1/🧵 Ein kurzer Einblick in @gemwallet_app, die #opensource, "non-custodial" #XRPL Web-#Wallet für das #Web3.0 und "#Ripple XRPL Grants Wave 3" Gewinner

2/ Ähnlich wie bei MetaMask ist #GemWallet eine "Browser-Extension"-App für den einfachen Umgang im #Web3, jedoch nativ auf dem #XRPL.

Funktionen sind z.B.:

• GemWallet #API (Brücke zwischen Websites und der Browser-Extension)

• Bezahlungen

• #Private/#Pubkey-Generierungen

Funktionen sind z.B.:

• GemWallet #API (Brücke zwischen Websites und der Browser-Extension)

• Bezahlungen

• #Private/#Pubkey-Generierungen

3/ 🛠️ Möchte man also per #API (NPM/Node.js oder CDN/Browser) eine Brücke zwischen dem #XRPL und seiner eigenen #Web3-#dApp herstellen, bietet #GemWallet die dafür notwendigen Tools und Werkzeuge.

github.com/GemWallet/gemw…

github.com/GemWallet/gemw…

4/ 😅 Aber was ist überhaupt "#Web3.0"?

Kurz gesagt reden wir von "#Web3", wenn das Fundament des klassischen #Web2 (#WWW) durch #Blockchain-Technologie geupgradet und dezentralisiert wird

Beispiele sind:

• Storage/Hosting: #IPFS /#ICP

• Dezentrale ID / "Login via #Wallet"

Kurz gesagt reden wir von "#Web3", wenn das Fundament des klassischen #Web2 (#WWW) durch #Blockchain-Technologie geupgradet und dezentralisiert wird

Beispiele sind:

• Storage/Hosting: #IPFS /#ICP

• Dezentrale ID / "Login via #Wallet"

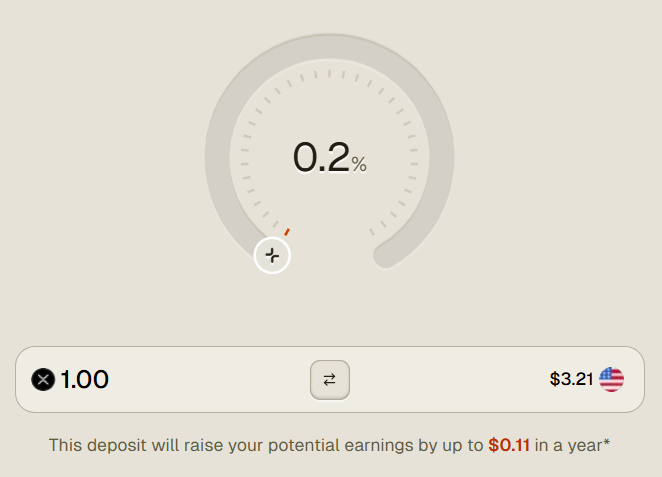

5/ 💡 Showcase / Demo-Transaktion

Florian Bouron zeigt auf seiner #Devnet E-Commerce Test-Webseite, wie der Umgang im #XRPL #Web3-Ökosystem aussehen könnte

Weitere Beispiele könnten Spenden-Webseiten oder zukünftig auch der Handel mit #NFTs sein

Florian Bouron zeigt auf seiner #Devnet E-Commerce Test-Webseite, wie der Umgang im #XRPL #Web3-Ökosystem aussehen könnte

Weitere Beispiele könnten Spenden-Webseiten oder zukünftig auch der Handel mit #NFTs sein

6/ 👉 Ablauf einer #Web3 #XRPL Authentifizierung

• Persö. Details veröffentlichen nicht notwendig

• Login mit dem #PublicKey & der Adresse (#Wallet)

• ID / Besitz der Keys beweisen (TX signieren) und Zugangs-Token aka. [J]SON [W]eb [T]oken erhalten.

• Persö. Details veröffentlichen nicht notwendig

• Login mit dem #PublicKey & der Adresse (#Wallet)

• ID / Besitz der Keys beweisen (TX signieren) und Zugangs-Token aka. [J]SON [W]eb [T]oken erhalten.

7/ 👉 Unterstützte Geräte

Derzeit werden nur die auf Chromium basierenden Desktop Browser unterstützt. (Mehr ist jedoch geplant)

✅ Chrome, Brave, Microsoft Edge

❌ Firefox, mobile iOS oder Android

Derzeit werden nur die auf Chromium basierenden Desktop Browser unterstützt. (Mehr ist jedoch geplant)

✅ Chrome, Brave, Microsoft Edge

❌ Firefox, mobile iOS oder Android

8/ 👉 Privatsphäre des eigenen #XRPL Accounts

Sobald eine Webseite für eine Transaktion die Account-Adresse (+#PubKey) auslesen möchte, muss das Leserecht hierfür vorher erst von einem selbst, via Konfirmations-Dialog, autorisiert werden

Hierfür fragt die Wallet ein Passwort ab

Sobald eine Webseite für eine Transaktion die Account-Adresse (+#PubKey) auslesen möchte, muss das Leserecht hierfür vorher erst von einem selbst, via Konfirmations-Dialog, autorisiert werden

Hierfür fragt die Wallet ein Passwort ab

9/ ⚠️ Hinweis ⚠️

Wie bei jeder Wallet, jeder App, jedem #Exchange und auch jeder Software, die die Verwahrung der #Keys übernimmt, muss sichergestellt sein, dass der Code keinen (un-)gewollten Exploit zulässt

Entscheidet daher selbst, ob ihr dem #opensource Code vertraut 😊

Wie bei jeder Wallet, jeder App, jedem #Exchange und auch jeder Software, die die Verwahrung der #Keys übernimmt, muss sichergestellt sein, dass der Code keinen (un-)gewollten Exploit zulässt

Entscheidet daher selbst, ob ihr dem #opensource Code vertraut 😊

10/ 👉 Zukunftspläne und Entwicklungen

• #NFT Support

• #XRPL #SmartContracts (aka. Hooks)

• Interoperabilität (aka. [#EVM-]#Sidechains)

/Ende

Folge mir hier: @krippenreiter

• #NFT Support

• #XRPL #SmartContracts (aka. Hooks)

• Interoperabilität (aka. [#EVM-]#Sidechains)

/Ende

Folge mir hier: @krippenreiter

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh