@MikeBurgersburg Mike, Can you check something out for me. I've been sitting on it for days and haven't finished off the analysis but it may overlap with the liquidity you have flagged.

@MikeBurgersburg 18th Nov #tether announced a 1B chain swap from #soluna as always they say there's no change is supply blah blah. I've never really bothered with tracking chain swaps.... but as I had already flagged that they had sent 1B to treasury.....it stuck out like big swinging ram nuts

@MikeBurgersburg If its a chain swap authorised should be reduced by 1B in Soluna with a corresponding increase in authorised where they get sent to. Treasury shouldn't change

@MikeBurgersburg You would only move token to treasury when they are redeemed.

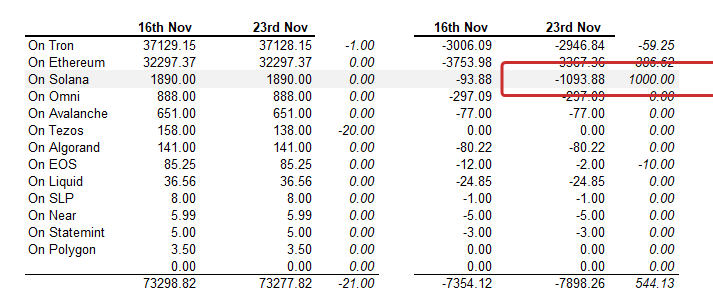

@MikeBurgersburg the variance table is from data I pulled from wayback vs the published data from 23rd. Wayback only had the 16th captured and not the 17/18th when the 1B was moved to treasury. I do have the daily captured data just havent had time to pull into in a sheet.

@MikeBurgersburg There can be some legit variance to the 1B token that were swapped if at the same time tokens were redeemed and burnt....but that is irrelevant as to why there is 1B of token parked up in Soluna treasury.

@MikeBurgersburg a #FUDDER might suggest that if you were able to do a cash reconciliation that the numbers add up as cash balance is down by 1B .....and a few days later when 1B has been redeemed things will balance up again.

@MikeBurgersburg I'm out and staying blocked (this time).

@MikeBurgersburg Ignore my question on the chainswap ended up going back through the daily captures and reconciled the timing .....

• • •

Missing some Tweet in this thread? You can try to

force a refresh