1/n

@avalancheavax was built to address issues of scalability prevalent in top protocols. And, with rapid popularity, Avalanche moved a step ahead to cater to its ballooning users by introducing Avalanche Subnets.

What is it?

How does it work?

Let’s Dive in👇🧵

@avalancheavax was built to address issues of scalability prevalent in top protocols. And, with rapid popularity, Avalanche moved a step ahead to cater to its ballooning users by introducing Avalanche Subnets.

What is it?

How does it work?

Let’s Dive in👇🧵

2/n

Before we dive into #subnets

Let’s first understand Avalanche.

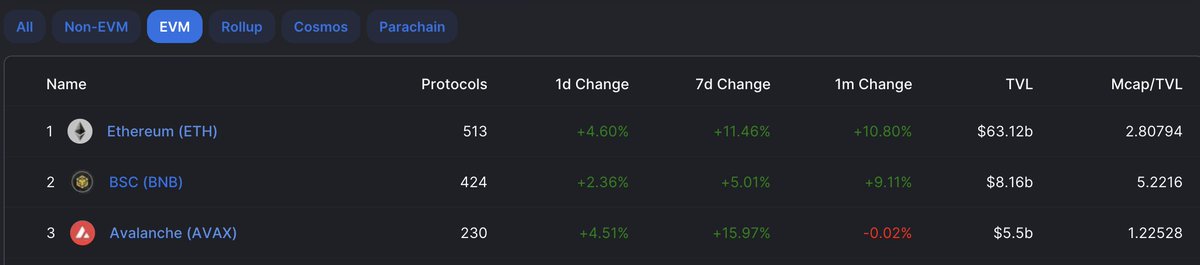

#Avalanche is a Proof-of-Stake smart contract platform for #dApps powered by the snowman consensus protocol with near-instant transaction finality. It has been the most successful EVM chain after #BSC.

Before we dive into #subnets

Let’s first understand Avalanche.

#Avalanche is a Proof-of-Stake smart contract platform for #dApps powered by the snowman consensus protocol with near-instant transaction finality. It has been the most successful EVM chain after #BSC.

3/n

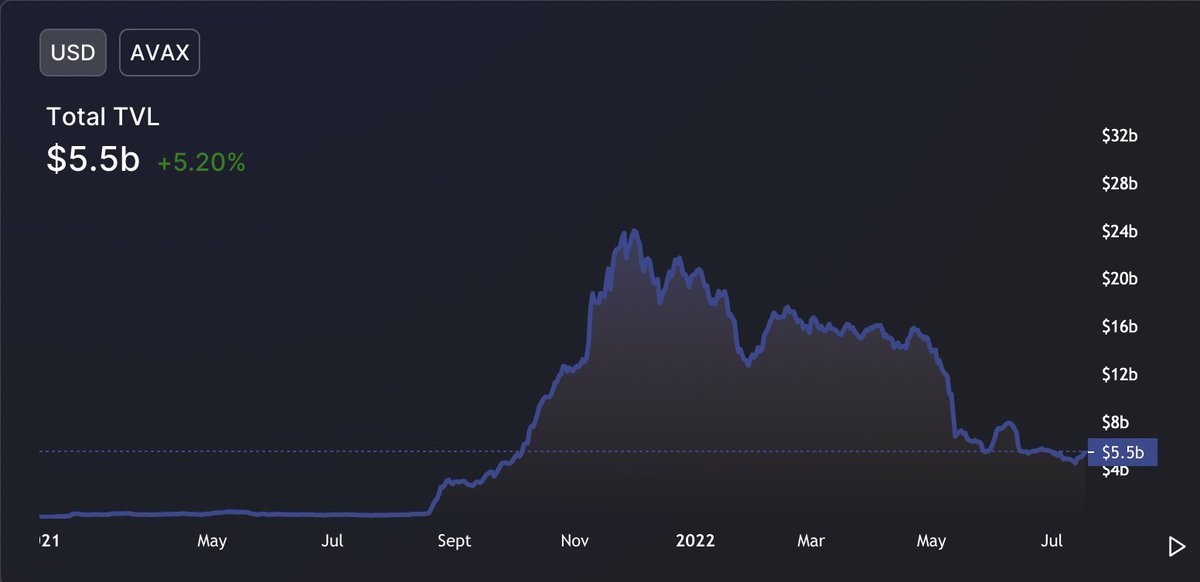

@avalancheavax launched its mainnet in Sept 2020 & Avalanche Rush - a Liquidity incentive Program in Aug 2021. This was a huge success & led to many #dApps migrating & bringing a lot of capital onto the platform.

Total Value Locked had reached $24B at its peak.

@avalancheavax launched its mainnet in Sept 2020 & Avalanche Rush - a Liquidity incentive Program in Aug 2021. This was a huge success & led to many #dApps migrating & bringing a lot of capital onto the platform.

Total Value Locked had reached $24B at its peak.

4/n

Current Avalanche Architecture

@avalancheavax is built around a system of 3 interoperable blockchains: the Exchange Chain (X-Chain), Contract Chain (C-Chain) & Platform Chain (P-Chain). In short, C-chain is for #DeFi, X-chain is for #transfers, & P-chain is for #staking.

Current Avalanche Architecture

@avalancheavax is built around a system of 3 interoperable blockchains: the Exchange Chain (X-Chain), Contract Chain (C-Chain) & Platform Chain (P-Chain). In short, C-chain is for #DeFi, X-chain is for #transfers, & P-chain is for #staking.

5/n

By splitting the #Avalanche architecture across 3 separate blockchains, Avalanche can optimize for flexibility, speed & security without any trade-offs. Thus, Avalanche is solving all major #blockchain issues.

Now, let’s understand how #subnets provide better scalability.

By splitting the #Avalanche architecture across 3 separate blockchains, Avalanche can optimize for flexibility, speed & security without any trade-offs. Thus, Avalanche is solving all major #blockchain issues.

Now, let’s understand how #subnets provide better scalability.

6/n

Enter Subnets

A subnet, or subnetwork, is a dynamic set of #validators working together to achieve #consensus on the state of a set of blockchains. Each blockchain on Avalanche is validated by exactly one subnet. A subnet can validate arbitrarily many blockchains.

Enter Subnets

A subnet, or subnetwork, is a dynamic set of #validators working together to achieve #consensus on the state of a set of blockchains. Each blockchain on Avalanche is validated by exactly one subnet. A subnet can validate arbitrarily many blockchains.

7/n

How do subnets work? (Architecture)

There is another subnet called the Primary Network, which validates Avalanche's built-in blockchains. All members of all subnets must also be members of the primary network. To become a member, you must #stake some Avalanche tokens.

How do subnets work? (Architecture)

There is another subnet called the Primary Network, which validates Avalanche's built-in blockchains. All members of all subnets must also be members of the primary network. To become a member, you must #stake some Avalanche tokens.

8/n

Why do we need subnets?

#dApps in the current state of monolithic blockchains struggle for blockspace as all apps compete for the common storage and execution space. This has led to app-specific chains where only one application lives leading to faster TPS & lower costs

Why do we need subnets?

#dApps in the current state of monolithic blockchains struggle for blockspace as all apps compete for the common storage and execution space. This has led to app-specific chains where only one application lives leading to faster TPS & lower costs

9/n

Creating a subnet

Choose a VM - By default it's the Subnet-EVM. But, Avalanche allows developers to create an #EVM or any other VM of their choosing. Besides EVM & AVM, there are other VM options such as #SpacesVm, #BlobVM & #TimestampVM.

Creating a subnet

Choose a VM - By default it's the Subnet-EVM. But, Avalanche allows developers to create an #EVM or any other VM of their choosing. Besides EVM & AVM, there are other VM options such as #SpacesVm, #BlobVM & #TimestampVM.

10/n

Furthermore, Pick up a chain ID, Set fees, #Airdrop configuration & other required configuration parameters.

Next, you can deploy the subnet on a local network to see it action.

For more information:

docs.avax.network/subnets/create…

Furthermore, Pick up a chain ID, Set fees, #Airdrop configuration & other required configuration parameters.

Next, you can deploy the subnet on a local network to see it action.

For more information:

docs.avax.network/subnets/create…

11/n

Some ground rules:

• Subnet validators must also validate the main chain, so effectively subnet validators are a subset of Main Avalanche validators.

• One subnet can validate more than one chain.

• It's optional for main chain validators to validate subnets

Some ground rules:

• Subnet validators must also validate the main chain, so effectively subnet validators are a subset of Main Avalanche validators.

• One subnet can validate more than one chain.

• It's optional for main chain validators to validate subnets

12/n

• Each validator must have at least 2000 AVAX.

• Minimum 5 validators are suggested, though it can run with a minimum of 1 validator as well.

• You can run your own validators if the infrastructure is available, if not, incentivizing existing validators also works.

• Each validator must have at least 2000 AVAX.

• Minimum 5 validators are suggested, though it can run with a minimum of 1 validator as well.

• You can run your own validators if the infrastructure is available, if not, incentivizing existing validators also works.

13/n

• Cross-chain transactions are possible between the different chains on the Avalanche platform.

• Cross-subnet transactions are not supported currently. But, it would be possible in the future.

• Cross-chain transactions are possible between the different chains on the Avalanche platform.

• Cross-subnet transactions are not supported currently. But, it would be possible in the future.

14/n

What can subnets enable?

Horizontal Scaling:

Subnet takes the load off the main chain without affecting the main chain. Currently, the C-chain processes around 500K–700K transactions/day while subnets process 300K–350K, reducing ~50% load on the C-chain.

What can subnets enable?

Horizontal Scaling:

Subnet takes the load off the main chain without affecting the main chain. Currently, the C-chain processes around 500K–700K transactions/day while subnets process 300K–350K, reducing ~50% load on the C-chain.

