @ ~$200k

Using time of the cycles & the fact that we expect the cycles to get longer. We can extrapolate with the 2.272 fib target, the log curve 🟥 zone, pitchfork channeling and simple time expansion, that the top will be:

🔥Q2/3 2022 @ ~$200k

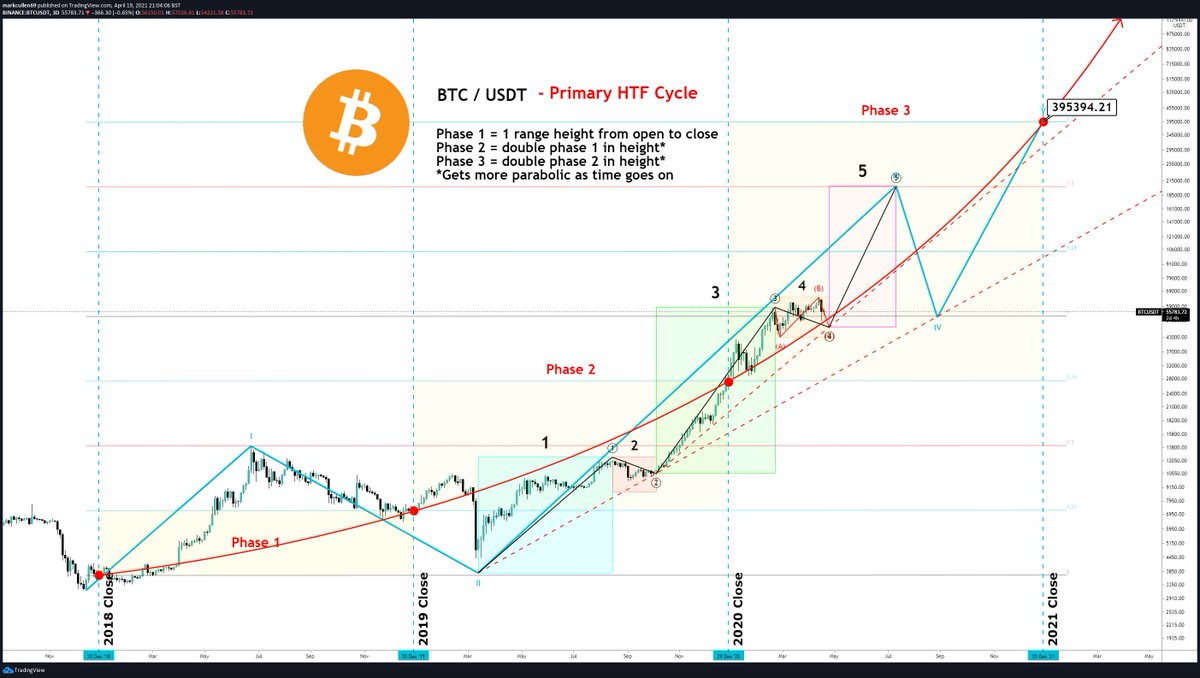

-- 7/ When to Buy back in?

The next 🐻 bottom can also be extrapolated in a similar fashion, using the 1.618 fib level, which happens to also coincide with Support, and time in relation to previous bottoming structures.

Bear market bottom at the end of Q2/3 2023 @ at

~60K

The next 🐻 bottom can also be extrapolated in a similar fashion, using the 1.618 fib level, which happens to also coincide with Support, and time in relation to previous bottoming structures.

Bear market bottom at the end of Q2/3 2023 @ at

~60K

-- 8/ Conclusion --

🔹IMHO i think we still have a while to go before #Bitcoin tops out

🔹None of the measures or indicators are saying we have a top

🔹That said i don't think we go in a straight line, so there will be swings on the way

Please RT & Like if this was useful.

🔹IMHO i think we still have a while to go before #Bitcoin tops out

🔹None of the measures or indicators are saying we have a top

🔹That said i don't think we go in a straight line, so there will be swings on the way

Please RT & Like if this was useful.

• • •

Missing some Tweet in this thread? You can try to

force a refresh