As fears of a new global financial crisis spread, major banks like #SVB, Signature, and First Republic are under fire.

Meanwhile, #Bitcoin's price soars. Could Bitcoin be the answer to the impending banking crisis? 🌎📉

Let's dive in! 🧵👇

Meanwhile, #Bitcoin's price soars. Could Bitcoin be the answer to the impending banking crisis? 🌎📉

Let's dive in! 🧵👇

1/ The 2008 financial crisis left economies shattered and lives upended. Governments bailed out banks, leading to currency devaluation and a double tax on citizens.

Now, with troubling similarities emerging, could Bitcoin provide the financial security we need?

Now, with troubling similarities emerging, could Bitcoin provide the financial security we need?

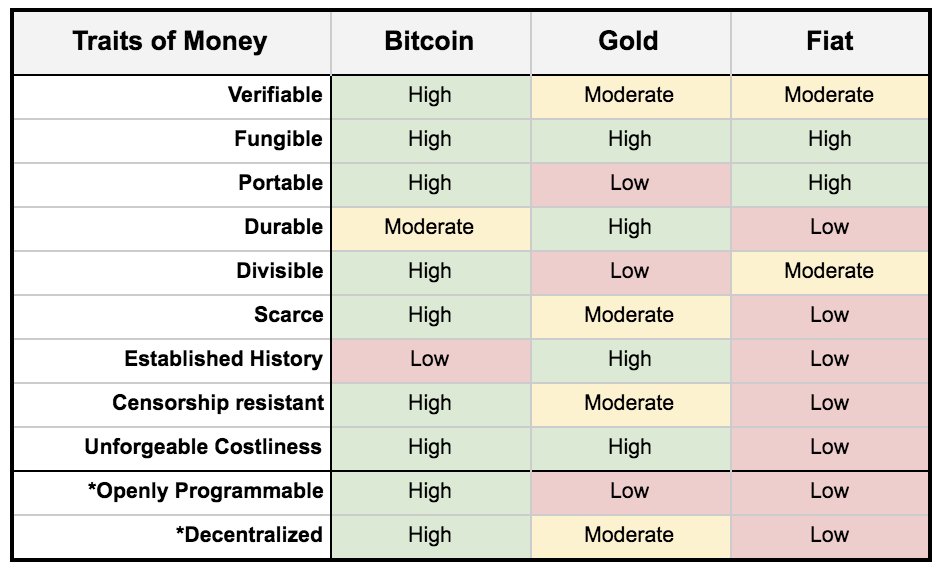

2/ #Bitcoin was born out of the ashes of the 2008 crisis, designed as a decentralized alternative to traditional banking systems. With capped supply and decentralized infrastructure, it offers protection against manipulation by central banks or governments.

3/ As the current financial turmoil unfolds, Bitcoin's value proposition becomes increasingly clear. As a truly global currency, it can be used anywhere, allowing individuals to opt out of the traditional financial system and store their wealth securely. 🔒🌍

4/ In the context of a global crisis, Bitcoin emerges as a potential hedge against systemic pressures. Its capped supply of 21 million coins introduces scarcity, helping to maintain its value over time and preserve purchasing power amidst rising balance sheets of central banks.

5/ With the Federal Reserve experiencing a substantial increase in borrowing activities in the past weeks, totaling $303 billion, we're seeing the growing demand for liquidity. This has resulted in higher asset prices, especially for Bitcoin. 📈

6/ Despite its advantages, Bitcoin's high volatility often raises questions about its effectiveness as a financial hedge. However, as #Bitcoin continues to establish its fundamentals and achieves mass adoption, it's strengthening its position and drops in volatility.

7/ #Bitcoin offers a decentralized solution to financial security. Its inherent characteristics make it a strong digital counterpart to gold, providing a safe-haven asset during economic turbulence. ⚖️

8/ By embracing the potential of Bitcoin, we can create a future less reliant on centralized systems and empower individuals to take control of their financial destiny. Bitcoin solves our dependence on central systems, providing an innovative and essential solution. 💡

Read our full analysis of Bitcoin in the banking crisis here:

flagship.fyi/outposts/marke…

What do you think about Bitcoin's potential as a solution during financial crises? Can it truly provide the financial security we need in times of uncertainty? Share your thoughts below! 💭👇

flagship.fyi/outposts/marke…

What do you think about Bitcoin's potential as a solution during financial crises? Can it truly provide the financial security we need in times of uncertainty? Share your thoughts below! 💭👇

https://twitter.com/1460708818007040007/status/1639192142886371329

Want to join the Flagship crew and stay ahead of the game?

Take the bait and come say Hi! 👋

discord.gg/flagship

Take the bait and come say Hi! 👋

discord.gg/flagship

• • •

Missing some Tweet in this thread? You can try to

force a refresh