1/17 As all #DEFI users, I had to overcome the meaning of IMPERMANENT LOSS and how to play with it. SO here is my 4 months research gathered in one thread only for you. Ping it, as it will be useful during your whole DEFI Journey 🧵4⃣->3⃣->2⃣->1⃣->👇

2/17 Problem:

a)Very few people understand the meaning of Impermanent Loss

b)People are loosing money due to IL and don’t know why

a)Very few people understand the meaning of Impermanent Loss

b)People are loosing money due to IL and don’t know why

3/17 Solution 1: Use that website to see how IL works dailydefi.org/tools/imperman…

4/17 Solution 2: Theory is 🤮: As soon as you deposit two tokens into a liquidity pool which prices are not correlated (token 1 price changes in a different % than token 2 price), Impermanent Loss occurs. When you withdraw from the LP, loss becomes permanent. Let's practice ->

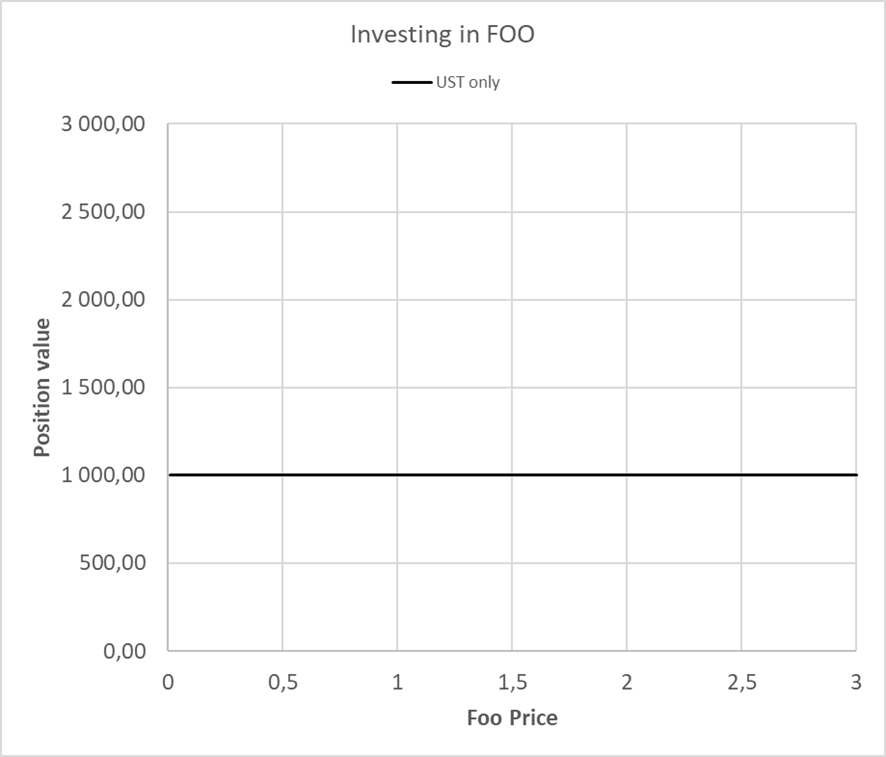

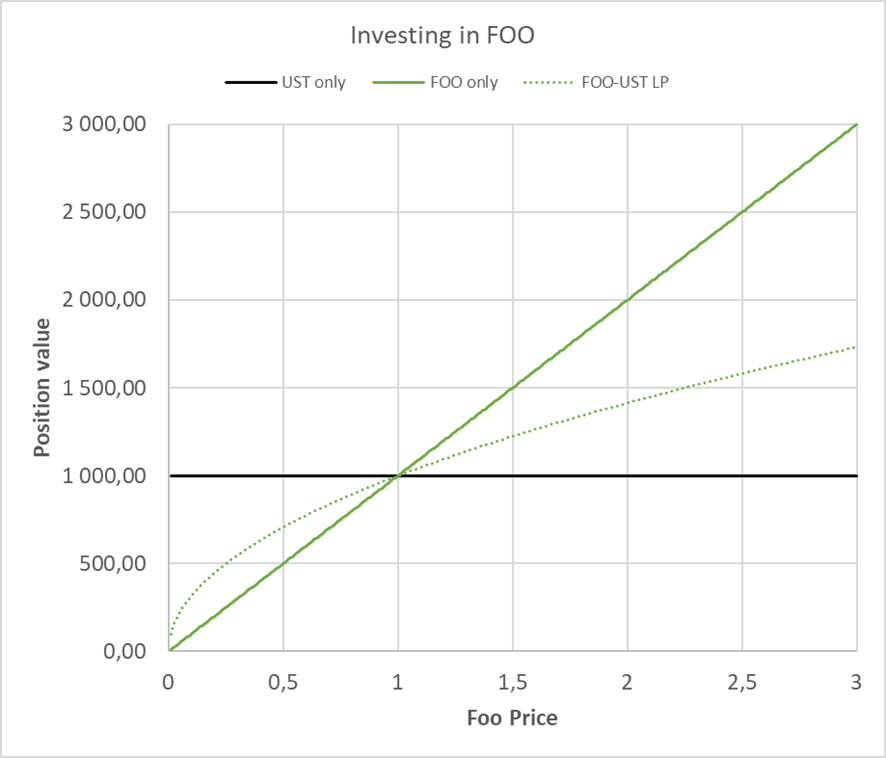

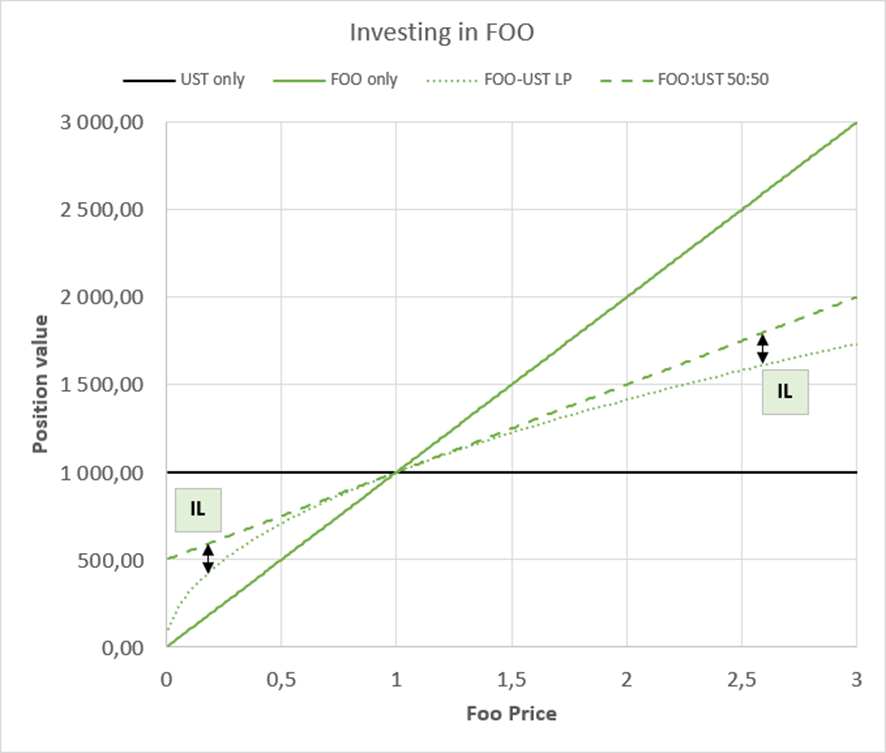

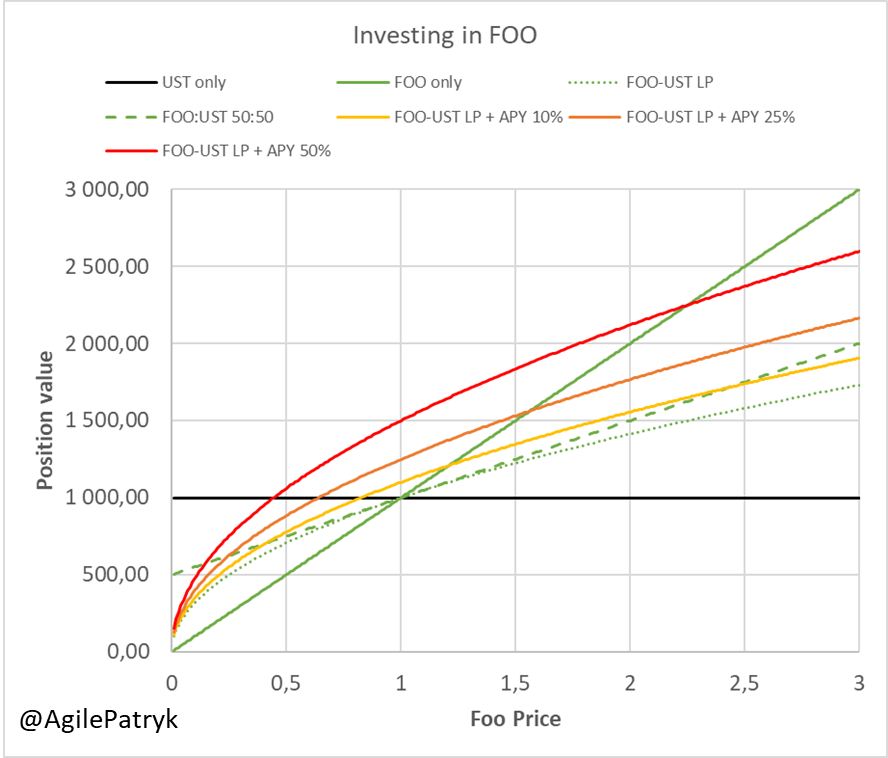

5/17 As a drawing is 100x better than a 17 posts thread (shit!!), let’s start with an example: I’ve 1,000 $USDT and want to invest in one token, $FOO for example (I don’t care about $FOO, this is just an example right?). So I have multiple strategy:

6/17 1) I don’t invest in the token. My Portfolio stands still, and doesn’t really bother about $FOO price variation

7/17 2) All-in on $FOO: $FOO goes to Zero I’m #REKT , $FOO goes to #Moon , @elonmusk send me there!!

8/17 3) I deposit 500$ in stable and 500$ in $FOO into a liquidity pool with 0% APR. I’m less rekted and less a moonboy than All-In strategy.

