We have now 3 months of disaggregated #trade data for FY23 in #Pakistan. Visible deceleration both on #exports and #imports. Some key elements in 🧵below:

#Exports grew in Jul-Sep 23 versus Jul-Sep 22 by 5.3%. Slightly faster growth in #goods than in #services.

#Pakistan

#Pakistan

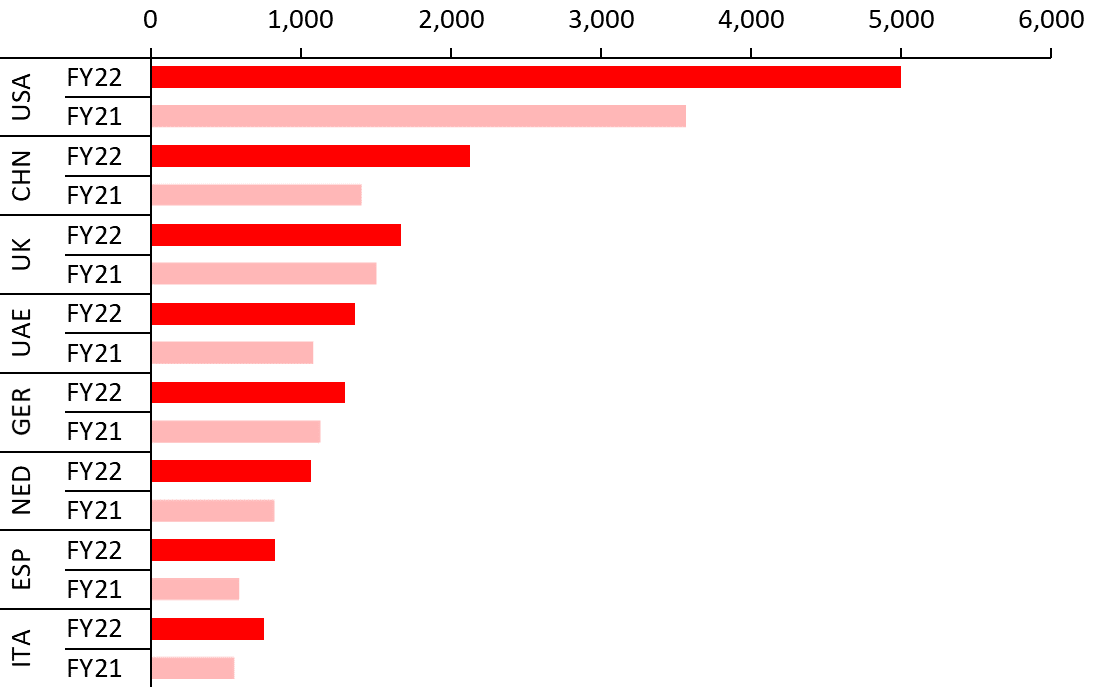

By destination: in general, expansions, but contractions of shipments to #China, to #UK and to #UAE.

#exports #Pakistan

#exports #Pakistan

#Textile #exports still expanding but at substantially lower rates. Contractions in exports of base metals, chemicals and minerals.

#Pakistan

#Pakistan

In #services, a concerning decline in #exports of #knowledge intensive services: telecom and business services.

#Pakistan

#Pakistan

In sum:

Deceleration in trade is associated with the deceleration in activity.

Restrictions to imports, particularly of #machinery and spare parts are a challenge for #exporters. /end

Deceleration in trade is associated with the deceleration in activity.

Restrictions to imports, particularly of #machinery and spare parts are a challenge for #exporters. /end

• • •

Missing some Tweet in this thread? You can try to

force a refresh