🐻♉️↗️↘️↔️⚠️🚩🔺🔻🧮

Global Macro Review 03/27/22

1/8

Nothing but #Quad3 #stagflation

as far as the 👁🗨 can 👀

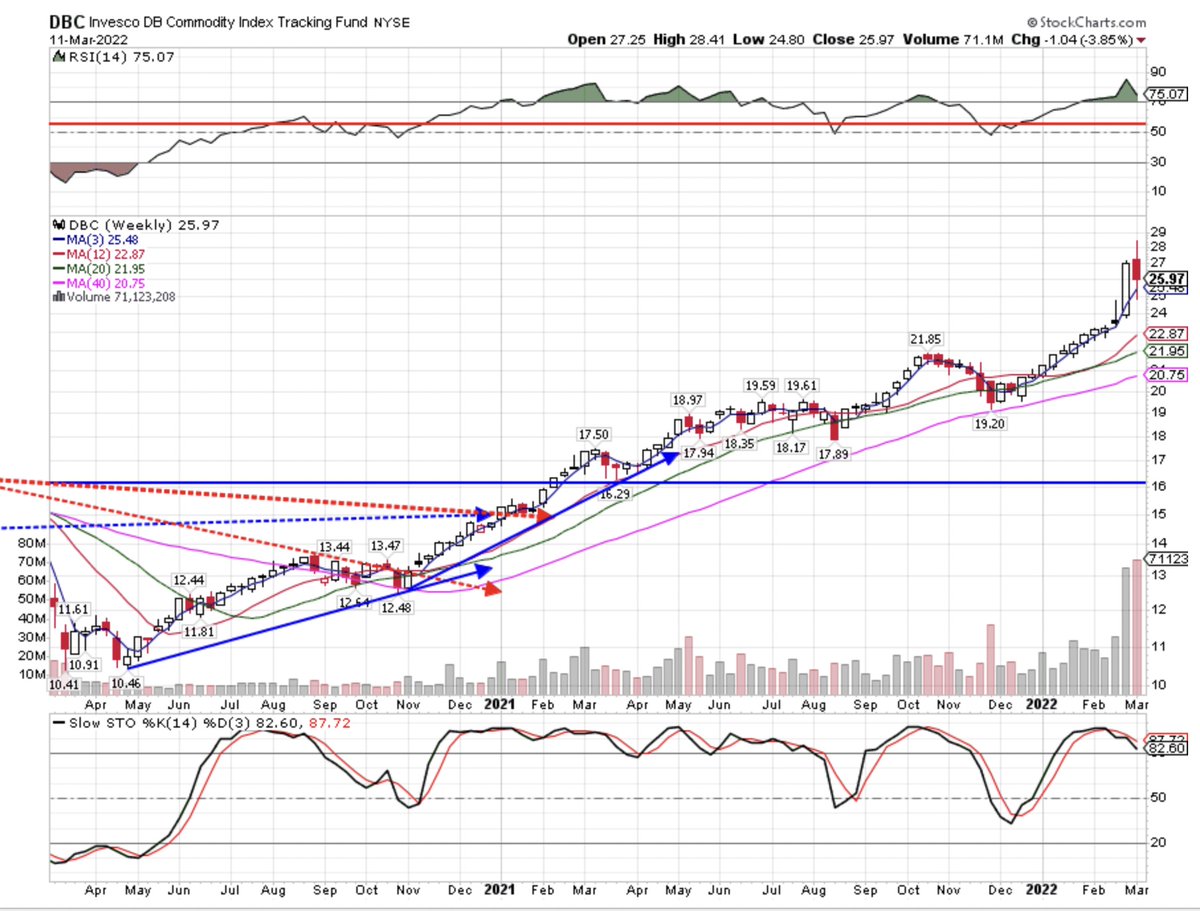

Commodities ↗️

Yields ↗️

Equities ↗️

Let’s dig into the 🧮!

Global Macro Review 03/27/22

1/8

Nothing but #Quad3 #stagflation

as far as the 👁🗨 can 👀

Commodities ↗️

Yields ↗️

Equities ↗️

Let’s dig into the 🧮!

2/8

The 🔑 to ↘️ prices is ↗️ prices?

Chart: The $CRB closed at a new cycle high 307.33 +5.16% and is now within striking distance of the June 2014 🔝

The 🔑 to ↘️ prices is ↗️ prices?

Chart: The $CRB closed at a new cycle high 307.33 +5.16% and is now within striking distance of the June 2014 🔝

2a/8

Hydrocarbons put in another shift this week 🚀

(w) = week (T) = Trend = 3 months

$BRENT +8.75% (w) +53.05% (T)

$GASO +7.15% (w) +56.35% (T)

$NATGAS + 15.45% (w) +54.55% (T) ⬅️

$WTIC +10.5% (W) +54.35% (T)

Chart: Uncle Joe is going to bottle up Natty and sell it to the EU

Hydrocarbons put in another shift this week 🚀

(w) = week (T) = Trend = 3 months

$BRENT +8.75% (w) +53.05% (T)

$GASO +7.15% (w) +56.35% (T)

$NATGAS + 15.45% (w) +54.55% (T) ⬅️

$WTIC +10.5% (W) +54.35% (T)

Chart: Uncle Joe is going to bottle up Natty and sell it to the EU

2b/8

Grains were also ↗️ on the week

$CORN +1.65% (w) +24.45% (T)

$SOYB +2.55% (w) +27.5% (T)

$SUGAR +3.6% (w) +2.14% (T) 🆕 ♉️

$WHEAT +4.55% (w) +34.1% (T)

Chart: $SUGAR +9.0% over (t) = trade duration = 1 month and now ♉️ Trend

Grains were also ↗️ on the week

$CORN +1.65% (w) +24.45% (T)

$SOYB +2.55% (w) +27.5% (T)

$SUGAR +3.6% (w) +2.14% (T) 🆕 ♉️

$WHEAT +4.55% (w) +34.1% (T)

Chart: $SUGAR +9.0% over (t) = trade duration = 1 month and now ♉️ Trend

2c/8

But not everything is ♉️ in the ag space

I will take my ☕️ black, please

Chart: $COFFEE +0.9% (w), -7.1% (t), -3.95% (T), but is that a 😄 I see?

But not everything is ♉️ in the ag space

I will take my ☕️ black, please

Chart: $COFFEE +0.9% (w), -7.1% (t), -3.95% (T), but is that a 😄 I see?

2d/8

Metals were more of a ↔️ 💼 this week

$PLAT -2.65% (w) +3.45% (T)

$COPPER -0.85% (w) +7.05% (T)

$GOLD +1.3% (w) +7.85% (T)

$SILVER +2.07% (w) +11.65% (T)

Chart: $DBB +5.8% (w) industrial metals remain bid ↗️ +17.25% (T) but on weakening volume

Metals were more of a ↔️ 💼 this week

$PLAT -2.65% (w) +3.45% (T)

$COPPER -0.85% (w) +7.05% (T)

$GOLD +1.3% (w) +7.85% (T)

$SILVER +2.07% (w) +11.65% (T)

Chart: $DBB +5.8% (w) industrial metals remain bid ↗️ +17.25% (T) but on weakening volume

2e/8

And, of course, we have to mention $LUMBER which has broken bad - not surprising given the 🚀 in rates and the effect on housing.

Chart: $LUMBER -17.05% (t), -16.5% (T)

And, of course, we have to mention $LUMBER which has broken bad - not surprising given the 🚀 in rates and the effect on housing.

Chart: $LUMBER -17.05% (t), -16.5% (T)

3/8

10Y treasury yields around 🌍 💥 ↗️

This is not normally indicative of growth slowing… but it could just be the markets doing CBs jobs as investors demand +yield given sticky #inflation

Chart: UST 10Y 2.48% 🇺🇸

10Y treasury yields around 🌍 💥 ↗️

This is not normally indicative of growth slowing… but it could just be the markets doing CBs jobs as investors demand +yield given sticky #inflation

Chart: UST 10Y 2.48% 🇺🇸

3d/8

The belly of the curve is threatening the long-end with #inversion raising the specter 👀 of #recession 12-18 months hence

5Y 2.561% +41.5 BPS this week alone 😮

30Y 2.602% +18.1 BPS

Chart: 30/5s 4.1 BPS dropped 23.5 BPS this week, a massive move ↘️

The belly of the curve is threatening the long-end with #inversion raising the specter 👀 of #recession 12-18 months hence

5Y 2.561% +41.5 BPS this week alone 😮

30Y 2.602% +18.1 BPS

Chart: 30/5s 4.1 BPS dropped 23.5 BPS this week, a massive move ↘️

4/8

Bond ETFs and 60/40 portfolios have been 💥

$TLT -3.6% (w) -13.35% (T)

$IEF -2.75% (w) -8.0% (T)

$LQD -2.1% (w) -10.1% (T)

$HYG -1.45% (w) -6.7% (T)

$BNDD -0.65% (w) - 4.63% (T)

$CWB +0.75% (w) -8.1% (T) ⬅️

Chart: $LQD -4.45% this month alone

Bond ETFs and 60/40 portfolios have been 💥

$TLT -3.6% (w) -13.35% (T)

$IEF -2.75% (w) -8.0% (T)

$LQD -2.1% (w) -10.1% (T)

$HYG -1.45% (w) -6.7% (T)

$BNDD -0.65% (w) - 4.63% (T)

$CWB +0.75% (w) -8.1% (T) ⬅️

Chart: $LQD -4.45% this month alone

5/8

Turning to equities … 🇺🇸

$SPX +1.8% (w) - 3.85% (T)

$COMPQ +2.0% (w) - 9.5% (T)

$IWM +1.4% (w) - 7.15% (T)

… as vol ↘️

$VIX 20.81 -3.06 pts

$VXN 27.34 -0.42 pts

$RVX 26.77 -3.0 pts

Chart: $COMPQ +3.45% (t), but still 🐻 (T)

Turning to equities … 🇺🇸

$SPX +1.8% (w) - 3.85% (T)

$COMPQ +2.0% (w) - 9.5% (T)

$IWM +1.4% (w) - 7.15% (T)

… as vol ↘️

$VIX 20.81 -3.06 pts

$VXN 27.34 -0.42 pts

$RVX 26.77 -3.0 pts

Chart: $COMPQ +3.45% (t), but still 🐻 (T)

5a/8

US Sectors

Alpha generators

$XLE +6.6% (w) + 43.45% (T)

$XLB +3.7% (w) +1.1% (T)

$XLU +2.8% (w) +5.9% (T)

Hurting returns long side

$XLV -0.55% (w) - 2.2% (T)

$XLRE -0.2% (w) - 5.6% (T)

$XLY +0.8% (w) - 9.75% (T)

Chart: $XLU +7.7% (t) is getting you 💰 this month

US Sectors

Alpha generators

$XLE +6.6% (w) + 43.45% (T)

$XLB +3.7% (w) +1.1% (T)

$XLU +2.8% (w) +5.9% (T)

Hurting returns long side

$XLV -0.55% (w) - 2.2% (T)

$XLRE -0.2% (w) - 5.6% (T)

$XLY +0.8% (w) - 9.75% (T)

Chart: $XLU +7.7% (t) is getting you 💰 this month

5c/8

Short some! 🩳

Chart: A #quad4 long, $XHB 🏠 -8.8% (w) -5.35% (t) -6.4% (T) is getting decimated by ↗️ mortgage rates with 30-year fixed at 4.54%

Short some! 🩳

Chart: A #quad4 long, $XHB 🏠 -8.8% (w) -5.35% (t) -6.4% (T) is getting decimated by ↗️ mortgage rates with 30-year fixed at 4.54%

6/8

Internat’l indices more of a ↔️ 💼

$NIKK +4.95% (w) - 2.2% (T)

$KOSPI +0.85% (w) - 8.95% (T)

$HSI -0.05% (w) - 7.7% (T)

$DAX -0.75% (w) - 9.2% (T)

$CAC -1.0% (w) - 7.75% (T)

$SSEC -1.2% (w) - 11.85% (T)

Chart: $NIKK 🇯🇵 - the best performing index over (t) duration +6.32%

Internat’l indices more of a ↔️ 💼

$NIKK +4.95% (w) - 2.2% (T)

$KOSPI +0.85% (w) - 8.95% (T)

$HSI -0.05% (w) - 7.7% (T)

$DAX -0.75% (w) - 9.2% (T)

$CAC -1.0% (w) - 7.75% (T)

$SSEC -1.2% (w) - 11.85% (T)

Chart: $NIKK 🇯🇵 - the best performing index over (t) duration +6.32%

6a/8

Resource rich countries getting you 💰

$EWZ +8.75% (w) +35.8% (T)

$EWA +3.15% (w) +6.0% (T)

$EWC +2.05% (w) +6.95% (T)

$EWW +1.9% (w) +7.75% (T)

Chart: $EWW 🇲🇽 Jarabe Tapatio 💃🏽 +7.0% (t) ♉️

Resource rich countries getting you 💰

$EWZ +8.75% (w) +35.8% (T)

$EWA +3.15% (w) +6.0% (T)

$EWC +2.05% (w) +6.95% (T)

$EWW +1.9% (w) +7.75% (T)