15/n

Custom Tokenomics & Fees:

Subnets can have their own customised #tokenomics & fee markets based on the requirements.

Compliance Based Validators:

It could enable permissioned use cases validator network where KYC/AML or other compliance requirements could be enforced

Custom Tokenomics & Fees:

Subnets can have their own customised #tokenomics & fee markets based on the requirements.

Compliance Based Validators:

It could enable permissioned use cases validator network where KYC/AML or other compliance requirements could be enforced

16/n

Faster transactions:

Subnets do not share network load with the mainnet which equates to lower latency & higher TPS that runs in parallel with each other. Theoretically, there is no limit to the number of subnets one can create as long as there are sufficient validators.

Faster transactions:

Subnets do not share network load with the mainnet which equates to lower latency & higher TPS that runs in parallel with each other. Theoretically, there is no limit to the number of subnets one can create as long as there are sufficient validators.

17/n

Lower transaction fees:

Transaction fees are lower because of a multitude of subnets & their validators result in less congestion compared to a #blockchain that runs all activities solely on one network.

Lower transaction fees:

Transaction fees are lower because of a multitude of subnets & their validators result in less congestion compared to a #blockchain that runs all activities solely on one network.

18/n

Highly customizable:

#Subnets can choose which virtual machines to run, decide their fee structure, validator requirements, which programming language to use & even who has access to the subnet. #Protocols can customize their rules according to their needs.

Highly customizable:

#Subnets can choose which virtual machines to run, decide their fee structure, validator requirements, which programming language to use & even who has access to the subnet. #Protocols can customize their rules according to their needs.

19/n

Moving to use-cases enabled by subnets:

@PlayCrabada is a big #GameFi project running on an Avalanche Subnet that created a subnet dedicated to gaming called the Swimmer Network. This feature allows players to pay the gas fees using an in-game rewards token ( $TUS )

Moving to use-cases enabled by subnets:

@PlayCrabada is a big #GameFi project running on an Avalanche Subnet that created a subnet dedicated to gaming called the Swimmer Network. This feature allows players to pay the gas fees using an in-game rewards token ( $TUS )

20/n

@DefiKingdoms (DFK) is one of the largest #GameFi projects that also has its own subnet on the Avalanche blockchain. It is a scaling solution that involves a dynamic set of validators working together to achieve consensus on the state of a set of blockchains.

@DefiKingdoms (DFK) is one of the largest #GameFi projects that also has its own subnet on the Avalanche blockchain. It is a scaling solution that involves a dynamic set of validators working together to achieve consensus on the state of a set of blockchains.

21/n

@dexalotcom is an Automated Market Maker on Avalanche which has also launched its Subnet Testnet in order to reduce transaction fees and achieve faster TPS. It's the first dApp apart from games to explore subnets.

@dexalotcom is an Automated Market Maker on Avalanche which has also launched its Subnet Testnet in order to reduce transaction fees and achieve faster TPS. It's the first dApp apart from games to explore subnets.

22/n

@wildlifestudios one of the 10 largest mobile game developers, is joining the Avalanche #Multiverse program & expanding into #Web3 gaming on its own subnet!

@playcastlecrush subnet Fuji testnet is live with the explorer.

Know more:

@wildlifestudios one of the 10 largest mobile game developers, is joining the Avalanche #Multiverse program & expanding into #Web3 gaming on its own subnet!

@playcastlecrush subnet Fuji testnet is live with the explorer.

Know more:

https://twitter.com/_patrickogrady/status/1529139883259748352?s=20&t=J8WsVM5PJKjr4I8-VXoU7Q

23/n

In March 2022, @avalancheavax launched #Multiverse - a dedicated $290M fund to accelerate the adoption and ecosystem growth on Avalanche Subnets.

Read here:

In March 2022, @avalancheavax launched #Multiverse - a dedicated $290M fund to accelerate the adoption and ecosystem growth on Avalanche Subnets.

Read here:

https://twitter.com/avalancheavax/status/1501217040752910336?s=20&t=dtwbAyM6JKD4FvO2hbPXUw

24/n

In future, vertical scaling will be limited. Thus, the best way to ensure adoption is to scale horizontally. This means platforms must have interoperable networks that make interactions fast & cheap for their users.

This is why #subnets might be the answer!

In future, vertical scaling will be limited. Thus, the best way to ensure adoption is to scale horizontally. This means platforms must have interoperable networks that make interactions fast & cheap for their users.

This is why #subnets might be the answer!

25/25

@avalancheavax is leading the foray with #subnets, making transactions fast, horizontally scalable and blockchains interoperable.

Follow us to know everything about #web3 and #blockchain!

RT to raise awareness.

Comment your questions below. 👇

@avalancheavax is leading the foray with #subnets, making transactions fast, horizontally scalable and blockchains interoperable.

Follow us to know everything about #web3 and #blockchain!

RT to raise awareness.

Comment your questions below. 👇

• • •

Missing some Tweet in this thread? You can try to

force a refresh