9/17 4) I keep 500$ of stable & 500$ of $FOO in my #web3 wallet. The you can see the Impermanent Loss "IL" showing his face between strategy 3 & 4. On the upper side you earn less, on the lower side you loose less.

10/17 5) Depending on the Liquidity Pool yield, IL can vary, and here you start seeing some singular points, so how do you end up by having a strategy wrt to how to manage IL?

11/17 I manage to answer the following question based on 1 YEAR Farming: At which point, it’s more interesting to exit a LP (50% stable/50% $FOO) and #HODL 100% $FOO in your #Web3 wallet:

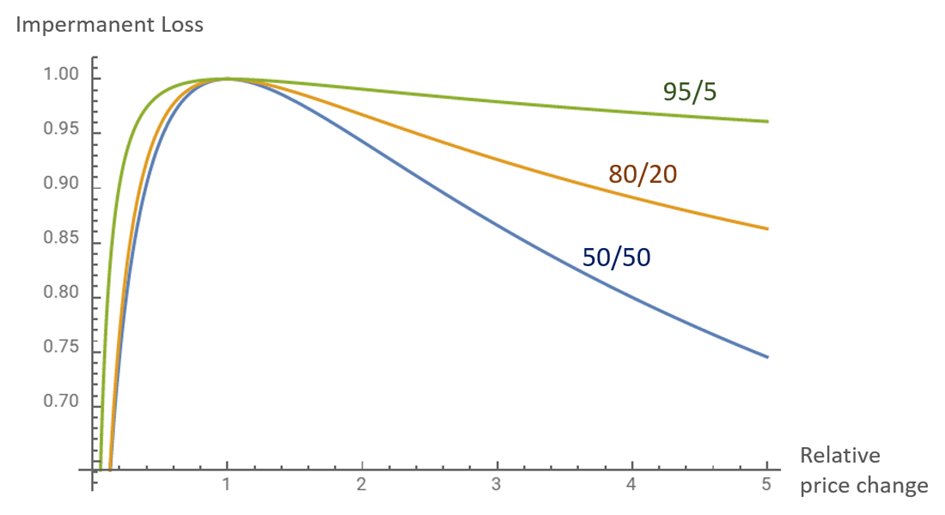

13/17 So now that you know how to make your own farming strategy around Impermanent Loss, I will tell you how you can reduce your IL Impact:

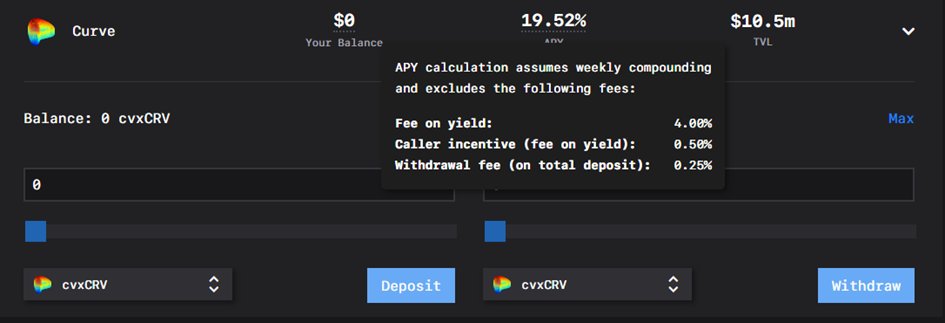

14/17 Use Stable Pool, or LP that are made up of assets with correlated prices. Juicy rewards on @VelodromeFi

https://twitter.com/VelodromeAlerts/status/1549178912286064640?s=20&t=yPlj8ej9rmxflBaLotkKOA

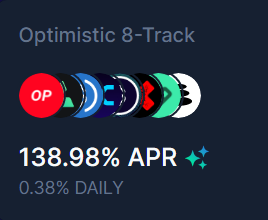

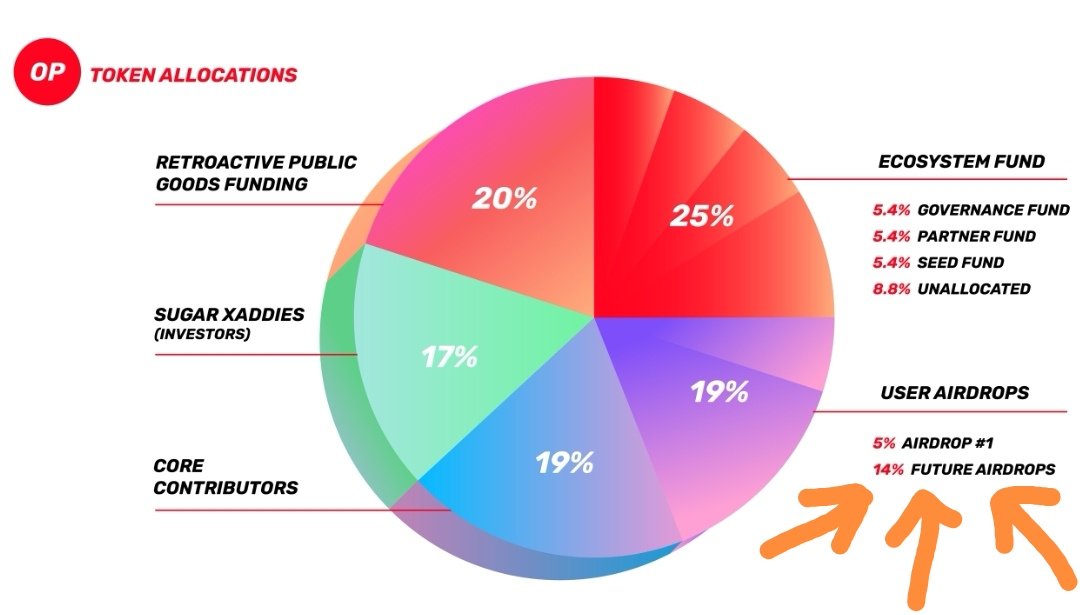

15/17 Use multiple tokens in a pool: This is the technology behing @BalancerLabs and @beethoven_x . Here is an example of a Pool with 8 tokens. If one token crashes, your total deposit value will be much less impacted.

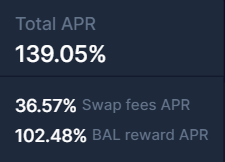

16/17 Invest in pool with unbalanced token split: Again a particularity of @BalancerLabs and @beethoven_x liquidity pools. Interesting fact here, a 80/20 Pool is very close to a #STAKING solution, however you’re earning liquidity mining and fees on it! Awesome!

17/17 Above charts and analysis were made thanks to @AgilePatryk work and our discussion. Thanks a lot mate. Now you have all the tools in hand to avoid jumping in your favorite Discord and ask the team: “Why did I withdraw less money than when I Got in”. Farm safe, Farm smart!

If you like this 🧵, please retweet and share this to your friends. Article is saved on my Notion webpage also, available directly from my Twitter profile.

Thanks for the reading!

https://twitter.com/Subli_Defi/status/1549744293061042177?s=20&t=nr77qFwwxzchaHndkPPgqA

Thanks for the reading!

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh