1/8 Forward curves for 🇪🇺 gas prices (TTF) show falling prices but levels remain double 🇺🇸 benchmark (Henry Hub) until 2031.

Thus the 'Doomsday crowd' forecasts de-industrialization of 🇪🇺.

I am positioned the other way.

Chart via @GeorgZachmann

#gas #gasprices #EnergyCrisis

Thus the 'Doomsday crowd' forecasts de-industrialization of 🇪🇺.

I am positioned the other way.

Chart via @GeorgZachmann

#gas #gasprices #EnergyCrisis

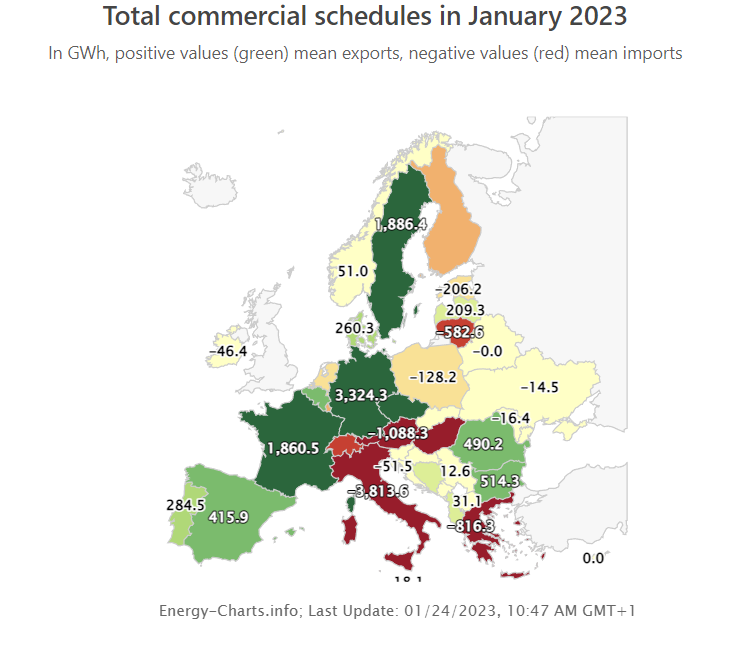

2/8 The first counter argument is that this is somewhat more a return to the past with TTF generally trading way above Henry Hub.

Chart via @MiguelGilTertre

Chart via @MiguelGilTertre

3/8 In this context I also recommend to read the Substack article from @adam_tooze from September 2022. In essence he refutes the 'cheap Russian gas hypothesis' for 🇩🇪 and focuses on the relevance of energy efficiency.

adamtooze.substack.com/p/chartbook-15…

adamtooze.substack.com/p/chartbook-15…

4/8 I believe the forward curve is useful only in short-term forecast and its effect is limited longer term. More noise than signal.

There is a good academic paper from 2009 on this topic on oil.

onhttps://eaber.org/wp-content/uploads/2011/05/IEEJ_Yanagisawa_2009.pdf

There is a good academic paper from 2009 on this topic on oil.

onhttps://eaber.org/wp-content/uploads/2011/05/IEEJ_Yanagisawa_2009.pdf

5/8 The same arguments can be applied to gas forward curves. Summary on the reasoning from the academic paper is below:

6/8 So again I would argue that the 'Doomsday crowd' is way too sure of 🇪🇺 demise.

We know that the 🇪🇺 is going into overdrive to wean itself of fossil fuels in general and 🇷🇺 gas/oil/coal in particular.

See also my threads from April 7th, 10th and 15th on the topic.

We know that the 🇪🇺 is going into overdrive to wean itself of fossil fuels in general and 🇷🇺 gas/oil/coal in particular.

See also my threads from April 7th, 10th and 15th on the topic.

7/8 You can argue that 🇪🇺 plans will not work. The answer to this will probably be a lot clearer by 2025.

In the meantime I suggest to follow a few analysts who have what I would call a better more nuanced understanding of Europe such as @JacobShap or @Geo_papic .

In the meantime I suggest to follow a few analysts who have what I would call a better more nuanced understanding of Europe such as @JacobShap or @Geo_papic .

• • •

Missing some Tweet in this thread? You can try to

force a refresh