1/📸Here is the monthly catch-up of Global #DeFi market analysis for SEPTEMBER '22. Last one is here below. 📸

September was interesting and see few narratives taking the lead as part of the #realyield subject.

So Where are we in #DeFi ?

https://twitter.com/Subli_Defi/status/1565624050491219968?s=20&t=QNS13Dse0bAOCxHhD_6qOA

September was interesting and see few narratives taking the lead as part of the #realyield subject.

So Where are we in #DeFi ?

3/ On the other hand, #crypto total market cap decreased dow to 0.9b$, so -6% since last month.

As you can see both trends TVL/MC are similar, that tells me that there no mig movement in or out.

As you can see both trends TVL/MC are similar, that tells me that there no mig movement in or out.

4/ Now according to @TheBlock__ stablecoin MC is very steady and sits at 142$. However you can see some rotation between $USDT (+1% in Sept) and $USDC (-2%). Most likely because @circlepay blocked adresses due to Tornado cash story!

Solution => Diversification

Solution => Diversification

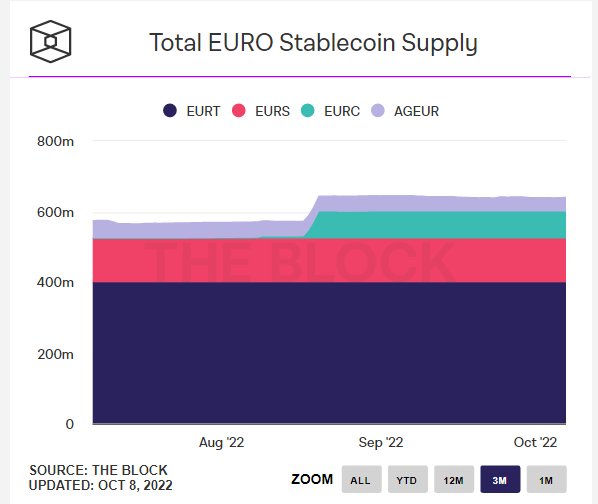

5/ $EUR stablecoin MC is also stable in September, no real change sitting at 640m$ Market Cap, which is only 0.44% of #stablecoins MC.

6/ But $EUR is still lossing its power against $USD and has breached the 1:1 threshold, and is now traded at 0.97$!!

It's a -24% fall in almost two years:

It's a -24% fall in almost two years:

7/ So here, nothing changed, and this steady state is governed by macro economics of course. I encourage you to read the below masterpiece made by @rektdiomedes :

https://twitter.com/rektdiomedes/status/1573379127532736512?s=20&t=b1vvGFPfr_J1FUy7htpJcQ

8/ In terms of chains, #L222 with #arbitrum and

#optimism continue to swallow TVL from other chains.

Smaller blockchains get an impressive increase of TVL also

#optimism continue to swallow TVL from other chains.

Smaller blockchains get an impressive increase of TVL also

9/ TVL of #Optimism is still driving by $OP Grants to project. If you want to know which protocols have been received $OP grants and how you can benefit as a #defi user, let's check this:

https://twitter.com/Subli_Defi/status/1576477062176440320?s=20&t=zSWdifu-eDeIWQqHlcuLDA

10/ I also recommend this smart article provided by @MessariCrypto :

https://twitter.com/MessariCrypto/status/1571091621961420802?s=20&t=zSWdifu-eDeIWQqHlcuLDA

11/ Activity on #Optimism jumped thanks to new Quests. Goal is for users to learn how to use 18 different protocols & mint #NFTs at completion

This could be useful for future airdrop (pure speculation)

I've made a full tuto for the 18 Quests:

This could be useful for future airdrop (pure speculation)

I've made a full tuto for the 18 Quests:

https://twitter.com/Subli_Defi/status/1573430677496025088?s=20&t=zSWdifu-eDeIWQqHlcuLDA

12/ Finally, on #Optimism something interesting to see! Despite a stable TVL, # of projects increased by 18%.

So a lot of things are coming and being built depiste this depressed time in #Cryptos

So a lot of things are coming and being built depiste this depressed time in #Cryptos

13/ #Arbitrum TVL did not change much, but same as for its sister blockchain, # of defi project increased by +10%.

