Now we have dissaggregated @StateBank_Pak data on #Pakistan's #trade performance for the full of the FY22.

This thread will show performance in #values. not #volumes. Keep in mind FY22 was extraordinary in terms of high #prices, both for #imports and #exports. 👇👇👇🧵

This thread will show performance in #values. not #volumes. Keep in mind FY22 was extraordinary in terms of high #prices, both for #imports and #exports. 👇👇👇🧵

1\ #Exports reached record highs, both #goods and #services, increasing by 26.6 and 17.1% respectively w.r.t. FY21. Good export prices and a decent #export response played a role here.

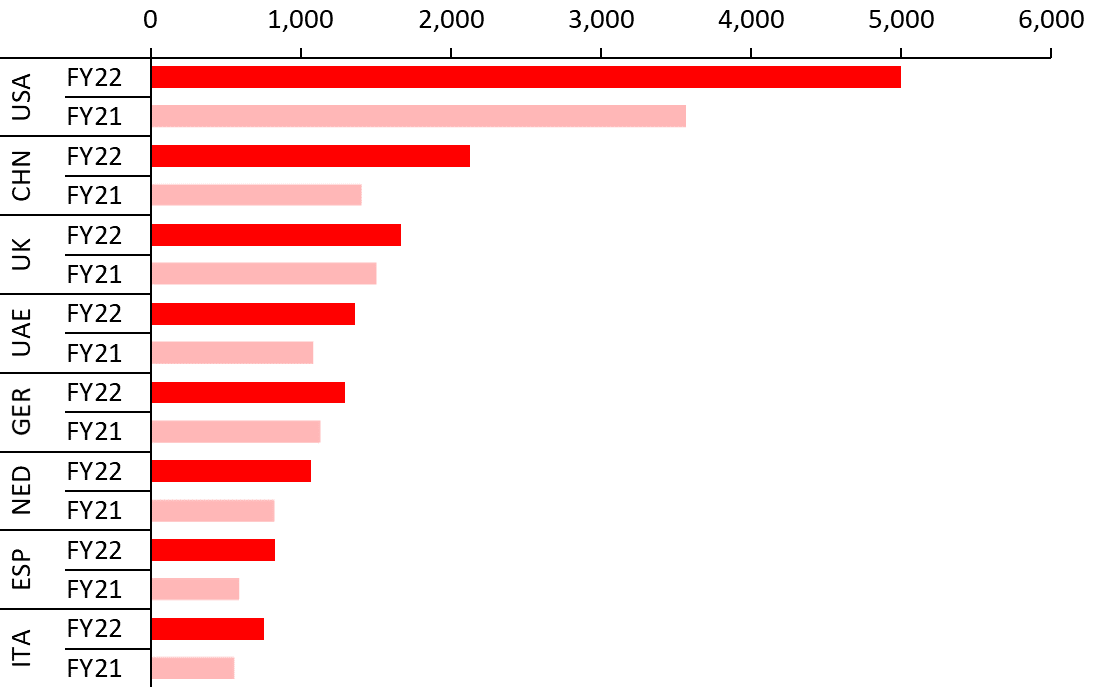

2\ #Pakistan #export growth was generalized by main destination. Particularly noticeable are increases in shipments to #USA and to #China - the two largest destinations.

3\ The #locomotive in #merchandise #export growth was #textile & #garments, with exports growing from about USD14bn in FY21 to USD18bn in FY22. Vegetable products also grew, while live animal exports shrank.

4\ In #services, #knowledge intensive services exports continue expanding (business services, some telecom), but now also #transport is growing fast, linked to the grow in overall #trade.

5\ The other side of the coin...#imports grew to record highs on the back of extraordinarily high #energy and #food prices. Faster import growth (at 34% compared to 25% #export growth) meant also an expansion of the trade deficit, increasing external vulnerability. #Pakistan

6\ Goods #imports from the top eight origins grew in FY22 vs FY21.

8\ A note on #prices (again!) - Check the evolution of main #import commodities: crude oil and edible oil as high as during the 2008 peak. #Cotton also high, but not nearly as much, and #rice relatively stably priced.

9\ To end with: structural reforms to boost #export competitiveness crucial to keep growth even w/ potentially lower export prices moving forward. Also #complementary infrastructure for #exporters to take advantage of a more #competitive #exchange rate.

• • •

Missing some Tweet in this thread? You can try to

force a refresh