USDC- safe alternative to USDT. Most people think so.

Wait, there's more. I believe #USDC is the McDonald's of #stablecoins.

My thesis on why USDC is a sleeping giant, risk assessment, and possible alphas.

This is part 3 of the #stablecoinwar series. Let's dive in. 🧶 1/n

Wait, there's more. I believe #USDC is the McDonald's of #stablecoins.

My thesis on why USDC is a sleeping giant, risk assessment, and possible alphas.

This is part 3 of the #stablecoinwar series. Let's dive in. 🧶 1/n

I'm going to get to what I mean by McDonald's of stablecoins. Ngl, I was blown away while reading @centre_io's whitepaper.

So let us run through how #USDC works, and I'll tell you about Centre's audacious vision. 2/n

So let us run through how #USDC works, and I'll tell you about Centre's audacious vision. 2/n

@centre_io Similar to #USDT, USDC is a fiat-backed stablecoin. I've gone through the 3C framework and USDT in previous threads, so I won't go into detail here. (No worries, I'll link them at the end of this thread.)

Remember how USDT is backed by a confusing list of financial assets? 3/n

Remember how USDT is backed by a confusing list of financial assets? 3/n

@centre_io USDC is much simpler.

Currently, USDC has about 24% of its assets in USD, with the remaining in short-term US Treasuries.

Yep, that's it! Really simple and transparent, which is why sentiment is generally shifting towards USDC from USDT.

Time to discuss USDC ecosystem. 4/n

Currently, USDC has about 24% of its assets in USD, with the remaining in short-term US Treasuries.

Yep, that's it! Really simple and transparent, which is why sentiment is generally shifting towards USDC from USDT.

Time to discuss USDC ecosystem. 4/n

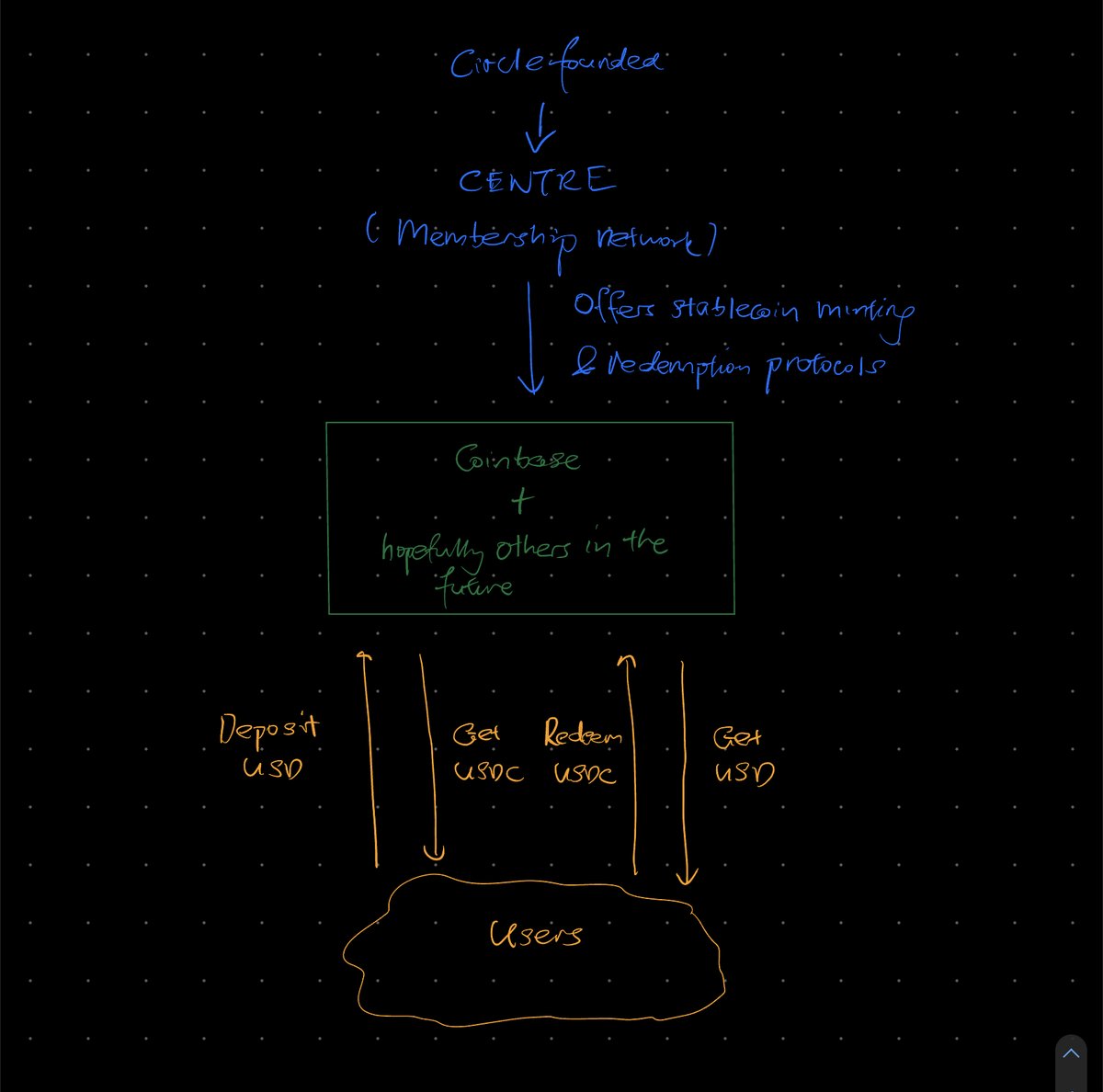

@centre_io .@centre_io is an association that manages the open-source smart contracts for USDC. It is founded by @circlepay, while @coinbase is the key figure in minting and issuing USDC.

This is a little confusing, so we got to invoke our favorite McDonald's. 5/n

This is a little confusing, so we got to invoke our favorite McDonald's. 5/n

@centre_io @circlepay @coinbase As you know, Ray Kroc was the legendary figure who franchised McDonald's. Anyone who was then interested in setting up a fast-food restaurant can do so without the hassle of creating their own menu/brand.

So, what's the link to #USDC? 6/n

So, what's the link to #USDC? 6/n

@centre_io @circlepay @coinbase Simple,

@centre_io = Ray Kroc

USDC smart contracts = McDonald's menu/brand

Instead of minting and issuing stablecoins themselves, Centre approves and audits issuers, while providing them with the technology (smart contract) to issue their own stablecoins.

There's more. 7/n

@centre_io = Ray Kroc

USDC smart contracts = McDonald's menu/brand

Instead of minting and issuing stablecoins themselves, Centre approves and audits issuers, while providing them with the technology (smart contract) to issue their own stablecoins.

There's more. 7/n

@centre_io @circlepay @coinbase This franchise model allows @centre_io to be the McDonald's of #stablecoins- distributed and global, but preserves local variance.

All 3 properties allow it to fulfill its vision of turning money as another native form of internet content.

How does this change things? 8/n

All 3 properties allow it to fulfill its vision of turning money as another native form of internet content.

How does this change things? 8/n

@centre_io @circlepay @coinbase When you send emails, you don't care about your recipient's location and service provider.

Stablecoins like USDT and USDC already achieve this to an extent. You can send them to anyone with an internet connection.

But 95% of the world are not in the US. 9/n

Stablecoins like USDT and USDC already achieve this to an extent. You can send them to anyone with an internet connection.

But 95% of the world are not in the US. 9/n

@centre_io @circlepay @coinbase When you consider how the most dominant stablecoin provider, @Tether_to, is a single entity, you realise that most of the world will get neglected.

They simply do not have the bandwidth/expertise for smaller local currencies.

This is where the franchise model comes in. 10/n

They simply do not have the bandwidth/expertise for smaller local currencies.

This is where the franchise model comes in. 10/n

@centre_io @circlepay @coinbase @Tether_to @centre_io and their protocols allow local providers, e.g. India's @Paytm, to register and issue Indian rupee stablecoin.

Another local provider, e.g. Vipps in Norway, can also register and issue Norwegian krone stablecoin.

This is where magic happens. 11/n

Another local provider, e.g. Vipps in Norway, can also register and issue Norwegian krone stablecoin.

This is where magic happens. 11/n

@centre_io @circlepay @coinbase @Tether_to @Paytm Instead of needing 2-5 business days for international wire transfer, consumers of @Paytm and Vipps can transfer money to each other using crypto technology. This means that money can be sent and received within minutes.

Money will become another form of internet content. 12/n

Money will become another form of internet content. 12/n

@centre_io @circlepay @coinbase @Tether_to @Paytm To be clear, this is @centre_io's vision, and @Paytm and Vipps are not using its stablecoins protocol.

But this is a hint of the future, and it is one much more ambitious than @Tether_to's.

Let's review what we've learnt thus far. 13/n

But this is a hint of the future, and it is one much more ambitious than @Tether_to's.

Let's review what we've learnt thus far. 13/n

@centre_io @circlepay @coinbase @Tether_to @Paytm @circlepay creates @centre_io, which provides stablecoins protocols and approves/audits interested issuers. Each respective issuer will facilitate USDC mint and USD redemption.

The green box is the area with huge unlocked potential. 14/n

The green box is the area with huge unlocked potential. 14/n

@centre_io @circlepay @coinbase @Tether_to @Paytm In the next few years, you may see your local fintech firm issuing stablecoins, and you enjoying the ease of truly global commerce.

So, is USDC risky? Will it actually depeg and never recover?

Time to assess its risk profile. 15/n

So, is USDC risky? Will it actually depeg and never recover?

Time to assess its risk profile. 15/n

@centre_io @circlepay @coinbase @Tether_to @Paytm As mentioned earlier, USDC is backed by 2 assets- cash (~24%) and short-term US treasuries (~76%). They are also independently audited monthly.

The bigger risk lies in short-term US treasuries. 16/n

The bigger risk lies in short-term US treasuries. 16/n

@centre_io @circlepay @coinbase @Tether_to @Paytm Short-term US treasuries are essentially a loan to the US government for a maximum of 52 weeks. In return, the US govt will pay you some interest when the bill matures.

There is a possible problem with our current macro-environment. 17/n

There is a possible problem with our current macro-environment. 17/n

@centre_io @circlepay @coinbase @Tether_to @Paytm To fight inflation, the Fed is raising interest rates. In other words, newer US treasuries will pay you a higher interest rate. Thus, the older bills that @circlepay currently owns will be less attractive.

What happens when everyone wants to redeem their USDC for USD? 18/n

What happens when everyone wants to redeem their USDC for USD? 18/n

@centre_io @circlepay @coinbase @Tether_to @Paytm @circlepay has to take out their cash to pay their customers. Once that is fully redeemed, they will have to sell their treasury bills in the secondary market. Because those bills are less attractive now, the sell price may be lower than the price they were bought at! 19/n

@centre_io @circlepay @coinbase @Tether_to @Paytm If that happens, @circlepay may be unable to pay all their customers in time. However, customers will still be able to redeem their USDC if they are willing to wait for the bills to mature.

Circle is also more than just USDC. 20/n

Circle is also more than just USDC. 20/n

@centre_io @circlepay @coinbase @Tether_to @Paytm It has other revenue sources, which means that they are likely to survive in the short-term if users abandon USDC.

For a fiat-backed stablecoin, USDC is one of the safest.

Alright, final part- some alphas for you! (Not financial advice though!) 21/n

coindesk.com/business/2021/…

For a fiat-backed stablecoin, USDC is one of the safest.

Alright, final part- some alphas for you! (Not financial advice though!) 21/n

coindesk.com/business/2021/…

@centre_io @circlepay @coinbase @Tether_to @Paytm Investing alpha:

If you believe that @centre_io's protocol will lead to a proliferation of other stablecoins, you'll be wise to look for wallets that provide an awesome UX and support #USDC.

If you're looking to build, here's an idea for you too! 22/n

If you believe that @centre_io's protocol will lead to a proliferation of other stablecoins, you'll be wise to look for wallets that provide an awesome UX and support #USDC.

If you're looking to build, here's an idea for you too! 22/n

@centre_io @circlepay @coinbase @Tether_to @Paytm Building alpha:

Offer personalised #stablecoin service to smaller markets that may be more neglected by traditional US firms- e.g. South East Asia cities.

This is happening in e-commerce, e.g. @ShopeeID beating @amazon in Indonesia. 23/n

Offer personalised #stablecoin service to smaller markets that may be more neglected by traditional US firms- e.g. South East Asia cities.

This is happening in e-commerce, e.g. @ShopeeID beating @amazon in Indonesia. 23/n

@centre_io @circlepay @coinbase @Tether_to @Paytm @ShopeeID @amazon This is it for today!

If you've enjoyed this thread, follow me @0x_armin for upcoming posts in #stablecoinwar series (@MakerDAO, @fraxfinance).

Like/Retweet the first tweet below to help your friends make better investments in this bear market: 24/end

If you've enjoyed this thread, follow me @0x_armin for upcoming posts in #stablecoinwar series (@MakerDAO, @fraxfinance).

Like/Retweet the first tweet below to help your friends make better investments in this bear market: 24/end

https://twitter.com/0x_armin/status/1535607794102964225

@centre_io @circlepay @coinbase @Tether_to @Paytm @ShopeeID @amazon @MakerDAO @fraxfinance Bonus readings (1/2):

Part 1 of the #stablecoinwar series.

Part 1 of the #stablecoinwar series.

https://twitter.com/0x_armin/status/1528708072872345600

@centre_io @circlepay @coinbase @Tether_to @Paytm @ShopeeID @amazon @MakerDAO @fraxfinance Sources (2/2):

Part 2 of the #stablecoinwar series.

Part 2 of the #stablecoinwar series.

https://twitter.com/0x_armin/status/1531244038396948480

Corrections (1/2):

@circlepay releases attestation, not audit reports for USDC. Thanks to @ItchyJack_ for highlighting this.

Not sure about the difference? Read this helpful response by @by_caballero

@circlepay releases attestation, not audit reports for USDC. Thanks to @ItchyJack_ for highlighting this.

Not sure about the difference? Read this helpful response by @by_caballero

https://twitter.com/by_caballero/status/1537035949246451714

Corrections (2/2):

@circlepay is the sole issuer of USDC, not @coinbase as wrongly written in the original thread. Thanks to @blockchnbison for pointing it out!

@circlepay is the sole issuer of USDC, not @coinbase as wrongly written in the original thread. Thanks to @blockchnbison for pointing it out!

https://twitter.com/blockchnbison/status/1538118546819059715

• • •

Missing some Tweet in this thread? You can try to

force a refresh