@ensdomains is one of the most important, yet least understood, pillars of the #Web3 ecosystem

While #ENS is often compared to the Internet’s domain name system, in reality it’s much more than that

Here’s why the $ENS token has the potential to 50x to 100x

👇

🧵

While #ENS is often compared to the Internet’s domain name system, in reality it’s much more than that

Here’s why the $ENS token has the potential to 50x to 100x

👇

🧵

2/

Ethereum Name Services allows users to translate blockchain addresses into human-readable names

On the surface, it works like the DNS (we’ll explain this in a second)

It has a MC of $285M, FDV of $1.4B, and its $ENS token trades at $14.09

In 2021, the price hit $85.69

Ethereum Name Services allows users to translate blockchain addresses into human-readable names

On the surface, it works like the DNS (we’ll explain this in a second)

It has a MC of $285M, FDV of $1.4B, and its $ENS token trades at $14.09

In 2021, the price hit $85.69

3/

This thread will cover the following:

• What is the DNS?

• What problem does #ENS solve?

• How does it work?

• What are its plans for the future?

• Who are the key players in the ecosystem?

• What are its #tokenomics?

• What’s the potential value of $ENS?

This thread will cover the following:

• What is the DNS?

• What problem does #ENS solve?

• How does it work?

• What are its plans for the future?

• Who are the key players in the ecosystem?

• What are its #tokenomics?

• What’s the potential value of $ENS?

4/

🔶 What is the DNS?

The Domain Name System (“DNS”), is one of the most important parts of the Internet

Because it operates behind the scenes, most people don’t appreciate its significance and often don’t even know it exists

Here’s how it works:

🔶 What is the DNS?

The Domain Name System (“DNS”), is one of the most important parts of the Internet

Because it operates behind the scenes, most people don’t appreciate its significance and often don’t even know it exists

Here’s how it works:

5/

Every device on the internet has a unique address – called an IP address – that helps other computers identify it. Unfortunately, this address is represented with a string of numbers such as “192.16.0.73”

Every device on the internet has a unique address – called an IP address – that helps other computers identify it. Unfortunately, this address is represented with a string of numbers such as “192.16.0.73”

6/

As you can imagine, people aren’t very good at remembering random strings of numbers, nor do they provide any context as to what’s on the site

That’s why the DNS was created – it serves as the “phonebook” of the Internet and translates IP addresses into human readable names

As you can imagine, people aren’t very good at remembering random strings of numbers, nor do they provide any context as to what’s on the site

That’s why the DNS was created – it serves as the “phonebook” of the Internet and translates IP addresses into human readable names

7/

For instance, let’s say you wanted to look up a page on facebook.com.

1. Your computer asks a DNS server for https://t.co/IHArHPyAyd 's IP address

2. The DNS find the IP address sends it back to you

3. Your computer then uses the IP address to access Facebook

For instance, let’s say you wanted to look up a page on facebook.com.

1. Your computer asks a DNS server for https://t.co/IHArHPyAyd 's IP address

2. The DNS find the IP address sends it back to you

3. Your computer then uses the IP address to access Facebook

8/

The Domain Name System is not just one server, but instead a global collection of servers. That way, if one doesn’t know the address you’re looking for, it can route it to another one.

This also provides redundancy in case a single server is attacked or goes down.

The Domain Name System is not just one server, but instead a global collection of servers. That way, if one doesn’t know the address you’re looking for, it can route it to another one.

This also provides redundancy in case a single server is attacked or goes down.

9/

🔶 Problem

While the DNS is extremely important to the internet, it has one major flaw – it’s centralized.

This creates numerous risks including the lack of privacy, the potential for censorship and security vulnerabilities.

🔶 Problem

While the DNS is extremely important to the internet, it has one major flaw – it’s centralized.

This creates numerous risks including the lack of privacy, the potential for censorship and security vulnerabilities.

10/

🔶 Solution

As such, decentralized DNS services - such as the Ethereum Name Service - aim to supplant this ~40 year old system and become the “phonebook” of the #blockchain

🔶 Solution

As such, decentralized DNS services - such as the Ethereum Name Service - aim to supplant this ~40 year old system and become the “phonebook” of the #blockchain

11/

🔶 Protocol Overview

The Ethereum Name Service (#ENS) is virtually identical to the internet's DNS system, in that it translates human-readable names into wallet addresses

🔶 Protocol Overview

The Ethereum Name Service (#ENS) is virtually identical to the internet's DNS system, in that it translates human-readable names into wallet addresses

12/

Currently, to send #crypto to a friend you need to know their wallet’s public address

This is a long string of alphanumeric characters such as:

0x7AAcA0f0cc1bA9b2C4889ACb2aeBfC01300d6f21

This is obviously not easy to remember!

Currently, to send #crypto to a friend you need to know their wallet’s public address

This is a long string of alphanumeric characters such as:

0x7AAcA0f0cc1bA9b2C4889ACb2aeBfC01300d6f21

This is obviously not easy to remember!

13/

$ENS allows users to create “nicknames” (e.g. “torygreen.eth”) and attach them to their wallet

Users can now send any Ethereum-enabled token to that new address and the user will receive it

$ENS allows users to create “nicknames” (e.g. “torygreen.eth”) and attach them to their wallet

Users can now send any Ethereum-enabled token to that new address and the user will receive it

14/

$ENS doesn’t just support #Ethereum, it can also be used on over 100 other chains

The full list is maintained on Github, but here’s a snapshot from last year:

$ENS doesn’t just support #Ethereum, it can also be used on over 100 other chains

The full list is maintained on Github, but here’s a snapshot from last year:

15/

🔶 How Does it Work?

#ENS operates using two main components:

• Registry: Contains all the “nicknames” registered on the system and the address of their resolvers

• Resolvers: Contain the information necessary to match each domain to its actual Ethereum address

🔶 How Does it Work?

#ENS operates using two main components:

• Registry: Contains all the “nicknames” registered on the system and the address of their resolvers

• Resolvers: Contain the information necessary to match each domain to its actual Ethereum address

16/

So if someone wanted to send 10 ETH to “alice.eth” using Metamask:

1. The user would open their Metamask wallet and add “alice.eth” as the recipient’s address

2. The system would then query the main registry to find out which resolver is responsible for “alice.eth”

So if someone wanted to send 10 ETH to “alice.eth” using Metamask:

1. The user would open their Metamask wallet and add “alice.eth” as the recipient’s address

2. The system would then query the main registry to find out which resolver is responsible for “alice.eth”

17/

3. The register would return the applicable resolver

4. The system would then query the resolver for the correct address, which would return “0x787192fc5378cc32aa956ddfdedbf26b24e8d78e40109add0eea2c1a012c3dec”

3. The register would return the applicable resolver

4. The system would then query the resolver for the correct address, which would return “0x787192fc5378cc32aa956ddfdedbf26b24e8d78e40109add0eea2c1a012c3dec”

18/

5. Metamask would then use this new address to complete the transaction

Like the DNS, this all occurs “under the hood”, so from a user perspective they simply type “alice.eth” in the address and the money is on its way.

5. Metamask would then use this new address to complete the transaction

Like the DNS, this all occurs “under the hood”, so from a user perspective they simply type “alice.eth” in the address and the money is on its way.

19/

While ENS originally only worked for .ens names, in late 2021 the protocol integrated traditional domains into the system

This opens up a world of potential as it makes it possible to register urls such as “alice .com” to a wallet and allow it to receive cryptocurrencies

While ENS originally only worked for .ens names, in late 2021 the protocol integrated traditional domains into the system

This opens up a world of potential as it makes it possible to register urls such as “alice .com” to a wallet and allow it to receive cryptocurrencies

20/

🔶 Long-Term Vision

While it’s tempting to think of the $ENS as a replacement for the DNS, in reality it’s so much more than that. It also acts as a:

• #Web3 identity

• Digital Wallet

• Decentralized website

🔶 Long-Term Vision

While it’s tempting to think of the $ENS as a replacement for the DNS, in reality it’s so much more than that. It also acts as a:

• #Web3 identity

• Digital Wallet

• Decentralized website

21/

🔹 Web3 Identity

In Web 1.0 we used usernames and passwords to sign in to websites

Web 2.0 allowed us to sign in with Google, Twitter, Facebook, etc…

In #Web3, users can use services such as #ENS as a “single sign-on” identity to access all websites

🔹 Web3 Identity

In Web 1.0 we used usernames and passwords to sign in to websites

Web 2.0 allowed us to sign in with Google, Twitter, Facebook, etc…

In #Web3, users can use services such as #ENS as a “single sign-on” identity to access all websites

22/

🔹 Digital Wallets

$ENS domains aren’t just “websites on the #blockchain”

They are effectively digital wallets

ENS makes it easy for users to send payments directly to websites or other users without going through an intermediary such as Venmo or Paypal

🔹 Digital Wallets

$ENS domains aren’t just “websites on the #blockchain”

They are effectively digital wallets

ENS makes it easy for users to send payments directly to websites or other users without going through an intermediary such as Venmo or Paypal

23/

🔹 Decentralized Website

Users can combine their $ENS address with IPFS (Filecoin’s decentralized storage solution) to create fully decentralized, censorship-resistant websites

🔹 Decentralized Website

Users can combine their $ENS address with IPFS (Filecoin’s decentralized storage solution) to create fully decentralized, censorship-resistant websites

24/

🔶 Market Overview

At first blush, it’s tempting to calculate the potential of #ENS using the DNS, which MIT researchers recently valued at $8B

But I believe this significantly understates the opportunity…

🔶 Market Overview

At first blush, it’s tempting to calculate the potential of #ENS using the DNS, which MIT researchers recently valued at $8B

But I believe this significantly understates the opportunity…

25/

Given its potential as a unified #Web3 identity, payment system and decentralized website provider, I believe the TAM may be closer to the $20T market for digital wallets

(what % of this is obtainable is unclear, and will depend on how the protocol develops)

Given its potential as a unified #Web3 identity, payment system and decentralized website provider, I believe the TAM may be closer to the $20T market for digital wallets

(what % of this is obtainable is unclear, and will depend on how the protocol develops)

26/

🔶 Competitive Overview

Key competitors in the decentralized DNS space include $ENS, Unstoppable Domains, Bonfida, Handshake and Namecoin

🔶 Competitive Overview

Key competitors in the decentralized DNS space include $ENS, Unstoppable Domains, Bonfida, Handshake and Namecoin

27/

🔶 Moat

#ENS is the largest player in the space, with 3.5x the FDV of its nearest competitor

To date it has:

• Registered 2.76M names

• Integrated 511 partners

• Attracted 594K owners

🔶 Moat

#ENS is the largest player in the space, with 3.5x the FDV of its nearest competitor

To date it has:

• Registered 2.76M names

• Integrated 511 partners

• Attracted 594K owners

28/

🔶 Traction

The protocol has achieved significant traction since launch. Since Q2 2021:

· MAUs grew 6.2x (from 9K to 55K)

· Registrations grew 21x (from 53K to 1.1M)

· Revenue (in ETH terms) grew 10.8x (from 1K to 12K)

🔶 Traction

The protocol has achieved significant traction since launch. Since Q2 2021:

· MAUs grew 6.2x (from 9K to 55K)

· Registrations grew 21x (from 53K to 1.1M)

· Revenue (in ETH terms) grew 10.8x (from 1K to 12K)

29/

$ENS is organized as a #DAO, and as of December 2022 it has nearly 60K members and $1 billion in its treasury (making it the 3rd largest DAO)

$ENS is organized as a #DAO, and as of December 2022 it has nearly 60K members and $1 billion in its treasury (making it the 3rd largest DAO)

30/

🔶 Ecosystem

The $ENS ecosystem is vast, and the protocol has over 500 partnerships including:

• Wallets: Coinbase, Rainbow, Trust Wallet

• dApps: Uniswap, Etherscan, Aave, OpenSea

• Browsers: Brave, Metamask, Cloudfare

🔶 Ecosystem

The $ENS ecosystem is vast, and the protocol has over 500 partnerships including:

• Wallets: Coinbase, Rainbow, Trust Wallet

• dApps: Uniswap, Etherscan, Aave, OpenSea

• Browsers: Brave, Metamask, Cloudfare

31/

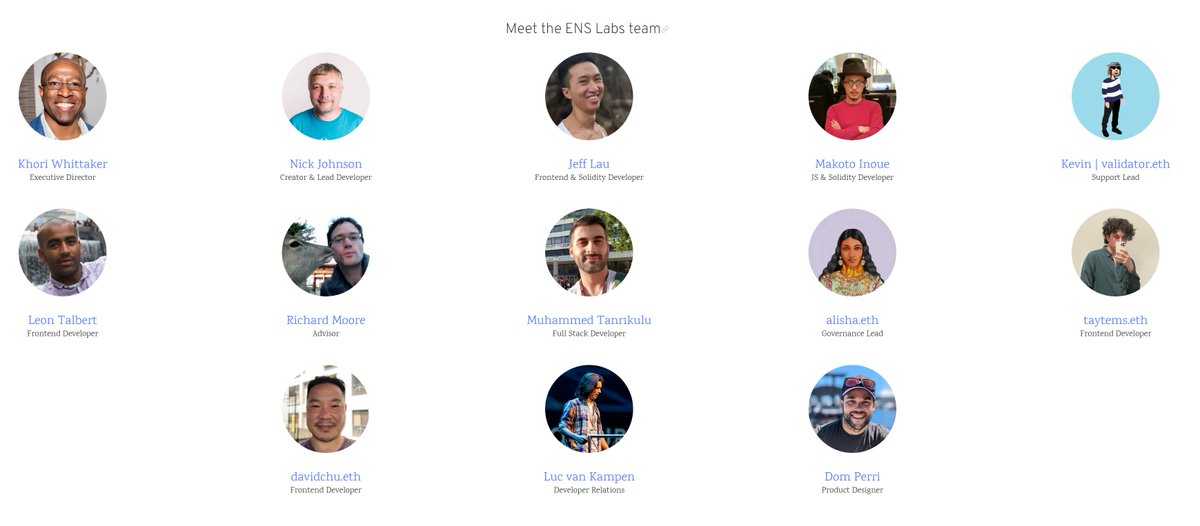

🔶 Team

$ENS was launched by @nicksdjohnson in 2017.

Key team members include @KhoriWhittaker, @_jefflau, @makoto_inoue, @talbert_leon, @ricmoo, @md_tanrikulu, @ValidatorEth, @futurealisha, @taytemss, @davidchuETH and @LucemansNL

🔶 Team

$ENS was launched by @nicksdjohnson in 2017.

Key team members include @KhoriWhittaker, @_jefflau, @makoto_inoue, @talbert_leon, @ricmoo, @md_tanrikulu, @ValidatorEth, @futurealisha, @taytemss, @davidchuETH and @LucemansNL

32/

🔶 Tokenomics

The $ENS token launched in November 2021 with an airdrop to existing domain name holders.

The token has capped total supply of 100M with the following distribution

• 25% airdropped to .ENS holders

• 25% to ENS contributors

• 50% to the DAO

🔶 Tokenomics

The $ENS token launched in November 2021 with an airdrop to existing domain name holders.

The token has capped total supply of 100M with the following distribution

• 25% airdropped to .ENS holders

• 25% to ENS contributors

• 50% to the DAO

33/

Out of the 100M tokens, 20M are currently in circulation:

• The airdrop vested immediately

• Tokens for core contributors have a 4 year lockup & vesting schedule

• The #DAOs tokens unlock over 4 years (although 10% was available immediately)

Out of the 100M tokens, 20M are currently in circulation:

• The airdrop vested immediately

• Tokens for core contributors have a 4 year lockup & vesting schedule

• The #DAOs tokens unlock over 4 years (although 10% was available immediately)

34/

While the fact that 80% of the tokens are unissued might concern some, it's important to remember that 500M tokens (50%) are controlled by the community

As such, it’s reasonable to assume that these won’t be issued unless it increases the overall value for all holders

While the fact that 80% of the tokens are unissued might concern some, it's important to remember that 500M tokens (50%) are controlled by the community

