You prefer earning safer yields on your #crypto investments? 👀

Well, I may have found a project that could interest you!

Just finished my research on @CruizeFinance, I'm excited to share my findings🧐

A breakdown of its unique mechanics 🧵👇

#yieldfarming #CruizeFinance

Well, I may have found a project that could interest you!

Just finished my research on @CruizeFinance, I'm excited to share my findings🧐

A breakdown of its unique mechanics 🧵👇

#yieldfarming #CruizeFinance

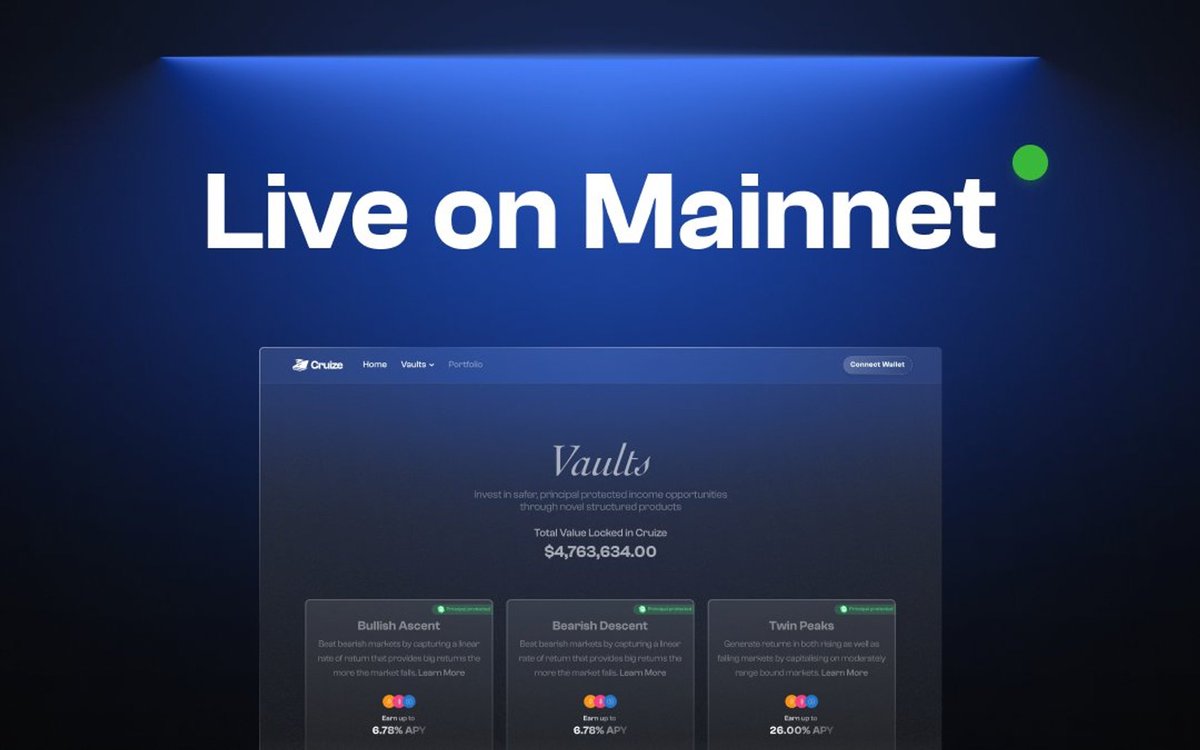

1⃣ Overview

🔸Cruize's a project that provides volatility-protected yield opportunities on #crypto using structured products

🔸It allows users to stake their capital & generate safer yields through the combination of derivatives & bonds in pre-packaged instruments

🔸Cruize's a project that provides volatility-protected yield opportunities on #crypto using structured products

🔸It allows users to stake their capital & generate safer yields through the combination of derivatives & bonds in pre-packaged instruments

2⃣ Competitors

🔸@CurveFinance & @AaveAave for example

▪️$CRV is known for its low slippage stable coin swaps on-chain

▪️$Aave has a broader range of services, including flash loans, uncollateralized loans & variable interest rates

🔸@CurveFinance & @AaveAave for example

▪️$CRV is known for its low slippage stable coin swaps on-chain

▪️$Aave has a broader range of services, including flash loans, uncollateralized loans & variable interest rates

3⃣ What are Structured Products?

🔸Structured products are like a pre-made package of money that people can buy

🔸They are made by combining different things like regular money, risky investments, and other special types of investments

🔸Structured products are like a pre-made package of money that people can buy

🔸They are made by combining different things like regular money, risky investments, and other special types of investments

🔸People buy structured products instead of buying regular investments because they can be customized to meet their specific needs.

To avoid losing money when a stock goes down, one can buy a structured product that only pays if the stock goes up.

To avoid losing money when a stock goes down, one can buy a structured product that only pays if the stock goes up.

🔸Principal protection which means that if someone buys the product & keeps it for a certain amount of time

🔸They are guaranteed to get their money back, even if the investments in the product don't do well

🔸They are guaranteed to get their money back, even if the investments in the product don't do well

🔸Structured products are like a special type of investment that can be tailored to each person's needs, and may offer certain protections or benefits that regular investments do not

4⃣ Liquidity Generation Event (LGE)

🔸Start date: 24th April, 1 PM UTC

🔸End date: 1st May, 1 PM UTC

🔸Hard cap: $5M Raised at $25m FDV

🔸Allocation: 20,000,000 tokens (20% of the supply)

🔸Vesting: 50% $CRUIZE (no vesting), 50% $ARMADA (3-month vesting)

🔸Start date: 24th April, 1 PM UTC

🔸End date: 1st May, 1 PM UTC

🔸Hard cap: $5M Raised at $25m FDV

🔸Allocation: 20,000,000 tokens (20% of the supply)

🔸Vesting: 50% $CRUIZE (no vesting), 50% $ARMADA (3-month vesting)

🔸LGE participants will receive bonus rewards in the form of rebates & $ARMADA #airdrop

🔸The allocation is set at 20% of the total sup ~ 20M tokens

🔸More details covered by @RamsesExchange

🔸The allocation is set at 20% of the total sup ~ 20M tokens

🔸More details covered by @RamsesExchange

https://twitter.com/RamsesExchange/status/1648068345550487555

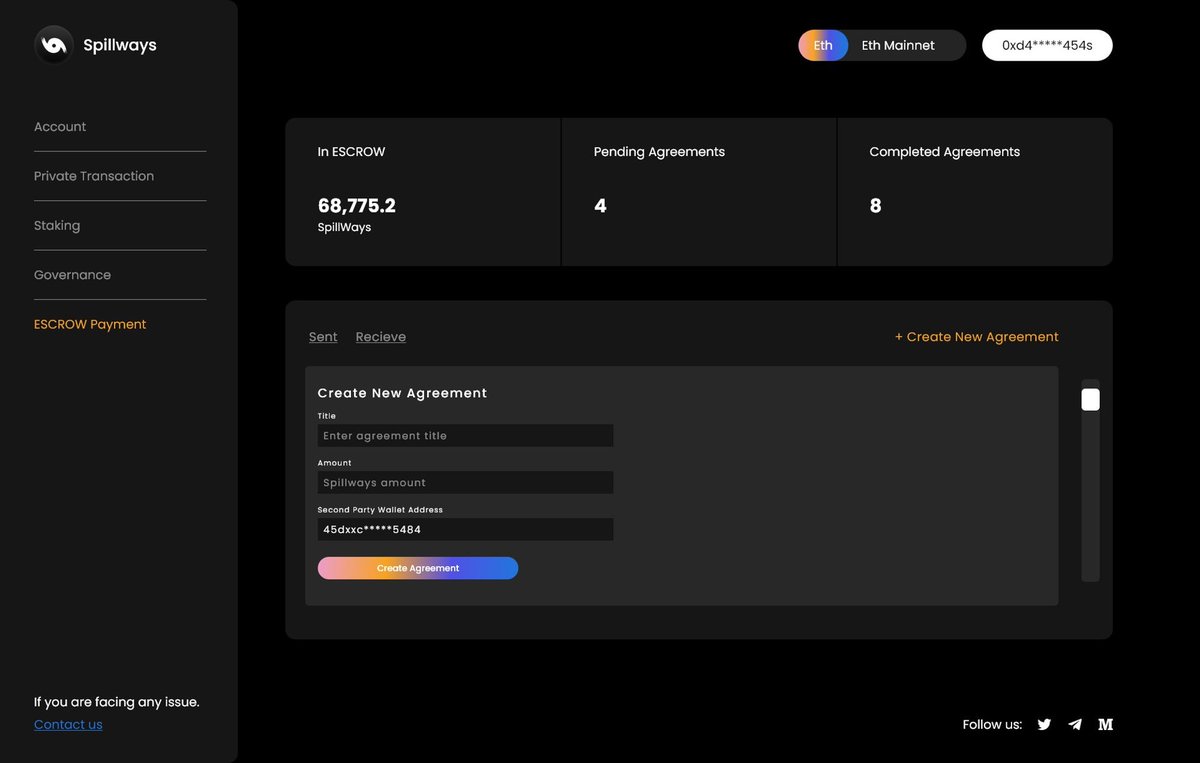

5⃣ Tokenomics

🔸 $CRUIZE - native token

🔸Max Sup: 100,000,000

▪️Used for the $CRUIZE protocol that can be staked for the escrowed token called $ARMADA

▪️$ARMADA can be used to accrue value from protocol earnings and participate in governance

🔸 $CRUIZE - native token

🔸Max Sup: 100,000,000

▪️Used for the $CRUIZE protocol that can be staked for the escrowed token called $ARMADA

▪️$ARMADA can be used to accrue value from protocol earnings and participate in governance

🔸$CRUIZE tokens can be earned by:

▪️Providing liquidity on supported #AMM pools

▪️Staking $CRUIZE to receive $ARMADA tokens

▪️Providing liquidity on supported #AMM pools

▪️Staking $CRUIZE to receive $ARMADA tokens

🔸Converting $CRUIZE to $ARMADA requires escrowing it in exchange for holder benefits with rate of 1:1

🔸ARMADA holders are entitled to:

▪️Revenue share of 40%

▪️Boosted yields

▪️Access to exclusive vaults

▪️Governance privileges

🔸ARMADA holders are entitled to:

▪️Revenue share of 40%

▪️Boosted yields

▪️Access to exclusive vaults

▪️Governance privileges

🔸The emission schedule for $CRUIZE tokens follows a 90-day epoch, while the vesting period for ARMADA tokens is also 90 days

🔸These measures ensure the sustainability of $CRUIZE's ecosystem & prevent excessive supply in circulation

🔸These measures ensure the sustainability of $CRUIZE's ecosystem & prevent excessive supply in circulation

6⃣ Distribution

🔸$CRUIZE has a token distribution plan that includes:

▪️Seed Round: 5%

▪️Public Sale: 20%

▪️Team: 15%

▪️Advisors: 2%

▪️Future Employees: 3%

▪️Community: 40%

▪️Reserves: 5%

▪️Liquidity: 10%

🔸$CRUIZE has a token distribution plan that includes:

▪️Seed Round: 5%

▪️Public Sale: 20%

▪️Team: 15%

▪️Advisors: 2%

▪️Future Employees: 3%

▪️Community: 40%

▪️Reserves: 5%

▪️Liquidity: 10%

🔸The Seed Round includes 10% as $CRUIZE and 10% as $ARMADA

🔸The remaining 75% is divided among the Team, Advisors, Future Employees, Community, Reserves & Liquidity

🔸The remaining 75% is divided among the Team, Advisors, Future Employees, Community, Reserves & Liquidity

7⃣ Risks Involved

🔸The Cruize Vaults smart contracts has been audited & battle tested

🔸But you must be aware of the risks before investing in vaults:

▪️Credit Risk

▪️Counterparty Risk

▪️Smart Contract Risk

▪️Network Risk

▪️Deposit Risks

🔸The Cruize Vaults smart contracts has been audited & battle tested

🔸But you must be aware of the risks before investing in vaults:

▪️Credit Risk

▪️Counterparty Risk

▪️Smart Contract Risk

▪️Network Risk

▪️Deposit Risks

8⃣ Solid Partners

🔸The team has managed to partnered up with some legit project in the field: @RamsesExchange, @LexerMarkets, @ArbitrumNewsDAO … to name a few!

🔸The team has managed to partnered up with some legit project in the field: @RamsesExchange, @LexerMarkets, @ArbitrumNewsDAO … to name a few!

9⃣ That's a wrap!

🔸I problably join their IDO, but you should #DYOR as this's #NFA!

🔸Have great day guys, congrats to those who xx with memecoin!

🔸I problably join their IDO, but you should #DYOR as this's #NFA!

🔸Have great day guys, congrats to those who xx with memecoin!

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter