cheqd has published the fourth iteration of their $CHEQ tokenomics.

cheqd.io/blog/cheqd-tok…

Here is our summary on the updates and what it means for current as well as future $CHEQ holders.

A 🧵👇

cheqd.io/blog/cheqd-tok…

Here is our summary on the updates and what it means for current as well as future $CHEQ holders.

A 🧵👇

TL;DR

The tokenomics change intends to improve the tokenomic sustainability of the cheqd network.

This is achieved through both an increase in gas ⛽️ price and the introduction of deflationary mechanisms in the form of burns ❤️🔥

The tokenomics change intends to improve the tokenomic sustainability of the cheqd network.

This is achieved through both an increase in gas ⛽️ price and the introduction of deflationary mechanisms in the form of burns ❤️🔥

Essentially, the tx fee used for identity transactions on the $CHEQ network will be split:

A) a portion will go back to Validators and Delegators as block rewards

B) a portion will be burnt (destroyed) to reduce supply

C) a portion will be designated to the Community Pool.

A) a portion will go back to Validators and Delegators as block rewards

B) a portion will be burnt (destroyed) to reduce supply

C) a portion will be designated to the Community Pool.

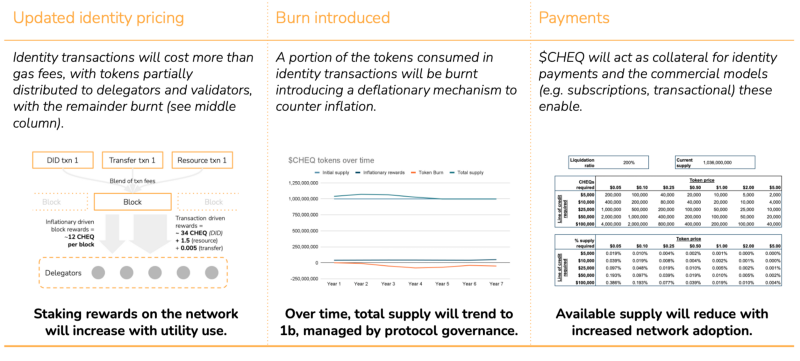

A) Identity transaction pricing

Identity tx like #DIDs and credential schema writes will have a cost greater than the regular gas price.

Similar to @osmosiszone $OSMO external incentive charges funding the community pool and rewards for #Kujira stakers scaling with network use.

Identity tx like #DIDs and credential schema writes will have a cost greater than the regular gas price.

Similar to @osmosiszone $OSMO external incentive charges funding the community pool and rewards for #Kujira stakers scaling with network use.

B) Burns ❤️🔥

A proportion of the identity tx charges will be burnt to establish equilibrium with the inflation on the network and target total supply returning to a total initial supply of one billion $CHEQ.

This is somewhat similar to #Ethereum's $ETH EIP-1559.

A proportion of the identity tx charges will be burnt to establish equilibrium with the inflation on the network and target total supply returning to a total initial supply of one billion $CHEQ.

This is somewhat similar to #Ethereum's $ETH EIP-1559.

The volume of tokens burnt will increase in the same way as distributions will, with the aim of bringing total supply back to one billion.

C) Community pool

The community will fund work deployed on the cheqd network.

An example of this is when the $CHEQ community pool recently funded work by @AnimoSolutions to reward them for their work on their Anoncreds demo on cheqd.

The community will fund work deployed on the cheqd network.

An example of this is when the $CHEQ community pool recently funded work by @AnimoSolutions to reward them for their work on their Anoncreds demo on cheqd.

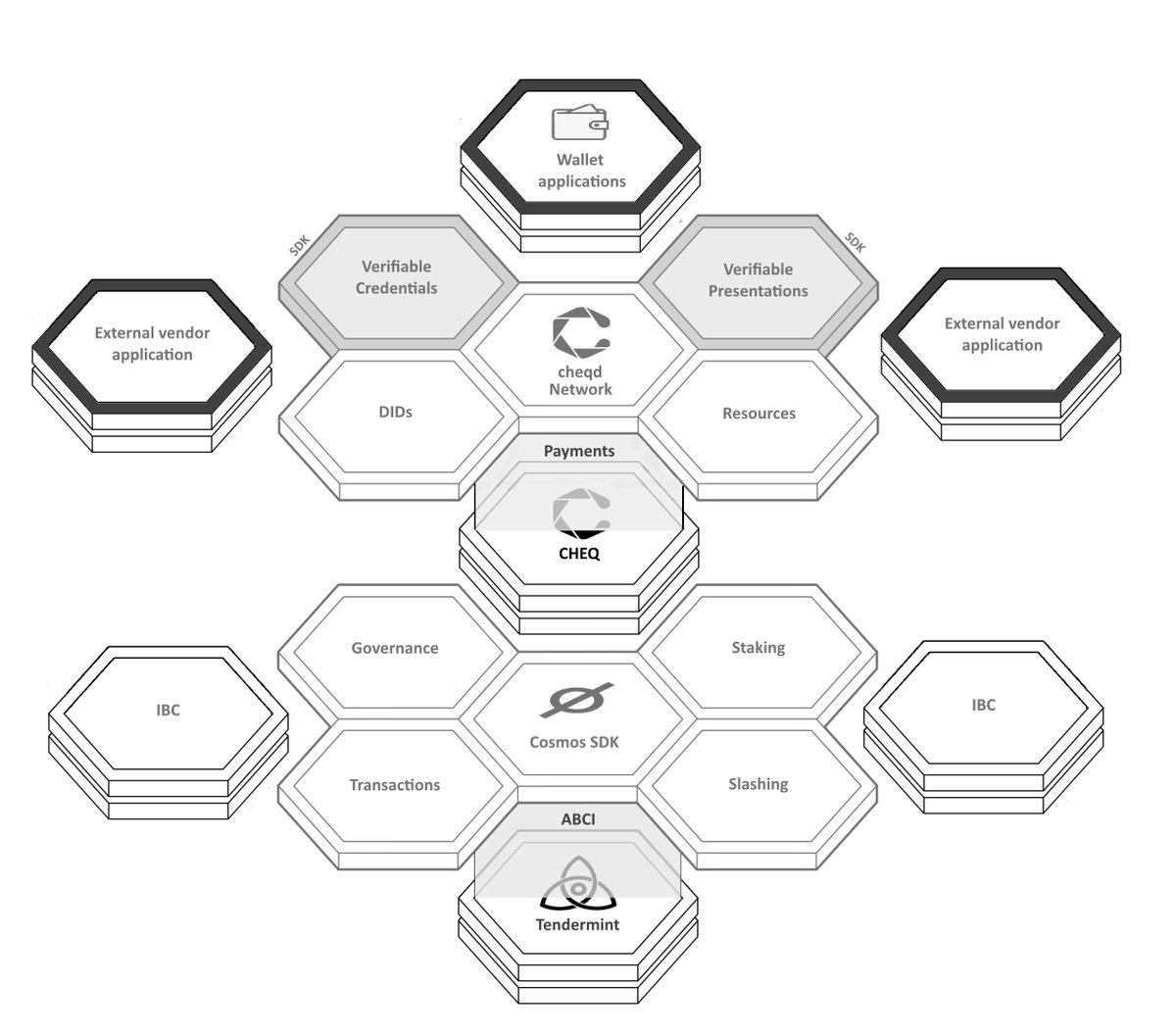

The change in tx fees on $CHEQ network self-sovereign identity/decentralised identity will affect both staking rewards and supply of $CHEQ as illustrated below 👇

So we covered the burn mechanism, but how exactly is staking APY affected?

If we assume that 50% of the tokens spent will be burnt, then we have 50% being distributed to delegators, validators and the community pool.

How this 50% is distributed will be up for governance vote.

If we assume that 50% of the tokens spent will be burnt, then we have 50% being distributed to delegators, validators and the community pool.

How this 50% is distributed will be up for governance vote.

Using this 50/50 example in the diagram below, any block with a DID written within it is worth approximately ~four times a standard block where the block reward is ~12 $CHEQ.

This means rewards on the network will begin to rise with adoption, similar to #Kujira.

This means rewards on the network will begin to rise with adoption, similar to #Kujira.

Even with the increase in tx fees on $CHEQ network, it is still very competitive to submit identity transactions on the cheqd network compared to other incumbents 👇

It will be interesting to follow these changes getting implemented to the $CHEQ tokenomics.

If you are interested in learning more about the cheqd network and $CHEQ, then check (pun intended) out our thread back in October 👇

If you are interested in learning more about the cheqd network and $CHEQ, then check (pun intended) out our thread back in October 👇

https://twitter.com/CosmosClub_/status/1586281915723964417

Thank you for reading all the way to the end 🙏

If you want to support us and for #cosmos to become more decentralised, make sure to (re-)delegate to @silk_nodes.

You can find direct validator links below 👇

linktr.ee/silknodes

If you want to support us and for #cosmos to become more decentralised, make sure to (re-)delegate to @silk_nodes.

You can find direct validator links below 👇

linktr.ee/silknodes

If you've found this thread helpful, please like or retweet.

Follow @CosmosClub_ for more threads like this.

Sign up to our newsletter for weekly news.

Subscribe to our podcast and YouTube channel on all things $ATOM $OSMO $KUJI $EVMOS and more 👇

linktr.ee/cosmosclub_

Follow @CosmosClub_ for more threads like this.

Sign up to our newsletter for weekly news.

Subscribe to our podcast and YouTube channel on all things $ATOM $OSMO $KUJI $EVMOS and more 👇

linktr.ee/cosmosclub_

• • •

Missing some Tweet in this thread? You can try to

force a refresh