#GM!

1/ What is Maximal Extractable Value (#MEV)? How does it become an integral part of the #blockchain network? How does MEV work? All of your questions will be answered in our latest #visualguide.

#Ethereum #cryptocurrency #TheMerge $ETH #DeFi

1/ What is Maximal Extractable Value (#MEV)? How does it become an integral part of the #blockchain network? How does MEV work? All of your questions will be answered in our latest #visualguide.

#Ethereum #cryptocurrency #TheMerge $ETH #DeFi

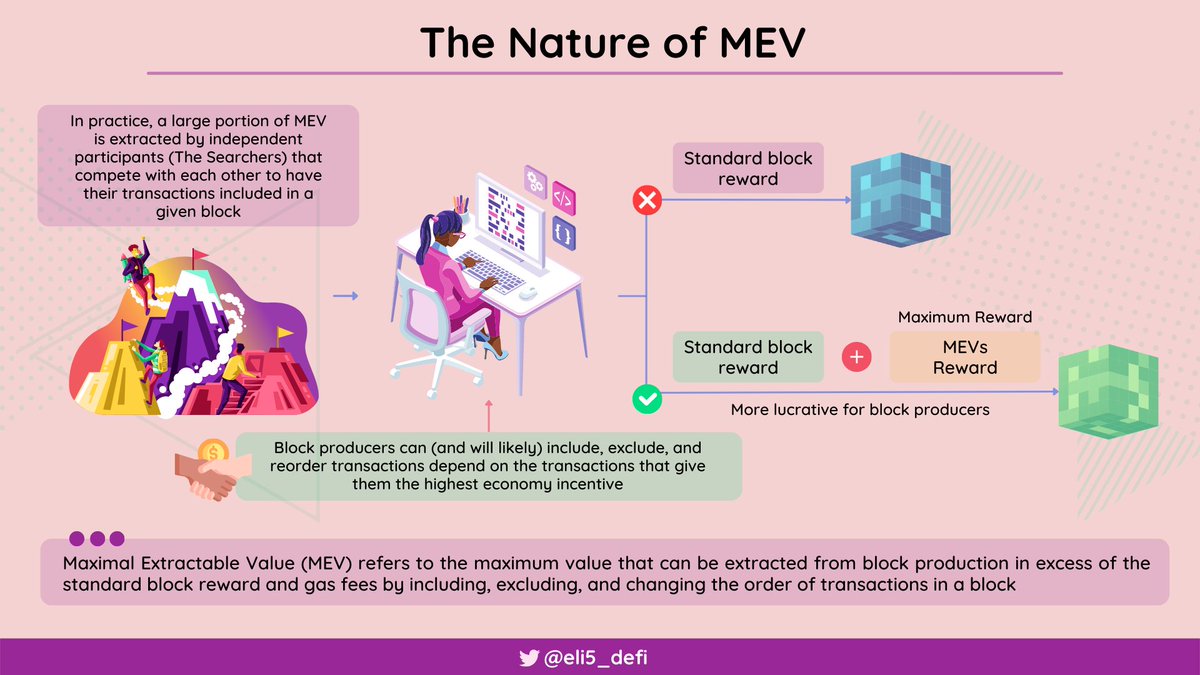

2/ In the blockchain transaction ordering process, the block producers are responsible to aggregate, selecting, and reordering transactions in the #blockchain network based on the given economic incentives thus creating opportunities for #MEV

3/ #MEV refers to the maximum value that can be extracted from a block more than the standard block reward and gas fees by including, excluding, and changing the order of transactions in a block

4/ In practice, a large portion of #MEV is extracted by independent participants (The Searchers) that deploy sophisticated value extraction strategies and compete with each other to have their transactions included in a given block

5/ There are several examples of value extractions strategies for #MEV:

- Gas golfing

- Generalized front-running

- Back running

- Time-Bandit Attack

- Gas golfing

- Generalized front-running

- Back running

- Time-Bandit Attack

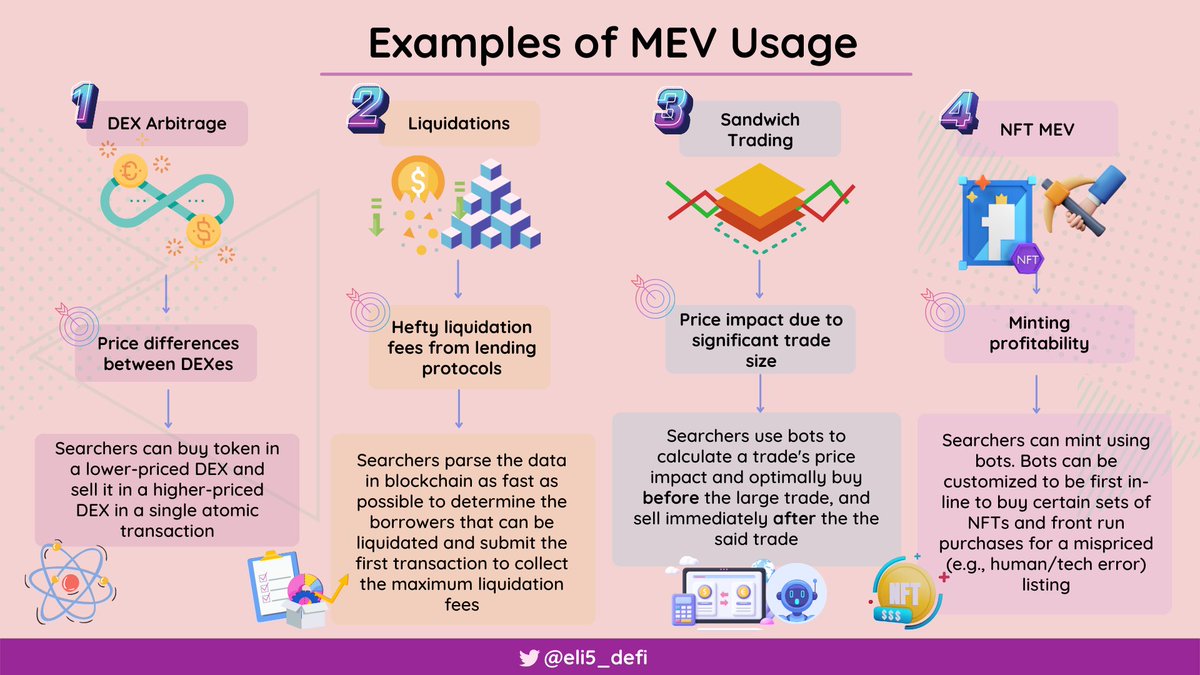

6/ #MEV is also being utilized for several conditions:

- #DEX Arbitrage

- Liquidations

- Sandwich Trading

- #NFT MEV

- #DEX Arbitrage

- Liquidations

- Sandwich Trading

- #NFT MEV

7/ #MEV efficiency/ incentive create lucrative opportunities and competition in a limited block space resulting in a congested network and exorbitant gas fees. MEV also can destabilize the consensus and lead to blockchain reorganization.

