1/4 Macrovoices Podcast Episode 334 with guest @Go_Rozen

From the transcript: "we just got back from 🇩🇪, the Germans are basically resigned to the fact that they are not going to have electricity this winter".

What was/is the reality?

#electricity #germany #EnergyCrisis

From the transcript: "we just got back from 🇩🇪, the Germans are basically resigned to the fact that they are not going to have electricity this winter".

What was/is the reality?

#electricity #germany #EnergyCrisis

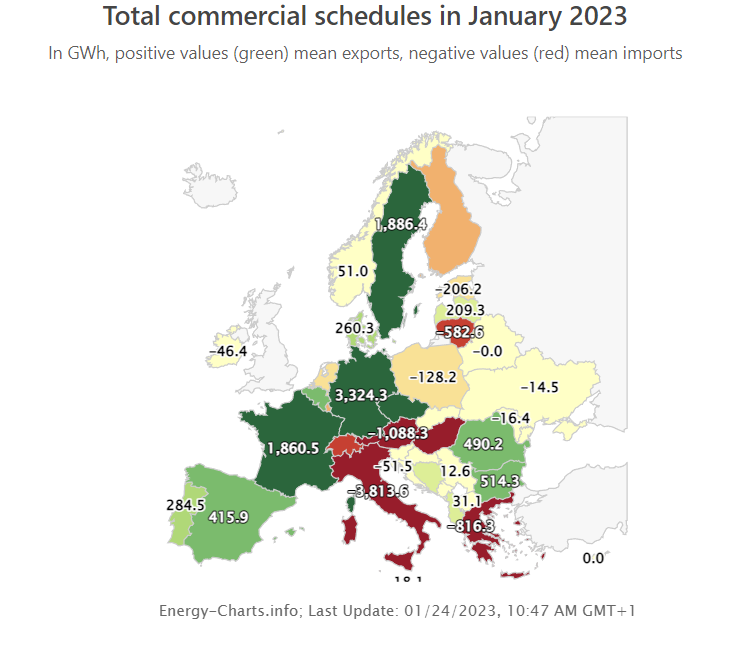

2/2 Actual situation up to January 24th 2023 for the month of January (peak of winter in 🇩🇪):

🇩🇪 biggest net exporter of electricity in Europe.

🇩🇪 biggest net exporter of electricity in Europe.

3/4 Same situation for December 2022. December average temperatures were -1.8C cooler than 5 year average.

4/4 Same situation (exception Norway) for November 2022.

November average temperatures were +1.1C warmer than 5 year average.

November average temperatures were +1.1C warmer than 5 year average.

• • •

Missing some Tweet in this thread? You can try to

force a refresh