1/16 Lots of noise on oil again at the moment.

Who wins the race between peak/falling oil consumption and supply constraints?

#oil

#XLE

Who wins the race between peak/falling oil consumption and supply constraints?

#oil

#XLE

2/16 I seek out information which does not confirm my thesis that oil consumption is peaking for good.

I listened to J Young on @JackFarley96 podcast this morning. The relevant part I disagree with is at 8:29 min "oil demand continues to grow at 1% annually".

I listened to J Young on @JackFarley96 podcast this morning. The relevant part I disagree with is at 8:29 min "oil demand continues to grow at 1% annually".

3/16 I am not trying to pick on one particular investor. There are others.

Below is past global oil consumption data and current forecast for 2022 by eia.gov . The data includes the downward revision in March by 1 mil barrel by the EIA. Data via @GregorMacdonald

Below is past global oil consumption data and current forecast for 2022 by eia.gov . The data includes the downward revision in March by 1 mil barrel by the EIA. Data via @GregorMacdonald

4/16 In the current environment of China lock downs, recession risk in US & Europe & continued elevated oil prices (demand destruction) I put my money on more downward revisions to come. That will put 2022 consumption under 2018. No growth in 4 years (2018-19 pre COVID years).

5/16 The argument continues that oil demand is not elastic and demand destruction limited.

I have written about the importance of transport and the proliferation of EV's for oil consumption before.

I have written about the importance of transport and the proliferation of EV's for oil consumption before.

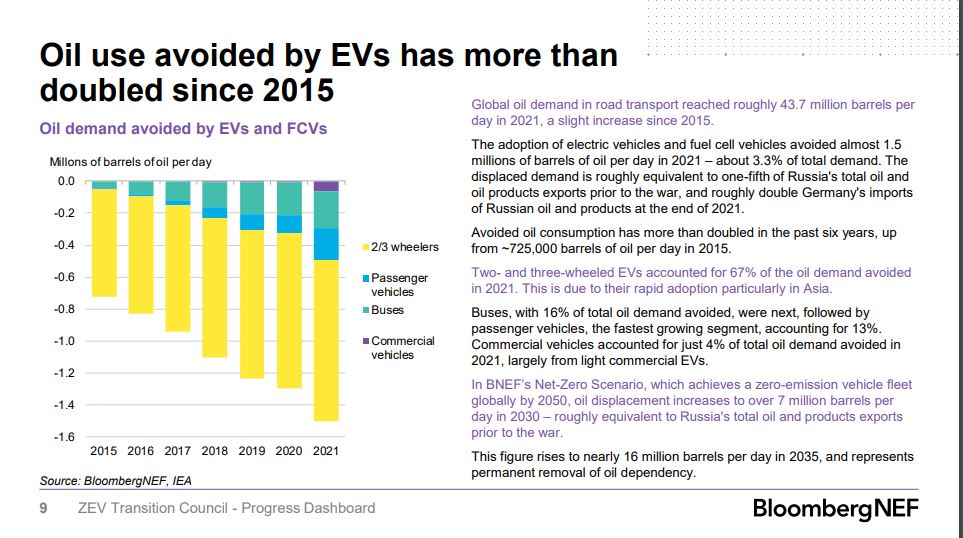

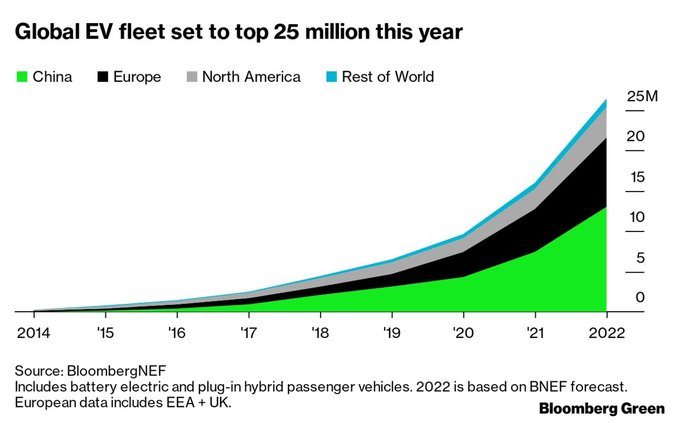

6/16 Bloomberg has recently added similar calculations. @colinmckerrache tweeted that the proliferation of electric 2 wheelers, buses, cars avoided approx 1.5 mil barrels of oil consumption per day in 2021 or 3.3% of oil demand in road transport.

7/16 One mil EV's avoid around 40k barrel of oil consumption per day. See my twitter thread dated March 31st for an explanation of the numbers.

8/16 We should easily see another 10 mil EV sales in 2022 avoiding another 400k barrels of oil consumption per day. Add in more 2 wheelers, buses and commercial vehicles and that number will be even higher.

9/16 It is also instructive to look at the breakdown in oil consumption between the OECD and the rest of the world. OECD consumption has been plateauing for years and is well below the 2007 peaks. No growth for 15 years.

11/16 I have written about the China car market before. We are not too far away from a tipping point for transportation driven oil demand in China to start falling.

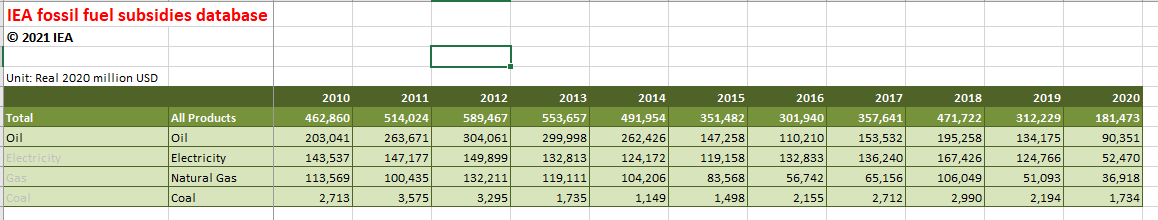

12/16 Lower fuel subsidies in Emerging market countries are another leg to the story of demand destruction. The IEA has a good dataset describing how much fuel subsidies have fallen between 2010 and 2020. They have more than halved! iea.org/data-and-stati…

13/16 The longer term bullish oil thesis comes down to this:

You disagree with the data that oil consumption is peaking.

I don't.

You disagree with the data that oil consumption is peaking.

I don't.

14/16 You believe that oil production is decreasing as oil fields are depleting and OPEC has no spare capacity.

I don't know but OPEC has not exactly been a beacon of accuracy in the past. finance.yahoo.com/news/saudi-ara…

I don't know but OPEC has not exactly been a beacon of accuracy in the past. finance.yahoo.com/news/saudi-ara…

15/16 You believe that geopolitical events will get further out of hand and more supply issues develop.

I don't know.

I don't know.

16/16 In summary it comes down to which trend is stronger & lasting. The fall in global oil consumption or fall in production/availability.

However you are operating in a market where there is no growth anymore. Not great for strategic investments in my opinion. Tactical only.

However you are operating in a market where there is no growth anymore. Not great for strategic investments in my opinion. Tactical only.

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh