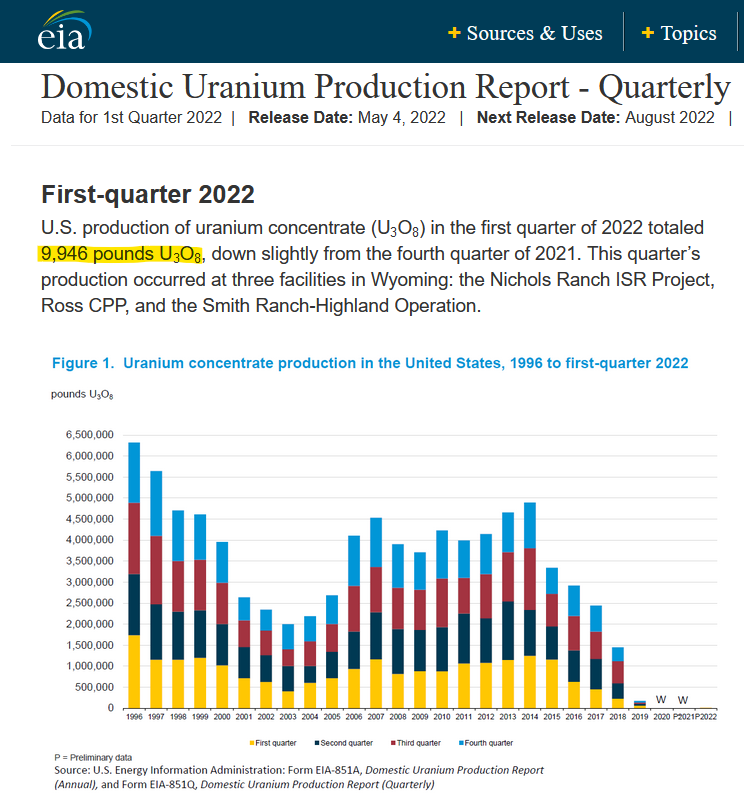

1) The #Uranium #mining #stocks #investing thesis in a nutshell🥜🧵 is that after Fukushima the price of #U3O8 sank, new mine projects were cancelled, many mines closed, investment dropped 💰⤵️ as investors thought "#Nuclear #energy is dying"🪦 but they were wrong!✖️😯 .../2👇

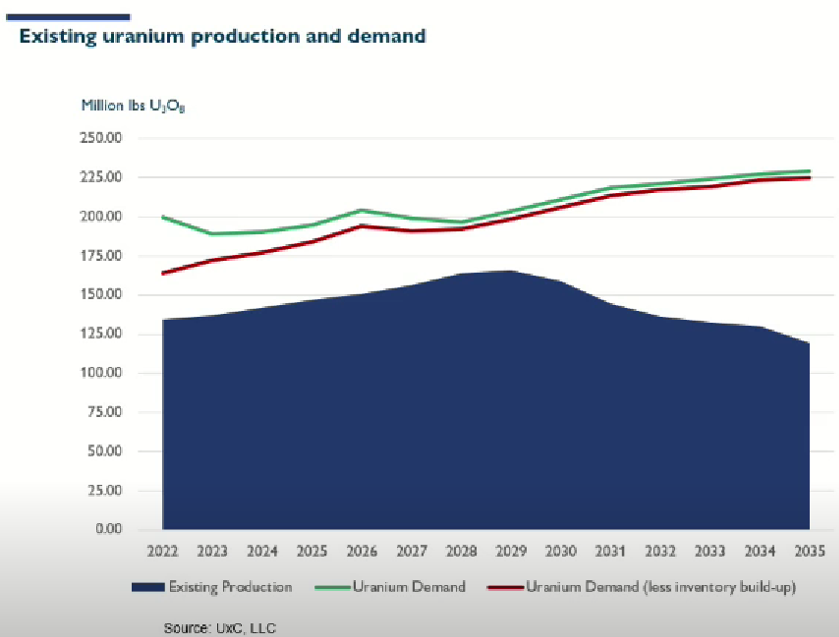

2) #Nuclear #energy has actually been growing steadily over past decade so that #Uranium demand today is back where it was before Fukushima.🌞⚛️🏗️↗️ A #Nuclear renaissance has been quietly underway for years but few have noticed🤷 and it's set to grow for years to come!⏫ .../3👇

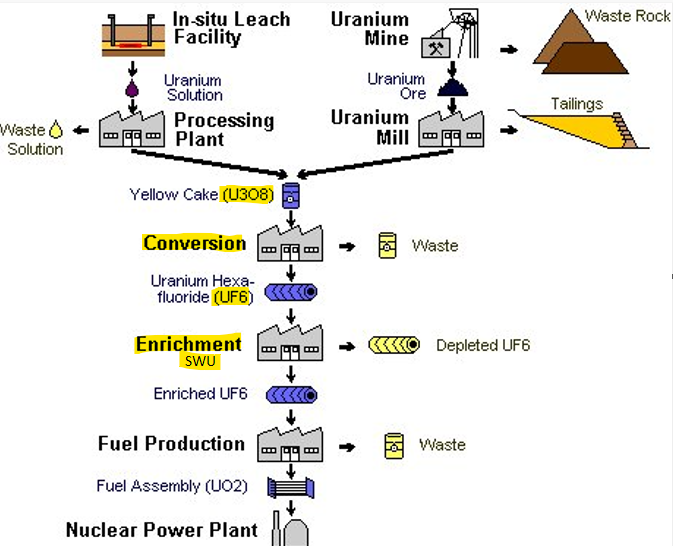

3) Rising #Nuclear demand🌞⚛️🏗️⤴️ as #Uranium supplies declined⛏️⤵️ has led to a massive mined supply deficit⏬ estimated earlier this year by industry consultants at ~65M lbs #U3O8 in 2022, partially offset by ~20M lbs of 'Secondary Supply' from other non-mined sources.⛏️.../4👇

4) But bringing idled & new large #Uranium mines into production will take far higher #U3O8 prices than those we see today, especially as inflation raises the bar to $95+/lb for enough mine production to fix the deficit.💰⬆️⛏️ Meanwhile, operating mines are in decline.↘️🗜️.../5👇

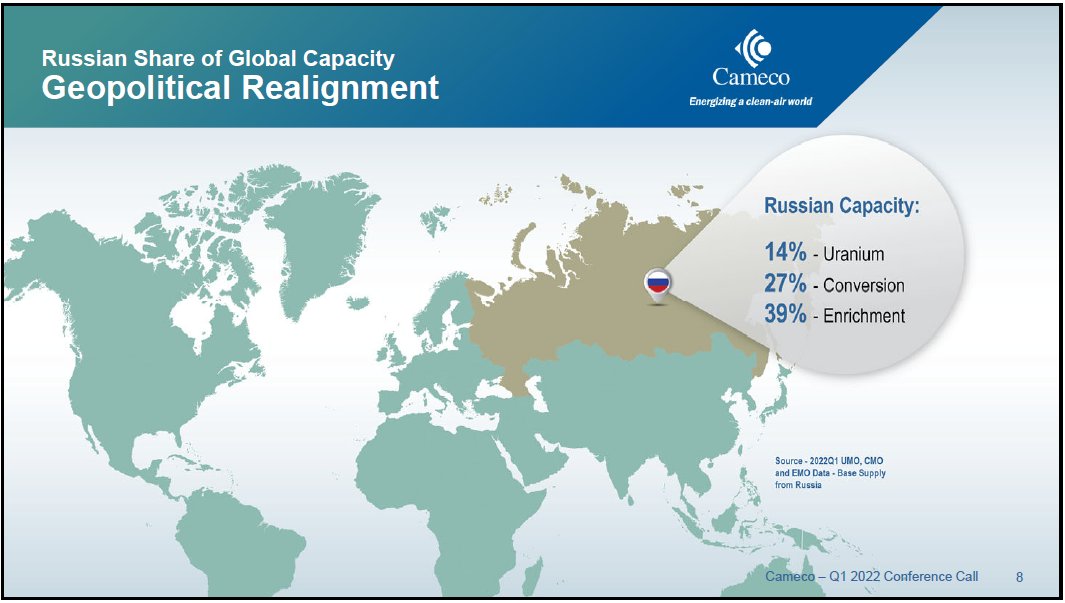

5) Then Russia invaded Ukraine🪖 in the midst of a global resurgence in demand for #Nuclear to urgently achieve #NetZero.🌞⚛️ #Uranium supply has been disrupted⛏️⤵️ while nations pivot to keep & add more reactors.🏗️⤴️ See this thread for more details.🧵👇

https://twitter.com/quakes99/status/1538333801444540416?s=20&t=BfMMOp_cCRYEs-TX8Fa3AQ

• • •

Missing some Tweet in this thread? You can try to

force a refresh