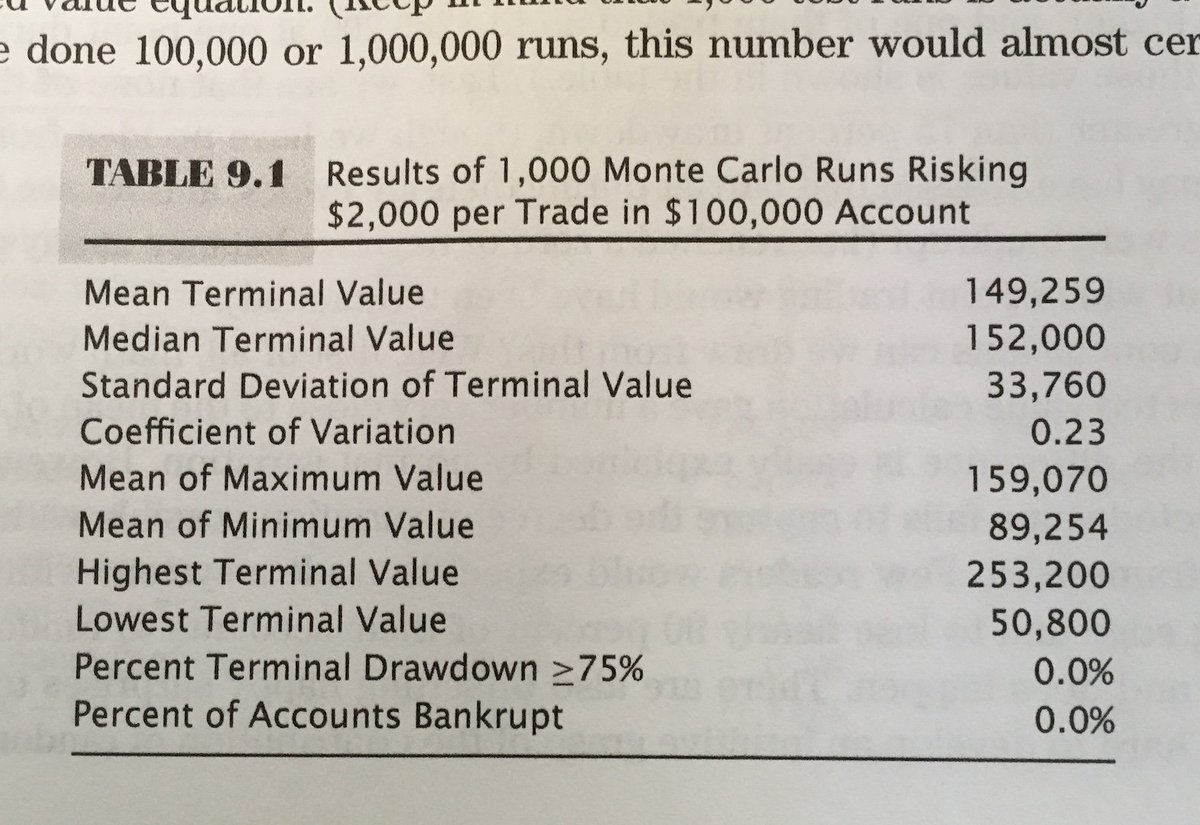

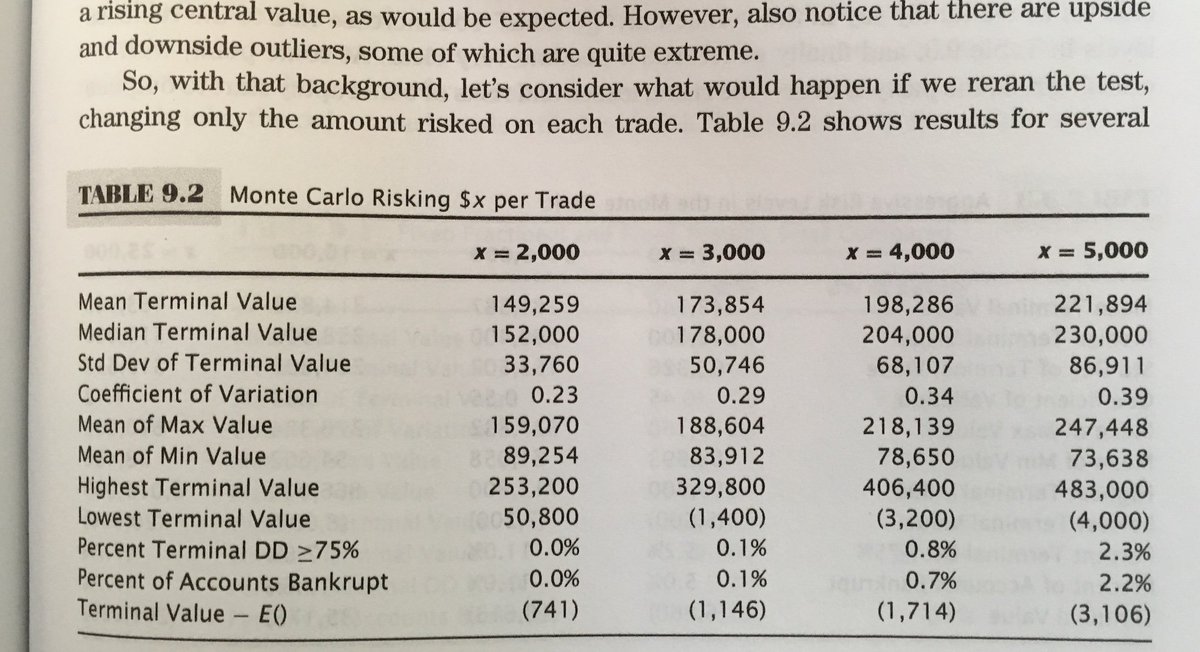

Everyone talks about only risking 2% per trade, but why 2%? Why not 3% or 30%? I’ll show you why.

/thread

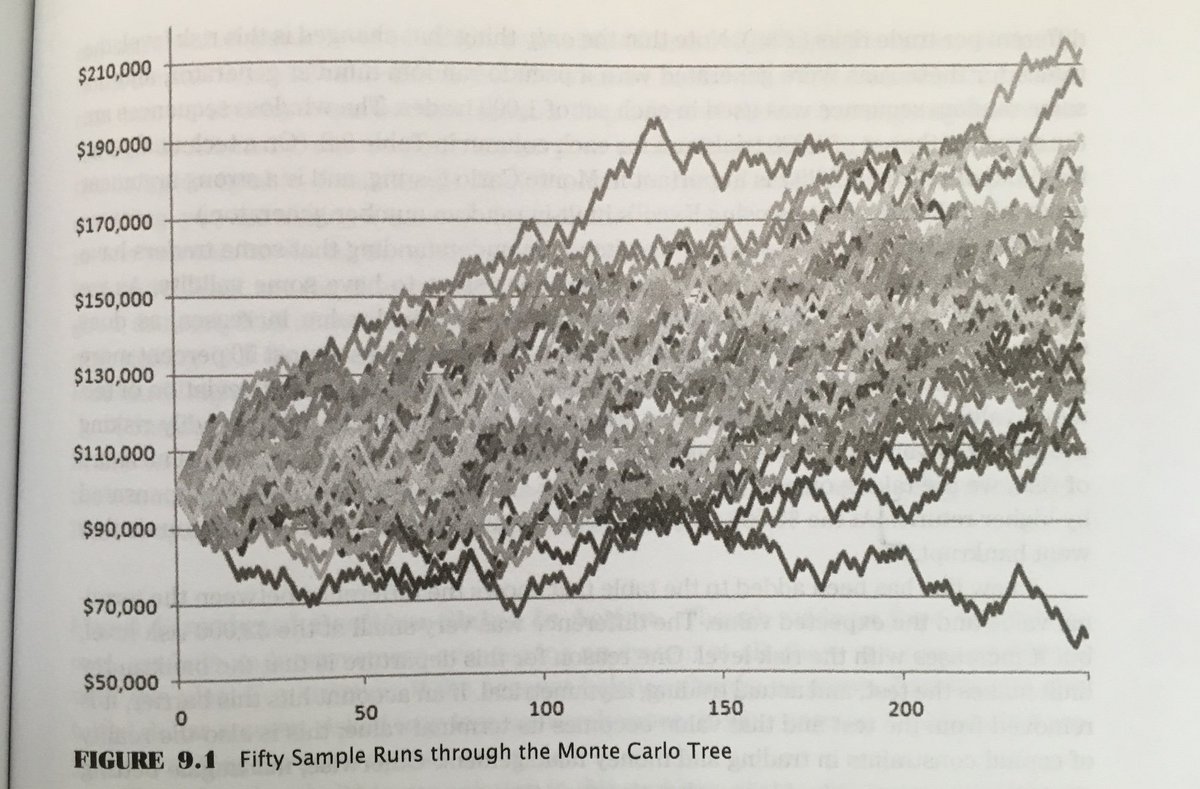

Too small, and you’ll never make any money. Positions too large will put you out of the game before you’ve had time to strike it big.

This is a key idea: if you run out of capital, you’re out of the game - so don’t take position sizes that will put you out of the game if you’re wrong.

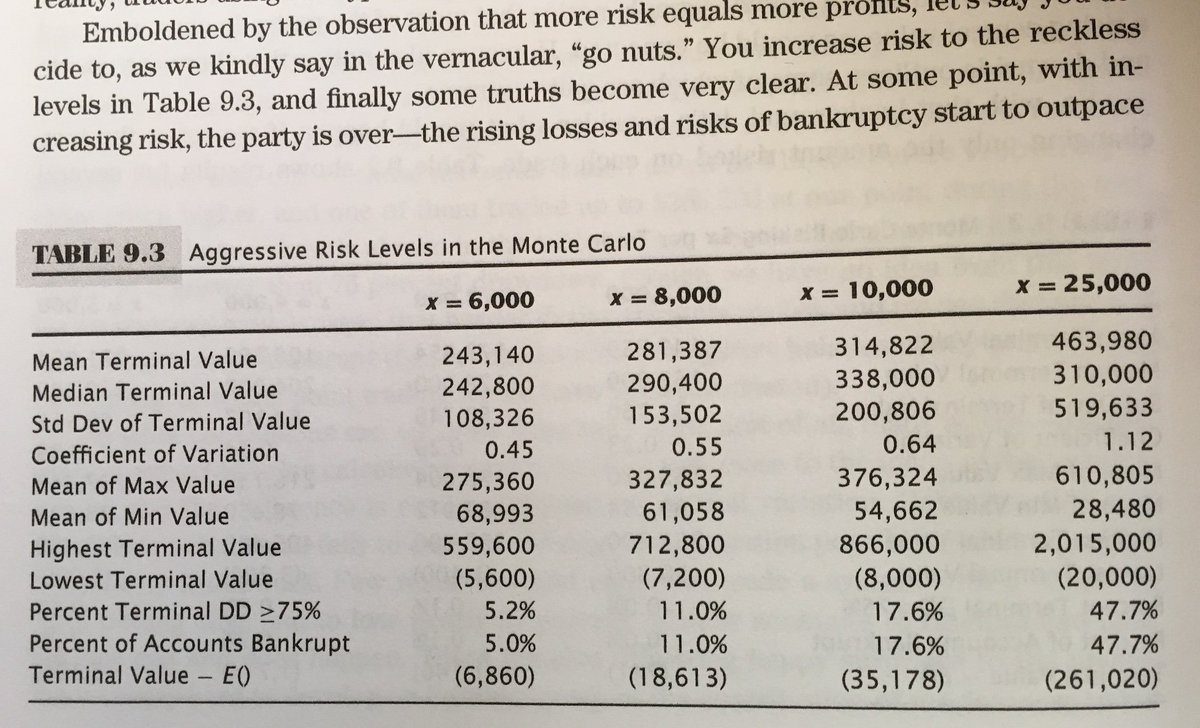

1. We are taking higher risk that is not adequately compensated by higher returns and

2. At the 5% risk level, 2% of traders have gone bankrupt.