Retired Earth Sciences Researcher, Professor, Analyst, Writer, Trekker and Explorer. 🥾🌎 Invested in the Global #Nuclear & #Uranium Renaissance 🌅⚛️⚡️⛏️ 🤠🐂

29 subscribers

How to get URL link on X (Twitter) App

2)If you're new to #investing in #Uranium #mining #stocks👶 then best starter🥣 is @Sprott Uranium Miners ETF: $URNM 🇺🇸🇬🇧🇦🇺 or Global X Uranium Index ETF $HURA 🇨🇦 both giving U pure-play #U3O8 sector exposure🌎⚛️⛏️😃 while U do your research📚🧐 #Nuclear #Energy🤠🐂🧵👇.../3

2)If you're new to #investing in #Uranium #mining #stocks👶 then best starter🥣 is @Sprott Uranium Miners ETF: $URNM 🇺🇸🇬🇧🇦🇺 or Global X Uranium Index ETF $HURA 🇨🇦 both giving U pure-play #U3O8 sector exposure🌎⚛️⛏️😃 while U do your research📚🧐 #Nuclear #Energy🤠🐂🧵👇.../3

Part 2 - #Uranium & #Nuclear #Energy Folks to Follow:

Part 2 - #Uranium & #Nuclear #Energy Folks to Follow:

2) #Uranium is very different from fuels like #coal & #gas that are burned "as is" in #electricity power plants.🏭⚡️ #Nuclear fuel needs to be specially processed and then packaged into fuel rods that are then loaded into reactors to generate #CarbonFree electricity.🌞⚛️⚡️👇../3

2) #Uranium is very different from fuels like #coal & #gas that are burned "as is" in #electricity power plants.🏭⚡️ #Nuclear fuel needs to be specially processed and then packaged into fuel rods that are then loaded into reactors to generate #CarbonFree electricity.🌞⚛️⚡️👇../3

2)#Uranium is a commodity like no other🧬 with unique terminology such as #U3O8, Conversion, #UF6 & enrichment SWU😖 in a #Nuclear fuel cycle♻️⚛️⛏️ where price signals are now indicating huge incoming bull market waves🌊 that perhaps I can help U prepare to ride !🏄💰🤠🐂🧵👇../3

2)#Uranium is a commodity like no other🧬 with unique terminology such as #U3O8, Conversion, #UF6 & enrichment SWU😖 in a #Nuclear fuel cycle♻️⚛️⛏️ where price signals are now indicating huge incoming bull market waves🌊 that perhaps I can help U prepare to ride !🏄💰🤠🐂🧵👇../3

2) #Uranium is a very different fuel unlike #coal & #gas that are burned "as is" in #electricity power plants.🏭⚡️ #Nuclear fuel needs to be specially processed and then packaged into fuel rods that are then loaded into reactors to generate #CarbonFree electricity.🌞⚛️⚡️👇../3

2) #Uranium is a very different fuel unlike #coal & #gas that are burned "as is" in #electricity power plants.🏭⚡️ #Nuclear fuel needs to be specially processed and then packaged into fuel rods that are then loaded into reactors to generate #CarbonFree electricity.🌞⚛️⚡️👇../3

2) #Uranium explorers drill rock core samples looking for signs of #U3O8 bearing ore.🧐 Rarely do they hit high-grade on first few attempts.😟 Geologists first look for visual signs in the core samples. Here's a description from pre-discovery 2013 drilling at $NXE's Arrow👇.../3

2) #Uranium explorers drill rock core samples looking for signs of #U3O8 bearing ore.🧐 Rarely do they hit high-grade on first few attempts.😟 Geologists first look for visual signs in the core samples. Here's a description from pre-discovery 2013 drilling at $NXE's Arrow👇.../3

If you're just beginning to invest in #Uranium #mining #stocks👶 then a great starter🥣 is #investing in a 100% Pure-Play Uranium ETF: $URNM 🇺🇸🇬🇧🇦🇺 or Horizons Global Uranium Index ETF $HURA 🇨🇦 giving U broad #U3O8 sector exposure⛏️😃 while U do your research📚🧐👇#Nuclear⚛️🤠🐂

If you're just beginning to invest in #Uranium #mining #stocks👶 then a great starter🥣 is #investing in a 100% Pure-Play Uranium ETF: $URNM 🇺🇸🇬🇧🇦🇺 or Horizons Global Uranium Index ETF $HURA 🇨🇦 giving U broad #U3O8 sector exposure⛏️😃 while U do your research📚🧐👇#Nuclear⚛️🤠🐂

If you're just beginning to invest in #Uranium #mining #stocks👶 then a great starter🥣 is #investing in a 100% Pure-Play Uranium ETF: $URNM 🇺🇸🇬🇧🇦🇺 or Horizons Global Uranium Index ETF $HURA 🇨🇦 giving U broad #U3O8 sector exposure⛏️😃 while U do your research📚🧐👇#Nuclear⚛️🤠🐂

If you're just beginning to invest in #Uranium #mining #stocks👶 then a great starter🥣 is #investing in a 100% Pure-Play Uranium ETF: $URNM 🇺🇸🇬🇧🇦🇺 or Horizons Global Uranium Index ETF $HURA 🇨🇦 giving U broad #U3O8 sector exposure⛏️😃 while U do your research📚🧐👇#Nuclear⚛️🤠🐂

To build your own #Uranium #mining #stocks portfolio📂 of #U3O8 equities traded in #Canada, #USA, #Australia & #UK🛒 U could choose from the holdings of 100% pure-play '@Sprott Uranium Miners ETF' $URNM 🇺🇸🇦🇺🇬🇧🛒⚛️⛏️🤠🐂 #Nuclear #investing #NetZero #ESG🏄♂️ sprottetfs.com/urnm-sprott-ur…

To build your own #Uranium #mining #stocks portfolio📂 of #U3O8 equities traded in #Canada, #USA, #Australia & #UK🛒 U could choose from the holdings of 100% pure-play '@Sprott Uranium Miners ETF' $URNM 🇺🇸🇦🇺🇬🇧🛒⚛️⛏️🤠🐂 #Nuclear #investing #NetZero #ESG🏄♂️ sprottetfs.com/urnm-sprott-ur…

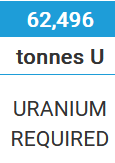

2) First let's make sure we understand the terms used to express #Uranium quantities.🤬 #Nuclear fuel requirements are usually quoted as 'metric tonnes of U' => 'MT U' or 'tU' ⚖️ but miners fill drums of yellow cake🛢️ which is #U3O8 that's not pure U so we must convert.🧮../3

2) First let's make sure we understand the terms used to express #Uranium quantities.🤬 #Nuclear fuel requirements are usually quoted as 'metric tonnes of U' => 'MT U' or 'tU' ⚖️ but miners fill drums of yellow cake🛢️ which is #U3O8 that's not pure U so we must convert.🧮../3

To build your own #Uranium #mining #stocks portfolio📂 of #U3O8 equities traded in #Canada, #USA, #Australia & #UK🛒 U could choose from the holdings of 100% pure-play '@Sprott Uranium Miners ETF' $URNM 🇺🇸🇦🇺🇬🇧🛒⚛️⛏️🤠🐂 #Nuclear #investing #NetZero #ESG🏄♂️ sprottetfs.com/urnm-sprott-ur…

To build your own #Uranium #mining #stocks portfolio📂 of #U3O8 equities traded in #Canada, #USA, #Australia & #UK🛒 U could choose from the holdings of 100% pure-play '@Sprott Uranium Miners ETF' $URNM 🇺🇸🇦🇺🇬🇧🛒⚛️⛏️🤠🐂 #Nuclear #investing #NetZero #ESG🏄♂️ sprottetfs.com/urnm-sprott-ur…

