$FXS saw a nearly 18% surge at one point in the past 24h following the expectation about its upcoming liquid staking protocol and $frxETH release.

What's in store for @fraxfinance and what the future holds: A 🧵

0/ 👇

What's in store for @fraxfinance and what the future holds: A 🧵

0/ 👇

1/ On its way to becoming a "decentralized central bank," @fraxfinance has shipped new innovations to the #crypto-verse.

And $frxETH, a liquid $ETH staking derivative to maximize staking yield and smoothen the @Ethereum staking process, is the latest one to come to life.

And $frxETH, a liquid $ETH staking derivative to maximize staking yield and smoothen the @Ethereum staking process, is the latest one to come to life.

2/ $frxETH acts as an $ETH-pegged #stablecoin, but the peg will be "soft" at first and become "tight" after Shanghai withdrawals, according to @samkazemian:

As frxETH can be exchanged 1:1 with ETH, the amount of frxETH in circulation must be equal to the

https://twitter.com/ShivanshuMadan/status/1572858258452520962

As frxETH can be exchanged 1:1 with ETH, the amount of frxETH in circulation must be equal to the

3/ amount of ETH in the Frax #ETH system.

It will join the liquid staking space with 40 fellow protocols as per @DefiLlama.

But how is $frxETH different from the others, especially $stETH? A product with a unique selling point is needed to persuade users to use it.

It will join the liquid staking space with 40 fellow protocols as per @DefiLlama.

But how is $frxETH different from the others, especially $stETH? A product with a unique selling point is needed to persuade users to use it.

4/ $stETH is not designed as a #stablecoin, and it does not have to trade 1:1 to $ETH to function correctly.

#stETH uses the rebasing mechanism to accrue yields, and it needs to be wrapped (aka $wstETH) for easier integrations with #DeFi protocols including @Uniswap.

#stETH uses the rebasing mechanism to accrue yields, and it needs to be wrapped (aka $wstETH) for easier integrations with #DeFi protocols including @Uniswap.

5/ Meanwhile in the $frxETH case:

Users deposit 1 $ETH -> receive 1 $frxETH -> exchange $frxETH for $sfrxETH by depositing it into the sfrxETH vault -> earn staking yield on their $frxETH.

So $frxETH is like $WETH -> easy access to #DeFi protocols.

Users deposit 1 $ETH -> receive 1 $frxETH -> exchange $frxETH for $sfrxETH by depositing it into the sfrxETH vault -> earn staking yield on their $frxETH.

So $frxETH is like $WETH -> easy access to #DeFi protocols.

6/ But the difference is, when users convert $ETH to $frxETH, their #ETH is already staked in a validator for yield.

Why two tokens? Why don't just use frxETH for value capturing?

That was well said in the design of frxETH as a stablecoin: it needs to keep the 1:1 peg with ETH.

Why two tokens? Why don't just use frxETH for value capturing?

That was well said in the design of frxETH as a stablecoin: it needs to keep the 1:1 peg with ETH.

7/ Which means that it shouldn't exp changes that can push the price far from where $ETH is.

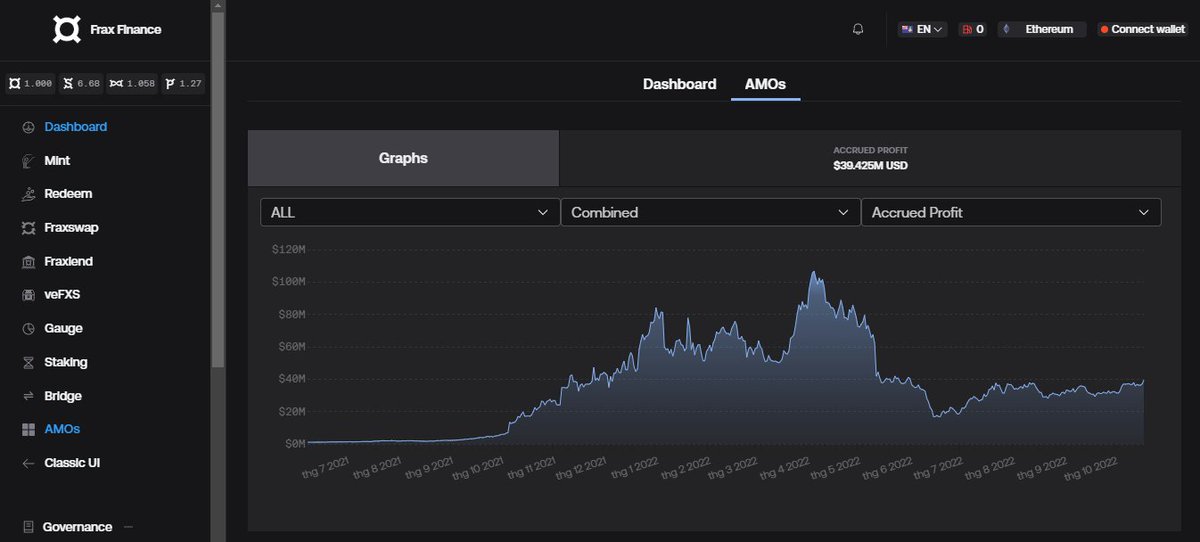

A stablecoin has to keep its peg, and it is when @fraxfinance AMOs come to the discussion imo.

Tl;dr: AMOs perform open market operations algorithmically to make $FRAX stay at $1, and

A stablecoin has to keep its peg, and it is when @fraxfinance AMOs come to the discussion imo.

Tl;dr: AMOs perform open market operations algorithmically to make $FRAX stay at $1, and

8/ it can do the same for $frxETH besides users arbitrages.

That is possible as there will be a #ETH/#frxETH pool on @curvefinance. #Frax bribes can create a better yield than the 5% ETH staking yield.

And frxETH will be used in other @fraxfinance products, such as Fraxlend.

That is possible as there will be a #ETH/#frxETH pool on @curvefinance. #Frax bribes can create a better yield than the 5% ETH staking yield.

And frxETH will be used in other @fraxfinance products, such as Fraxlend.

9/ The team expects more yields for users as the asset is playing around the #Frax ecosystem instead of unlocking just staking fees & block rewards.

Still almost 2 weeks away before the public launch, but the system has been up and running with 739 $ETH staked and 15 blocks.

Still almost 2 weeks away before the public launch, but the system has been up and running with 739 $ETH staked and 15 blocks.

10/ Although there's not much information announced, @DeFiDave22 revealed a bullish narrative for $frxETH and $FRAX (now reached $1.363B in market cap).

And the community started with interesting questions while FraxFerry is being developed.

https://twitter.com/DeFiDave22/status/1558550393415553024

And the community started with interesting questions while FraxFerry is being developed.

11/ There have been currently no public statements from the team so far, but it couldn't stop $FXS from climbing.

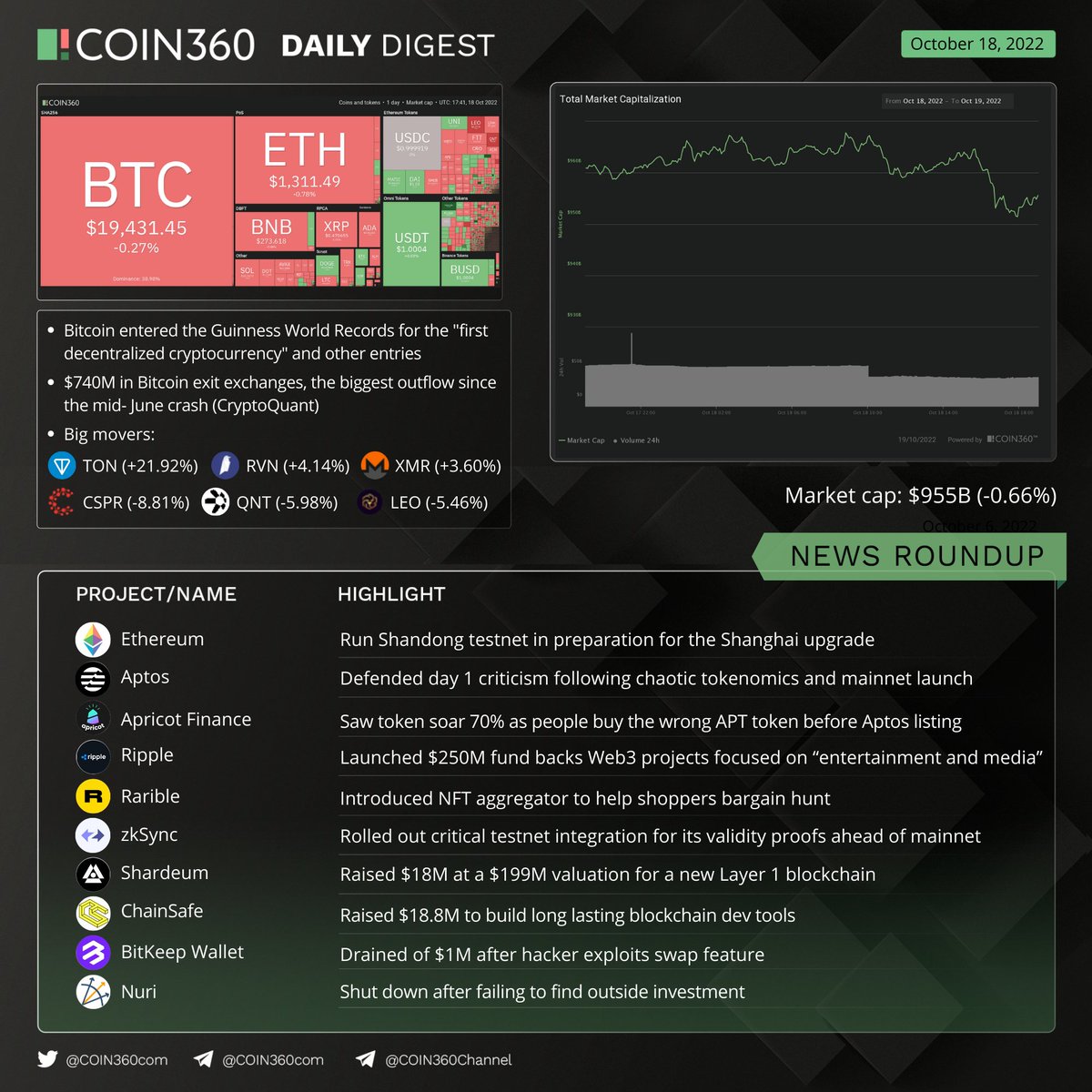

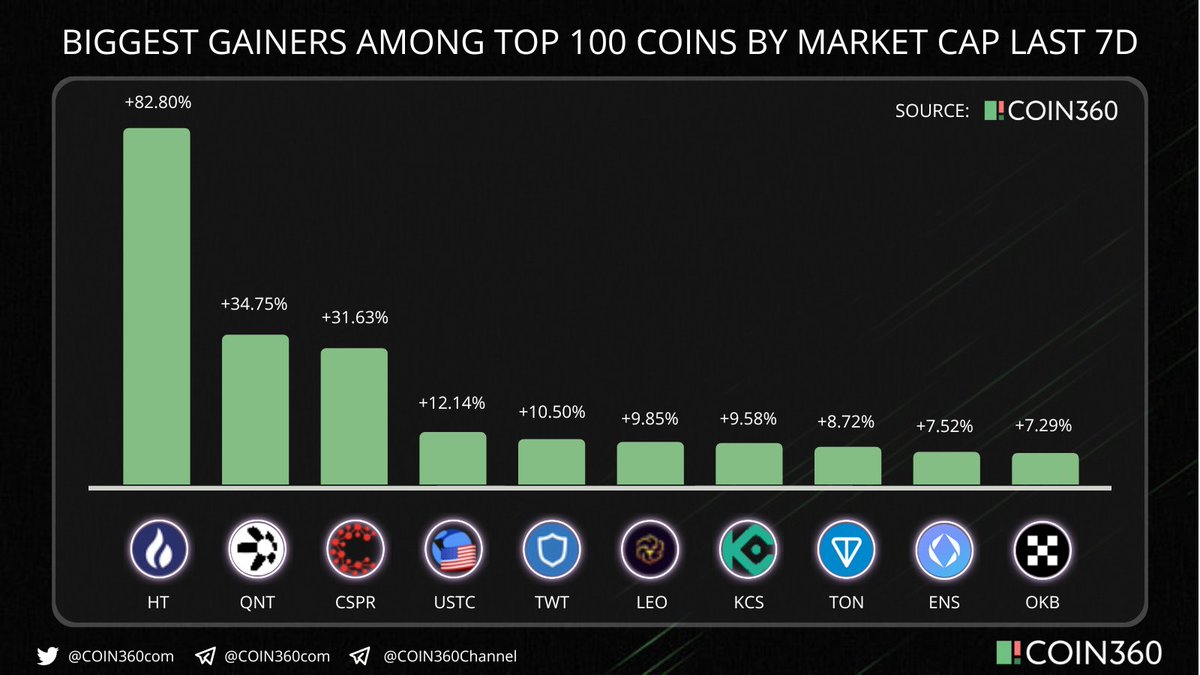

As per @COIN360com, @fraxfinance native token has:

+9.15% in 24h

+30% in 7D

+24.65% in 30D

coin360.com/coin/frax-shar…

As per @COIN360com, @fraxfinance native token has:

+9.15% in 24h

+30% in 7D

+24.65% in 30D

coin360.com/coin/frax-shar…

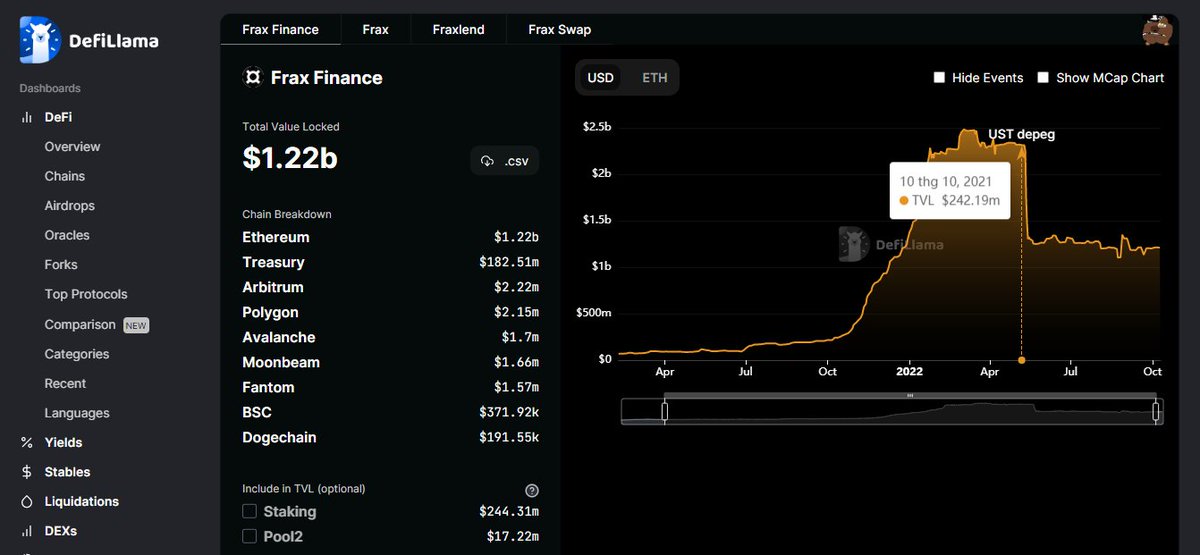

12/ It's currently the #12 biggest #DeFi protocol by TVL on @defillama, with a +5.25% increase in the past month.

@fraxfinance AMOs alone generated $39.425M in accrued profit as of Oct 18.

@fraxfinance AMOs alone generated $39.425M in accrued profit as of Oct 18.

