Thanks to @GeoffCutmore & @steve_sedgwick for the chat on #SquawkBox this morning!

Short and sweet today, but I hope it was of some interest. The notes I put together ahead of time will follow in this thread...

1/x

Short and sweet today, but I hope it was of some interest. The notes I put together ahead of time will follow in this thread...

1/x

First of all, it's #ValentinesDay and SOMEONE is going to get massacred today when the #CPI is released, so naturally:-

2/x

2/x

Roses are red, violets are blue,

JayPow doesn't know

And neither do you.

#inflation's effects are not as universal as they were, but does that mean we can all now relax?

3/x

JayPow doesn't know

And neither do you.

#inflation's effects are not as universal as they were, but does that mean we can all now relax?

3/x

The #jobs market, meanwhile, is still smokin' hot (at least, it is if that last #NFP print is to be believed). Certainly not enough signs of distress to derail the #Fed's loudly declared intent.

4/x

4/x

Not hard to find signs of weakness but also (partial explanations) and offsets. Falling #energy prices cast a long shadow on some of the macro numbers.

#PMI #ISM #oil #gas

5/x

#PMI #ISM #oil #gas

5/x

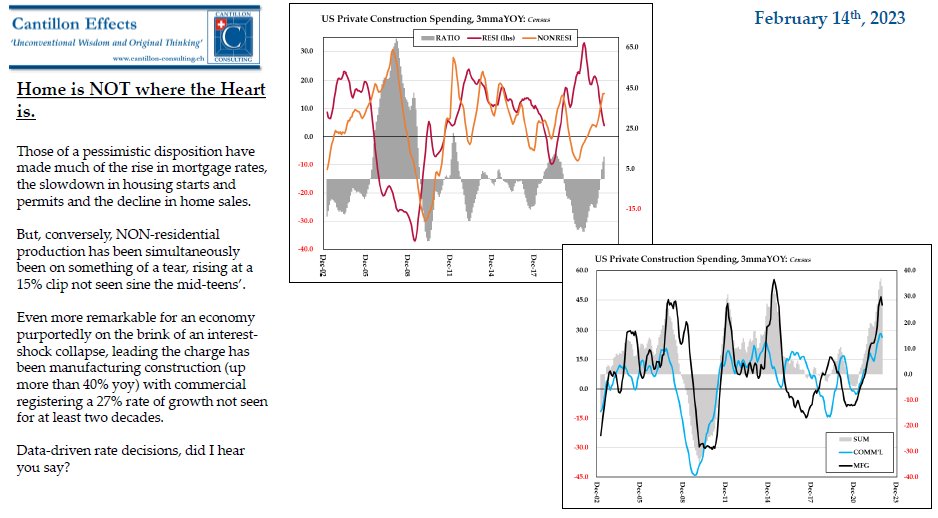

Ironically, in a world supposedly plagued by weakening industry and where finance is both dearer and more pickily extended, those at the higher, capital intensive end of the productive chain are breaking a lot more ground than those at the lower.

#CRE #manufacturing #housing

6/x

#CRE #manufacturing #housing

6/x

Adding to the confusion, we are potentially suffering from some serious misapprehensions about just how tight are money & #credit. In these circumstances, the widely-noted lack of #moneysupply growth may well be deceptive.

7/x

7/x

Furthermore, we may have come up a long way from the bottom in fairly short order, but its still too early to say we're risking the bends, much less altitude sickness, when it comes to real #yields

8/x

8/x

Heads or Tails? Kopf oder Zahl?

Both market & #FOMC have managed to talk themselves into a corner regarding today's #CPI release. What we REALLY need for direction is a brief rally/sell-off on a weak/strong number which gets instantly rejected & sucks in volume on the move

9/x

Both market & #FOMC have managed to talk themselves into a corner regarding today's #CPI release. What we REALLY need for direction is a brief rally/sell-off on a weak/strong number which gets instantly rejected & sucks in volume on the move

9/x

The wider import is that such reversals -of policy, positioning, of data and direction- may be here to stay. #Multiflation, we call it and it's a doozy!

10/x

10/x

Larger divergences from expectations. Wider ranges of outcomes. Lesser predictability. Shortened horizons (and hence higher natural rates). Time to get the flared jeans and the Adidas T-shirts out of the wardrobe & start doing the Tiger Feet dance.

11/x

11/x

Oh, and 60/40 RIP. Risk parity, too, probably - a well as a host of other mechanical correlation strategies.

It's a world of rigorous Auftragstaktik up at the sharp end, not Chateau generalship and sandbox Schlieffen Plans.

#Multiflation!

12/x

It's a world of rigorous Auftragstaktik up at the sharp end, not Chateau generalship and sandbox Schlieffen Plans.

#Multiflation!

12/x

@threadreaderapp please unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh