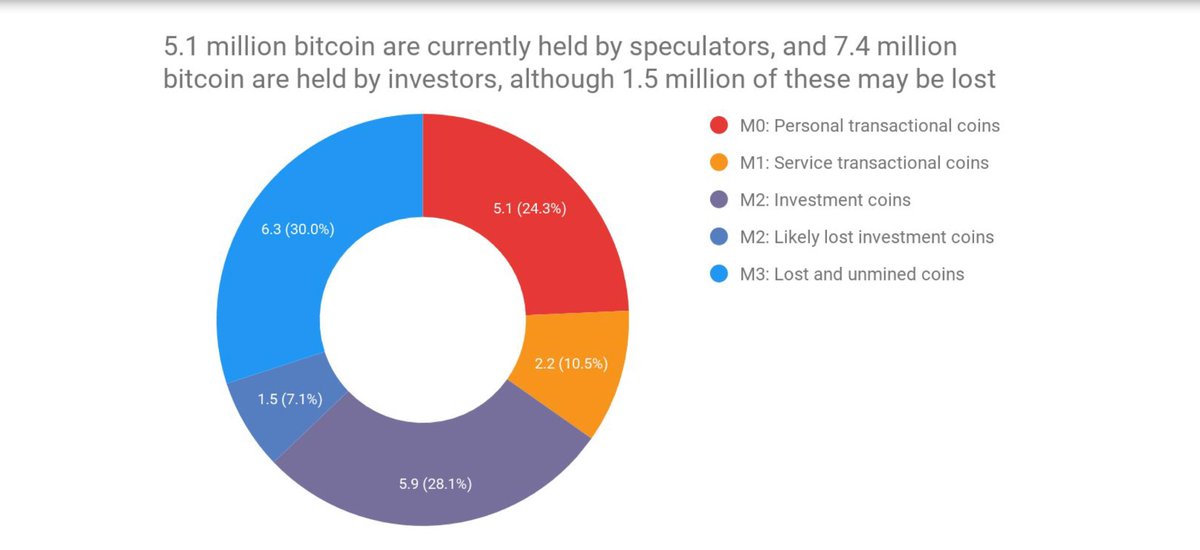

These hodlers don't care about the day to day, or year to year volatility, they want to accumulate.

We have a situation where most hodlers are accumulating and won't sell at any price, plus constant demand for censorship resistance.

These wild swings in supply vs demand only happen today in bitcoin. Your typical invest advisor has no idea.