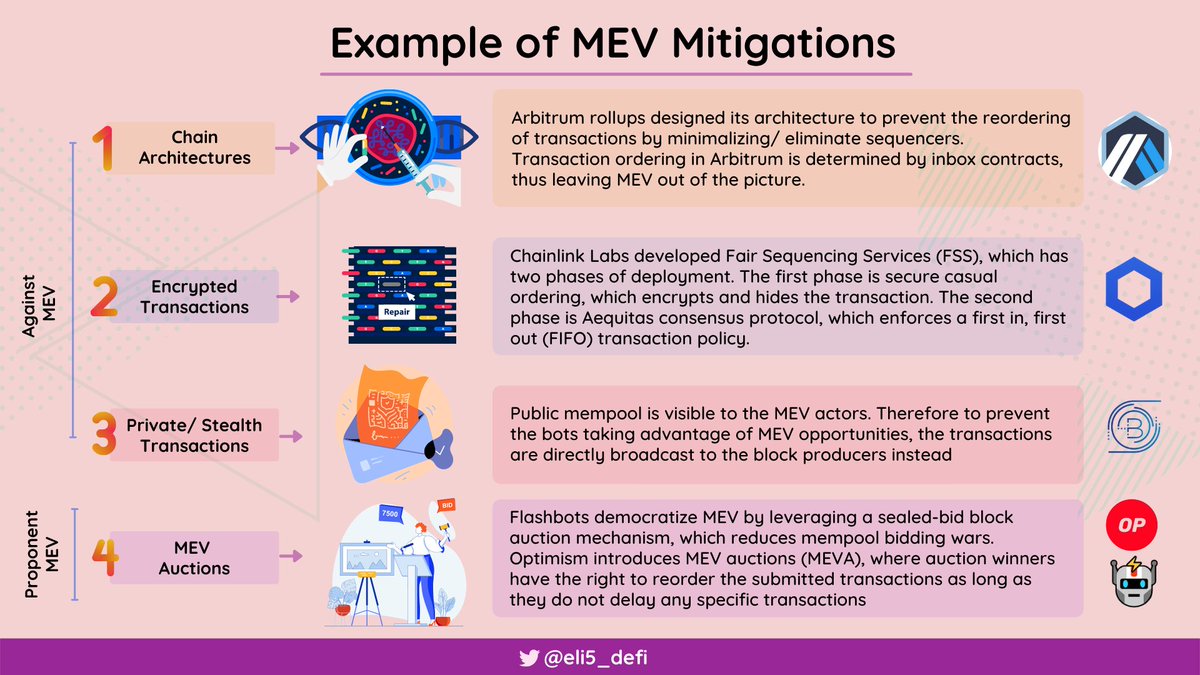

8/ Several mitigations have been proposed to reduce #MEV negative externalities, such as:

- Chain architectures (@arbitrum)

- Encrypted transactions (@chainlink)

- Private/ stealth transactions (@bloxroute)

- MEV Auctions (#FlashBots, @optimism)

- Chain architectures (@arbitrum)

- Encrypted transactions (@chainlink)

- Private/ stealth transactions (@bloxroute)

- MEV Auctions (#FlashBots, @optimism)

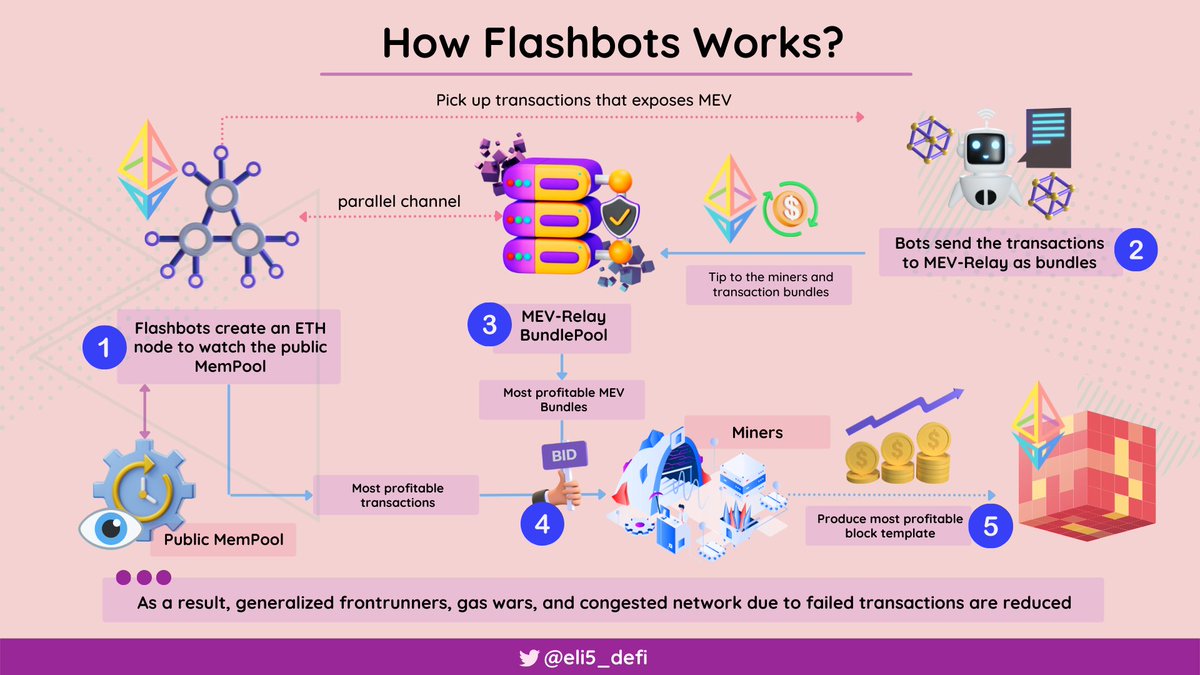

9/ #FlashBots is a research and development organization that aims to bring transparency to MEV activity, democratize MEV and distribute the fair redistribution of #MEV revenue to prevent the existential risk caused by #MEV.

@thegostep @hasufl @bertcmiller

@thegostep @hasufl @bertcmiller

10/ #FlashBots work by connecting up The Searchers and The Block Producers together through their sealed-bid block auction mechanism. The transactions relayed to the Flashbots server will not be broadcasted to the public pool which lessens the negative #MEV externalities.

11/ Proposer/ Builder Separation (#PBS) is splitting the block construction role from the block proposal role in #POS #Ethereum. However, it is not an immediate requirement for #TheMerge to complete.

@VitalikButerin @drakefjustin @fradamt @ObadiaAlex @phildaian

@VitalikButerin @drakefjustin @fradamt @ObadiaAlex @phildaian

12/ #PBS integration will be disruptive for #Ethereum and #MEV because of these reasons:

- Encourage block diversity

- Competition to create 'The Best Block'

- Non-economic agenda can be accommodated by the block proposers

- Drive Ethereum towards modularization

- Encourage block diversity

- Competition to create 'The Best Block'

- Non-economic agenda can be accommodated by the block proposers

- Drive Ethereum towards modularization

13/ As the #PBS isn't required immediately after The Merge, the community put efforts into a project called MEV-Boost. #MEV-Boost streamlines and utilizes the post-merge MEV process that aligns with PBS.

@thegostep

@thegostep

16/ The complete A to Z information about #Ethereum #Merge to #POS can be found in our previous thread:

https://twitter.com/eli5_defi/status/1551217741985591296?s=20&t=rSqHGs-DSEuYGK2WKu-0GQ

17/ We also cover #Ethereum Layer 2 rollups solution in here:

#DeFi #Crypto #Bitcoin #Ethereum #Arbitrum #Optimism #L222 #ZKSync $ETH

#DeFi #Crypto #Bitcoin #Ethereum #Arbitrum #Optimism #L222 #ZKSync $ETH

https://twitter.com/eli5_defi/status/1533504611273031680?s=20&t=rSqHGs-DSEuYGK2WKu-0GQ

18/ Tagged account below for #MEV education and visibilities:

@hasufl

@thegostep

@0xmisaka

@bertcmiller

@sxysun1

@libevm

@FrankieIsLost

@0xfoobar

@noxx3xxon

@mevintern

@mevcollector

@snoopy_mev

@0xShitTrader

@Figment_io

@hasufl

@thegostep

@0xmisaka

@bertcmiller

@sxysun1

@libevm

@FrankieIsLost

@0xfoobar

@noxx3xxon

@mevintern

@mevcollector

@snoopy_mev

@0xShitTrader

@Figment_io

19/ And shout-out to the account below for amazing educational content across CT:

@SalomonCrypto

@blocmatesdotcom

@shivsakhuja

@rektdiomedes

@knowerofmarkets

@rektdiomedes

@BarryFried1

@The_ReadingApe

@VirtualKenji

@ManoppoMarco

@Storgan_ManleyX

@SalomonCrypto

@blocmatesdotcom

@shivsakhuja

@rektdiomedes

@knowerofmarkets

@rektdiomedes

@BarryFried1

@The_ReadingApe

@VirtualKenji

@ManoppoMarco

@Storgan_ManleyX

20/ Like our thread and want to support us? please use our #GMX referral link for 10% trading discount:

gmx.io/#/?ref=eli5defi

gmx.io/#/?ref=eli5defi

21/ If you find our thread and visual guide useful, please like and retweet. Also, big thanks to @mimiLFG and @minnymousegirl for proofreading and reviewing this #visualguide

https://twitter.com/eli5_defi/status/1566089087542386689?s=20&t=B4HcvucKA47WvXcJQ9LXuw

• • •

Missing some Tweet in this thread? You can try to

force a refresh