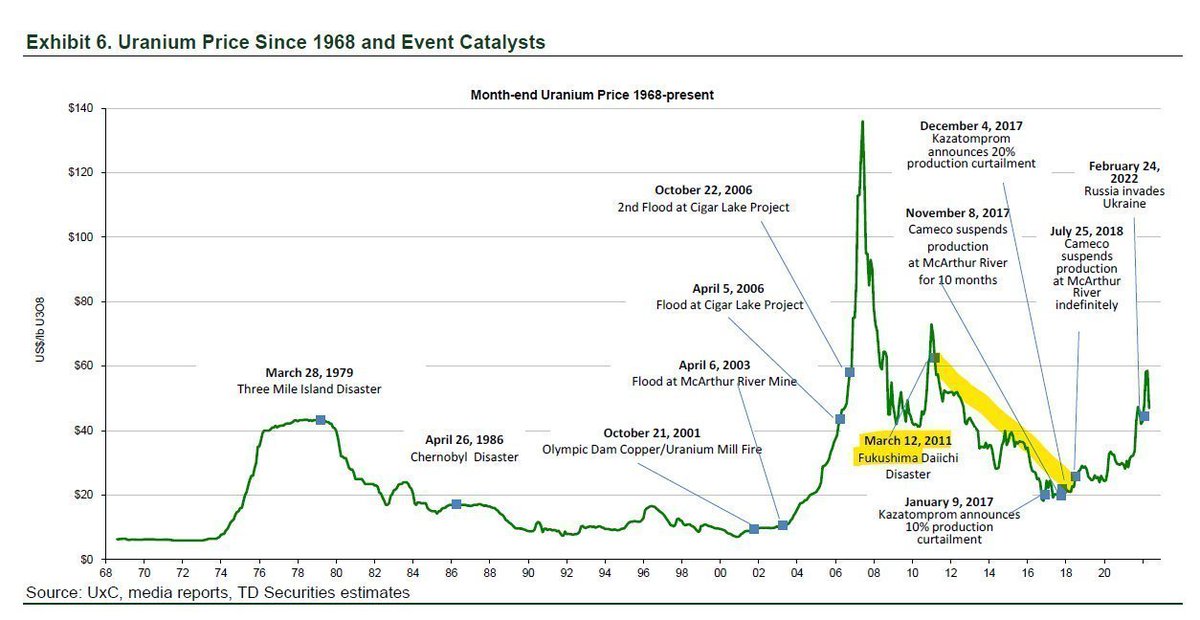

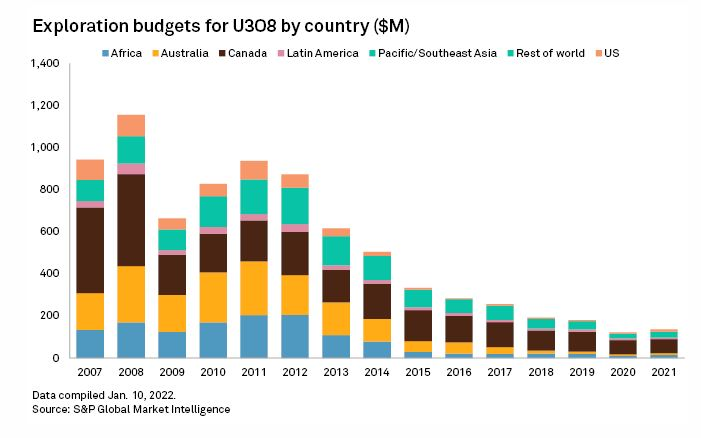

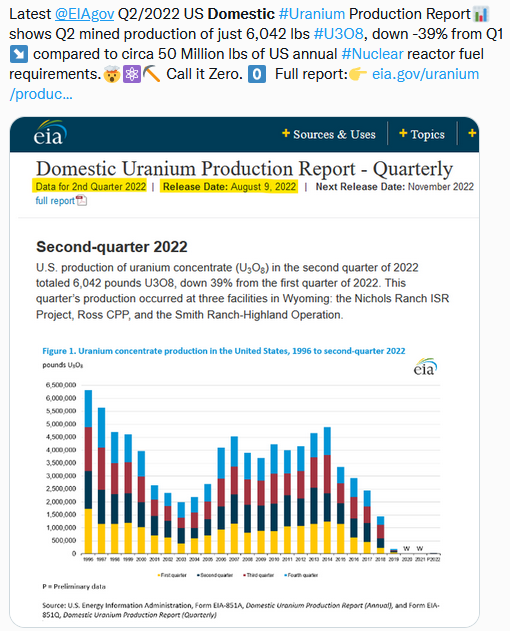

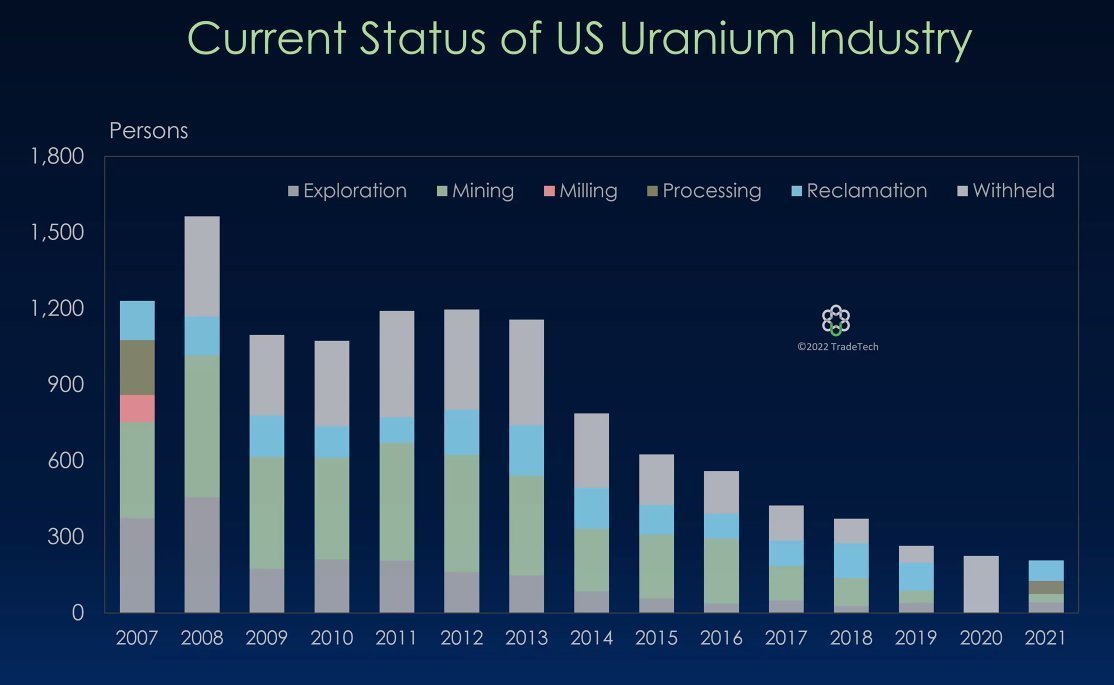

2)The #Uranium #mining #stocks #investing thesis in a nutshell🥜 is that after Fukushima the #U3O8 price sank, new mine projects were cancelled, many mines closed, investment dropped💰⤵️ as investors mistakenly thought '#Nuclear #energy is dying'🪦 but they were wrong!✖️😯../3👇

2)The #Uranium #mining #stocks #investing thesis in a nutshell🥜 is that after Fukushima the #U3O8 price sank, new mine projects were cancelled, many mines closed, investment dropped💰⤵️ as investors mistakenly thought '#Nuclear #energy is dying'🪦 but they were wrong!✖️😯../3👇

Lowest risk #Uranium #investing option🦺 is a Fund that stacks raw #Nuclear fuel #U3O8🏦⚛️ providing direct 1-to-1 exposure to U3O8 Spot price.📈👯 In North America that's @Sprott Physical Uranium Trust (TSX: $U.UN $U.U OTC: $SRUUF)🇺🇸🇨🇦 & in #UK Yellow Cake plc (AIM: $YCA)🇬🇧🛒⛏️

Lowest risk #Uranium #investing option🦺 is a Fund that stacks raw #Nuclear fuel #U3O8🏦⚛️ providing direct 1-to-1 exposure to U3O8 Spot price.📈👯 In North America that's @Sprott Physical Uranium Trust (TSX: $U.UN $U.U OTC: $SRUUF)🇺🇸🇨🇦 & in #UK Yellow Cake plc (AIM: $YCA)🇬🇧🛒⛏️

2)#Uranium is a very different fuel than #coal & #gas that are burned "as is" in #electricity power plants.🏭⚡️ #Nuclear reactor fuel needs to be specially processed & then packaged into fuel rods that are then loaded into reactors to generate #CarbonFree electricity.🌞⚛️⚡️👇../3

