Community banks have long been targets by bad actors.

With limited resources and capabilities bad actors Trojan their way into the bank to launder their cash.

#communityone #ponzi #communitybank #fraud

With limited resources and capabilities bad actors Trojan their way into the bank to launder their cash.

#communityone #ponzi #communitybank #fraud

with crypto the bad actors waltz in the front door under the guise of digital transformation.

So imagine the world of pain a little community bank will find itself in when its not just suspect accounts they may have inadvertently laundered.

So imagine the world of pain a little community bank will find itself in when its not just suspect accounts they may have inadvertently laundered.

But the great white knight of their local bank thats been part of the community for 100 years is the biggest fraud of them all.

Now think about this.

If the smartest guys in the industry ...who are self proclaimed smartest and most astute nobheads that have ever walked the planet are flapping around saying .....no one saw this coming.

What chances does anyone in a tiny little community bank have?

How many community banks are in the US?

How many are at risk...how many have been exploited by those walking in the front door promising the world.

How many are at risk...how many have been exploited by those walking in the front door promising the world.

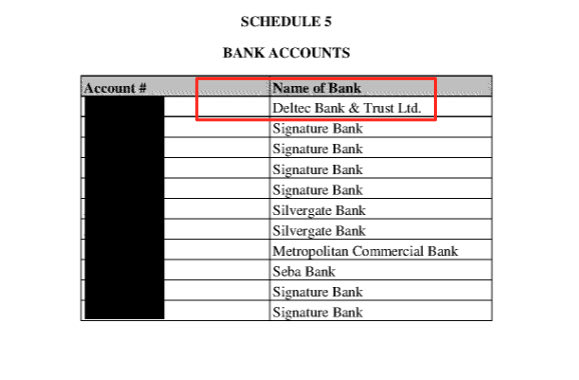

How many of #silvergate's other clients are community banks? How many are shelf co's self reporting crapo money transmission spivs? and how many of those are funneling cash to the digital exchanges? h/t @DataFinnovation for flagging silvergate's report....

• • •

Missing some Tweet in this thread? You can try to

force a refresh