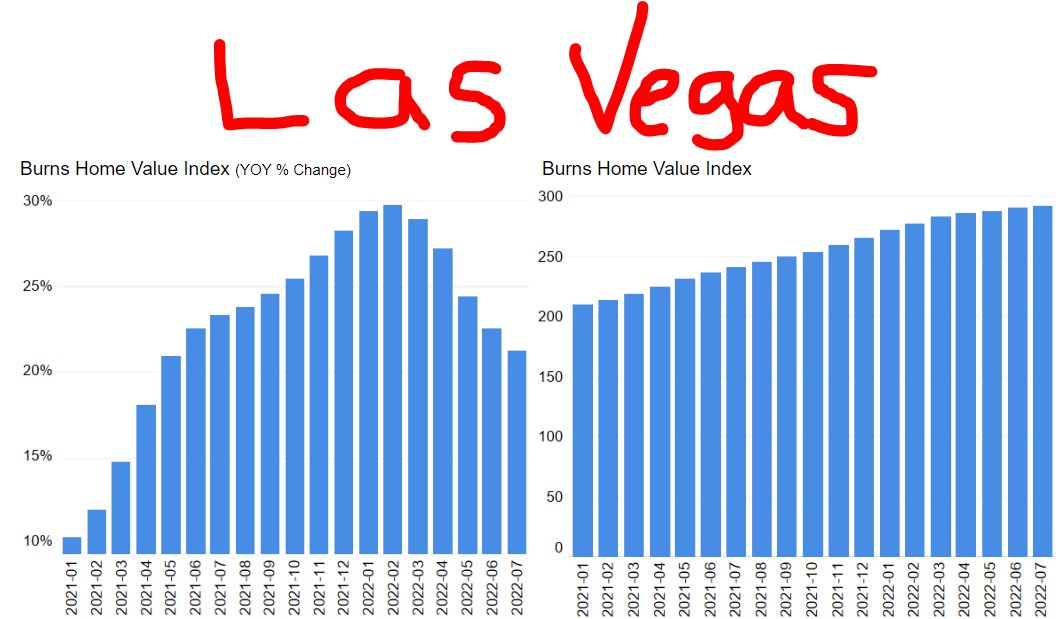

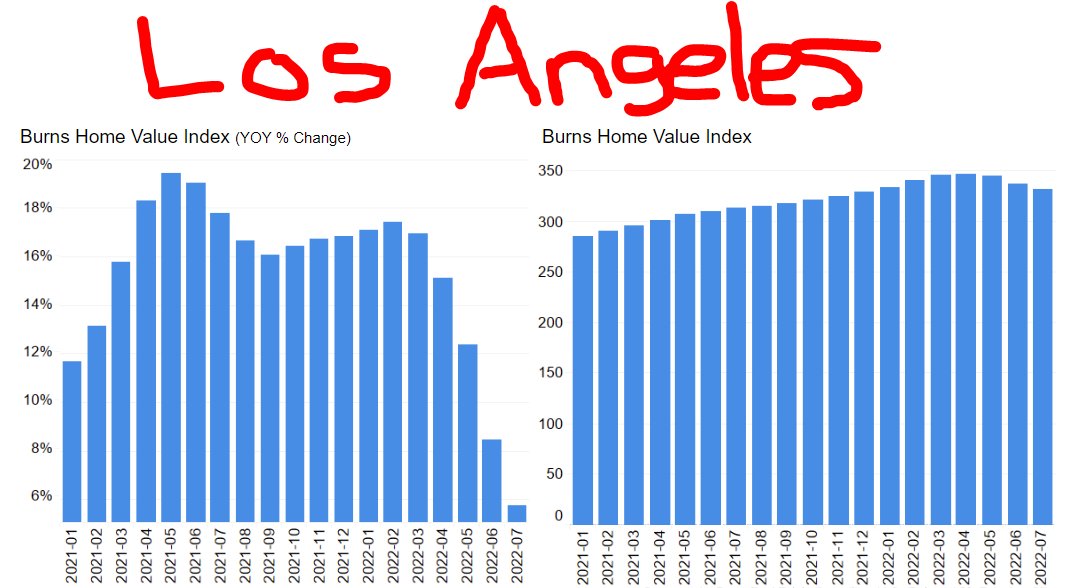

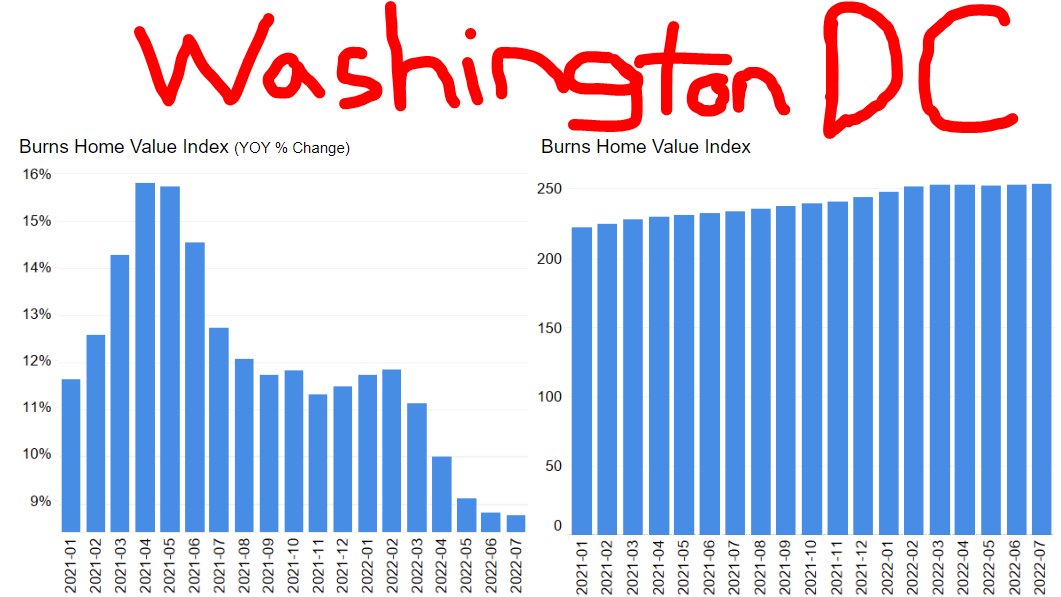

Home price trends across 20 top housing markets. Pace of price increases moderating (left chart), which you can see in our underlying home price index flattening out or actually falling in a few markets (right chart). Start it off with #Atlanta.

#Austin home prices

#Boise home prices

#Charlotte home prices

#Chicago home prices

#Dallas home prices

#Denver home prices

#Houston home prices

#LasVegas home prices

#LosAngeles home prices

#Miami home prices still going vertical.

#Nashville home prices

#Orlando home prices

#Phoenix home prices

#Sacramento home prices

#SanAntonio home prices

#SanJose home prices

#Seattle home prices

#Tampa home prices

#WashingtonDC home prices

• • •

Missing some Tweet in this thread? You can try to

force a refresh