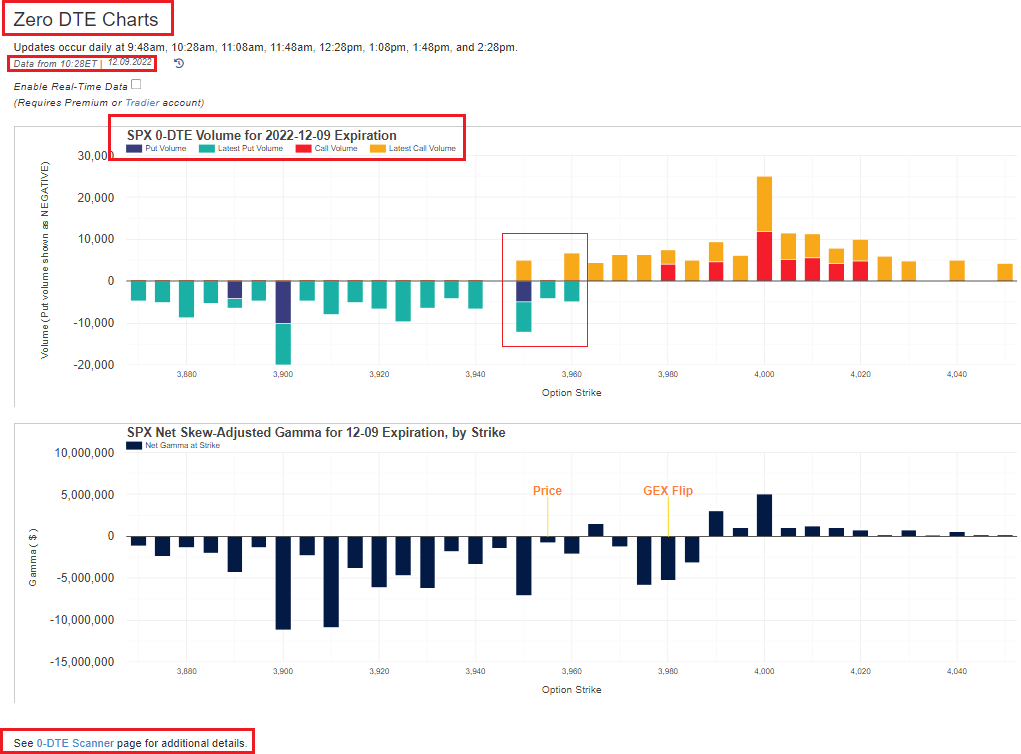

$SPX #0DTE scanner and $GEX charts from @TradeVolatility

3900 puts and 4000 calls continue to attract the highest number of bets

4000 call has the largest volume change

The struggle area now: 3950/3960

The safest 0DTE play is selling the 3900/4000 strangle for $1.50

#SPX #ES

3900 puts and 4000 calls continue to attract the highest number of bets

4000 call has the largest volume change

The struggle area now: 3950/3960

The safest 0DTE play is selling the 3900/4000 strangle for $1.50

#SPX #ES

We are going to sell the 3935/4000 strangle for $4.25

*Price went lower since the screenshot

#ES_F #trading #options #daytrading #futures

*Price went lower since the screenshot

#ES_F #trading #options #daytrading #futures

Value now: $1.20

Theta decay is corrosive in #0DTE options.

$SPX $ES #ES_F #SPX #futurestrading #OptionsTrading #trading #DayTrading $SPY

Theta decay is corrosive in #0DTE options.

$SPX $ES #ES_F #SPX #futurestrading #OptionsTrading #trading #DayTrading $SPY

• • •

Missing some Tweet in this thread? You can try to

force a refresh