Airdrop is still expected with new quests coming in September, you can have a look at this well done summary made by @corleonescrypto :

Airdrop is still expected with new quests coming in September, you can have a look at this well done summary made by @corleonescrypto :

https://twitter.com/corleonescrypto/status/1576914062578880513?s=20&t=zSWdifu-eDeIWQqHlcuLDA

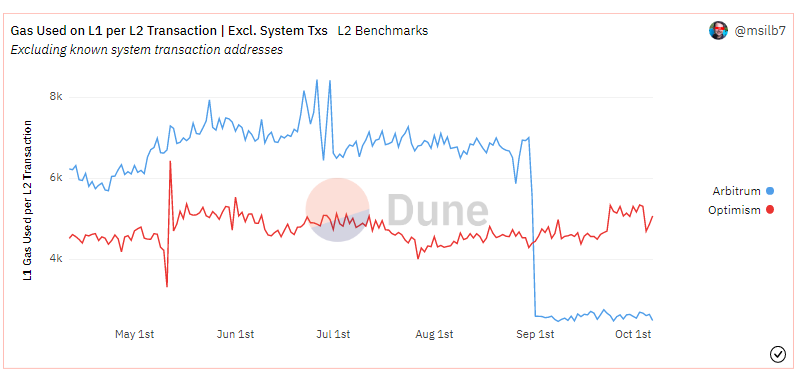

14/ However i see a big difference between these 2 Layer 2:

- #Optimism is the house of common mortals, Basic Defi products, accessible to everyone => Public goods

- #Arbitrum is the house of Defi-ers, with complex but efficient Financial Products (Perp, Options, DOV, etc...)

- #Optimism is the house of common mortals, Basic Defi products, accessible to everyone => Public goods

- #Arbitrum is the house of Defi-ers, with complex but efficient Financial Products (Perp, Options, DOV, etc...)

15/ But thanks to #arbitrumnitro upgrade made on 31-Aug, gas costs have been kept to the bottom allowing an increase qty of transactions for the pleasure of all of us

16/ Finally, getting out of analytics, i'd like to recommend some threads that can change the way you are tackling Defi? Let's start with @Dynamo_Patrick and it's master thread for crypto research:

https://twitter.com/Dynamo_Patrick/status/1568415104072585217?s=20&t=zSWdifu-eDeIWQqHlcuLDA

17/ @ReveloIntel is gathering fundamental data through interviews, global news and (the thing i like most due to lack of available time) provide summary of AMA with projects.

This newsletter is something i read during the morning.

This newsletter is something i read during the morning.

https://twitter.com/ReveloIntel/status/1566058200062902273?s=20&t=zSWdifu-eDeIWQqHlcuLDA

18/ As a CT "influencer" "creator" whatever you want to call me, the business model is always the same: 1st target is build a community.

I've learned a lot listening to @DeFi_Dad on this interview with @LongHashVC

I've learned a lot listening to @DeFi_Dad on this interview with @LongHashVC

https://twitter.com/LongHashVC/status/1577633551830245376?s=20&t=zSWdifu-eDeIWQqHlcuLDA

19/ Tokenomics is still the basis of all fundamental analysis. Remember that tokenizing an asset is used mainly for fund raising not always giving back money to investors! Read it twice!!

But here is a lit of must to read articles about #tokenomics:

But here is a lit of must to read articles about #tokenomics:

https://twitter.com/thedefivillain/status/1576550651915833344?s=20&t=zSWdifu-eDeIWQqHlcuLDA

20/ Of course this market is terrific at the moment, but there are still a lot of opportunities, you just need to look at the right place, at the right time, and conduct proper risk management. Here are some advices to go through that cycle:

https://twitter.com/TheDeFinvestor/status/1575911334163537920?s=20&t=zSWdifu-eDeIWQqHlcuLDA

21/ As DEFI is large, fortunately for all of us, we have guy such as @rektdiomedes that screens what's going on on the blockchain and listed projects that have kept shipping products that could make the difference in a near future:

https://twitter.com/rektdiomedes/status/1567248653974224900?s=20&t=zSWdifu-eDeIWQqHlcuLDA

I did not want to have this thread that long. Please let me know if this is too long or good like that. I want to make sure it meets your expectations.

If so, thanks for retweeting the 1st post:

New cacth-up in 4 weeks! Good lucj for October.

If so, thanks for retweeting the 1st post:

https://twitter.com/Subli_Defi/status/1578857907181195265?s=20&t=zSWdifu-eDeIWQqHlcuLDA

New cacth-up in 4 weeks! Good lucj for October.

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh