TODAY IN THE MARKETS

$VIX

Down day for the #SPX, and the #VIX closed down -6.26% and below 20DMA

Yesterday: large bearish engulfing candle

Today: Continuation

Despite the lack of sync this looks like a bullish development for $SPX

#ES_F #trading $SPY $ES #options #VIX $VVIX

$VIX

Down day for the #SPX, and the #VIX closed down -6.26% and below 20DMA

Yesterday: large bearish engulfing candle

Today: Continuation

Despite the lack of sync this looks like a bullish development for $SPX

#ES_F #trading $SPY $ES #options #VIX $VVIX

$XLF

#XLF was rejected at 20DMA

The sector remains above the 200DMA, and near support

For the October #SPX rally to continue it's necessary for #XLF to hold above $34.40

#trading #banks #options #ES_F $SPX $SPY $ES #DayTrading #Futures #inflation #ratehikes #Fed #Financial

#XLF was rejected at 20DMA

The sector remains above the 200DMA, and near support

For the October #SPX rally to continue it's necessary for #XLF to hold above $34.40

#trading #banks #options #ES_F $SPX $SPY $ES #DayTrading #Futures #inflation #ratehikes #Fed #Financial

$QQQ

It is in "the pinch", right between the 100DMA and the 20DMA.

One is support, the other is resistance

Let's see which side #QQQ comes out on.

It's still in the uptrend channel.

#NASDAQ #IXIC #NDX $NDX #NQ_F #options #trading #Futures #DayTrading #TradingSignals #SPX #ES_F

It is in "the pinch", right between the 100DMA and the 20DMA.

One is support, the other is resistance

Let's see which side #QQQ comes out on.

It's still in the uptrend channel.

#NASDAQ #IXIC #NDX $NDX #NQ_F #options #trading #Futures #DayTrading #TradingSignals #SPX #ES_F

$SPX

Down day with lower volume

Rejection at 200DMA, support at 20DMA, another "pinch"

It's inside the rising channel with bottom band support at 3930 for tomorrow

Rejected also from trend line

But it's all about #Gamma

#SPX #ES_F $SPY $ES #options #trading #Futures $VIX

Down day with lower volume

Rejection at 200DMA, support at 20DMA, another "pinch"

It's inside the rising channel with bottom band support at 3930 for tomorrow

Rejected also from trend line

But it's all about #Gamma

#SPX #ES_F $SPY $ES #options #trading #Futures $VIX

The #SPX stocks above 50DMA Index

Closed below 20DMA, but managed to bounce from support

Not the more bullish picture, but it's still looking OK

It closed at 78.5%. Closing below 63.5% would be extremely bearish

$SPX $SPY $ES #ES_F #trading #options #Futures #MarketBreadth

Closed below 20DMA, but managed to bounce from support

Not the more bullish picture, but it's still looking OK

It closed at 78.5%. Closing below 63.5% would be extremely bearish

$SPX $SPY $ES #ES_F #trading #options #Futures #MarketBreadth

The #SPX stocks above 200DMA

It closed at 57.5%

Remains above the trendline, the 50% level, the 200DMA and the 20DMA

Continues to show good internal health of $SPX

#ES_F #options #trading #Futures #DayTrading $SPY $VIX #inflation #recession #BullMarket #bearmarket

#Gamma

It closed at 57.5%

Remains above the trendline, the 50% level, the 200DMA and the 20DMA

Continues to show good internal health of $SPX

#ES_F #options #trading #Futures #DayTrading $SPY $VIX #inflation #recession #BullMarket #bearmarket

#Gamma

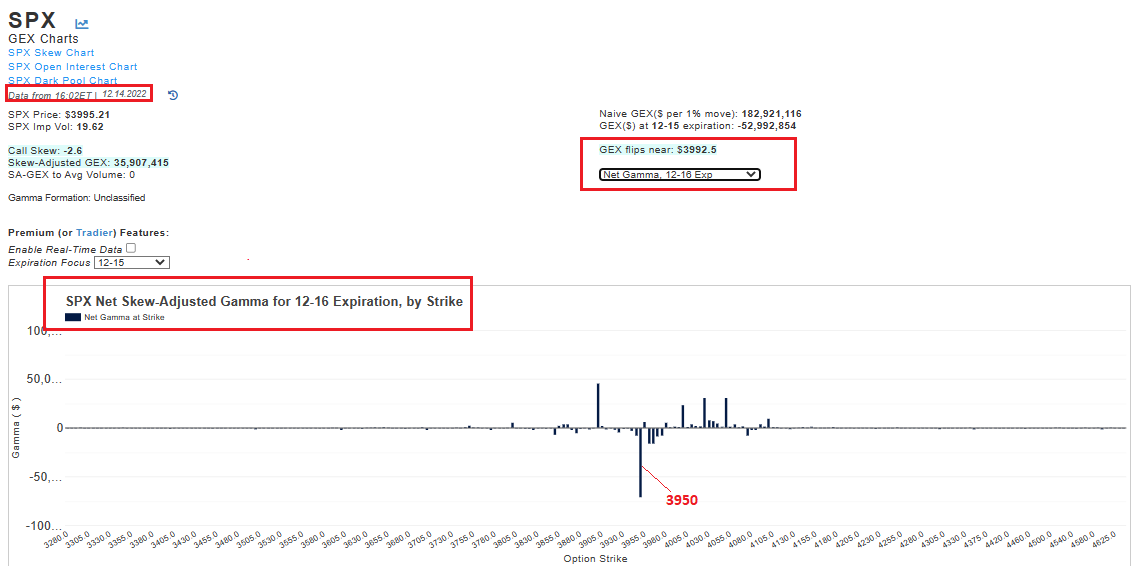

$SPX #OPEX #Gamma

Tomorrow all the action will be dictated by MMs hedging large $Gamma exposure

Despite the big neg. stack size at 3950, pos. Gamma exposure almost doubles the negative one

#SPX achieved to close above the Flip point and 4000

Chart from @TradeVolatility #ES_F

Tomorrow all the action will be dictated by MMs hedging large $Gamma exposure

Despite the big neg. stack size at 3950, pos. Gamma exposure almost doubles the negative one

#SPX achieved to close above the Flip point and 4000

Chart from @TradeVolatility #ES_F

Chart of the day

$BE #BE

We are choosing another green energy company today

Bloom Energy Corp

It broke above resistance today in higher volume

After moving up more than 11% it pulled back for a gain of only +5.92%, but still closing above resistance

A good long play

#trading

$BE #BE

We are choosing another green energy company today

Bloom Energy Corp

It broke above resistance today in higher volume

After moving up more than 11% it pulled back for a gain of only +5.92%, but still closing above resistance

A good long play

#trading

Short of the day

$PBR

Petroleo Brasileiro S.A. after breaking below 200DMA 2 days ago, it gapped down and closed below important support losing -9,86% today

It did so in very heavy volume

All in this chart indicates lower prices ahead

#PBR #Oil #energy #trading #options

$PBR

Petroleo Brasileiro S.A. after breaking below 200DMA 2 days ago, it gapped down and closed below important support losing -9,86% today

It did so in very heavy volume

All in this chart indicates lower prices ahead

#PBR #Oil #energy #trading #options

unroll @UnrollHelper

• • •

Missing some Tweet in this thread? You can try to

force a refresh