As such, it’s reasonable to assume that these won’t be issued unless it increases the overall value for all holders

35/

The $ENS token functions as a governance token - holders can submit proposals and vote on key issues facing the protocol

The #DAO currently follows a delegate model, allowing holders to assign their voting rights to a representative (users can self-delegate)

The $ENS token functions as a governance token - holders can submit proposals and vote on key issues facing the protocol

The #DAO currently follows a delegate model, allowing holders to assign their voting rights to a representative (users can self-delegate)

36/

🔶 Valuation

$ENS ‘s FDV is currently $1.4B, and I do not believe it is unrealistic for the token to 50x-100 from here.

This is based on the following assumptions:

• ARPU of $123.35

• 320M owners

• 3x revenue multiple

🔶 Valuation

$ENS ‘s FDV is currently $1.4B, and I do not believe it is unrealistic for the token to 50x-100 from here.

This is based on the following assumptions:

• ARPU of $123.35

• 320M owners

• 3x revenue multiple

37/

Currently, #ENS has 594K owners and a total revenue of around $73M

That’s an average revenue per user / owner (ARPU) of $123.35

Currently, #ENS has 594K owners and a total revenue of around $73M

That’s an average revenue per user / owner (ARPU) of $123.35

38/

We can assume that ownership can expand to 320M - which is the total number of cryptocurrency owners worldwide

This would imply a revenue of $39.5B

We can assume that ownership can expand to 320M - which is the total number of cryptocurrency owners worldwide

This would imply a revenue of $39.5B

39/

Given #ENS’s potential use as a payment solution, we can apply a fintech multiple of 3x to get a value of $118B

This would represent an ~85x increase over the FDV today

Given #ENS’s potential use as a payment solution, we can apply a fintech multiple of 3x to get a value of $118B

This would represent an ~85x increase over the FDV today

40/

Not only is 80x possible, but it may be conservative!

• Revenue projections only account for registrations & renewals (not payment and website functionality)

• Crypto adoption is still relatively low

• Fintech multiples are at a historical low- they were 25x last year

Not only is 80x possible, but it may be conservative!

• Revenue projections only account for registrations & renewals (not payment and website functionality)

• Crypto adoption is still relatively low

• Fintech multiples are at a historical low- they were 25x last year

41/

For instance, if we bring Fintech multiples to the 2022 average of 6x and assume that #ENS achieves a similar penetration to Visa at 1.2B users, that yields a valuation of $888B (>600x return from today)

While this may seem like a stretch, it’s definitely not impossible

For instance, if we bring Fintech multiples to the 2022 average of 6x and assume that #ENS achieves a similar penetration to Visa at 1.2B users, that yields a valuation of $888B (>600x return from today)

While this may seem like a stretch, it’s definitely not impossible

42/

If you want to learn more about ENS, I suggest following:

@0xMistressPunk

@BrantlyMillegan

@damedoteth

@ENS_DAO

@ensdomains

@ENSMaxisNFT

@ensprotect

@futurealisha

@nicksdjohnson

@nos_eth

Please tag anyone I missed!

If you want to learn more about ENS, I suggest following:

@0xMistressPunk

@BrantlyMillegan

@damedoteth

@ENS_DAO

@ensdomains

@ENSMaxisNFT

@ensprotect

@futurealisha

@nicksdjohnson

@nos_eth

Please tag anyone I missed!

Note: This is obviously not financial or investment advice nor a recommendation to purchase ENS

It’s just a few thoughts on how things could potentially play out

Like with any forecast, it’s a guess at best, and just as many things could go wrong and drive the price to $0

It’s just a few thoughts on how things could potentially play out

Like with any forecast, it’s a guess at best, and just as many things could go wrong and drive the price to $0

I hope you've found this thread helpful.

Follow me @MTorygreen for more fundamental analysis on Web3 protocols.

Like/Retweet the first tweet below if you can:

Follow me @MTorygreen for more fundamental analysis on Web3 protocols.

Like/Retweet the first tweet below if you can:

https://twitter.com/MTorygreen/status/1600535664616869889

• • •

Missing some Tweet in this thread? You can try to

force a refresh