Market microstructure is so important in trading.

Here’s some brilliant analysis from Kaiko that I’ve summarised.

A must read thread for crypto traders. 👇🏼

Here’s some brilliant analysis from Kaiko that I’ve summarised.

A must read thread for crypto traders. 👇🏼

Volumes - Amid last weeks broad market rally, #Crypto trade volumes reached their highest level since the FTX collapse.

On 14 March, trade volumes on the 18 most liquid centralised exchanges rose to $51bn, hitting 4-month highs.

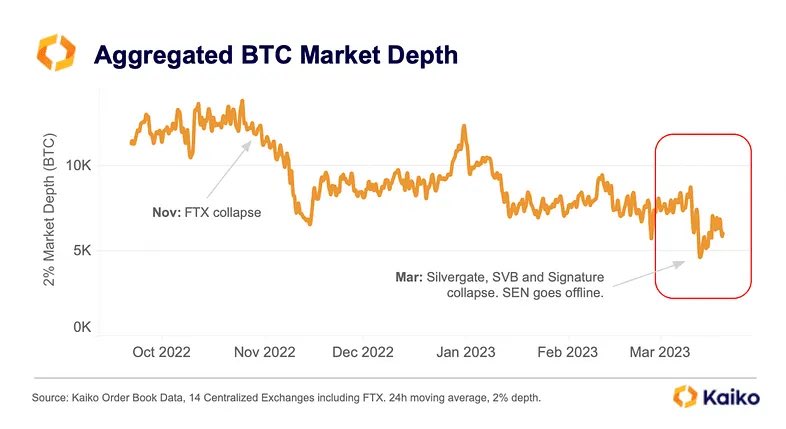

Liquidity - despite the rising volumes, liquidity remains thin.

Aggregate market depth for BTC-USD and BTC-USDT pairs has hit 10-month lows.

Aggregate market depth for BTC-USD and BTC-USDT pairs has hit 10-month lows.

Market depth dropped even lower than levels seen in the immediate aftermath of FTX, likely due to the closure of major on-ramp banks for crypto markets.

Kaiko looked at 20 centralised exchanges to see the usage of stablecoins vs fiat. Stablecoin usage has increased to 78%.

80% of all stablecoin-denominated trades are using #USDT.

Price - Bitcoin is largely outperforming the broader crypto market, best visualised by the BTC to ETH price ratio, which reached its highest level since July 2022. Since March 12,

BTC is up 31% compared with ETH’s 18% gains.

BTC is up 31% compared with ETH’s 18% gains.

Regulation - With different jurisdictions regulating in different ways, there are opportunities for different countries and therefore currencies.

Can #Europe or #APAC can replace some of the fiat payment rails that have been dismantled in the U.S?

Can #Europe or #APAC can replace some of the fiat payment rails that have been dismantled in the U.S?

Again looking at the 20 top exchanges, the US still dominates with 47% market share and Korean Won second at 39%.

Weekend Trading - In 2023 so far, volumes were on average 33% lower on weekends relative to weekdays.

This gap varies significantly between exchanges, ranging from 40% on #Gemini and #Kraken to 30% on Coinbase and 24% on #Binance US.

This gap varies significantly between exchanges, ranging from 40% on #Gemini and #Kraken to 30% on Coinbase and 24% on #Binance US.

Macro - looking at Bitcoins correlation with traditional assets. #BTC correlation with #Nasdaq is approaching the post FTX low.

BTC correlation with safe-have gold has surged to its highest level since January. #Gold prices jumped by 7.2% in March.

BTC correlation with safe-have gold has surged to its highest level since January. #Gold prices jumped by 7.2% in March.

Last week, the Feds balance sheet grew by approx $300bn, due to increased demand by banks for liquidity.

Hope you found this thread useful.

We’re here to help you navigate crypto markets using our combined 38 years experience in macros sales and trading.

Follow us at @LDNCryptoClub for more!

We’re here to help you navigate crypto markets using our combined 38 years experience in macros sales and trading.

Follow us at @LDNCryptoClub for more!

• • •

Missing some Tweet in this thread? You can try to

force a refresh