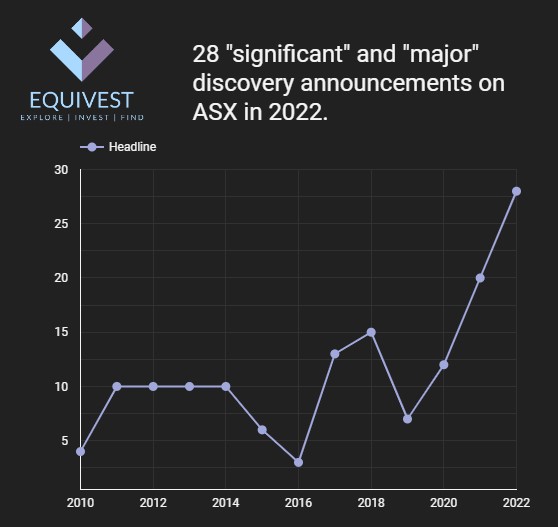

1/6 Most of the new #discovery announcements and good first holes ends up as a minor discovery.

How to spot significant discoveries as an investor?

How to spot significant discoveries as an investor?

2/6 Three steps to follow🪜:

1) Study significant discoveries

2) Study the failed discoveries

2) Learn the essentials of geology

Let's dig in.

1) Study significant discoveries

2) Study the failed discoveries

2) Learn the essentials of geology

Let's dig in.

3/6 Do the following:

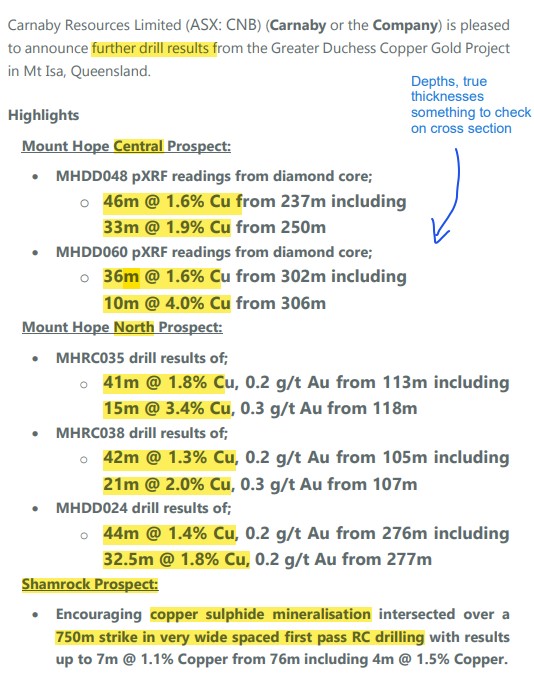

• Select commodity of interest e.g. #copper #nickel #uranium #gold

• Study top discoveries made in the last years

• Look at announcements (grades, footprint, structures, geophysical anomalies etc.)

• Put it into a system

• Select commodity of interest e.g. #copper #nickel #uranium #gold

• Study top discoveries made in the last years

• Look at announcements (grades, footprint, structures, geophysical anomalies etc.)

• Put it into a system

4/6 Study the failed "discoveries".

Ask questions:

• Why did the share price collapse?

• What were the first warning signs?

• How could you exit without loss💰 or even with profit 💵?

Ask questions:

• Why did the share price collapse?

• What were the first warning signs?

• How could you exit without loss💰 or even with profit 💵?

5/6 During the study process you will probably arrive at the conclusion that you need to understand more geology.

I run the #Geology101 for Investors course. Only content out there that links geology with investments insights. equivest.capital/geology-for-in…

I run the #Geology101 for Investors course. Only content out there that links geology with investments insights. equivest.capital/geology-for-in…

6/6 So, let's recap what we've learned🗒️:

1⃣ Study significant discoveries.

And remember to do one commodity at a time.

2⃣ Study the failed discoveries. Do this by:

1) Looking for warning signs.

2) Focus on how to book profits.

And don’t forget the #Geology.

1⃣ Study significant discoveries.

And remember to do one commodity at a time.

2⃣ Study the failed discoveries. Do this by:

1) Looking for warning signs.

2) Focus on how to book profits.

And don’t forget the #Geology.

• • •

Missing some Tweet in this thread? You can try to

force a refresh