Most of the new #investor rely on free #stock tips or recommendation from social media or news channel.

There is nothing wrong in this unless you buy those stocks blindly.

These are some websites and sources that you can use to do due diligence of the stocks before investing?

There is nothing wrong in this unless you buy those stocks blindly.

These are some websites and sources that you can use to do due diligence of the stocks before investing?

1. Zerodha Varsity- Fundamental Analysis

Most of you won't have an Commerce or a CA background and this Fundamental Analysis Module is written in layman language which can be understood by all.

Moreover it will help in understanding basic terminology.

zerodha.com/varsity/module…

Most of you won't have an Commerce or a CA background and this Fundamental Analysis Module is written in layman language which can be understood by all.

Moreover it will help in understanding basic terminology.

zerodha.com/varsity/module…

Now there are some cool websites which can help you in analysis financials of the listed companies in India.

Let's go one by one and also see what are the benefits of using this.

Note: All the website are free and you don't have to pay anything.

Let's go one by one and also see what are the benefits of using this.

Note: All the website are free and you don't have to pay anything.

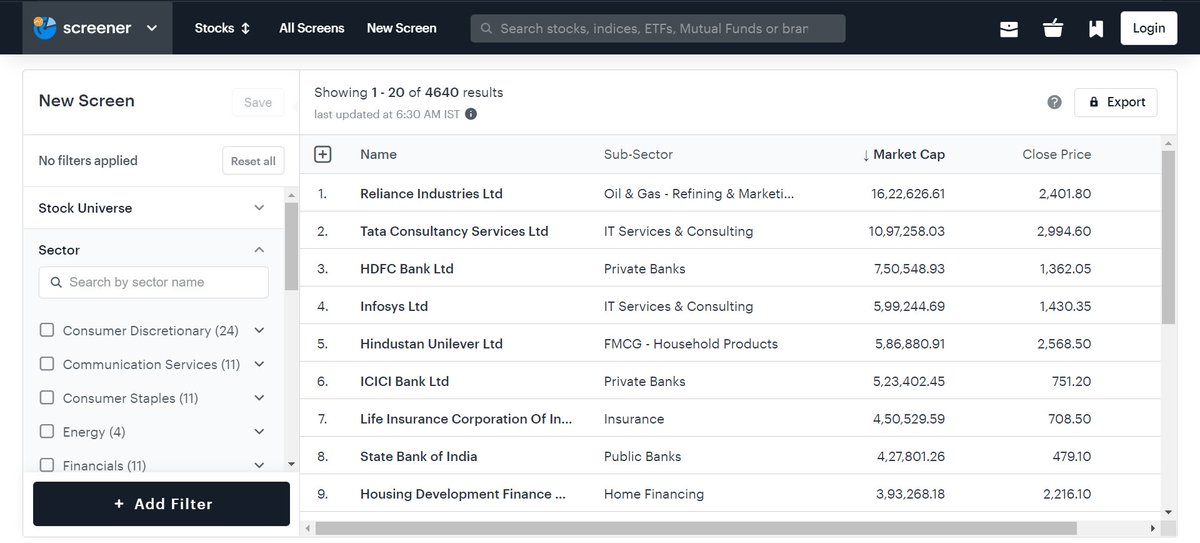

2. @screener_in

Website: screener.in

Uses:

