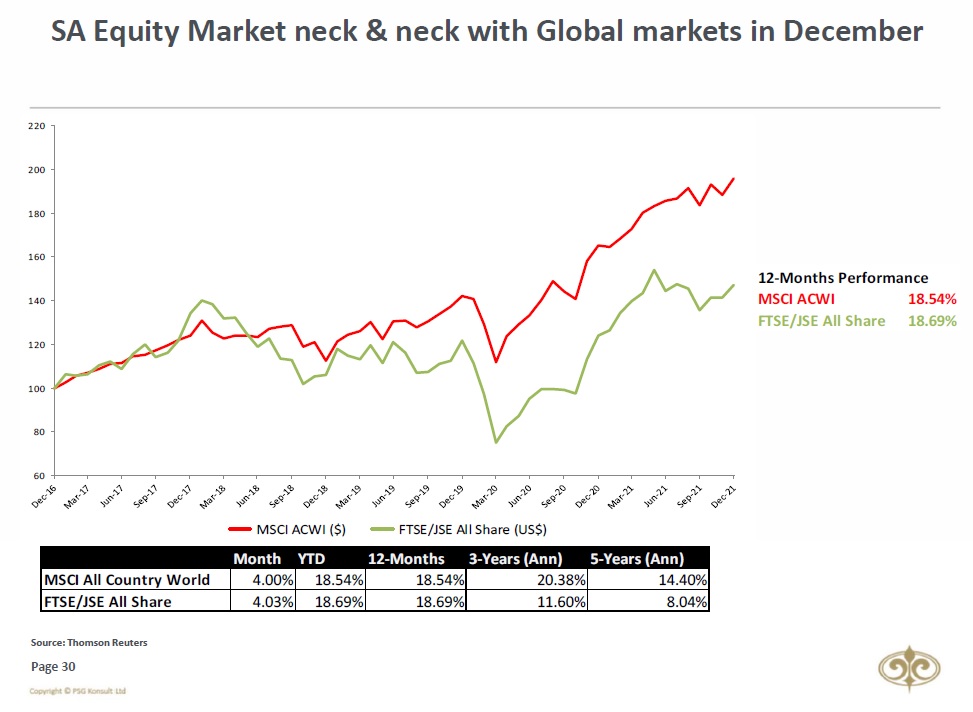

UPDATE ON MARKETS: Happy New Year, everyone. The South African market ended 2021 with its best performance in 12 years. FTSE/JSE All Share increased by 4.8% during December, SA Property stocks increased by 7.88% in December, while SA All Bond Index improved 2.69% for the period.

2/10

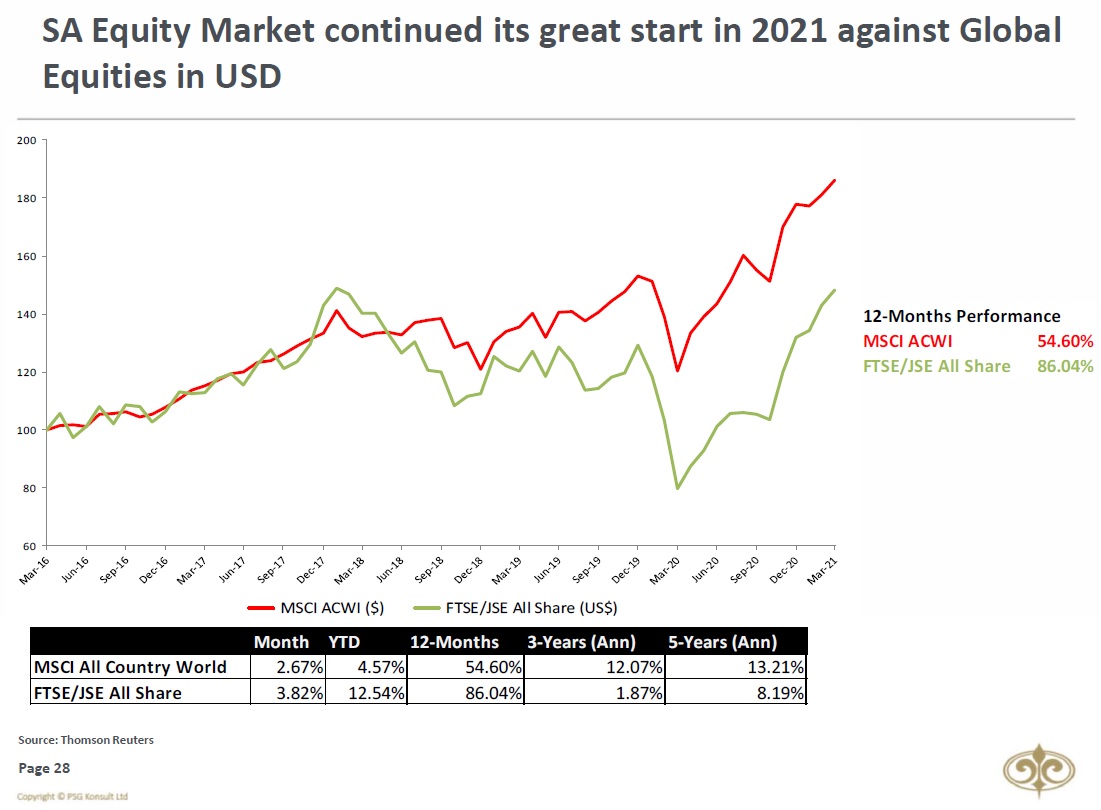

FTSE/ JSE All Share (+4.03%) in USD, performed in line with MSCI All Country World Index (+4.00%), while MSCI Emerging Markets Index (+1.88%) again lagged both these indices. The 12-month performance for JSE in USD terms was also in line with the MSCI ACWI’s performance.

FTSE/ JSE All Share (+4.03%) in USD, performed in line with MSCI All Country World Index (+4.00%), while MSCI Emerging Markets Index (+1.88%) again lagged both these indices. The 12-month performance for JSE in USD terms was also in line with the MSCI ACWI’s performance.

3/10

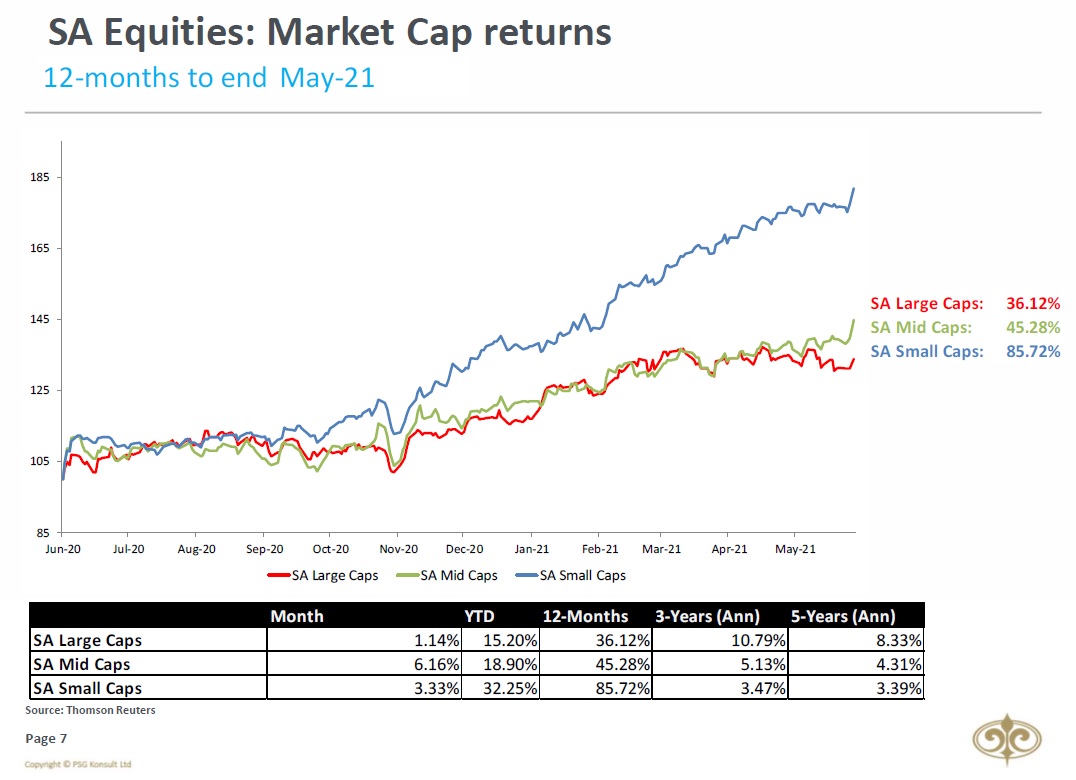

South African Small-Caps again dominated during December, improving by 7.33%. Both Large- and Mid-Caps also enjoyed solid returns over the same period with increase of 4.8% and 4.3%, irrespectively.

South African Small-Caps again dominated during December, improving by 7.33%. Both Large- and Mid-Caps also enjoyed solid returns over the same period with increase of 4.8% and 4.3%, irrespectively.

4/10

Foreigners were net sellers of both South African Equities and Bonds in December. Foreigners were now net sellers of SA Equities for nine months in a row.

Foreigners were net sellers of both South African Equities and Bonds in December. Foreigners were now net sellers of SA Equities for nine months in a row.

5/10

From a sectoral point of view, December saw Financials enjoyed a massive comeback from its poor November performances. Local Banks were the biggest winners in terms of attribution (compared to Capped Swix) during December.

From a sectoral point of view, December saw Financials enjoyed a massive comeback from its poor November performances. Local Banks were the biggest winners in terms of attribution (compared to Capped Swix) during December.

6/10

Rand again retraced (-0.72%) against USD in December & 2.43% against the British Pound. This is quite disappointing, as South African Rand went from the best performing currency (against the USD) midyear 2021 to the worst-performing BRICS currency for the full year 2021.

Rand again retraced (-0.72%) against USD in December & 2.43% against the British Pound. This is quite disappointing, as South African Rand went from the best performing currency (against the USD) midyear 2021 to the worst-performing BRICS currency for the full year 2021.

8/10

The US Dollar Index tested its 50-day Moving Average during December. A break and close below this level (95.57) could see the next resistance level at the 200-day moving average at 93.

The US Dollar Index tested its 50-day Moving Average during December. A break and close below this level (95.57) could see the next resistance level at the 200-day moving average at 93.

9/10

What a MASSIVE recovery for most commodities during December! Brent Oil increased 12.8%, while Palladium increased by 9.11% for December.

What a MASSIVE recovery for most commodities during December! Brent Oil increased 12.8%, while Palladium increased by 9.11% for December.

10/10 & Final

Should consensus (Refinitiv Eikon) be 100% correct in target prices, the JSE could still grow 12.5% from current levels.

Should consensus (Refinitiv Eikon) be 100% correct in target prices, the JSE could still grow 12.5% from current levels.

Unroll @threadreaderapp

• • •

Missing some Tweet in this thread? You can try to

force a refresh