The Senate weighed in on the grid & the @PUCTX's proposed market design changes last week. Today, the House State Affairs Cmte meets to ask questions of the PUC, #ERCOT, the Independent Market Monitor & industry. I'll tweet some highlights here. #txlege 1/

dallasnews.com/news/politics/…

dallasnews.com/news/politics/…

@PUCTX Livestream is here and the first panel has just started.

tlchouse.granicus.com/MediaPlayer.ph…

Another good summary of the events of last week from @rtoinsider and @tkleckner1 here

rtoinsider.com/articles/31219…

tlchouse.granicus.com/MediaPlayer.ph…

Another good summary of the events of last week from @rtoinsider and @tkleckner1 here

rtoinsider.com/articles/31219…

Chair Lake starts by saying it was "misinformation" that extremes weren't included in the study. They in fact did not include Uri.

Here's the quote from the study: "The 1980-2019 sample does not include the extreme cold weather event caused by Winter Storm Uri in 2021... (cont.)

Here's the quote from the study: "The 1980-2019 sample does not include the extreme cold weather event caused by Winter Storm Uri in 2021... (cont.)

"Further analysis would be needed to develop a representative long-term load sample that incorporates this type of extreme event at an appropriate probability & to develop a corresponding reliability standard. Such analysis is beyond the scope of this study." pg 45.

You decide.

You decide.

He says that the 11,000MW removed from the market in the E3 report was a "best guess" and says the Loss of Load Expectation (LOLE, or days of outages per ten years) might not be 1.25 but it would be 1.1 or .95. Actually, with 5-6GW of retirements it would ~0.1 (page 7)

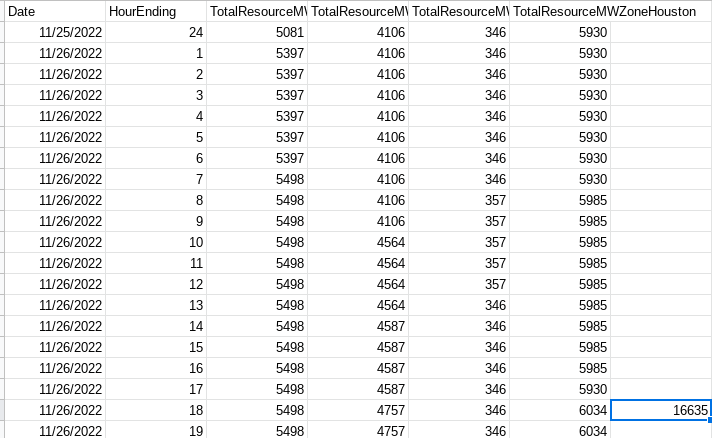

Lake also cites an incident on November 26 which I think is being addressed for the first time. 4,000MW of non-spin ancillary service was deployed. He blames wind. There were >16GW of thermal out that day including nearly ~4GW of coal, half of which broke down *that day*!

The table below shows the 3,735MW of coal that was offline on 11/26 including 3 of 4 of @nrgenergy units at Parish in Ft Bend County and half of a Limestone coal unit, too.

But sure, blame the wind.

But sure, blame the wind.

Here's a look at total thermal (gas, coal, and nuclear) outages on the evening of 11/26: 16,635MW were offline but Chair Lake says wind was the problem.

That's roughly 25% of the entire thermal fleet.

#txlege #energytwitter

That's roughly 25% of the entire thermal fleet.

#txlege #energytwitter

Chair Lake also invoked May 13, when we got close to outages because 2.9GW of thermal generation went offline after ERCOT & PUCT told Calpine to delay repairs. Also of course, no discussion of climate change even though that was part of the problem.

texastribune.org/2022/05/17/tex…

texastribune.org/2022/05/17/tex…

There is no doubt that wind and solar variability are challenging but so is themral availability. Remember though the IMM says the uncertainty in the market is from 3 things: demand/load forecast, thermal outages & renewable production. Some are too fixated on only one of those.

Lake describes the PCM (his preferred plan) as getting us to less than one outage in 10 years as opposed to the one per year now.

I'm sorry, didn't he guarantee there would be no outages this winter?! And now it's one outage per year?!

I'm so confused. Which is it?!

#txlege

I'm sorry, didn't he guarantee there would be no outages this winter?! And now it's one outage per year?!

I'm so confused. Which is it?!

#txlege

Rep @toddahunter asks if he can guarantee the PCM will guarantee new generation. He says yes.

[There is of course no guarantee.]

Hunter also wants to know how long it will take to implement. Chair Lake says to ask ERCOT. Consultants says 3-4, but Lake says 2-3 years.

[There is of course no guarantee.]

Hunter also wants to know how long it will take to implement. Chair Lake says to ask ERCOT. Consultants says 3-4, but Lake says 2-3 years.

Hunter: How soon can we see new generation?

Lake: That depends on "regulatory certainty from PUC and" #txlege.

Q: Give me a general answer: do you have a timeline or a date?

A: Depends.

Lake: That depends on "regulatory certainty from PUC and" #txlege.

Q: Give me a general answer: do you have a timeline or a date?

A: Depends.

Rep. Hunter wants to know if they will take action on Jan. 12. Chair Lake says yes, they will take a vote that day.

[I guess he's ignoring the letter from the Senate Business & Commerce Committee.]

Rep. Hunter says so 2 days after we start, you're going to make a decision?

[I guess he's ignoring the letter from the Senate Business & Commerce Committee.]

Rep. Hunter says so 2 days after we start, you're going to make a decision?

This was always the most bizarre thing to me. Why did the PUC pick a date two days after the #txlege session begins to make such a massive decision? So crazy I can't begin to fathom the logic.

Rep. Hunter gets him to agree it's not binding, but rather a recommendation.

#txenergy

Rep. Hunter gets him to agree it's not binding, but rather a recommendation.

#txenergy

Rep. Hunter asks if the "gas desk" at ERCOT is still alive. He says, basically, yes. See below.

After this was proposed the oil and gas industry went crazy and has shut it down, so ERCOT does not have a desk monitoring conditions in the gas supply system.

nbcdfw.com/investigations…

After this was proposed the oil and gas industry went crazy and has shut it down, so ERCOT does not have a desk monitoring conditions in the gas supply system.

nbcdfw.com/investigations…

Rep. @toddahunter asks if they took into account EVs and encourages the PUCT and their consultant to look at EVs more carefully.

Also says he wants to make sure if the PCM is implemented, that it's clear to customers what it costs. The consultant said $480 million/year.

#txlege

Also says he wants to make sure if the PCM is implemented, that it's clear to customers what it costs. The consultant said $480 million/year.

#txlege

Rep @DonnaHowardTX asks why the consultant @ethree_inc recommended the "FRM" (a capacity market similar to PJM and ISO-New England) and he supports he PCM.

Chair Lake said that "we" support the PCM and then stopped and said two of my colleagues expressed "interest"...

Chair Lake said that "we" support the PCM and then stopped and said two of my colleagues expressed "interest"...

Then says he can't speak for the others. Interesting.

He says difference between FRM and PCM is it's too hard to predict so far ahead as required by FRM.

Note that PCM requires on an administratively set demand curve far in advance.

He says difference between FRM and PCM is it's too hard to predict so far ahead as required by FRM.

Note that PCM requires on an administratively set demand curve far in advance.

PCM is a capacity market construct.

Lake is now saying they may make it seasonal or even monthly instead of annual. That would be better but would still require ERCOT to set a demand curve accurately. Forecasting is a major problem in all capacity market constructs.

Lake is now saying they may make it seasonal or even monthly instead of annual. That would be better but would still require ERCOT to set a demand curve accurately. Forecasting is a major problem in all capacity market constructs.

Rep @DonnaHowardTX asks about renewables in the PCM. Lake says dropping renewables from them makes the price go down but wouldn't hurt renewable development.

Next tweet is a direct quote from the @PUCTX's own consultant who they paid $600k not to listen to them apparently:

Next tweet is a direct quote from the @PUCTX's own consultant who they paid $600k not to listen to them apparently:

From the E3 report, page 85: "This reduction in compensation could result in smaller wind and solar buildout (relative to the counterfactual), which would have the effect of increasing energy prices.”

Got that? Not real ambiguous is it?

#txlege

Got that? Not real ambiguous is it?

#txlege

As @PhilJankowski points out here, some policymakers including Lake seem obsessed with new natural gas. PCM would NOT guarantee new gas but even if it did it wouldn't gaurantee better reliability outcomes. Gas was the biggest problem during Uri.

https://twitter.com/PhilJankowski/status/1599789782132932608?s=20&t=b09-XluvdMflROnbT-QldA

But note that not only was gas the biggest problem during Uri, it's extremely expensive.

The @PUCTX's consultant told them no matter what new system they implement, a "high renewables" case would save $4 billion (roughly 20%).

The @PUCTX's consultant told them no matter what new system they implement, a "high renewables" case would save $4 billion (roughly 20%).

Rep. @DonnaHowardTX says her understanding is the problem with Uri wasn't the market it was failure of gas supply. Wants to know if gas supply has fixed its problems. Chair Lake says you'd have to ask the @txrrc. They aren't there, though. Rep. Howard sighs.

#txlege #txenergy

#txlege #txenergy

Lake says Uri isn't the only problem. There's also "blue sky days" when there's not enough generation. He says PCM would help both but seems to suggest its more about blue sky days.

You have to define the problem you're trying to solve. PCM would not solve for Uri. #txlege

You have to define the problem you're trying to solve. PCM would not solve for Uri. #txlege

Rep. John Smithee asks if Lake has responded to the letter from the Senators. He says he has not. He asks how you'd respond. He says he "doesn't remember" exactly what the criticism was.

Here it is, for easy reference.

#txlege #energytwitter

Here it is, for easy reference.

#txlege #energytwitter

https://twitter.com/DrSchwertner/status/1598452253828042755?s=20&t=b09-XluvdMflROnbT-QldA

Rep. Slawson asks if renewables not participating in the PCM (not eligible for credits) would hurt them. Lake says absolutely not.

His consultant begs to differ: "this reduction in compensation could result in smaller wind and solar buildout."

He does not mention this.

His consultant begs to differ: "this reduction in compensation could result in smaller wind and solar buildout."

He does not mention this.

This answer from Chair Lake to @JaredLPatterson is just wrong. He says "the only way they get money," meaning thermal plants, is from the spot market.

In fact, ~90% of the market is bilateral, meaning two parties contract with each other and don't go through the spot market

In fact, ~90% of the market is bilateral, meaning two parties contract with each other and don't go through the spot market

Rep. Patterson also asks if PUC has looked at what 30 hours the PCM would have been paid in 2021. The answer is no. There has been no backcast done by ERCOT or the PUC, at least that they've shared. All of the credits would've added more costs to February '21.

#txlege

#txlege

Who determines how many credits, asks Patterson. Lake says "the market." Uh, no, as E3 put in the report there would be an "*administratively" set demand curve. The number would be set by ERCOT.

It is not the most market driven solution, again according to his consultant (cont)

It is not the most market driven solution, again according to his consultant (cont)

"The BRS design constitutes the smallest change to the existing market framework by largely preserving the current energy-only market dynamics and all of the generator incentives that exist in it, including scarcity pricing and the operating reserve demand curve (ORDC)." (cont)

Continued: "[The BRS] has low risk of market power and the shortest implementation timeline of any market design that was studied." (pg. 18)

The way to preserve the most competition while increasing reliability *quickly* is the BRS.

#txlege #energytwitter

The way to preserve the most competition while increasing reliability *quickly* is the BRS.

#txlege #energytwitter

One of the biggest problems w/ PCM is it will take fantastic foresight by ERCOT to set the demand curve (illustrated by E3 below) AND for the generators to anticipate and be ready for those 30 hours. If it's hard to predict (and it will be), they may not be ready. #energytwitter

Lake address renewables in PCM again. he says he has "no fear" that PCM would hurt renewables. But what about consumers? What about competition in the market? Here's his own consultant on that question:

“If the PCM design were to be implemented in a non-technology-neutral manner, e.g., by excluding the cost/compensation of resources such as wind or solar, this would diminish its effectiveness as a competitive market mechanism.”

Yep. #txlege #txenergy

Yep. #txlege #txenergy

ERCOT CEO Vegas begins by talking about the "blue sky" days, saying they need new tools

Look, if the PCM is to solve that problem, then let's be clear about it: It's not designed to solve Uri. It's meant to solve ramping. Ok, let's be clear what problem we're trying to solve.

Look, if the PCM is to solve that problem, then let's be clear about it: It's not designed to solve Uri. It's meant to solve ramping. Ok, let's be clear what problem we're trying to solve.

Vegas also points to ERCOT's Winter Assessment that shows on low wind days, he says, we could have outages. He fails to say that that would only happen if we had extremely high load (hello #energyefficiency) and lots of thermal outages (and lack of gas supply)

#energytwitter

#energytwitter

#ERCOT CEO Vegas is focused almost entirely on swings from renewables, not extremes caused by massive storms.

People need to understand this.

Most of the solutions to these two issues are not the same.

#txlege

People need to understand this.

Most of the solutions to these two issues are not the same.

#txlege

Rep. @toddahunter asks about cost of $480m.

Vegas: "Costs are passed onto customers."

Hunter wants them to get this info to the public.

Note there has not been a single town hall or education event of any kind by the PUC to help the public understand or to *listen* to them.

Vegas: "Costs are passed onto customers."

Hunter wants them to get this info to the public.

Note there has not been a single town hall or education event of any kind by the PUC to help the public understand or to *listen* to them.

Rep Raymond asks about costs. Note, Texas rates are roughly average, though up 50-90% this year. But even before this year, our *bills* were the 7th highest in the country. A lot of reasons for this including lack of #energyefficiency and very hot summers.

https://twitter.com/douglewinenergy/status/1576272682458365952?s=20&t=p_vqEI4pUIBQQ8c28E8emw

A lot of questions about how PCM would work from @JaredLPatterson. #ERCOT's Vegas says load serving entities (reatilers, munis, co-ops) can decide whether to buy performance credits or not but there will be massive uncertainty as to when the hours of scarcity will be.

It will be extremely difficult to hedge performance credits.

Patterson also asks if the wear and tear of RUC-ing (requiring fossil plants to run even when they want to be offline) and the age of the old plants will lead to retirements.

Vegas: Absolutely.

Patterson also asks if the wear and tear of RUC-ing (requiring fossil plants to run even when they want to be offline) and the age of the old plants will lead to retirements.

Vegas: Absolutely.

Ind. Market Monitor says cost of conservative operations over the last year is 10% of the market. I've been saying this for a looooong time but met with strident denials. Costs of non-spin, increased costs from removing generation to RUC, etc. is >$3 billion this year!

IMM Bivens says the assumptions in the E3 report are wrong and skew everything. She does not believe 11GW will retire in the next 3 years.

There is no reason to think that much gen would retire. It really makes no sense and screws up the analysis. #txlege #energytwitter

There is no reason to think that much gen would retire. It really makes no sense and screws up the analysis. #txlege #energytwitter

Chairman @toddahunter asks IMM if she's for the PCM. She says not at this time. Says IMM will put in comments by the Dec 15 deadline.

Her biggest concern with PCM: "I think we have an operational flexibility problem not a capacity problem."

Bingo!

#txlege #txenergy

Her biggest concern with PCM: "I think we have an operational flexibility problem not a capacity problem."

Bingo!

#txlege #txenergy

Hunter: Does the PCM guarantee new generation?

Bivens: No capacity market construct would guarantee new generation.

Hunter: so the answer's no?

Bivens: Correct.

#energytwitter

Bivens: No capacity market construct would guarantee new generation.

Hunter: so the answer's no?

Bivens: Correct.

#energytwitter

Hunter askss what she favors (paraphrasing as I always do unless using quotes): Energy-only market results in reserve margin we're looking for. Need an operational flexibility product. Does not think we need the PCM or other capacity constructs.

#txlege #energytwitter

#txlege #energytwitter

Rep. @DonnaHowardTX follows up. IMM Bivens says that ORDC provides more money to generators as uncertainty increases. She doesn't think E3 properly captured this dynamic. If you have more gas plants out, or wind dies down, or demand is higher, payments to generators go up.

Ind Market Monitor thinks there should be some kind of "uncertainty product" with a 2 hour startup and 4 hour duration. This would solve the problem of operational flexibility in a market based way (as opposed to RUCs which are out of market and no one likes).

Lake says the IMM is dealing in theory not operational realities. Ouch. I don't think that's true at all. (Bivens is a deeply experienced professional, btw. She understands operational realities)

He also says if we don't add supply, we'll have to have more conservation notices.

He also says if we don't add supply, we'll have to have more conservation notices.

Lake says they don't want to "ask people to reduce" their use and lumps in DR programs to this. This shows Lake's misunderstanding of #demandresponse. You don't just ask them, you pay them! You help them lower their bills while increasing reliability and lowering system costs.

Now Vegas says we have problems this winter and could be in outages if we had high demand, high gas plant outages, and low wind. "We know we have this potential today."

Guess all that happy talk at the press conference was just happy talk? No guarantees now.

#txlege #txenergy

Guess all that happy talk at the press conference was just happy talk? No guarantees now.

#txlege #txenergy

Says we added 2GW of thermal over the last year. Interesting! Says we also added 4GW of load. Also interesting, perhaps because our energy efficiency goal is dead last among the 27 states with a goal and 80% below average?!

aceee.org/white-paper/20…

#txlege #energytwitter

aceee.org/white-paper/20…

#txlege #energytwitter

ERCOT CEO Vegas now talking about Uri. Points to many causes including gas, coal, wind outages, fuel supply issues.

Says they're "assuming better performance and that we've solved those issues."

This is a potential fatal assumption to Texans w/ little evidence to support it.

Says they're "assuming better performance and that we've solved those issues."

This is a potential fatal assumption to Texans w/ little evidence to support it.

@katiecolemack of @TXManufacturers is up next. Says PCM is a new model of a capacity market and that capacity markets have not worked other places. She says a capacity market is a not a guarantee of new gen. They "simply increase consumer costs" and "hope" there's new gen #txlege

Coleman says the $480m number is likely too low. It is a net number assuming lower costs in the energy market (moving money to the capacity market). If it doesn't do that, costs could be much higher.

E3 says cost of performance credits would be $5.7 billion.

#txlege

E3 says cost of performance credits would be $5.7 billion.

#txlege

She says a mid sized manufacturer would likely see an increase of $11m per year in energy costs.

Good bye Texas miracle! (that's me, not Katie)

She alludes to PUC and ERCOT saying if not for ancillary services and RUCs we would have outages is proof... (cont)

Good bye Texas miracle! (that's me, not Katie)

She alludes to PUC and ERCOT saying if not for ancillary services and RUCs we would have outages is proof... (cont)

...that we have enough capacity but need more operational, flexible resources.

She points out that E3 says in two places we do not have a capacity problem and agrees with this and with IMM that that's not the problem.

She believes PCM would *increase* regulatory uncertainty...

She points out that E3 says in two places we do not have a capacity problem and agrees with this and with IMM that that's not the problem.

She believes PCM would *increase* regulatory uncertainty...

From the report: "long implementation timeline and administratively complex" is how the @PUCTX's own consultant described the Chairman's favored solution.

Bizarre. #txlege #energytwitter

Bizarre. #txlege #energytwitter

Coleman addressing something I was about to ask #energytwitter about: what are these 3GW of bankruptcies Lake keeps asking about:

(1) Brazos Electric & (2) Panda driven by Uri. And (3) Talen was due to poor gas hedging strategies.

None were caused by market design problems.

(1) Brazos Electric & (2) Panda driven by Uri. And (3) Talen was due to poor gas hedging strategies.

None were caused by market design problems.

Coleman's also making the point that I made earlier that most generation is sold bilaterally (she says 80%) not on the spot market. The potential of high prices causes load serving entities to buy more generation ahead of time and is a signal to generation to build or to stay.

@TimMorstad of @AARPTX up next. Notes that electricity costs are up significantly this year. Over 40% of Texans are "energy insecure" meaning they choose between food, medicine, and energy. He also thinks costs of PCM might be understated.

dallasnews.com/business/energ…

dallasnews.com/business/energ…

Morstad says there's no guarantee of new generation. "That's a lot to ask of consumers... asks them to explore options" they haven't much yet. Says older Texans often live in inefficient homes on fixed incomes. Notes that >40% of peaks are driven by heating and cooling... (cont)

Notes that #energyefficiency would create jobs, lower energy costs, & increase reliability. It likely isn't enough alone, he says, but could help.

Asks them to 1) be sensitive to adding costs, 2) be wary of untested solutions & 3) expand energy efficiency.

#txlege cc: @AARPTX

Asks them to 1) be sensitive to adding costs, 2) be wary of untested solutions & 3) expand energy efficiency.

#txlege cc: @AARPTX

Michelle Richmond is representing generators who support increased capacity payments which they say they need to build. But she says there are 4GW ready in the interconnection process right now.

Hmm.

Note also ERCOT added 1.5GW of gas in 2022.

#txlege

Hmm.

Note also ERCOT added 1.5GW of gas in 2022.

#txlege

Richmond says ORDC isn't enough. (IMM said it added $3 billion to the market this year alone!)

She said gas prices are really high and that's hurting some generators. (So we should build more?!)

I'm so confused by this testimony.

#txlege #txenergy

She said gas prices are really high and that's hurting some generators. (So we should build more?!)

I'm so confused by this testimony.

#txlege #txenergy

Richmond says that industrial DR programs aren't available to residential and results in a "wealth transfer" from residential customers to industrial.

I think we need DR of all kinds but she's not wrong. We should be laser focused on increased residential demand side resources.

I think we need DR of all kinds but she's not wrong. We should be laser focused on increased residential demand side resources.

Richmond, incorrectly, says the IRA favors wind, solar, and storage. In 2025 the Production Tax Credit and Investment Tax Credit become technology neutral for non-polluting plants. Gas w/ carbon capture, geothermal, nuclear are all eligible.

Note that a gas w/ carbon capture plant was recently announced in Odessa. The IRA undoubtedly helped with this. It's tech neutral as long as you don't pollute.

cbs7.com/2022/11/08/net…

cbs7.com/2022/11/08/net…

Next up is Bob Helton from @ENGIEgroup says renewables are predictable, reliable, and are a low cost resource. There are forecast misses just as there are with demand and thermal plants. Says renewables should not be excluded from the PCM construct.

Again, the @PUCTX's consultant agrees with him. Helton says this would be the only market to exclude like that. E3 says that excluding #wind and #solar would "diminish its effectiveness." #txlege #txenergy

https://twitter.com/douglewinenergy/status/1599804782968832001?s=20&t=b09-XluvdMflROnbT-QldA

Concerns Helton has with PCM include the hours when it would be triggered would be very hard to figure out.

They're now onto the discussion. Richmond says its pay for performance. Not actually true, it's pay for *availability,* at least as described by E3 in the PUC's report.

They're now onto the discussion. Richmond says its pay for performance. Not actually true, it's pay for *availability,* at least as described by E3 in the PUC's report.

Rep. Slawson asks about how #demandresponse would participate in the PCM. Coleman cites 2 main ways: 1) reduce use during one of the hours in question or (2) bid availability of demand capacity into the voluntary forward market and earn "performance credits"

Rep Raymond asked what's in the IRA. A few changes:

Extension of wind and solar ITC & PTC to 2032. Storage is now eligible. Also adds all other zero emission techology including nuclear.

ITC and PTC now directly available to co-ops and munis. Wasn't before.

Extension of wind and solar ITC & PTC to 2032. Storage is now eligible. Also adds all other zero emission techology including nuclear.

ITC and PTC now directly available to co-ops and munis. Wasn't before.

Also big incentives for #energyefficiency, #transmission, #EVs (all kinds, cars, trucks, buses), #hydrogen, #carboncapture, #climate adaptation, are in the #IRA

So much more.

this thread is very helpful

So much more.

this thread is very helpful

https://twitter.com/jessejenkins/status/1555517241990549507?lang=en

Julia Harvey represeting co-ops doesn't seem to support PCM. Says it doesn't reward generators specifically to be available during a Uri-like event. Also notes E3 didn't recommend it at least partially bc it's untested. The uncertainty around it could increase costs. #txlege

Now Cathy Webking of TEAM, an association of the smaller retailer electric providers, says the E3 study didn't much consider residential & small commercial customers. She agrees w/ earlier testimony that $480m PCM cost is a net cost and is "theoretical." Could be higher...

Webking, who represents many of the independent retailers (ie, those who don't own generation) points out the volatility and uncertainty in PCM, which would really be difficult for small REPs. Says the details, which we keep hearing they'll get to, matter a lot. #txlege

I think this is a huge point. PCM favored by gentailers who own 80+% of ther ERCOT market but could kill most of the independents, further consolidating market power.

And that's just on the retail side. Similar dynamic with generators where market is highly concentrated #txlege

And that's just on the retail side. Similar dynamic with generators where market is highly concentrated #txlege

Now Mark Bell of AECT, an org representing many different kinds of electric cos. (transmission & distribution, generators, retail, & publicly owned).

He says there are 8GW of batteries in the #ERCOT queue. Truly amazing. Lots of dispatchable and flexible resources on the way!!

He says there are 8GW of batteries in the #ERCOT queue. Truly amazing. Lots of dispatchable and flexible resources on the way!!

Next up is Shelly Botkin, ED of @txpublicpower. One public power entity in TX, CPS San Antonio, is in serious trouble. 25% are at least 30 days behind on payment. Added costs, with no proposed ratepayer assistance, puts an even higher burden on customers.

expressnews.com/business/artic…

expressnews.com/business/artic…

Next up is @cyrustx of @TexasSierraClub says we don't have a capacity problem, we have a "capabilities" problem. Slightly different words than IMM & Katie Coleman but close.

He also points out the need for #energyefficiency & for programs where customers get paid to shift use.

He also points out the need for #energyefficiency & for programs where customers get paid to shift use.

Reed also points out the need for a program for Texans "least able to pay for their energy." Texas used to have the System Benefit Fund for this.

Again, 25% of San Antonio ratepayers are behind on their payments. Would be good to know what those numbers are around the state.

Again, 25% of San Antonio ratepayers are behind on their payments. Would be good to know what those numbers are around the state.

In public testimony, Ken Flippin says the cheapest energy is the energy you don't use. It saves money but also saves lives. Increases "survivability" of homes in extreme weather, storms, etc. Notes codes haven't been increased since 2015 and utility EE goals since 2011. #txlege

Next is Larry Linenschmitt who intros himself as a conservative. Notes that pollution impacts life in the womb so reducing pollution is pro-life. Says we should be stewards of God's creation.

Notes harm to consumers from climate change including higher energy bills & insurance.

Notes harm to consumers from climate change including higher energy bills & insurance.

Interesting testimony. Notes lots of prominent conservatives and Christian colleges that recognize the harm caused by climate change.

Says the billions in investment from renewable energy has been great for Texas consumers.

Says the billions in investment from renewable energy has been great for Texas consumers.

Linenschmidt points out the $7.8 billion in cost saving this year alone in Texas from renewables, citing @joshdr83 study below. He also notes that over the last 12 years renewables have saved 244 billion gallons of water!!! #txlege #energytwitter

ideasmiths.net/wp-content/upl…

ideasmiths.net/wp-content/upl…

He also rightly points out there has been no discussion of pollution from gas and coal plants or the subsidies to the oil and gas industry which are massive.

[Note: the biggest is "Intangible Drilling Costs"]

canarymedia.com/articles/fossi…

[Note: the biggest is "Intangible Drilling Costs"]

canarymedia.com/articles/fossi…

• • •

Missing some Tweet in this thread? You can try to

force a refresh