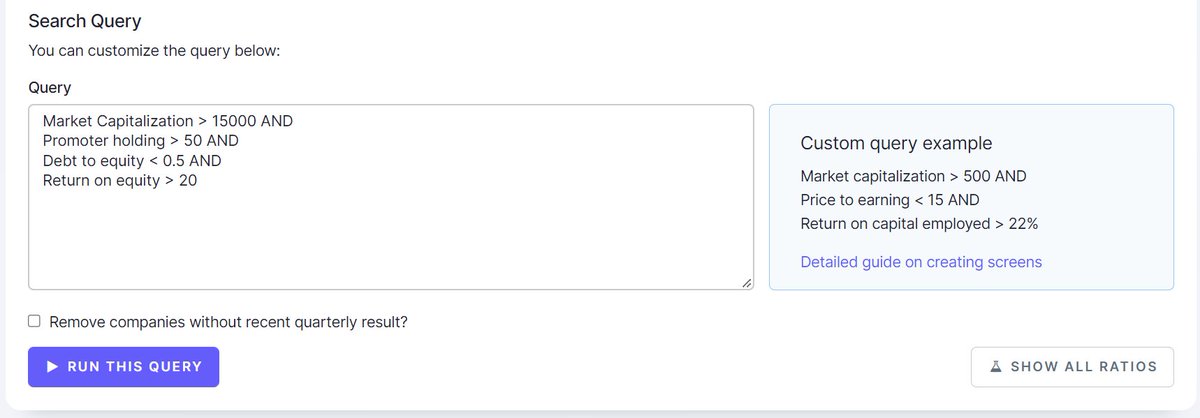

⚡️Creating your screener which can help in filtering the stocks

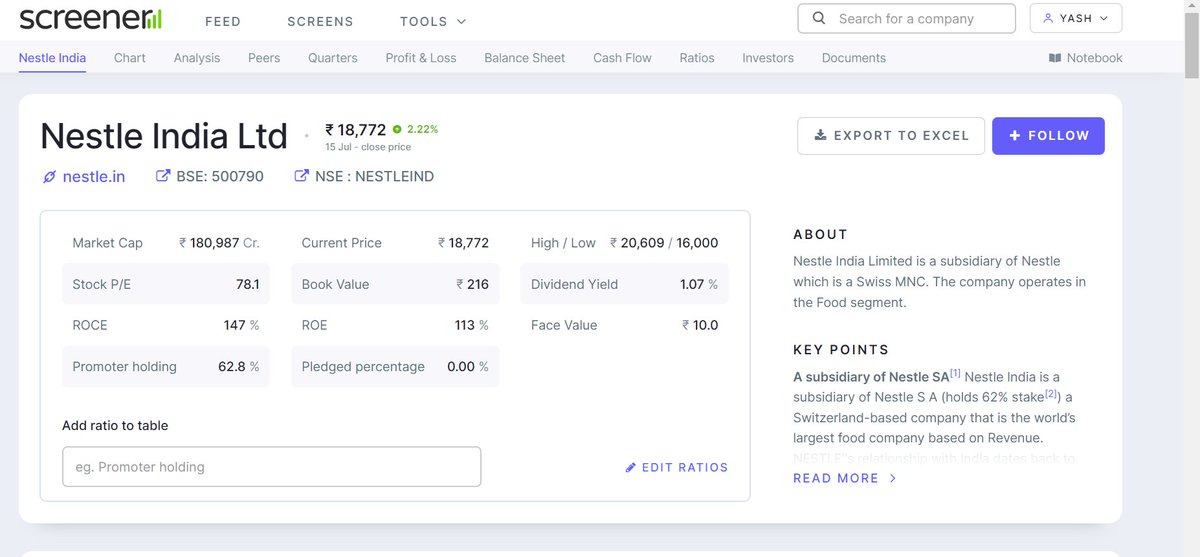

⚡️Brief information on the company

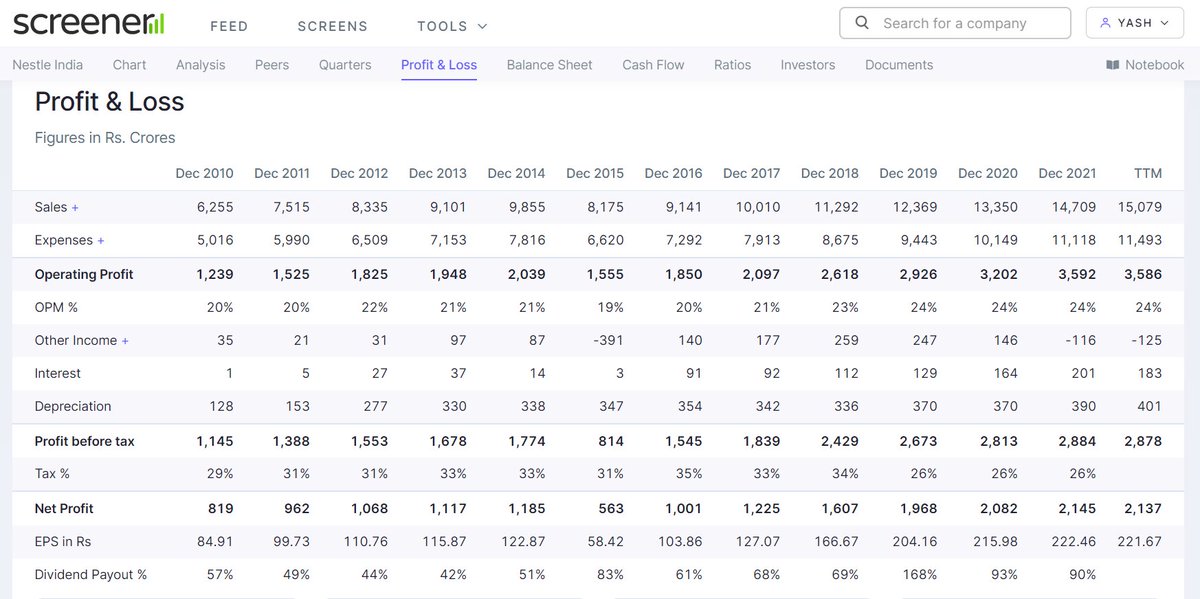

⚡️YoY or QoQ data in a single website

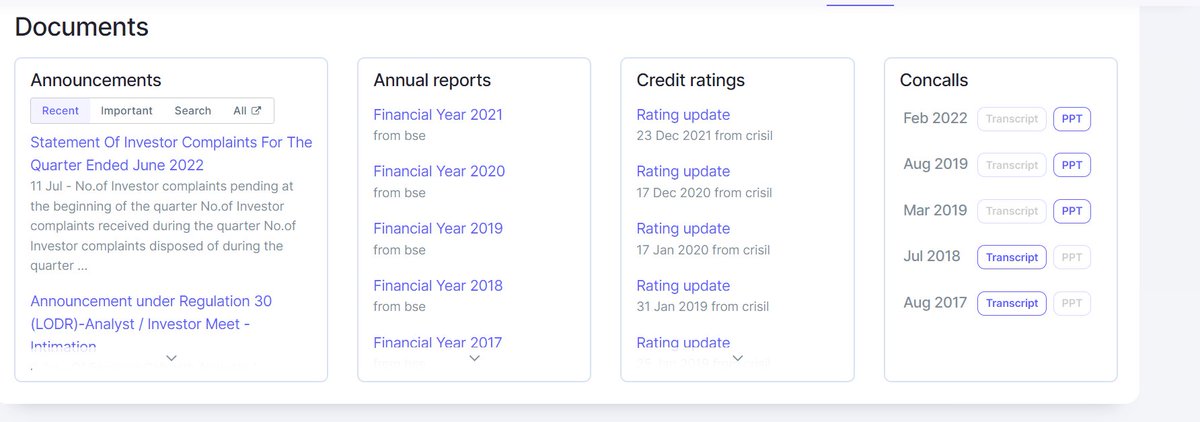

⚡️All the links for results, concall presentation, ratings update can be checked here

Website: screener.in

Uses:

⚡️Creating your screener which can help in filtering the stocks

⚡️Brief information on the company

⚡️YoY or QoQ data in a single website

⚡️All the links for results, concall presentation, ratings update can be checked here

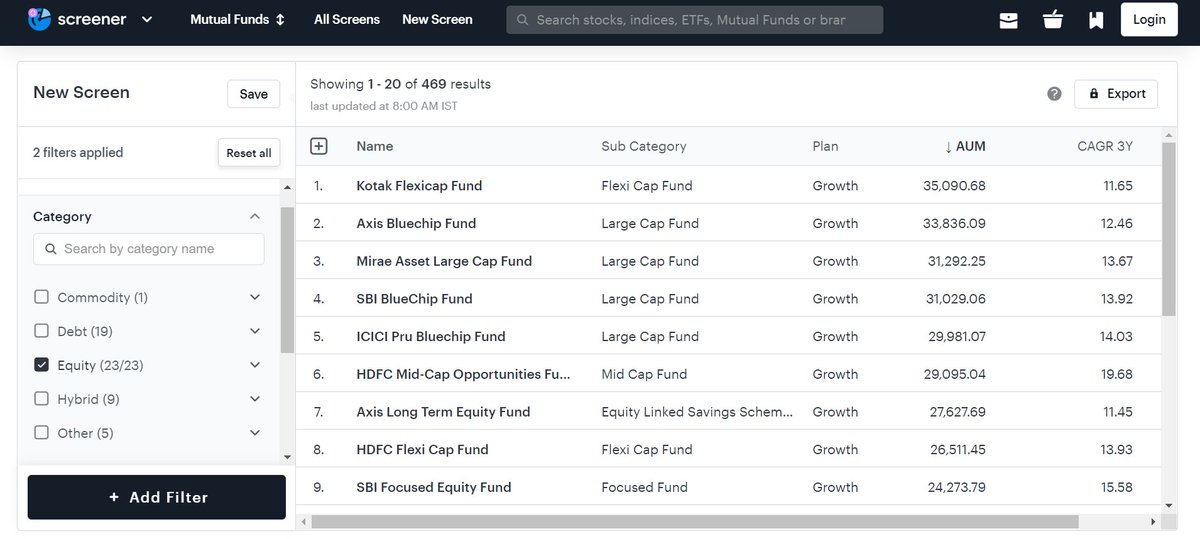

3. @TickertapeIN

Website: tickertape.in

Uses:

⚡️Create screener to filter stock in particular industry

⚡️Create Mutual Fund Screeners

⚡️It gives entire overview of the company

⚡️Plus you can get data of promoter pledging trend in a single website

Website: tickertape.in

Uses:

⚡️Create screener to filter stock in particular industry

⚡️Create Mutual Fund Screeners

⚡️It gives entire overview of the company

⚡️Plus you can get data of promoter pledging trend in a single website

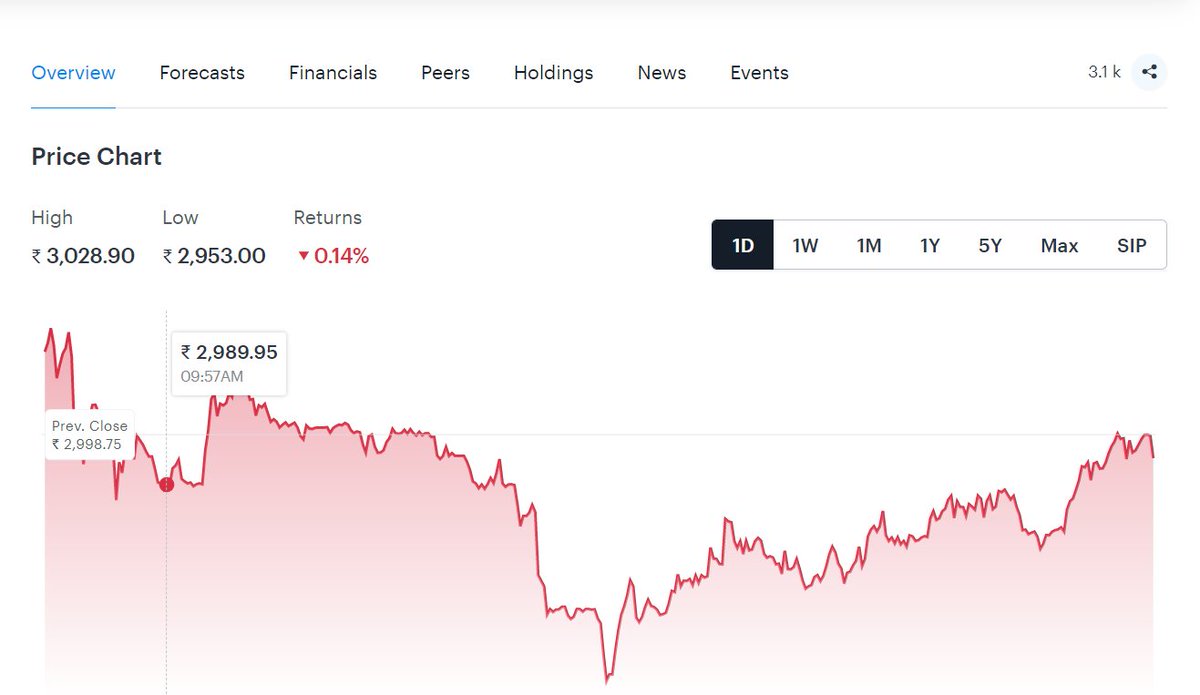

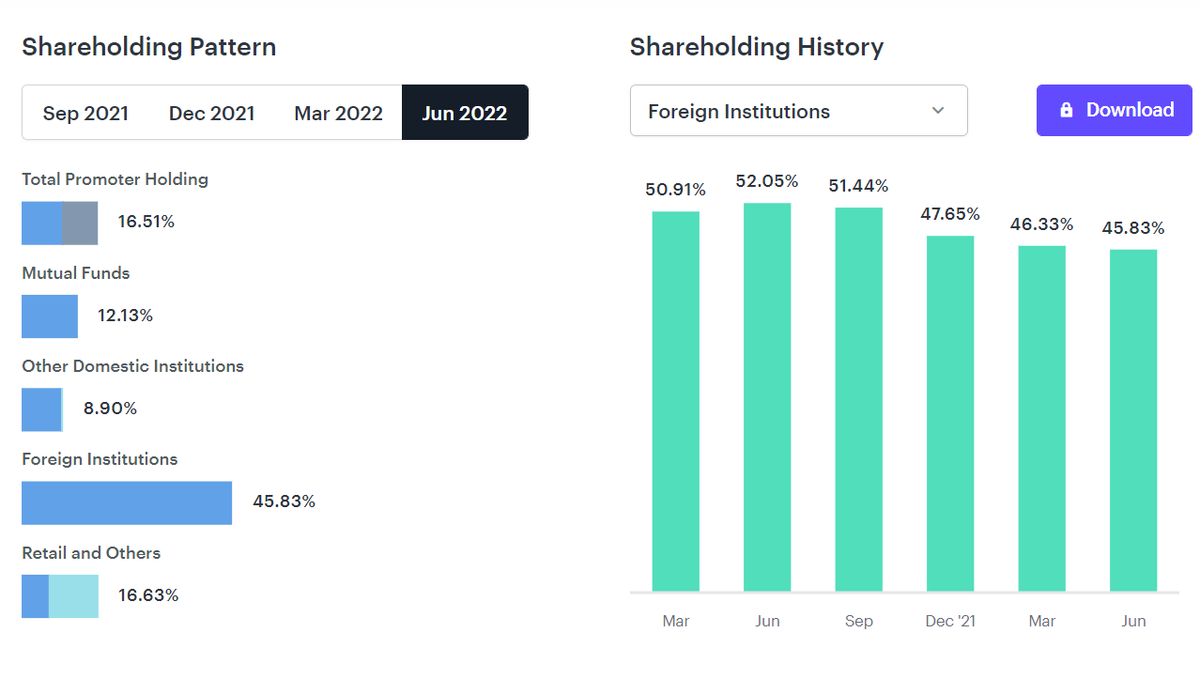

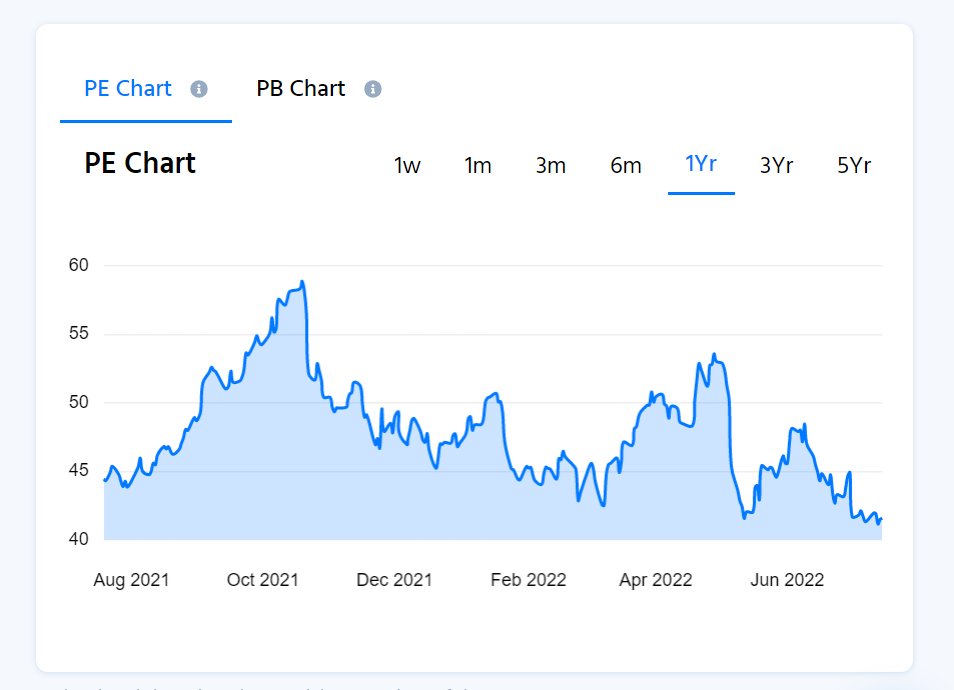

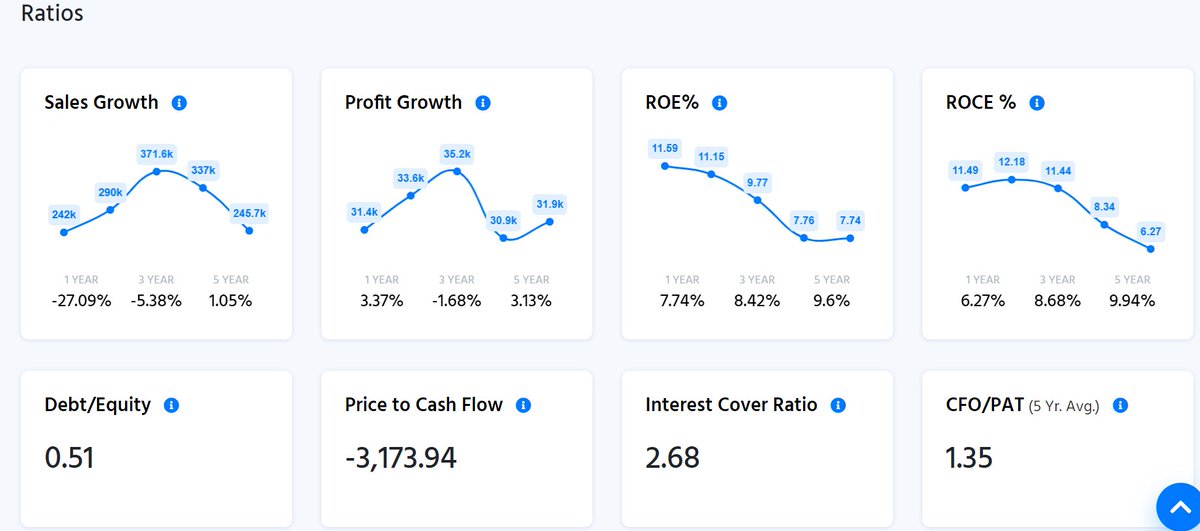

4. @finologyticker

Website: ticker.finology.in

Uses:

⚡️An amazing website for those who like to check financial data in graphical form

⚡️It gives PE and PB chart for stocks

⚡️All the annual reports, rating reports and company's presentation is available here

Website: ticker.finology.in

Uses:

⚡️An amazing website for those who like to check financial data in graphical form

⚡️It gives PE and PB chart for stocks

⚡️All the annual reports, rating reports and company's presentation is available here

This are some websites that you can use to do fundamental analysis of the listed #stocks.

All the financial data that you need can be viewed here for free.

Follow me @YMehta_ for more.

Like/Retweet the first tweet below if you can:

All the financial data that you need can be viewed here for free.

Follow me @YMehta_ for more.

Like/Retweet the first tweet below if you can:

https://twitter.com/YMehta_/status/1548536004109533190

• • •

Missing some Tweet in this thread? You can try to

force a refresh