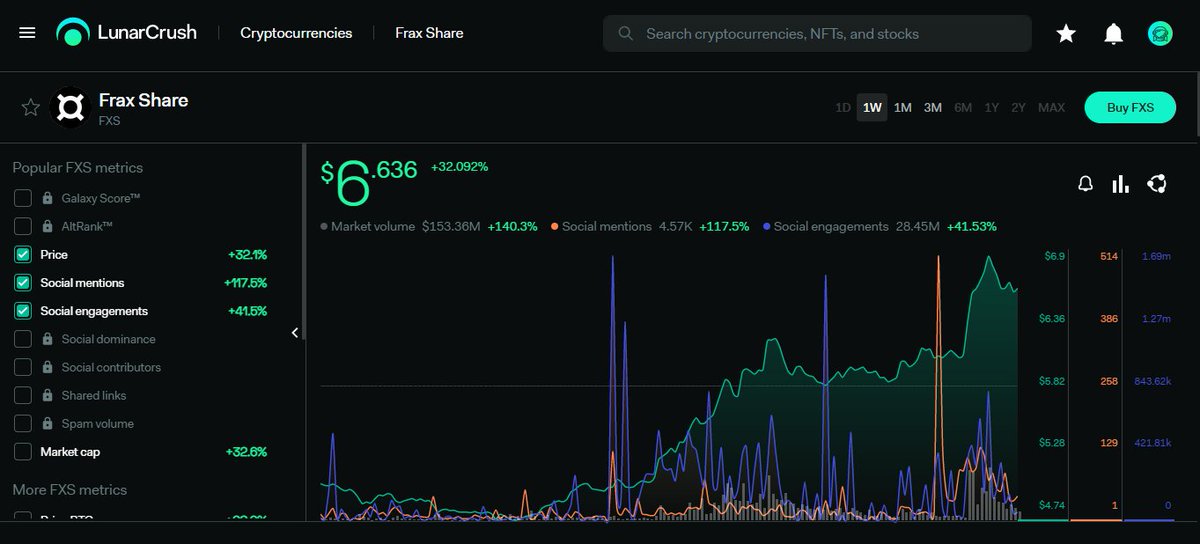

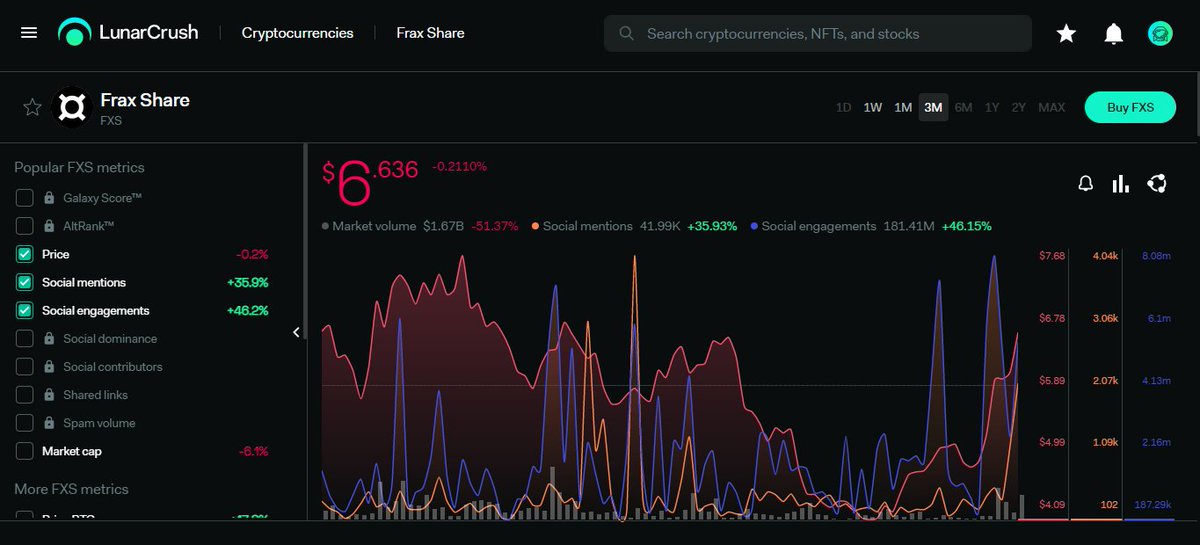

13/ According to @LunarCrush, @fraxfinance social dominance has grown over the last 3 months, but it only saw a big difference last week.

Specifically:

- Social mentions: +35.9% in 3M, -37.3% in 1M, +117.5% in 1W

- Social engagements: +46.2% in 3M, +15.1% in 1M, +41.5% in 1W

Specifically:

- Social mentions: +35.9% in 3M, -37.3% in 1M, +117.5% in 1W

- Social engagements: +46.2% in 3M, +15.1% in 1M, +41.5% in 1W

14/ More details on @fraxfinance?

We have some useful links for you:

1️⃣ #Frax tokens & how they work:

$FXS: coin360.com/coin/frax-shar…

$FRAX: coin360.com/coin/frax-frax

2️⃣ $frxETH in-depth explanation by @ShivanshuMadan:

And @0xLolin:

We have some useful links for you:

1️⃣ #Frax tokens & how they work:

$FXS: coin360.com/coin/frax-shar…

$FRAX: coin360.com/coin/frax-frax

2️⃣ $frxETH in-depth explanation by @ShivanshuMadan:

https://twitter.com/ShivanshuMadan/status/1573752587219742720

And @0xLolin:

https://twitter.com/0xLolin/status/1560396678930341888

15/

3️⃣ The bull case for $FRAX as “The Central Bank of the Internet” by @Ishanb22:

4️⃣ Frax overview by @MessariCrypto: messari.io/report/the-def…

5️⃣ @flywheelpod on frxETH:

flywheeloutput.com/p/everything-w…

And Frax's DeFi Trinity Stack: flywheeloutput.com/p/fraxs-defi-t…

3️⃣ The bull case for $FRAX as “The Central Bank of the Internet” by @Ishanb22:

https://twitter.com/Ishanb22/status/1564270700277501956

4️⃣ Frax overview by @MessariCrypto: messari.io/report/the-def…

5️⃣ @flywheelpod on frxETH:

flywheeloutput.com/p/everything-w…

And Frax's DeFi Trinity Stack: flywheeloutput.com/p/fraxs-defi-t…

16/

6️⃣ What's Next for FRAX/FXS by @compassings: compassings.substack.com/p/whats-next-f…

7️⃣ @fraxfinance Mega Thesis by @Rewkang:

8️⃣ Frax TVL on @defillama: defillama.com/protocol/frax-…

9️⃣ Frax $FXS social stats on @lunarcrush: lunarcrush.com/coins/fxs/frax…

6️⃣ What's Next for FRAX/FXS by @compassings: compassings.substack.com/p/whats-next-f…

7️⃣ @fraxfinance Mega Thesis by @Rewkang:

https://twitter.com/Rewkang/status/1479193841680928768

8️⃣ Frax TVL on @defillama: defillama.com/protocol/frax-…

9️⃣ Frax $FXS social stats on @lunarcrush: lunarcrush.com/coins/fxs/frax…

17/ Who to follow for various views and insights?

@samkazemian is the #1 choice (ofc), followed by the giga 🧠 s:

@DeFiDave22

@flywheelpod

@0xLolin

@ShivanshuMadan

@MessariCrypto

@Ishanb22

@compassings

@Rewkang

Plus @DefiMoon @Crypto_McKenna etc to name a few.

@samkazemian is the #1 choice (ofc), followed by the giga 🧠 s:

@DeFiDave22

@flywheelpod

@0xLolin

@ShivanshuMadan

@MessariCrypto

@Ishanb22

@compassings

@Rewkang

Plus @DefiMoon @Crypto_McKenna etc to name a few.

18/ That's a quick wrap for Frax updates. A big thank you to all the teams/people mentioned in this thread for your data and insights!

Did we miss something? Any #DeFi enthusiast please feel free to join the discussion and correct me if I'm wrong somewhere.

Together we learn 🫡

Did we miss something? Any #DeFi enthusiast please feel free to join the discussion and correct me if I'm wrong somewhere.

Together we learn 🫡

19/ Join us on #Twitter and #Telegram for the latest updates (we also provide you with a collection of insights from thought leaders in the Telegram channel every day 😉).

Telegram chat: t.me/COIN360com

Telegram announcement: t.me/COIN360Channel

Telegram chat: t.me/COIN360com

Telegram announcement: t.me/COIN360Channel

20/ If you found this thread helpful, please show some love on our first tweet:

Support much appreciated!

https://twitter.com/COIN360com/status/1582365020150562817

Support much appreciated!

• • •

Missing some Tweet in this thread? You can try to

force a refresh