#CryptoBytes

What happened to @solendprotocol?

It is a decentralized lending platform on #Solana that has been facing community backlash after its recent actions that seem to go against the ethos of decentralization. A summary 🧵👇

#WebTr3e 🌳 #DeFi #Crypto #Solend

What happened to @solendprotocol?

It is a decentralized lending platform on #Solana that has been facing community backlash after its recent actions that seem to go against the ethos of decentralization. A summary 🧵👇

#WebTr3e 🌳 #DeFi #Crypto #Solend

Just 2-3 weeks ago, $BTC’s poor price action led to a massive sell-off in major altcoins such as $ETH and $SOL, which reached lows of $881.56 and $25.86, respectively. This also led to on-chain liquidations at the $1K-$1.1K level, according to @parsec_finance.

/1

/1

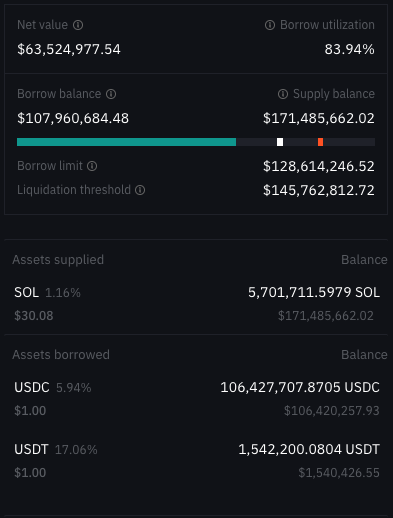

One prominent potential liquidation that stood out was a $108M $USDC debt on the #Solend platform where a user deposited 5.7M $SOL, worth $170M at the time, as collateral. The liquidation price of $22.27 was very close to the $SOL price then.

/2

/2

This alarmed the Solend team. 😦 Liquidation of this large user would pose liquidity issues and create bad debt. Many users withdrew their assets, causing $USDC and $USDT utilization in the Main Pool to spike to 100%.

/3

/3

This meant that depositors could not withdraw their assets, and positions collateralized by $USDC or $USDT could not be liquidated. The Solend team attempted to reach out to this user to reduce his position but to no avail. 👇

/4

https://twitter.com/0xrooter/status/1538030262721781761

/4

Solend thus created a community proposal, SLND1, for Solend Labs to have emergency power to temporarily take over the whale account and proceed with OTC liquidations to mitigate any fallouts if the price of $SOL continued to drop sharply.

/5

/5

According to the proposal, if $SOL’s price hits the whale’s liquidation level of $22.27, the account would be liquidated up to 20% of its borrows (~$36M). It would have been difficult for a DEX like Solend to absorb such a large impact.

/6

/6

The vote passed 6 hours after it was initiated, with 97.5% voting for the proposal. However, over 90% of the votes came from a single wallet. 👀

/7

/7

Unsurprisingly, this vote came with heavy backlash and mockery from the community, with several Twitter influencers such as @cobie calling Solend out for going against free-market principles and decentralization.

See tweet 👇

/8

See tweet 👇

https://twitter.com/cobie/status/1538529982804287488

/8

The criticisms prompted the Solend team to reevaluate and release another proposal, SLND2:

1️⃣Invalidate SLND1

2️⃣Increase governance time from 6 hours to 1 day

3️⃣Work on a new proposal that doesn’t involve control of an account

/9

1️⃣Invalidate SLND1

2️⃣Increase governance time from 6 hours to 1 day

3️⃣Work on a new proposal that doesn’t involve control of an account

/9

The vote passed with 99.8% of voters in favor of the proposal. Thankfully, $BTC also formed a local bottom, temporarily relieving liquidation fears as $SOL rebounded above $30. This gave the Solend team extra time to deal with the situation.

/10

/10

Just hours after SLND2 passed, the team initiated a new proposal, SLND3:

1️⃣Per-account borrow limit of $50M

2️⃣Temporarily reduce max liquidation close factor from 20% to 1%

3️⃣Temporarily reduce liquidation penalty to 2%

/11

1️⃣Per-account borrow limit of $50M

2️⃣Temporarily reduce max liquidation close factor from 20% to 1%

3️⃣Temporarily reduce liquidation penalty to 2%

/11

The latest Solend governance proposal, SLND3, has now passed with 99.7% of voters for the proposal.

See the proposals here 👇

realms.today/dao/7sf3tcWm58…

/12

See the proposals here 👇

realms.today/dao/7sf3tcWm58…

/12

On June 22, the team finally got in touch with the whale (3oSE...uRbE ) and he agreed to spread positions across different lending platforms. The user has shifted $35M of $USDC borrows from Solend to @mangomarkets, leaving $73M of $USDC debt on Solend.

/13

/13

As a result, $USDC utilization rate went down from 100% to 93%, allowing depositors to withdraw $USDC again. 😮💨 This may have relieved some strain on Solend, but the whale’s position is still susceptible to liquidations if prices go sufficiently low.

/14

/14

At the very least, it is commendable that the #Solend team responded to the backlash proactively and with transparency despite community doubts about its decentralization. 🙌

/15

/15

“Code is law”, but when the stability or fate of a project is hanging in the balance, operators must decide if they should override the ethos of #decentralization, or leave community pressure to reign.

/16

/16

This is not the first instance of poor governance decisions made by protocols. Ultimately, governance is meant to involve the #crypto community to protect token holders’ interests. However, malicious self-interest can threaten the principles and values that #DeFi stands for.

/17

/17

Liked this summary? Subscribe to our daily newsletter for updates on the market 👇

bit.ly/CanopyCollecti…

Retweet the first tweet to share! 🌳

bit.ly/CanopyCollecti…

Retweet the first tweet to share! 🌳

https://twitter.com/TreehouseFi/status/1540216636979806209

• • •

Missing some Tweet in this thread? You can try to

force a refresh