#PreMarketCapsule | 5th September, Monday | Edition: 34

In the document ⬇️

1. #Nifty Range and Breadth

2. #Banknifty range and Breadth

3. #Sector Breadth

4. #FII Derivative Activity

5. #Summary of the analysis

In the document ⬇️

1. #Nifty Range and Breadth

2. #Banknifty range and Breadth

3. #Sector Breadth

4. #FII Derivative Activity

5. #Summary of the analysis

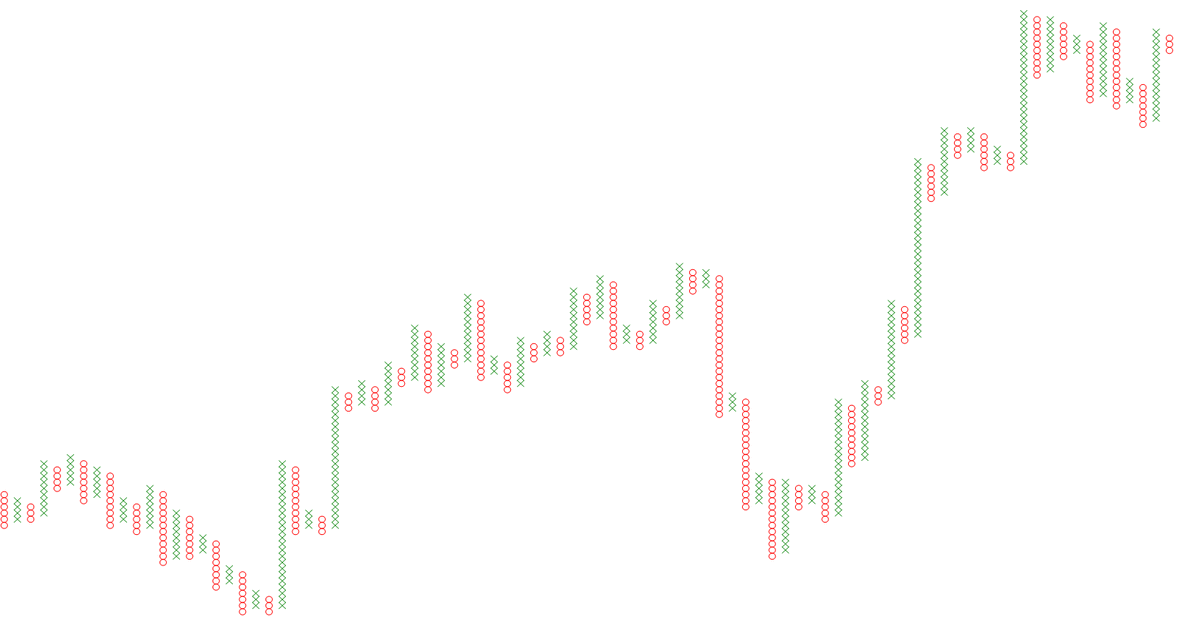

1. The marked zone in 'Green' is Demand Zone for Nifty

2. Price has traded there for more time than expected near the Demand Zone

3. Price trading near the demand zone is a negative sign and may have weakened the zone

#Nifty #nifty50 #NIFTYFUT

2. Price has traded there for more time than expected near the Demand Zone

3. Price trading near the demand zone is a negative sign and may have weakened the zone

#Nifty #nifty50 #NIFTYFUT

1. View is Bullish until trading above Triple Moving Average

2. Currently trading near previous Swing High

#Niftybank #banknifty #BNF

2. Currently trading near previous Swing High

#Niftybank #banknifty #BNF

#Sector #Analysis

#Auto #Bank #Financial Services #FMCG #Healthcare #IT #Media #Metal #Pharma #PrivateBank #PSUBank #Realty #ConsumerDurables #OilandGas

#Auto #Bank #Financial Services #FMCG #Healthcare #IT #Media #Metal #Pharma #PrivateBank #PSUBank #Realty #ConsumerDurables #OilandGas

Summary of #premarketcapsule for 5th September, Monday

To get early (a day before) and complete access to the document, join the Telegram Channel at t.me/thenoiselesstr… or Join Technical Club at @StockEdgeSocial

Software Credit: @Definedge

Data Credit: @mystockedge

Community Credit: @StockEdgeSocial

Software Credit: @Definedge

Data Credit: @mystockedge

Community Credit: @StockEdgeSocial

@StockEdgeSocial @Definedge @mystockedge That's a wrap!

If you enjoyed this thread:

1. Follow me @kaushikaki for more of these

2. RT the tweet below to share this thread with your audience

If you enjoyed this thread:

1. Follow me @kaushikaki for more of these

2. RT the tweet below to share this thread with your audience

https://twitter.com/kaushikaki/status/1566607093339242499

• • •

Missing some Tweet in this thread? You can try to

force a refresh