Key Takeaways from Month in Macro

1. Nominal #GDP slowed through April, with real GDP contracting by -0.47% and #inflation rising by 0.23%. #Nominal GDP has grown approximately 4.7% from one year prior, continuing the downtrend beginning in February 2022.

1. Nominal #GDP slowed through April, with real GDP contracting by -0.47% and #inflation rising by 0.23%. #Nominal GDP has grown approximately 4.7% from one year prior, continuing the downtrend beginning in February 2022.

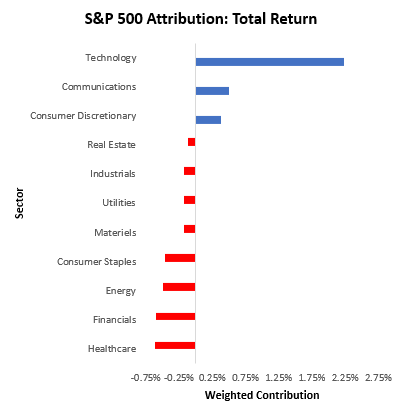

2. During this time, #equity markets have posed significant strength (though lopsided), while #treasury markets have weakened in unison.

3. Looking forward, these sequential improvements have adjusted our #real growth outlook, with a #contraction in yearly real GDP growth more likely in H1 2024 than in Q4 2023. Our #inflation outlook remains one of resilient inflation.

4. Neither stocks nor bonds offer attractive return-on-risk here. Stocks remain highly exposed to weakness in the economic growth cycle, while bonds likely face headwinds from higher rates to combat resilient inflation. Cash remains an attractive hiding place for most investors.

The entire report is available through the link below! 45pages of the best #macro content available for all our #subscribers.

prometheus-research.net/p/month-in-mac…

prometheus-research.net/p/month-in-mac…

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter