🇺🇸 #Fed (1) | As I expected ⬇, the Fed is on track to tighten its policy quickly and strongly for economic and political reasons.

christophe-barraud.com/why-is-the-fed…

christophe-barraud.com/why-is-the-fed…

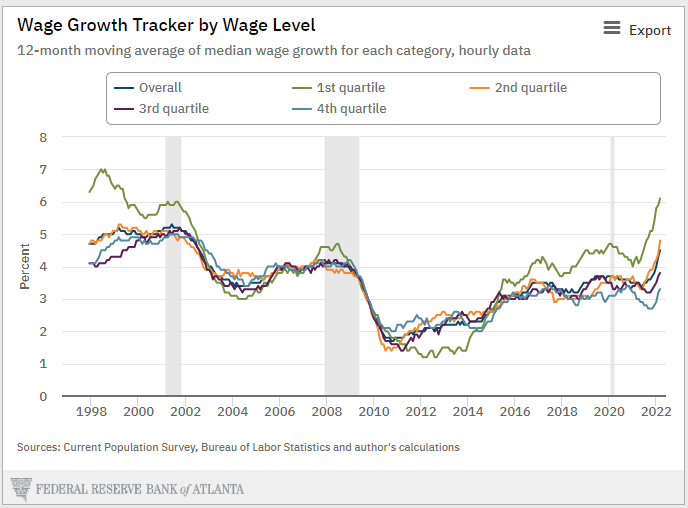

🇺🇸 #Fed (2) | On the economic front, Inflation is well above target and the risk of a wage/price spiral for low-income families has become real.

🇺🇸 #Fed (3) | Given that the labor market also looks tighter than indicated by the U.R., the Fed can easily justify a tightening move.

https://twitter.com/C_Barraud/status/1517128839570329601

🇺🇸 #Fed (4) | However, there is a risk that the Fed could be more aggressive than needed in the short term due to political reasons. #Inflation has become the main concern of households and mainly explains why #Biden approval recently fell to a new low.

cnbc.com/2022/04/13/bid…

cnbc.com/2022/04/13/bid…

🇺🇸 #Fed (5) | As I repeated several times, Biden advisors and economists have never been able to understand inflation dynamic, completely missing the spike of rents and its impact on inflation, the consequence of Covid-19 and ongoing supply chain disruptions.

🇺🇸 #Fed (6) | Instead of acting sooner and implementing a fine-tuning monetary policy, they are too late and look ready to put all in on tightening measures without thinking it could plunge the economy into #recession.

🇺🇸 #Fed (7) | My guess is that they could raise rates by 50bps in May and at least 50bps in June and July. I wouldn’t be surprised if they try to test 75bps from June depending on financial conditions.

https://twitter.com/C_Barraud/status/1517361021001863177

🇺🇸 #Fed (8) | Focusing on the balance sheet, a $95B monthly reduction would potentially result in selling MBS which could have significant implications on mortgage rates. The latter already bounced a lot in a very short period.

https://twitter.com/C_Barraud/status/1513866198508843020

🇺🇸 #Fed (9) | Therefore, the Fed will tighten sharply its policy after #inflation peaked, which would probably result in a quick deceleration. Then, I won’t be surprised if it makes a pause just before midterms after realizing the economy is probably in recession.

• • •

Missing some Tweet in this thread? You can try to

force a refresh