BULL TRAP THESIS 🧐

Read this comprehensive thread so you understand why this is the BIGGEST BULL TRAP that we have ever seen

#thread 🧵

Read this comprehensive thread so you understand why this is the BIGGEST BULL TRAP that we have ever seen

#thread 🧵

Let's start with JPOW & Interest Rates

Currently, Fed has been raising interest rates to battle inflation which puts downward pressure on the #StockMarket

So if Fed keeps raising rates, it's #bearish for #stocks & #crypto.

Raising Camign → Pause → Decreasing Campaign

2🧵

Currently, Fed has been raising interest rates to battle inflation which puts downward pressure on the #StockMarket

So if Fed keeps raising rates, it's #bearish for #stocks & #crypto.

Raising Camign → Pause → Decreasing Campaign

2🧵

We are in a #BearMarket and this recent rally has sparked a lot of enthusiasm from #investors and #traders.

Bear Market Rallies are a common phenomenon during the Bear Market and usually have multiple selling climaxes and declining volume on the rallies.

3🧵

Bear Market Rallies are a common phenomenon during the Bear Market and usually have multiple selling climaxes and declining volume on the rallies.

3🧵

Now, I am going to dive into different charts to show you the confluence of what I am saying.

First up, $VIX 👑

4🧵

First up, $VIX 👑

4🧵

💡 Look for divergence when #VIX makes a lower low, #stocks should make a higher high and when it does not happen, we can anticipate a turn in the markets.

5🧵

5🧵

💡 Indicies Divergence

Monitor Three Major Indices: #DOW #NASDAQ #SPY and look for divergence, all three indices should follow each other and make higher highs and lower lows in tandem. When it does not happen, we can anticipate a turn in the markets.

6🧵

Monitor Three Major Indices: #DOW #NASDAQ #SPY and look for divergence, all three indices should follow each other and make higher highs and lower lows in tandem. When it does not happen, we can anticipate a turn in the markets.

6🧵

💡 International #Bonds Divergence

Monitor International 10Y Bond Yields: #USA, #British, #German bonds and look for divergence.

Yield 📈 → Currency 📈 → Equities 📉

7🧵

Monitor International 10Y Bond Yields: #USA, #British, #German bonds and look for divergence.

Yield 📈 → Currency 📈 → Equities 📉

7🧵

💡 #DXY Dollar Index at MAJOR support!

If the #Dollar bounces from its MID RANGE support, we could see a 6% rally which would be very #bearish for #stocks and #crypto.

8🧵

If the #Dollar bounces from its MID RANGE support, we could see a 6% rally which would be very #bearish for #stocks and #crypto.

8🧵

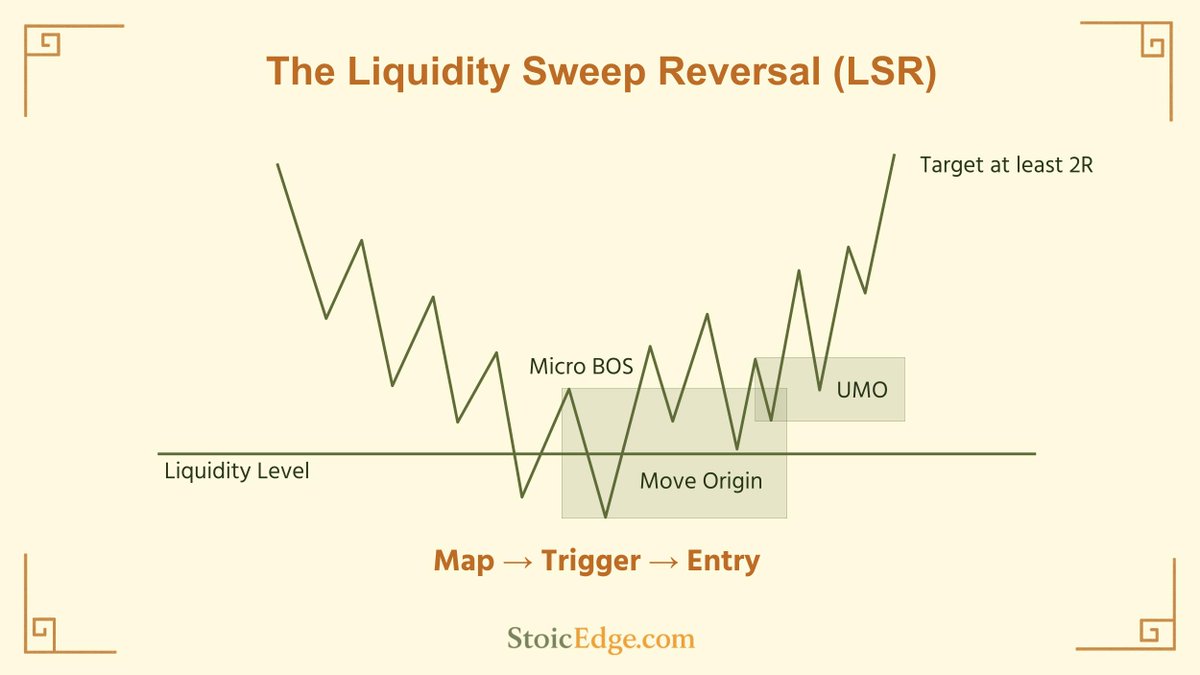

#SP500 $ES_F $ES Technical Analysis

1. Liquidity Grab ✓

2. Displacement ✓

3. Structure Break ✓

4. Retracement ✓

5. Short inside Optimal Trade Entry ✓

9🧵

1. Liquidity Grab ✓

2. Displacement ✓

3. Structure Break ✓

4. Retracement ✓

5. Short inside Optimal Trade Entry ✓

9🧵

This new bullish sentiment across #stocks and #crypto is getting out of control, intelligent 🧐 investors call it "Irrational Exuberance"

F&ck around...

10🧵

F&ck around...

10🧵

Enjoyed this #thread?

Like & Retweet the first tweet to spread the message 🙏

Follow @StoicTA for more #TRADINGTIPS and #SwingTrading

Like & Retweet the first tweet to spread the message 🙏

Follow @StoicTA for more #TRADINGTIPS and #SwingTrading

https://twitter.com/StoicTA/status/1618996351928537088?s=20&t=QdbnZD_X5C8AscBEsczcVQ

• • •

Missing some Tweet in this thread? You can try to

force a refresh