2)#Uranium is a very different fuel than #coal & #gas that are burned "as is" in #electricity power plants.🏭⚡️ #Nuclear reactor fuel needs to be specially processed & then packaged into fuel rods that are then loaded into reactors to generate #CarbonFree electricity.🌞⚛️⚡️👇../3

2)The #Uranium #mining #stocks #investing thesis in a nutshell🥜 is that after Fukushima the #U3O8 price sank, new mine projects were cancelled, many mines closed, investment dropped💰⤵️ as investors mistakenly thought '#Nuclear #energy is dying'🪦 but they were wrong!✖️😯../3👇

2)The #Uranium #mining #stocks #investing thesis in a nutshell🥜 is that after Fukushima the #U3O8 price sank, new mine projects were cancelled, many mines closed, investment dropped💰⤵️ as investors mistakenly thought '#Nuclear #energy is dying'🪦 but they were wrong!✖️😯../3👇

2) For illustrative purposes I'll use Spot #Uranium & #Nuclear fuel cycle prices published by @Numerco a year ago on 16 December 2021 before #Russia's invasion🪖 when optimal tails assay was 0.146%:

2) For illustrative purposes I'll use Spot #Uranium & #Nuclear fuel cycle prices published by @Numerco a year ago on 16 December 2021 before #Russia's invasion🪖 when optimal tails assay was 0.146%:

2) #Nuclear #energy has recovered over the past decade⚛️🏗️⤴️ so that #Uranium demand today is back where it was before Fukushima & surging higher.🌞 A #Nuclear revival has been underway for years📈 now kicked into high gear🏎️ by an #EnergyCrisis & #NetZero targets.🎯⚡️⏫ .../3👇