Chart: $EWW 🇲🇽 Jarabe Tapatio 💃🏽 +7.0% (t) ♉️

7/8

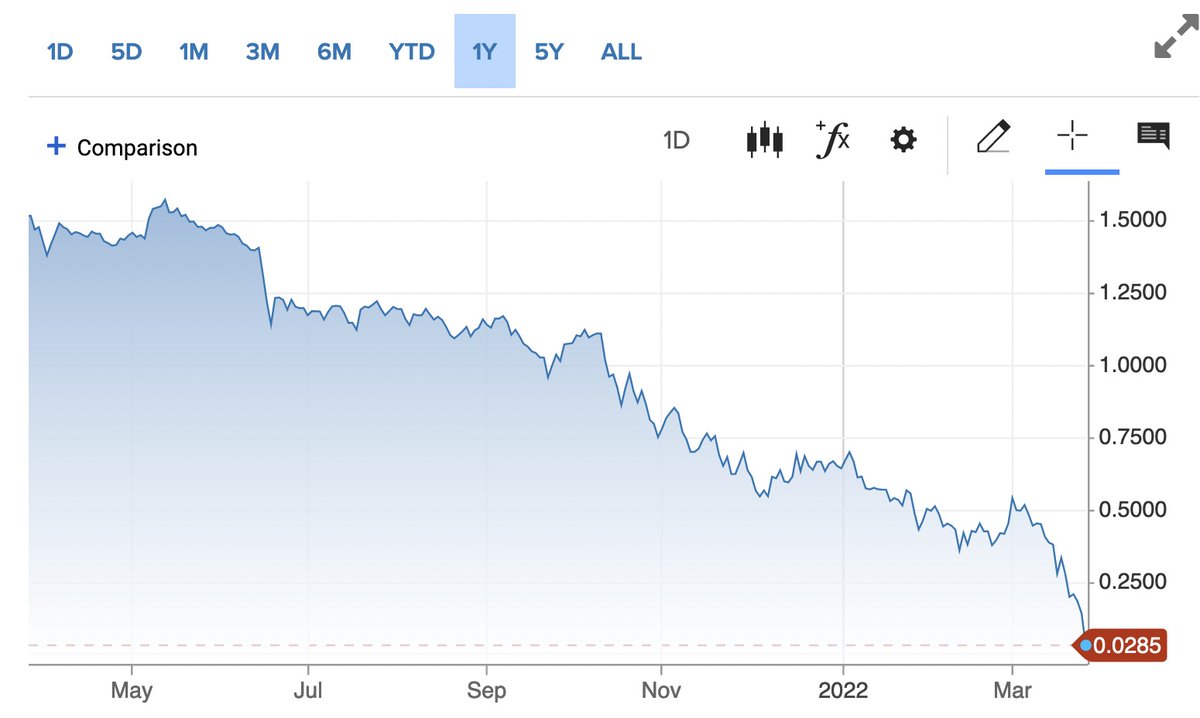

In #FX, the 💴 continues to get 🔥

$FXY -2.4% (w) -6.35% (T) 🐻

$FXE -0.65% (w) -3.35% (T)

$FXB +0.02% (w) -1.8% (T)

$FXF +0.15% (w) -1.6% (T)

$UUP +0.6% (w) +2.65% (T)

$FXC +1.0% (w) + 2.65% (T)

$FXA +1.47% (w) +3.68% (T) ♉️

Chart: $FXA +3.97% over (t) duration 🦘🦘♉️

In #FX, the 💴 continues to get 🔥

$FXY -2.4% (w) -6.35% (T) 🐻

$FXE -0.65% (w) -3.35% (T)

$FXB +0.02% (w) -1.8% (T)

$FXF +0.15% (w) -1.6% (T)

$UUP +0.6% (w) +2.65% (T)

$FXC +1.0% (w) + 2.65% (T)

$FXA +1.47% (w) +3.68% (T) ♉️

Chart: $FXA +3.97% over (t) duration 🦘🦘♉️

8/8

Bond market vigilantes doing #CB work, but yields not ↗️ enough to attract 💰 from $SPX or $CRB

Quarterly #opex on 3/31 + ‘month-end markup’ + systematic rebalancing = possible 🌊

Stick with 📈 and have a super profitable 💰 week!

Bond market vigilantes doing #CB work, but yields not ↗️ enough to attract 💰 from $SPX or $CRB

Quarterly #opex on 3/31 + ‘month-end markup’ + systematic rebalancing = possible 🌊

Stick with 📈 and have a super profitable 💰 week!

• • •

Missing some Tweet in this thread? You can try to

force a refresh