2) #Nuclear #energy has recovered over the past decade⚛️🏗️⤴️ so that #Uranium demand today is back where it was before Fukushima & surging higher.🌞 A #Nuclear revival has been underway for years📈 now kicked into high gear🏎️ by an #EnergyCrisis & #NetZero targets.🎯⚡️⏫ .../3👇

2) #Zaporizhzhya NPP's reactors were upgraded after Fukushima⚛️🧰👷 to prevent any hydrogen explosion & radiation release💥 as happened in Japan due to the lack of a steel-reinforced concrete containment dome and passive hydrogen venting in their 1960's vintage reactors.☮️.../3👇

2) #Zaporizhzhya NPP's reactors were upgraded after Fukushima⚛️🧰👷 to prevent any hydrogen explosion & radiation release💥 as happened in Japan due to the lack of a steel-reinforced concrete containment dome and passive hydrogen venting in their 1960's vintage reactors.☮️.../3👇

2) #Nuclear #energy has grown steadily over past decade so that #Uranium demand today is back where it was before Fukushima.🌞⚛️🏗️↗️ A #Nuclear renaissance has been quietly underway for years📈 & has been kicked into high gear by the #ClimateCrisis & #EnergyCrisis.🏎️🏗️⏫ .../3👇

2) #Nuclear #energy has grown steadily over past decade so that #Uranium demand today is back where it was before Fukushima.🌞⚛️🏗️↗️ A #Nuclear renaissance has been quietly underway for years📈 & has been kicked into high gear by the #ClimateCrisis & #EnergyCrisis.🏎️🏗️⏫ .../3👇

https://twitter.com/NucNetNews/status/15689230528423116832)Fukushima Daiichi #nuclear reactors were 1960's vintage with no steel-reinforced concrete containment. A loss of backup power led to a hydrogen explosion & radiation release. After Fukushima, ZNPP reactors were upgraded to prevent that from ever happening at #Zaporizhzhia .../3

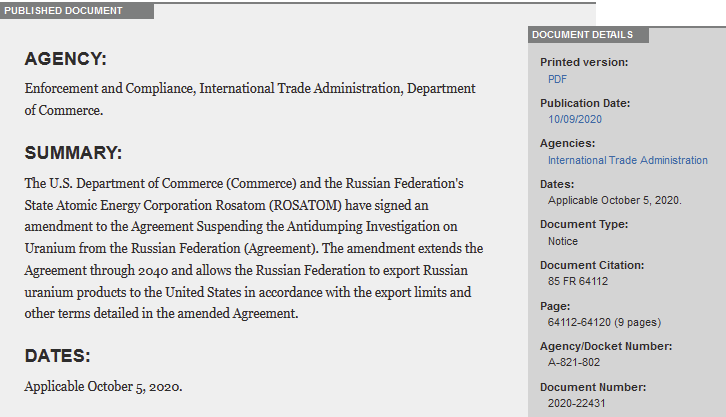

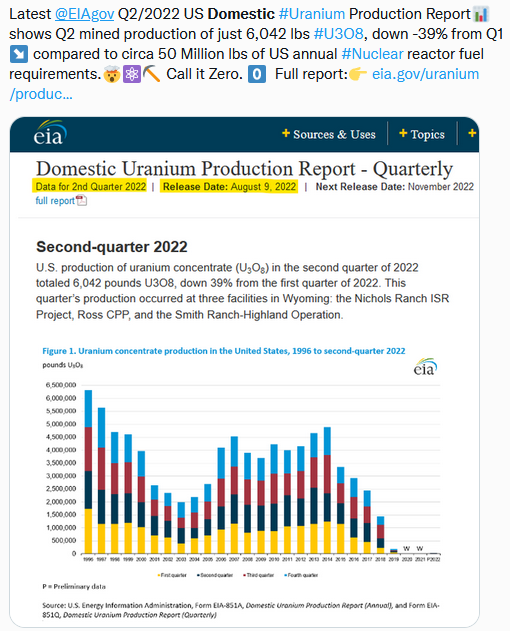

2)US #Nuclear utilities send #Russia hundreds of $Millions per year under a "Russian Suspension Agreement" US government extended in 2020 that allows utilities to purchase & import 20% of their enriched #Uranium reactor fuel from Russia (about 10M lbs/yr #U3O8 equivalent)😯../3👇

2)US #Nuclear utilities send #Russia hundreds of $Millions per year under a "Russian Suspension Agreement" US government extended in 2020 that allows utilities to purchase & import 20% of their enriched #Uranium reactor fuel from Russia (about 10M lbs/yr #U3O8 equivalent)😯../3👇